The recent tapering of the bond purchasing program by the Federal Reserve shows the economy and job growth are improving across America, though there is still more work that needs to be done. Not all industries, states, and metropolitan areas are growing at the same rate, however. Some have robust growth, and increasing populations. Others are losing jobs and people, and have not really climbed out of the Great Recession or made any progress.

These factors are very important for regional banks. Regional banks are mirrors of the metropolitan areas and communities they serve and represent. If a metropolitan area has robust job growth and increasing population, the demand for loans for housing, automobiles, and new businesses will increase, driving bank profits higher. A bank in a poor economic environment will have less loan demand, as well as the higher possibility of borrowers defaulting on their loans. Included in this article below are two regional bank stocks that I believe have good potential to run higher, mainly in areas of the country where I expect higher than average GDP and job growth.

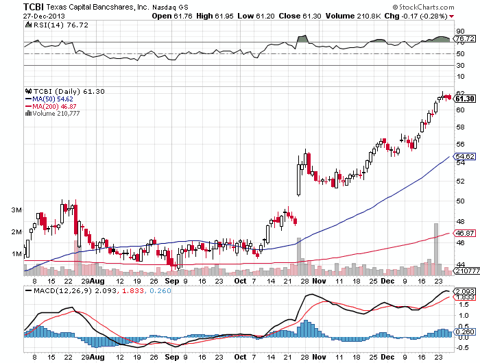

Texas Capital Banchsares (TCBI)

Texas Capital Bancshares is one of the largest commercial bas in Texas with offices in Houston, Austin, and Dallas, among other major areas. Texas, as you probably know, has one of the best economies in the nation. Led by the domestic energy production boom, Texas has an unemployment rate that is a full percentage point lower than the national rate. It also has the benefits of no state income tax, and a friendly regulatory business environment. Texas Capital Bancshares specializes in financial service solutions to entrepreneurs, business professionals, and commercial businesses. They provide commercial loans for general corporate purposes, treasury management services, as well as a successful mortgage warehouse lending business.

Total deposits increased by 33% year over year from Q3 2012, and they also had 10% growth in total loans during that same time frame. Texas Capital Bancshares balance sheet is also well positioned for growth in a higher interest rate environment, with over 90% of their loans being variable rates. With strong expected revenue and earnings growth for FY 2014, the forward P/E ratio of 17.5 makes Texas Capital Bancshares a tremendous opportunity.

Click to enlarge images.

Eagle Bancorp, Inc. (EGBN)

Eagle Bancorp is a leading commercial and consumer bank located in the Washington, D.C./Arlington-Alexandria metro area. With an unemployment rate more than a full percentage point lower than the national average, this area has held up well during the Great Recession. This is partially due to the federal government, which employs nearly 150,000 people in the area. Another major draw to this area are the large defense contractors, and a budding technology scene that could draw young people to this region for years to come.

Most of Eagle Bancorp's revenue, which is up 10% from Q3 2012, is from the commercial side of the business, as Bancorp derives very little revenue from residential mortgages. Bancorp has shown the ability to connect with the community and continually increase deposits, as they have one of the highest growth rates of any bank in the market and hold the largest market share of any community bank in the D.C. metro area. There is still an exceptional opportunity for growth in deposits, as Eagle Bancorp, even with the largest market share of any community bank in the region, is only 1.87% of the entire market. Eagle Bancorp's attractive deposit base has allowed them to earn a net interest margin of 4.31% in Q3 2013, up from 4.27% in Q2 2013 and 4.2% in Q1 2013. Eagle Bancorp is well positioned in an environment of rising rates, with over 50% of their loans being variable rates, and a large percentage of their fixed-rate loans expiring within the next year or two.

In conclusion, both of these companies have strong balance sheets and positive revenue growth supported by their core banking activities. This fact, coupled with the areas these banks are located in, should allow them to continue sustainable growth for shareholders in the future.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire