Evans Bancorp (EVBN) operates as the holding company for Evans Bank, which provides various banking services to consumer and commercial customers in western New York. It is, by any reasonable consideration, a regional bank focused wholly on local and community commerce. In fact, in August of 2010, the company created the "Evans Community Commitment Team", a collection of employees who volunteer throughout the local community promoting service and local unity. Through its efforts, the "Evans Community Commitment Team" regularly validates the bank's devotion to local neighborhoods. This volunteer organization supports non-profit charities with both manpower, and sponsorship dollars. Evans is deeply rooted in its community's identity, and has been for nearly a century. It employs approximately 250 employees, and has 15 total locations.

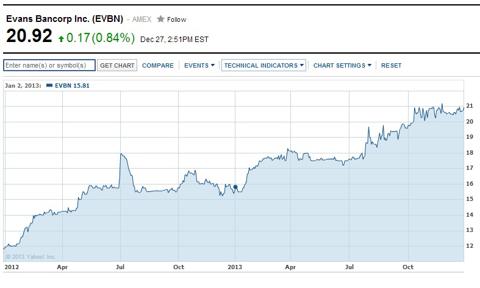

The company operates with a simple motto; choose better, not bigger. It sounds like an easily disregarded cliché; something that was created by a marketing consultant to appeal to specific demographics. It is not. The company truly lives by this credo, and it shows in the bank's consistently above par performance. In fact, for the last two years, the company has grown at an average rate of 38% annually. On the last trading day of 2011 the company's PPS was $11.92. One year later, in 2012, it was $15.50. As of the time of this editorial being written, the company's current price per share is $20.92.

This consistent two year climb has been the culmination of steady and responsible performance in core banking competencies since 2008. Total deposits increased from 404 million dollars in 2008, to nearly 700 million in 2012. Total loans grew from $349 million in 2008, to over $600 million by the end of last year. These growth rates, from that multi-year period, come in at 74% and 72% respectively. When the final numbers are released for 2013, the annual marginal growth is expected to have maintained a similar pace.

Most Recently Reported Financials

For the quarter ended on September 30, 2013 the company reported double-digit net income growth. This occurred in spite of the fact that the company set aside substantially more in loan-loss provisions than it set aside during the same quarter in 2012. Net income for the period totaled 2.5 million dollars, or 58 cents per share. That represented a 14.7% increase from the previous year's third quarter, when Evans' net income totaled only 2.1 million dollars, or 51 cents per share.

In its quarterly report the bank cited the following three factors as stimulants for growth;

● Higher net interest income

● Lower non-interest expenses

● Increased fee revenue

In consideration of the company's three year EPS growth, its current run rate, and its three year history of significantly improving in the fourth quarter year-over-year, annual earnings for 2013 should see an increase of no less than 3-6% over 2012 (which was 1.95, the above chart rounds up). The annual EPS for 2013 should be reported between 2.02 and 2.07.

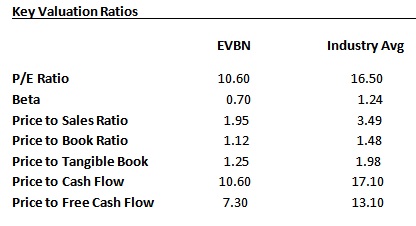

Valuation Criteria and Comparable Data

In recent years, where volatility in asset classes, and an abundance of bad debt, has plagued banks of all sizes with relentless setbacks and declines in performance, Evans Bancorp has forged ahead. Through a series of judicious financial decisions, the execution of responsible growth opportunities, and a commitment to its core clientele, the company has not only survived, but thrived.

As a matter of comparison, the company will be evaluated against an "industry average." For the sake of clarity, the usage herein of the term "industry average" shall include not only other regional banks with comparable metrics, such as 1st Century Bancshares (FCTY), Community West Bancshares (CWBC), and 1st Constitution Bancorp (FCCY), but also against larger national banks whom exist and compete in the same space and same markets. These include, but will not be limited to institutions such as First Niagara Financial (FNFG), M&T Bank (MTB), and Eagle Bancorp (EGBN).

First, in consideration of the standard key valuation ratios, Evans can be seen to compare favorably across the board;

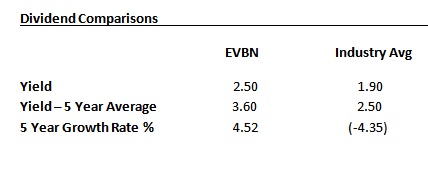

Secondly, in consideration of comparative dividend statistics, the company also measures favorably;

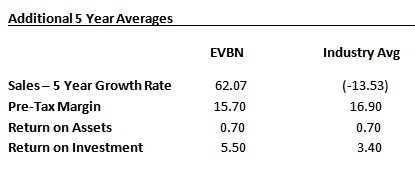

Thirdly, in consideration of comparable five year averages, Evans truly stands out. This is especially so in the area of growing sales, where the company has handily outpaced the industry over the last half decade;

Lastly, as it pertains to shareholder commitment, Evans Bancorp has clearly aligned the interests of insiders and institutional investors with those of retail shareholders. Of the 4.2 million shares outstanding, 12% are owned by insiders, and 36% are owned by institutions. Furthermore, the company maintains a sizeable float of 3.93 million shares, which further indicates its commitment to offering price stability and not exposing its shareholders to unruly volatility.

Analyst Rating(s)

Since Evans is a small, regional bank, the company is not privileged by a significant analyst following. In fact, only thestreet.com appears to offer any recommendation on the company as an investment vehicle. Given the fact that the company has a market cap of less than 100 million dollars, and is not actively traded on a daily basis, this should not come as a surprise. However, alongside the empirically supported endorsement detailed herein, thestreet.com does offer a favorable ratings assessment. Thestreet.com gives the company an "A-minus" rating with a "buy" recommendation.

Risks

Evans Bancorp appears, by nearly every measurable standard, to be an enticing investment opportunity. However, objectivity dictates that an assessment of applicable risks be considered. First of all, the company has been on a significant bull run dating back to 2008, and has really taken off over the last two years. Obviously, this trend cannot continue forever. No company, in any sector, maintains a permanent upward trajectory. If, in fact, this company has reached the top, than growth opportunities moving forward could be minimized. Secondly, the bank is obviously vulnerable to market risk. The primary market risk the company is exposed to is interest rate risk. The company's core banking activities, of lending and deposit-taking, expose the bank to interest rate risk, which occurs when assets and liabilities re-price at different times, and by different amounts, as interest rates change. As a result, net interest income earned by the bank is subject to the effects of changing interest rates. Lastly, the bank is geographically located in a rather depressed region of the country. Economic struggles, a disheartening job market, and a stagnant housing market in western New York, do not do much to encourage the prospects of local financial institutions. All of these considerations should be weighed as a potential hazard to the company's future success.

Conclusion

Evans Bancorp's motto is "choose better, not bigger." They personify this message. Over the last five years, despite existing in a depressed part of the country, enduring the aftermath of massive recession, the bank's sales outpaced the industry by a factor of no less than six. Furthermore, the company's return on investment ratio, and five year dividend growth rate, significantly outperformed the industry. The company has grown and flourished during this time as a result of responsible management and a tireless commitment to its community. Those two attributes have proven to be long term catalysts for growth across generations, and through various industries.

Additionally, the company is currently completing the consolidation of its administrative and back-office facilities, and shifting those employees to more cost efficient spaces in already existing offices. This should help make the company even "leaner and meaner" going into 2014. Moreover, the bank's loan portfolio is quite healthy. The rate of charge-offs and non-performing loans are refreshingly low, and its allowance for loan losses is more than sufficient by comparison. In consideration of all these facts, and based on the banks rolling 12 quarter EPS performance, its current run rate, and it's continued income growth, a forecast of 26-31% growth in 2014 is quite reasonable. A fair and equitable 12 month price target for the bank's shares would then be equal to $26.36.

Given the facts, endorsements, and projections herein, Evans Bancorp certainly warrants additional consideration from prospective investors. Additional due diligence, and serious investment consideration, is suggested.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: All the information gathered, and research conducted, for this article came from the company's SEC filings, the company's website, thestreet.com, and direct communication between the author and current bank employees.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire