Ennis Inc. (EBF) is a small cap company still waiting to take off from the great recession. Two of the main contributing factors for this are the company's size, as well as a lack of understanding of the simplistic business model utilized. We would like to address the two segments of goods Ennis supplies, print and apparel, as well as the change in product mix that has slowly taken place over the course of the past few years. Ennis is changing just as the print industry is itself, and the company trades at a significant discount given its past performance and future prospects.

Since 1909 Ennis Inc. has plugged along labeled as a printing company. The printing market is incredibly fragmented, making the payoff for companies willing to participate within it asymmetric. As a company operating in this industry, it is very difficult to increase market share, and rather easy to lose it. Initially making a living as a newspaper printer and publisher in addition to cotton tags, Ennis has found ways to make subtle changes in order to maintain revenues and growth. The printing industry's sales are unchanged from three years ago and are still 21% below pre-recession levels according to the National Association for Printing Leadership. Decreased demand for printed goods has caused Ennis to re-focus its initial print-heavy strategy and look at other markets to employ and utilize resources: the apparel market, to be specific.

While the company has evolved throughout the years, one things has stayed constant: it helps companies advertise or convey brand image. Whether it be labels, point of purchase printing, custom business forms, and most recently e-commerce Ennis helps convey brand image in a professional manner. High levels of customization and product quality is what Ennis competes on, another factor that has remained constant since 1909. This by default makes the industry a prospect for slow recovery after downturns, due to the fact advertising and marketing expenses are the first to be cut from company budgets and the last to be added back. In order to mitigate the impact of decreased demand for print form products, Ennis acquired a company called Alstyle in 2004 and began manufacturing and distributing T-shirts of all shapes, sizes, and style. Apparel seems to be rather random, but the assets and markets previously held and served made this transition seamless and allowed for Ennis to continue helping companies convey brand image as well as advertise. People may stop reading print newspapers, but won't stop wearing T-shirts with company's names on them. This was in response to the apparent and downright obvious soon to be changed market of printed goods, and it as an appropriate addition. Ennis has proved to be malleable and versatile for over 100 years, so do not think this one time exemplification of foresight is rare or nonrecurring.

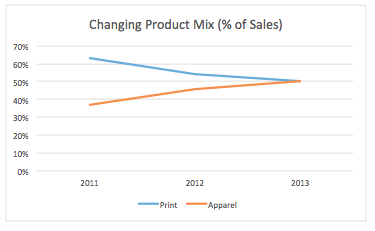

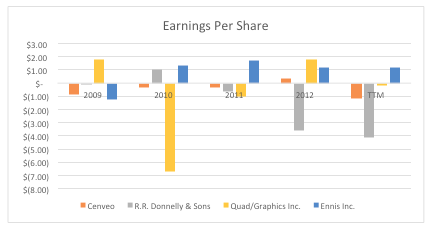

From the chart above, the now balanced product mix and sales are more evident than ever (print and apparel each contribute 50% to sales) and have proved to add support to the company's earnings. The largest players in the printing industry such as R.R. Donnelly & Sons (RRD), Quad Graphics (QUAD), and Cenveo (CVO) have all struggled to keep up with change since the downturn.

Ennis has proven to outpace the three largest companies in the printing industry since 2009. The apparel segment added in 2004 has been the company's latest big change to product mix, and has proven to have been a sound decision. This has been the theme since 1909. Ennis will probably always be a printing company, but it will add any product to the mix as it sees fit, in order to increase earnings. Many of the assets utilized by the company can be used to produce many different products, which is why Ennis produces so many small high margin custom products, and makes seamless transitions into new markets.

It appears the trend in the product mix between print and apparel will continue; whether the rate of change will remain constant cannot be known. As a side note, the trend has proven to be positive and the seed for the company's most recent operating performance. The company's sales were down 2.2% for the comparable quarter of 2012 and print product sales were down 8.2% for the same comparison time period, but apparel sales were up 7.6%. The printing segment margins have remained stable at over 30% for the most recent quarter while Apparel margins increased to 23.1% from 14.4% the same quarter a year earlier. Management noted this increase in margin for the Apparel segment was due to lower material input costs and increased levels of production. The increased level of production associated with causing the increase in margin, means the company is experiencing economies of scale and is operating in the lower end of potential production output range.

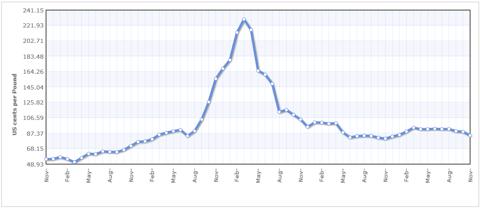

With increased reliance on the production and distribution of T-shirts comes more exposure to commodity prices; specifically cotton.

The chart above depicts monthly cotton prices since 2008, courtesy of Index Mundi. Market forces were as apparent as ever, as the supply of cotton was very low in 2010 & 2011 driving the price up and eventually attracting new producers, only to have the price forced back down again. This shift in product mix is favorable for the company, but an understanding of the changing influences are essential for investors. As cotton prices drop Ennis becomes more profitable; with the inverse obviously being true as well. This is an area of influence worth paying large amounts of attention to. Additional risks inherent in this business are those associated with the change in technology. There is a no doubt print product demand is falling, but whether or not it is falling for these customized printed goods is open for debate. The need for custom printed business forms may dwindle, but do not forget it is in business's best interest to make sure their name is on as many goods as possible, printed or not. Ennis has begun making the transition to digitized products, becoming involved in ecommerce by creating EOS TouchPoint (a web to print portal). Web to print portals centralize the information needed to consolidate and create your companies marketing material such as brochures, booklets, point of sale materials, and even financial data from in house computers. This is an area of the business we expect to bloom considerably over the next few years.

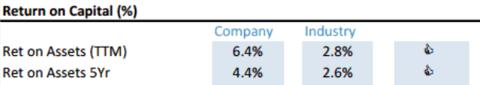

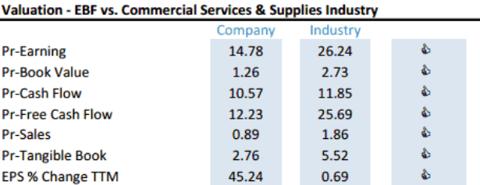

Even with higher efficiency and income generation for a given level of assets (a key check), Ennis still trades at a significant discount. This is evidenced by the fact that the company is as well capitalized as it is, and yet trades at nearly book value, while the average company in the industry trades at almost 3 times book. Value plays the largest role in terms of long-term stock price performance, and when the market isn't buying more of a company's stock whose earnings are increasing, it makes for a perfect buying opportunity as signs of the company being neglected become most apparent. The company has averaged a current asset to total liability ratio of about 1.5 over the course of the past few years, ensuring the business is in no financial danger (the main cause of good companies trading at major discounts.)

Expect Ennis to keep plugging along just as it has. As companies add back some of these exclusions from budgets these past few years, Ennis will benefit. Margins will continue to expand from increased production within the apparel segment, while print margins are expected to remain stable. If industry growth has been negative, yet the average company in the industry trades at a P/E of 26, Ennis deserves the industry average multiple given its outperformance. The company is trading directly at its historical earnings multiple, but this is subject to change as the product mix shifts and Ennis continues to prove its ability for re-creating itself. 2013 EPS for the company was $1.22, and the shares are currently trading at $17. Through 2014 expect the multiple to expand to the industry average of 26, leading to a 2014 year end share price of $31.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: AlphaStreetResearch is a team of Investment Research Analysts. This article was written by Mr. William Hambley, Junior Research Analyst.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire