The prospect of discovering a stock with an extremely low float, strong fundamentals, and virtually zero followers is almost equivalent to finding a brown paper bag filled with money on the side of the road. These types of stocks have been subject to ridiculous gains in a short period of time. Examples include Vision Media (VISN), InterCloud Systems (ICLD), and ARC Wireless (ARCW).

Vision Media has a float of approximately 4.5 million shares. Shares gained more than 1300%+ in three months.

InterCloud Systems has a float of approximately 3.8 million shares. The stock jumped more than 500% in less than two months.

ARC Wireless has a float of approximately 1 million shares. Shares soared more than 400% in three months.

The float of a stock, in simplest terms, represents the number of shares available for the public to buy. When a company with a low stock float announces good news, the buyers tend to be more aggressive than the sellers, and constrained demand leads to serious spikes in price and volume. This is a double-edged sword, as the price can sharply decline on any negative news. Supply and demand is in effect more than ever for low float stocks.

The next low float stock that is bound to make heads spin is Erba Diagnostics (ERB), a fully integrated in vitro diagnostics company I first highlighted back in November. Erba Diagnostics has a float of approximately 7.5 million shares, extremely solid fundamentals with upcoming catalysts, and a chart eerily similar to the ones posted above (minus Intercloud).

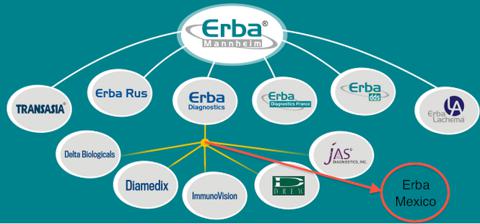

The elevator pitch behind Erba, which I've discussed in detail in my previous article, is as follows: Erba Diagnostics (USA) consists of six wholly owned subsidiaries, and has a parent company named Erba Manheim, which consists of five wholly owned subsidiaries and Erba Diagnostics. The synergies behind the 13 divisions of the Erba group are through the roof, and it is in the best interest of the parent company's CEO and founder, Suresh Vazirani, to recognize these synergies by merging together all of the companies into a single, public entity, Erba Diagnostics.

Insiders own 82% of Erba Diagnostics, and management has dropped subtle hints of continued acquisitions in the future, both in the U.S. and abroad. The combined revenues of all 13 divisions should reach a minimum of $600 million, which at a 2x revenue multiple would represent approximately $27 dollars per share.Even if the company issued 40 million shares and diluted the company (highly unlikely), bringing the current number of outstanding shares to 83 million, the fully combined company would be worth approximately $15 per share. With shares currently trading around $2.15, and a current market capitalization of $92 million, Erba's valuation is out of whack.

The Synergies

After digging through some of Erba's old SEC filings, I stumbled upon an investor presentation that was filed in September of 2012. Here are some quotes that point out blatant synergies between the subsidiaries of Erba Diagnostics and highlight the market potential of this massive diagnostics company.

-Erba Diagnostics' diverse product portfolio consists of more than 200 FDA cleared products, and more than 400 CE marked products.

-Transasia (Vazirani's first company) owns 78% of Erba, and the relationship between the two is "expected to expand Erba's customer and geographic markets."

-Transasia's customer base is expected to have access to Erba's suite of products, including its immunology platform. Transasia's customer base is five times greater than Erba's.

-Erba's geographic markets will expand into India, Eastern Europe, the Middle East, and South America. Keep in mind that Erba Manheim's Transasia division is located in India, Erba Lachema is located in Eastern Europe, and Erba DDS is located in the Middle East.

-Transasia is expected to introduce its products into Erba's sales channel.

-Erba is targeting a $60 billion in vitro diagnostics market that is growing at a rapid rate. Specifically, Erba is targeting the Infectious disease market, autoimmunity disease market, and immunoassay market with its lineup of more than 400 products.

-The autoimmune market remains a niche market with no single company currently posing a dominant market position.

-Erba currently has 250 systems placed in the USA under a Reagent Rental Agreement. This agreement allows customers to obtain the system with no up-front cost as long as they purchase test kits for the system from Erba.

-One system currently generates an average of $30,000 in test kit revenue per year. The company is targeting 12% system expansion per year in the US.

-Erba's goal continues to be a leader in the diagnostics industry, and they expect to accomplish this through, "working capital, synergistic acquisitions, and Transasia's sales channel."

Erba's Upcoming Catalyst

It's only a matter of time before Erba begins to pop up on investor radars. The entire Erba group has joined together at several medical exhibitions to showcase their product portfolio to the medical community and investors alike. The most recent trade show occurred last month in Germany, at the 2013 MEDICA exhibition. These events generate buzz and exposure for Erba, and as more and more people take note of this company, their massive product portfolio, and their extensive geographical reach, more investors will take note and buy into the company.

The next big event that will surely put Erba on the map of investors is the 32nd annual JP Morgan Healthcare Conference, taking place in San Francisco during the week of January 13th. This conference is the type of exposure that can propel Erba to the forefront of the investing community. The entire Erba group will be present at the conference, and will be giving a presentation to attendees. Erba recently hired Stonegate Securities for investor relations and public relations. This move shows that Erba is gearing up for a big debut to individual and institutional investors alike. This may be the catalyst that induces a run up in shares similar to run ups experienced by the low float companies mentioned before.

Erba Diagnostic's improving business has resulted in an improved balance sheet, growing sales both organically and externally, and increased profitability quarter over quarter. Quarterly earnings serve as a catalyst for Erba, and the continued improvement in the company's fundamentals will surely act as a positive catalyst for the stock price.

Erba's latest 10-Q showed revenues increasing 83%, and gross profit increasing by 46% year over year. The company reported positive net income for the second quarter in a row, and the recently established Erba Mexico subsidiary should begin to generate revenues soon, as it targets a market that is expected to surpass $400 million this year.

Erba expects to experience an increase in sales as the Affordable Care Act is implemented in the US. Erba recently doubled the production capacity at its Miami Lakes facility, and will be acquiring two vacant buildings next to the plant. The organic growth stemming from Erba Diagnostics and its five subsidiaries is almost as exciting as the potential growth through future acquisitions.

Conclusion

Erba Diagnostics presents a solid investment opportunity for many investors at current prices. Although this is a small cap company that is subject to volatility, the company is growing, has turned profitable, and is positioned in a massive market that is continuing to expand. Erba has an offering of more than 400 FDA and CE approved products, and will be able to reach a global audience through the sales channel of Transasia.

This is a stock with almost zero followers, and it went under the radar ever since Suresh Vazirani acquired the division from Phillip Frost's previous company, IVAX Diagnostics. Erba Dianostics has a total of 7 followers on StockTwits, 121 on Seeking Alpha, and only one article has been published on the company...mine. This company is poised to gain an increase in followers after the company presents itself at the 32nd annual JP Morgan Healthcare Conference to institutional investors, and with a float of only 7 million shares, this stock is poised to take off once the market realizes that the fair value and the current value are grossly apart.

Disclosure: I am long ERB. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire