These investment total return approaches are rising but currently underperforming the S&P 500 total return index:

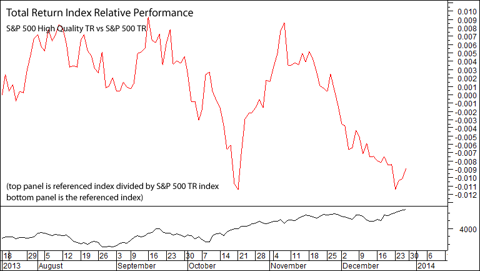

- high quality

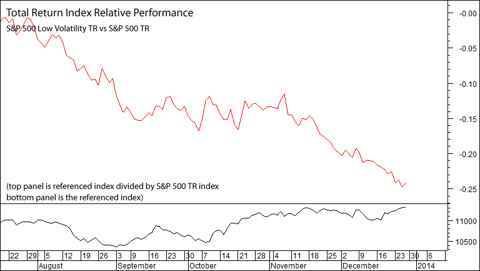

- low volatility

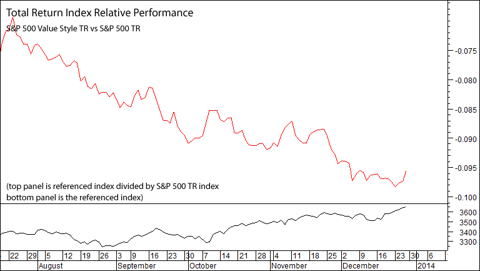

- value style

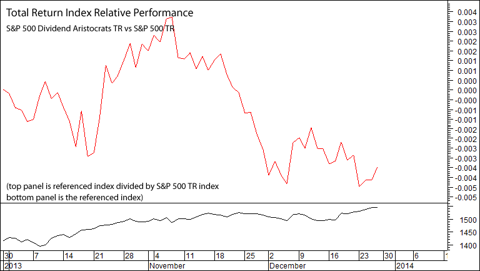

- dividend focus

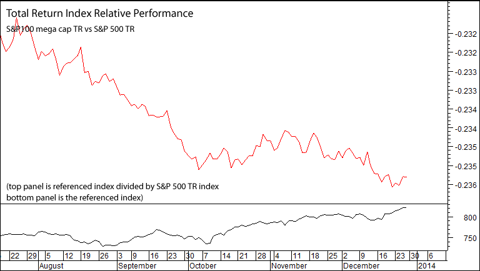

- mega-cap

These investment total return approaches are rising and currently outperforming the S&P 500 total return index:

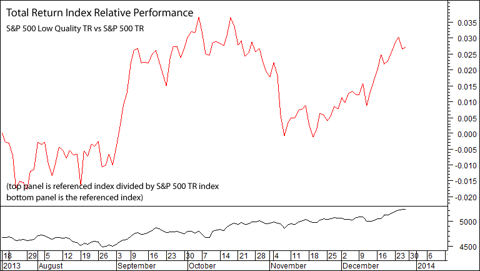

- low quality

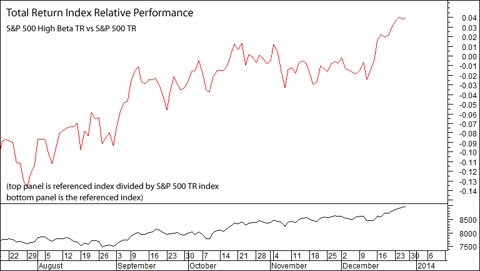

- high Beta

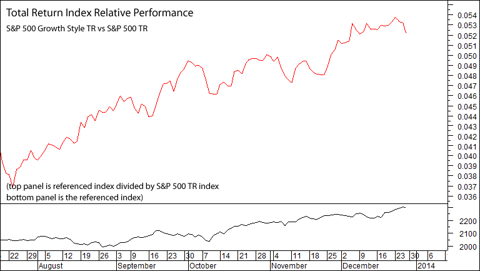

- growth style

- small-cap

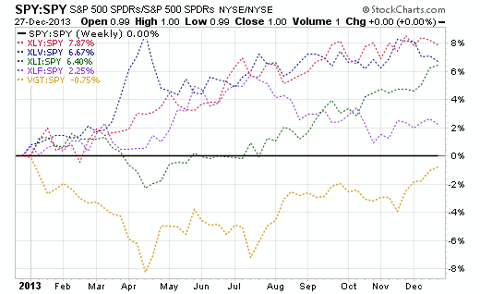

These sectors are currently outperforming the S&P 500 index (from best to worst):

- consumer cyclicals

- healthcare

- industrials

- financials

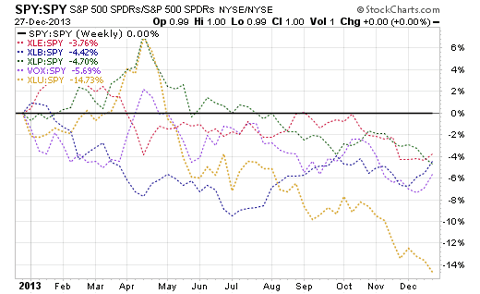

These sectors are currently underperforming the S&P 500 index (from worst to best):

- utilities

- telecommunications

- consumer staples

- basic materials

- energy

For conservative or moderately conservative investors that generally would suggest current underperformance of their portfolios, in terms of the S&P 500. However, beating the S&P 500 in any short period is not generally the goal of conservative or moderately conservative investors, who view investing as a marathon, not a sprint. Conservative investors are more focused on risk control and/or income than aggressive or moderately aggressive investors.

We are in an aggressive investor's market at this time. A cautionary note, though, is that markets tend to be most attractive on a trailing price performance basis when they have the least upside potential; and least attractive on a trailing price performance basis when they have the most upside potential.

Analysts spent much of 2013 upwardly adjusting their year-end S&P 500 price targets, which were blown away early in the year. We have not even begun 2014 and a substantial portion of many investment firm's price projections are already realized. The typical 2014 price projection for the S&P 500 is 1900 to 2000. We are currently at 1840. Are analysts not up to their challenges, or is the market getting too far ahead of itself?

Analysts tend to have a trend extrapolation element in their projections. The fact that they have been and currently seem to be so far behind the price growth curve is a little bit concerning. However, for now the market overall is in an upward trend - and it is until it isn't.

Lets look at the chart data behind our listing of What's Working and What's Not.

For those conservative or moderately conservative investors who may wish to lean a little bit toward the momentum of the market, without abandoning their long term approach, these charts will show what they need today to move toward the leading edge.

For those who don't want any change in approach - who intend to stand firm with quality, lower volatility, value, dividends, and large companies - these data will help explain the lagging performance they are probably experiencing. Lagging doesn't mean poor or bad. Prudence has good returns this year too, just a bit less; and the performance spread is widening as of late.

Charts are an altogether different thing than fundamental and valuation approach, which is important, but not the subject of this particular discussion

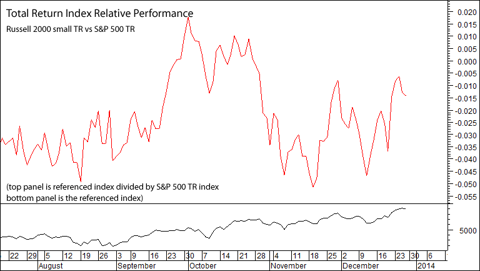

In the following charts, the upper panel plots the price of the subject total return index divided by the price of the S&P 500 total return index - a declining line means the subject index is underperforming, and a rising line means the subject index is outperforming. The bottom panel plots the price of the subject total return index.

High Quality

Low Volatility

Value Style

Dividend Focus

Mega-Cap

Low Quality

High Beta

Growth Style

Small-Cap

In the following two charts the performance of sector ETFs are divided by the performance of SPY (the S&P 500 ETF)/

Outperforming Sectors

Underperforming Sectors

We discussed fundamental and valuation aspects of the sectors in a recent prior article, called "2013 U.S. Sectors Outlook".

Directly Relevant ETFs:

- (SPY) and (IVV) S&P 500

- (SPHQ) S&P 500 High Quality

- (SPLV) S&P 500 Low Volatility

- (IVE) S&P 500 Value Style

- (SDY) S&P 1500 Dividend Aristocrats

- (OEF) S&P 100

- (no ETF for low quality)

- (SPHB) S&P 500 High Beta

- (IVW) S&P 500 Growth Style

- (IVM) Russell 2000 Small-CAp

- (XLB) S&P 500 Basic Materials

- (XLE) S&P 500 Energy

- (XLF) S&P 500 Financials

- (XLI) S&P 500 Industrials

- (XLP) S&P 500 Consumer Staples

- (XLU) S&P 500 Utilities

- (XLV) S&P Healthcare

- (XLY) S&P Consumer Cyclicals

- (VOX) MSCI Telecommunications

- (VGT) MSCI Technology

Disclosure: QVM has positions in SPY, SDY, XLI, XLV, and VGT as of the creation date of this article (December 28, 2013). We certify that except as cited herein, this is our work product. We received no compensation or other inducement from any party to produce this article, but are compensated retroactively by Seeking Alpha based on readership of this specific article.

General Disclaimer: This article provides opinions and information, but does not contain recommendations or personal investment advice to any specific person for any particular purpose. Do your own research or obtain suitable personal advice. You are responsible for your own investment decisions. This article is presented subject to our full disclaimer found on the QVM site available here.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: Disclosure: QVM has positions in SPY, SDY, XLI, XLV, and VGT as of the creation date of this article (December 28, 2013). We certify that except as cited herein, this is our work product. We received no compensation or other inducement from any party to produce this article, but are compensated retroactively by Seeking Alpha based on readership of this specific article.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire