As an income-driven investor there are a number of minimum criteria I like to establish before deciding whether I should be bullish or bearish on a particular dividend paying stock.

For example these criteria include but are not limited to a dividend yield over 2.2%, a forward P/E ratio of 18.5 or lower, and strong dividend behavior over the last several years. In today's article I wanted to venture into the IT Services sector and highlight several reasons why I'm staying bullish on shares of Accenture, plc (ACN).

#1: Recent Performance And Trend Behavior Signals a Longer-Term Buying Mode

On Friday, shares of ACN, which currently possess a market cap of $53 billion, a forward P/E ratio of 16.82 and a dividend yield of 2.25% ($1.86), settled at a price of $82.51/share. Based on their closing price of $82.51/share, shares of ACN are trading 7.28% above their 20-day simple moving average, 8.66% above their 50-day simple moving average and 9.38% above their 200-day simple moving average. These numbers indicate a short-term, mid-term and long-term uptrend for the stock which generally signals a moderate buying mode for most long-term investors.

#2: Recent Dividend Behavior

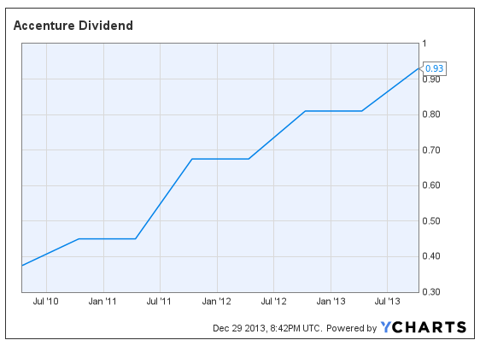

Since April 14, 2010, when Accenture began paying a semi-annual dividend, the company has increased its semi-annual distribution four times in the last three-and-a-half years, with the most recent increase having taken place in October of this year. The company's forward yield of 2.25% ($1.86) coupled with its ability to maintain its quarterly distribution over last three-and-a-half years, make this particular IT Services play a highly considerable option, especially for those who may be in the market for a moderate stream of quarterly income.

#3: Comparable Dividend Growth

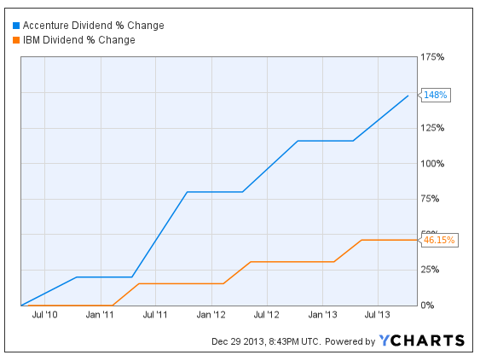

Not only does the company's 2.25% dividend yield and three-and-a-half-year dividend behavior make this particular stock a highly attractive option for most income-driven investors, its dividend growth over the last several years versus one of its sector-based peers is also something income-driven tech investors like myself should consider. From a comparable standpoint, ACN's dividend has grown a solid 148% over the past three-and-a-half years, whereas the dividend growth of its sector-based peer IBM (IBM) had only increased 46.15% over the same period.

#4: Recapping FQ1, Looking Ahead To FQ2

On Thursday, December 19, Accenture reported its quarterly results for FQ1 and a number of factors contributed to the company's solid report which beat EPS estimates by a margin of $0.05/share and revenue estimates by a margin of $150 million.

It should be noted that new bookings totaled $8.7B in FQ1, up from $8.4B in FQ4 and a depressed $7.5B in the year-ago period. Secondly, the company's consulting ($4.3B) and outsourcing ($4.4B) segments respectively made up 49% and 51% of bookings vs. 46% and 54% in FQ4. Lastly, the company's revenues in the Americas was only +3% vs. +8% in FQ4, EMEA revenues were +3% vs. +2% in FQ4, and Asia-Pacific revenues only fell -6% vs. -7% in FQ4. In my opinion the company would need to enhance the revenue generated by each of these segments, especially if it wants to meet or exceed analysts' expectations for FQ2.

How can Accenture surpass FQ2 estimates?

Before I highlight some of the reasons why I think Accenture will meet and/or exceed estimates I think we must first keep in mind that analysts are calling for Accenture to earn $1.04/share on revenue of $7.22 billion. If the company can demonstrate an increase of at least 3.0% to 4.0% in terms of the revenue generated from its Americas segment, an increase of at least 1% to 1.5% in terms of the revenue generated from its Asia-Pacific segment, and an increase of at least 3.5% to 4.5% in terms of the revenue generated from its EMEA segment I see no reason why the company's EPS and Revenue estimates can't be met or even slightly exceeded when the company announces its FQ2 results sometime in early 2014.

Risk Factors (Most Recent 10-K)

According to Accenture's most recent 10-K there are a number of risk factors investors should consider before establishing a position. These risk factors include but are not limited to:

#1 - The company's operations could be adversely affected by volatile, negative or uncertain economic conditions and the effects of these conditions on its clients' businesses and levels of business activity.

#2 - The company's ability to keep its supply of skills and resources in balance with client demand around the world and attract and retain professionals with strong leadership skills, its business, the utilization rate of its professionals and the results of operations may be materially adversely affected.

#3 - The company's operations and its ability to grow could be materially negatively affected if it cannot adapt and expand its services and solutions in response to ongoing changes in technology and offerings by new entrants.

Conclusion

For those of you considering a position in Accenture, I strongly recommend keeping a close eye on the company's earnings growth, its dividend behavior and its ability to deliver on its previously established commitments over the next 12-24 months as each of these factors could play a role in the company's long-term performance.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in ACN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire