Crédit Agricole (OTCPK:CRARY), France's largest bank by assets, has spent much of the past decade in a seemingly perpetual state of crisis. After putting the financial crisis behind it, Crédit Agricole was thrust right into the European sovereign debt crisis, thanks to its large exposure to Greece. Few events during the sovereign debt crisis highlight Crédit Agricole's legacy issues better than Emporiki Bank and the sale of the unit for €1 in October 2012. Crédit Agricole acquired Emporiki in 2006 for €2.2 billion, and the €2.2 billion lost in selling it does not take into account the additional €6 billion that Emporiki Bank cost Crédit Agricole as the Greek economy collapsed. However, throughout 2012 and 2013, Crédit Agricole has worked diligently to rebuild its capital base, wind down its exposure to peripheral European countries, and cut costs. The progress that Crédit Agricole has made has helped drive its shares up over 50% in 2013, outpacing both BNP Paribas (OTCQX:BNPQY) (up over 32%) and Société Générale (OTCPK:SCGLY) (up over 48%). However, despite the progress it has made, Crédit Agricole trades at a valuation far below its French peers BNP Paribas and Societe Generale. In our view, such a discount is unwarranted in light of Crédit Agricole's continued turnaround, and we believe that in 2014, the bank's discount to its peers will begin to narrow, and we see upside potential of over 25% as Crédit Agricole continues its recovery. Unless otherwise noted, financial statistics used in this article will be sourced from the following: Crédit Agricole's Q3 2013 earnings release or its Q3 2013 earnings presentation.

A Note on Ownership: Parsing A Unique Structure

Crédit Agricole's discount to its French banking peers has been driven not only by its crisis-era losses, but by an ownership and capital structure that may seem bizarre to many investors. This structure, a vestige of Crédit Agricole's legacy as a collection of regional French agricultural banks (Crédit Agricole itself was founded in 1894) has created confusion over Crédit Agricole's capital levels and heightened investor fears over the company's capital levels. However, as we will show, such fears are misplaced, and Crédit Agricole's capital levels do not indicate any material weakness at the bank.

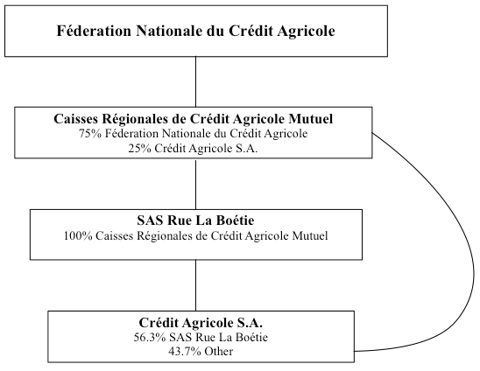

Although Crédit Agricole was founded in 1894, the bank went public only in 2001, and did so in a somewhat byzantine structure that has persisted to this day. Although Crédit Agricole is now publicly traded, only a portion of the true Crédit Agricole is listed. The entity that is listed on the Euronext Paris is Crédit Agricole S.A., and SAS Rue La Boétie, which owns 56.3% of its outstanding share, controls this entity. SAS Rue La Boétie is a shell and it itself is owned and controlled by a grouping of 39 French regional banks known as the Caisses Régionales de Crédit Agricole Mutuel (also known as CRCAM) that form the core of Crédit Agricole's French banking network. However, what makes the situation complex is that Crédit Agricole S.A. itself owns 25% of CRCAM, meaning that in effect, Crédit Agricole holds a stake of over 14% in itself. However, the remaining 75% of CRCAM is owned by the Féderation Nationale du Crédit Agricole (or FNCA). Together, these various entities form the Crédit Agricole Group (also known as Groupe Crédit Agricole, depending on the documents at hand), and the byzantine structure of Crédit Agricole's ownership has obfuscated its capital levels. We present a chart of Crédit Agricole's ownership structure below.

Crédit Agricole Ownership Structure

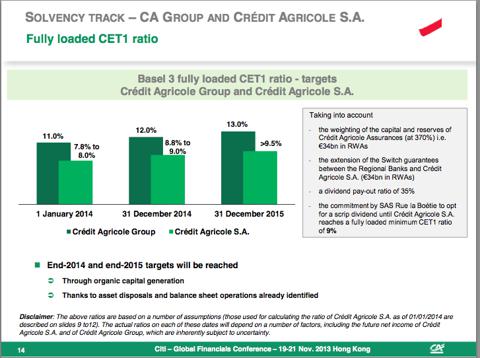

The reason that this issue is potentially of material concern is that the "alphabet soup" of Crédit Agricole entities has created diverging capital levels at the bank. As the bank noted in its presentation at the 2013 Citi Global Financials Conference (held on November 19-21), Crédit Agricole Group is set to begin 2014 with a pro forma Basel III ratio of 11%. Crédit Agricole S.A., however, is set to begin the year with a pro forma Basel III ratio of "just" 7.8-8%

Of concern to investors is that the European Central Bank and European Banking Authority (as well as Banque de France) will base their regulation of Crédit Agricole not on the capital levels of Crédit Agricole Group, but on the lower levels of Crédit Agricole S.A., and we suspect that this concern has played a role in the bank's continuing discount to its peers. However, there is little reason to believe that the relevant European regulatory agencies will alter their stance towards the bank. During the last round of European Union banking stress tests, the European Banking Authority based it results on Crédit Agricole Group, not on the standalone capital levels of Crédit Agricole S.A. Indeed, rating agencies have praised the structure, and see it as a buffer against weakness for the bank's listed entity, for this structure allows Crédit Agricole S.A. to be supported in periods of prolonged weakness by its network of French regional banks. There have been no indications to suggest that any relevant financial agency within the Eurozone has based their assessment of Crédit Agricole on the capital levels of Crédit Agricole S.A, and the bank reiterated in November 2013 that future stress tests would be conducted at the Group level. And in any case, we see the issue as being largely irrelevant in the long run, at least from the standpoint of capital. While this unique structure will always lead to a gap in capital levels between Crédit Agricole S.A. and Crédit Agricole Group, and as long as the gap between the capital levels of the two entities does not diverge significantly, and Crédit Agricole S.A. remains above required Basel III capital levels, we do not believe that this structure will have an adverse impact on equity investors in Crédit Agricole S.A.

Core Results: Putting the Past to Rest

2013 has been a year of transformation for Crédit Agricole, as the bank has focused on cutting costs and strengthening its balance sheet amidst continued uncertainty across Europe. We present an aggregated overview of Crédit Agricole's results for Q3 2013 and the first three quarters of the year in the table below (note: the results below are attributable to equity holders of Crédit Agricole S.A., and are not applicable to Crédit Agricole Group)

Crédit Agricole S.A. 2013 Results (in Millions of €)

Q3 2013 | Q3 2012 | Y/Y Change | Q1-Q3 2013 | Q1-Q3 2012 | Y/Y Change | |

Revenue | €4,122 | €4,315 | -4.47% | €12,471 | €12,927 | -3.53% |

Operating Expenses | (€2,806) | (€2,858) | -1.82% | (€8,409) | (€8,635) | -2.62% |

Gross Operating Income | €1,316 | €1,457 | -9.68% | €4,062 | €4,292 | -5.36% |

Risk Expenses & Other Income | (€373) | (€510) | -26.86% | (€1,209) | (€1,505) | -19.67% |

Pretax Income | €943 | €947 | -0.42% | €2,853 | €2,787 | +2.37% |

Net Income | €712 | €835 | -14.73% | €2,235 | €2,262 | -1.19% |

Net Income, Group Share | €617 | €749 | -17.62% | €1,956 | €2,068 | -5.42% |

Like many banks in Europe, Crédit Agricole is contending with an uncertain macroeconomic environment, but it is doing what is in its power to limit the effects of this uncertainty. Crédit Agricole continued to cut costs during the quarter, and the bank is forecasting €40 million in additional cost cuts in the fourth quarter, and pro forma headcount fell 3% year-over-year in Q3 (down 10% when including the impact of divested operations). Crédit Agricole has made progress across many of its divisions, and we discuss the bank's performance across its three most important divisions below (French banking, international banking, and investment banking); other divisions that Crédit Agricole operates include asset management, specialized finance (namely auto loans) and insurance (of which Crédit Agricole's French life insurance business accounts for 70% of the division's total revenue)

- French Retail Banking: Crédit Agricole's French retail business is divided into two segments: the regional banks that form its core and LCL (previously known as Credit Lyonnais), which Crédit Agricole acquired in 2003. During the third quarter, Crédit Agricole made continued progress at both divisions. At its regional banks, total on-balance sheet deposits (which exclude life insurance) rose by 4.1% to €340 billion, helping push the division's loans-to-deposits ratio down to 122%, down 4 percentage points year-over-year. While this has long been a source of concern for Crédit Agricole, the ratio is falling, and assuming the French economy does not move into free fall, we expect that Crédit Agricole will be able to continue lowering the ratio in a controlled fashion. The loans-to-deposits ratio also declined due to loan growth that was well below that of deposit growth; total loans grew by 60 basis points to €397 billion, driven by a 2.4% increase in mortgage lending. Revenue at the French regional network rose 3.3% year-over-year (on a Crédit Agricole Group basis) as net interest income rose due to lower funding costs and the bank saw a 1.3% rise in commission & fee income. With a 0.7% drop in operating expenses, the regional bank division boosted operating income by 7.1%, even after accounting for a 21.2% increase in risk expenses, which was due to 9 basis point increase in impaired loans (as a percentage of total loans), to 2.5%. However, the ratio has remained stable since Q1 2013, and with the regional banks having a coverage ratio of 105.7%, we believe that Crédit Agricole has prudently managed credit risk within the division. Within LCL, many of the same trends were at play. On-balance sheet deposits grew by 7.4% year-over-year, and combined with a 1.2% increase in loans (with a 2.5% increase in mortgage lending), LCL's loans-to-deposits ratio now stands at 109%, down 6 percentage points year-over-year. Although total revenues fell by 2.3% within the division, continued operating expense controls (down 1.8% year-over-year) and disciplined credit risk management helped push net income at LCL up by 6.2% year-over-year. Crédit Agricole noted that during the quarter, LCL saw improving credit metrics across all markets, and its impaired loan ratio remains steady at 2.4%, with a 74.6% coverage ratio. Together, Crédit Agricole's two French banking divisions boosted net income by 10.3% year-over-year to €393 million.

- International Banking: Crédit Agricole's international banking business is comprised mainly of Cariparma, its Italian subsidiary, which accounts for 65% of the division's total revenue. The remainder of the business is comprised of other European markets (21%) and Africa, but these markets account for less than a quarter of the division's total loan portfolio. As is the case in France, Cariparma is contending with an uncertain macroeconomic environment, but remains profitable. Total revenues at Cariparma fell by 1.5% year-over-year to €395 million in Q3 2013 (versus a 4.4% decline in the first three quarters of the year), but rose 30 basis points sequentially. Crédit Agricole's other international banking operations posted a 1.8% revenue decline during the quarter with the decline partially offset by a pro forma 6.5% decline in operating expenses after taking into account the impact of severance plans (headcount has fallen by 3.2% year-over-year). On-balance sheet deposits fell by 2.25% year-over-year to €34.7 billion, alongside a 1.3% fall in outstanding loans to €33 billion (loans rose by 4.09% in other international markets), giving Cariparma a 95.1% loans-to-deposits ratio. We note that this 1.3% decline in loans was far better than the 5.7% decline for Italy as a whole (per figures from the Italian Banking Association). While impaired loans stand at 10.3% for Cariparma (with a 43.7% coverage ratio), a continued worsening is unlikely to have a highly adverse impact on Crédit Agricole. Given that Crédit Agricole Group (the relevant entity for assessing solvency and liquidity) has a total of €714 billion in outstanding loans, Cariparma's loans account for less than 5% of the bank's total loan portfolio, and were a surge in impaired loans to occur, we believe that Crédit Agricole is in a position to withstand it (we will have more detail on exposure to PIIGS nations later).

- Investment Banking: Within Crédit Agricole's investment banking division, total revenue from continuing operations fell 14.7% to €891 million. We note that the bulk of the €154 million year-over-year decline was caused by an €86 million (down 20.6% year-over-year) fall in fixed income trading revenue, due to persistent weakness in credit trading volumes and ongoing uncertainty over the Federal Reserve's views on tapering. Pro forma operating expenses from continuing operations (excluding costs from divested CLSA and other businesses) fell by 2%, but this was not enough to prevent a 55.9% fall in net income at the division during Q3 2013 to €155 million (net income fell by 32.9% to €664 million in the first three quarters of 2013). Although Crédit Agricole's investment banking division has posted a muted performance in 2013, it remains solidly profitable, and as the bank's consolidated performance shows, its overall results a far stronger than its investment banking results, a testament to the diversity of its operations, both in France and around the world.

Crédit Agricole has made progress in cutting costs throughout its business, and pretax income was essentially unchanged during Q3 2013, despite persistent weakness at its investment banking division, and actually rose year-to-date in 2013. However, cost cutting was not the only source of progress than Crédit Agricole has made in 2013. The bank has also made meaningful progress in strengthening its balance sheet, via both increases in capital and cuts in its exposure to Europe's periphery.

Capital & Balance Sheet: Setting the Stage for a Stronger 2014

As of the end of Q3 2013, Crédit Agricole Group's pro forma Basel III common equity tier 1 (CET1) ratio stood at 10.5%, a 120 basis point increase since the end of 2012, and a 50 basis point increase sequentially. As we noted above, the bank is forecasting a CET1 ratio of 11% at the end of Q4, and is aiming to raise its CET1 ratio to 12% by the end of 2014, and 13% by the end of 2015.

Alongside an increase in its Basel III CET1 ratio, Crédit Agricole has kept itself busy shedding assets in the PIIGS nations (Portugal, Italy, Ireland, Greece, and Spain), across both its insurance operations and its core baking operations, and the trend continued during Q3 2013. We present Crédit Agricole's gross insurance exposure to the five PIIGS nations in the table below, compared to both the end of 2012 and the end of 2011.

Crédit Agricole Group Gross PIIGS Exposure (Insurance, in Millions of €)

Change vs. YE 2012 | Change vs. YE 2011 | ||||

Portugal | € 1,078 | € 1,572 | € 1,877 | -31.42% | -42.57% |

Italy | € 4,724 | € 4,387 | € 7,078 | 7.68% | -33.26% |

Ireland | € 604 | € 1,045 | € 1,309 | -42.20% | -53.86% |

Greece | € 0 | € 0 | € 1,890 | 0.00% | -100.00% |

Spain | € 764 | € 979 | € 3,155 | -21.96% | -75.78% |

Total PIIGS Gross Exposure | € 7,170 | € 7,983 | € 15,309 | -10.18% | -53.16% |

Since the end of 2011, Crédit Agricole has shed over half of its gross exposure to PIIGS assets, and has reduced exposure by over 10% so far this year.

Crédit Agricole Group PIIGS Loan Exposure (Net, in Millions of €)

Q3 2013 | YE 2012 | Change vs. YE 2012 | |

Portugal | € 1,423 | € 1,679 | -15.25% |

Italy | € 57,788 | € 62,092 | -6.93% |

Ireland | € 2,008 | € 2,148 | -6.52% |

Greece | € 3,606 | € 4,091 | -11.86% |

Spain | € 7,037 | € 7,168 | -1.83% |

Total PIIGS Loans | € 71,862 | € 77,178 | -6.89% |

Total Group Loans | € 714,000 | € 734,900 | -2.84% |

Exposure as a % of Total Loans | 10.06% | 10.50% | -44 bps |

At Crédit Agricole, total loans to PIIGS nations account for just over 10% of total loans, and during 2013, the bank has reduced its loan portfolio in each of the five PIIGS countries, with aggregate PIIGS loans falling by almost 7% so far this year. A similar trend has played out with Crédit Agricole's net exposure to sovereign PIIGS debt.

Crédit Agricole Group PIIGS Sovereign Debt Exposure (Net, in Millions of €)

Change vs. YE 2012 | Change vs. YE 2011 | Change vs. YE 2010 | |||||

Portugal | € 100 | € 174 | € 628 | € 1,060 | -42.53% | -84.08% | -90.57% |

Italy | € 4,485 | € 4,551 | € 3,962 | € 10,115 | -1.45% | 13.20% | -55.66% |

Ireland | € 94 | € 99 | € 160 | € 111 | -5.05% | -41.25% | -15.32% |

Greece | € 0 | € 0 | € 115 | € 655 | -0% | -100.00% | -100.00% |

Spain | € 180 | € 154 | € 281 | € 2,241 | 16.88% | -35.94% | -91.97% |

Total PIIGS Sovereign Exposure | € 4,859 | € 4,978 | € 5,146 | € 14,182 | -2.39% | -5.58% | -65.74% |

Total Group Assets | € 1,932,100 | € 2,008,000 | € 1,879,500 | € 1,730,800 | -3.78% | 2.80% | 11.63% |

Exposure as a % of Total Assets | 0.25% | 0.25% | 0.27% | 0.82% | -0 bps | -2 bps | -57 bps |

Crédit Agricole has eliminated billions of euros in peripheral sovereign debt from its balance sheet in the last three years, and ended Q3 2013 with less than €5 billion in net exposure to PIIGS sovereign debt, down more than 65% since the end of 2010. Crédit Agricole has made meaningful progress in narrowing its exposure to PIIGS assets across several different portions of its business. The bank has largely exited its Greek assets, and has made meaningful progress in shedding assets across Europe's periphery. And yet, despite all this, shares of Crédit Agricole continue to trade at multiples that are well below peers BNP Paribas and Société Générale, as shown in the table below.

Crédit Agricole Peer Comparison

For all the concern about Crédit Agricole's capital levels, the bank is better capitalized than peer Société Générale, even as it trades at multiples that are meaningfully lower. The bank trades at less than 10x forecasted 2013 EPS, whereas its competitors trade at well above 12. Although Crédit Agricole's forward EPS growth for 2013-2015 is below its peers, it stands meaningfully higher on a five-year basis, where BNP Paribas' growth is muted due to its meaningfully higher investment banking and capital markets exposure. It is the reason that BNP Paribas is "Bucket 3" of the Financial Stability Board's list of global systemically important banks (requiring a 2% capital surcharge) one "bucket" above Crédit Agricole (which has a 1.5% surcharge), despite the fact that BNP Paribas ended Q3 2013 with €1.855621 trillion in assets, versus €1.9321 trillion for Crédit Agricole.

In our view, the discount that Crédit Agricole trades at is unwarranted, and as the capital levels of Crédit Agricole S.A. continue to increase, we believe that the discount will begin to close as concerns about shifting regulatory views begin to abate, and we present our valuation matrix for Crédit Agricole below.

Crédit Agricole Valuation Matrix

Metric | Peer Multiple | Crédit Agricole Input | Implied Value |

Price-to-Book | 0.82 | € 16.10 | € 13.19 |

2013 P/E | 12.40 | € 0.97 | € 12.08 |

2014 P/E | 10.10 | € 1.18 | € 11.91 |

2015 P/E | 8.62 | € 1.39 | € 11.98 |

The average of these four metrics leads to an implied price target of €12.29 for shares of Crédit Agricole, representing upside of 33.82% for the bank's Paris-listed shares (based on a December 27 closing price of €9.185), which trade under the ticker ACA. Alternatively, investors may also invest in Crédit Agricole's ADR's which trade under the ticker CRARY, with each ADR representing half of an ordinary share. Taking our price target of €12.29 for Crédit Agricole's ordinary shares and applying a conservative €/$ exchange rate of 1:1.3 (versus the current rate of around €1.37449) yield a pro forma price target of $7.98 for Crédit Agricole's ADR's, representing upside of 26.67% relative to their December 27 closing price of $6.30.

Conclusions

Crédit Agricole's byzantine ownership structure has led to confusion over its true capital levels, but as we have shown, European regulatory authorities continue to examine Crédit Agricole's capital levels on a group basis, for the interlinked nature of Crédit Agricole S.A. and its regional banks is designed to bind them together, both in good times and bad. The bank has shed billions in PIIGS exposure, has continued to post profits in its international retail banking division and is continuing to cut costs and raise capital levels amidst continued macroeconomic uncertainty. Despite its progress, shares of Crédit Agricole continue to trade far below its peers, something we see as unwarranted. We believe that as 2014 progresses, this discount will begin to close, and with continued progress in strengthening its balance sheet, we see solid upside for investors in the coming year.

Disclosure: I am long OTCPK:CRARY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire