In an earlier article (titled: These 2 Funds Are Perfect For Each Other) my Betalyst View included the following statement: "As an income hungry investor, I would probably take on both Western Asset Global High Income Fund (EHI) and Eaton Vance Tax-Managed Buy-Write Opportunity Fund (ETV), then allocate at least 30 to 50% of my portfolio to higher yielding closed end funds to crank up the average yield on the overall portfolio (this also comes with more risk of course)." In this article, I will be highlighting a closed end fund that "cranks" up the average yield of an income portfolio.

The purpose of this article is to highlight an income closed end fund offering an investor's portfolio solid monthly income, diversification, security, consistency and most importantly, a high yield. Highlighted on Morningstar's website, AllianzGI Convertible & Income II Common Fund (NCZ) seeks total return with capital appreciation and high current income through investment in convertible and non-convertible income producing non-investment grade securities.

- Quote Snapshot

- Market Cap: $655.8mil

- Distribution Rate: 11.40%

- Total Leverage Ratio: 30.88%

- 52 Week Range: $7.74 - 9.10

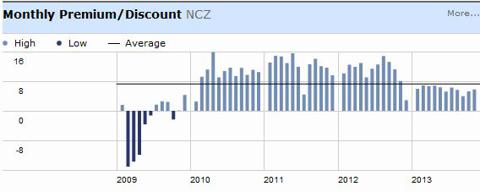

- Premium/Discount: +6.17%

- Current Market Price: $8.94

- NAV: 8.43

Here is why I currently own NCZ and why I'll be taking a bigger position in my portfolio:

- High Distribution Rate - NCZ currently distributes a solid 11.40% and has consistently distributed at that level for a couple of years. Comparing NCZ to other closed end funds that yield a similar distribution rate, NCZ stands out as one of the most consistent and highest paying closed end funds. Similar funds (by distribution) include AllianzGI Convertible & Income I Fund (NCV) and PIMCO High Income Fund (PHK).

- Distribution Composition - For the last five years this fund has paid out Fund Income (which is better than S/T or L/T capital gains or returning capital to investors), which is a good indicator from a distribution perspective. Similar funds, specifically funds like PIMCO Global StockPLUS & Income Fund (PGP) and PHK, have returned capital to investors, which is not always viewed positively from a capital preservation perspective (note: I believe that ROC, returning capital, is not a favorable attribute for highly yielding closed end funds. I believe that ROC has the impact of increasing the total leverage ratio and the expense ratio if the fund is leveraged and executes a consistent strategy, overtime. I would rather see a fund decrease the leverage ratio (decrease risk in tandem) and increase NAV than return capital as distributions).

- Distribution Frequency - With a distribution rate of 11.40% every investor's portfolio could find this fund useful from a monthly distribution perspective. When doing the math, and even leveraging NCZ in an investor's personal portfolio, that 11.40% distribution rate could turn into 15% (or more, depending on the amount of leverage taken) as your dividends reinvest in the fund to yield higher returns every month (note: only leverage your personal account if you understand the fees/costs associated with leveraging a closed end fund with your broker).

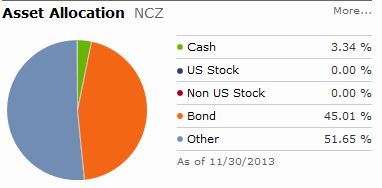

- Asset Allocation - NCZ offers a combination of both Convertibles and Fixed Income, split 45.01% bonds, 51.65% other, and 3.34% cash, making the fund relatively diversified. Many investors find themselves questioning how Fed Tapering and other government related developments will impact their portfolios, and frankly speaking, how does anyone really know what is actually going to happen in the market in 2014? The answer to this, is nobody actually knows. However, by fully diversifying a portfolio, the minimum due diligence is completed to guarantee that swings in interest rates will not put a portfolio into a downward spiral and cost an investor major losses.

- Better Than the Alternatives - When it comes to closed end funds, the funds focusing on Convertibles are fairly slim, especially if an investor is searching for a high yielding closed end fund. The alternatives are listed below to get a better idea on what's available.

- Low Expense Ratio - NCZ's expense ratio is comparably lower than other high yielding funds with similar portfolio strategies, charging 1.31%. When it comes to a closed end fund's expense ratio, I believe 1.31% is not a surprising figure given the portfolio management maintenance required to balance such a high yielding portfolio. If a similar closed end fund had the same expense ratio and lower distribution rate, I would view that as an issue since the charged expenses aren't justified by the distribution rate I would be getting, compared to NCZ.

Considerations I've taken into account before buying more NCZ shares:

- Morningstar rates NCZ as a Two Star fund - "The fund invests in both high-yield (or junk) bonds as well as convertible securities, both bonds and preferred shares. First, managers pick strong companies, then choose the vehicle based on valuation and expected returns. Managers also create synthetic convertibles." At first glance, the fund strategy seems a bit risky, however, the fund does identify and invest in relatively financially sound companies, and picking up their junk bonds doesn't exactly set the alarm off for risky. Based on their most recent 10-Q, the majority of the companies listed are multi-national and stable entities, so as an investor, I'm not too concerned about their portfolio bond rating allocations or investment selections.

- Market Price decreases - Since my holding period is between 5 and 10 years, short-term price fluctuations aren't that much of a concern from an investment longevity perspective. An advantageous strategy to execute with NCZ would be Dollar Cost Averaging a lump sum paired with reinvested dividends every month for optimal performance and payout.

- Fund Leverage - As of this article's publication, NCZ's leverage is at 30.88%, which is definitely on the higher side of the closed end fund spectrum. In fact, 30.88% is very high, however, it is never surprising to see bond funds leveraged to this level to realize higher yields. If NCZ was focused on primarily Equity investment vehicles, the leverage ratio would be more concerning.

What are the alternatives and why haven't I considered them (sorted by distribution rate):

- AllianzGI Convertible & Income I "NCV" Fund - In an article I wrote a couple of weeks back, I explained why NCV is currently a sell and how NCZ is a buy (read it here). In brief, NCV is actually overbought and the price is in service to drop to become more efficiently priced to distribute the same amount as NCZ. Some reasons to why NCV might be overbought may be due to the popularity of the fund with a couple of large institutional investors, which may find AllianzGI's funds very attractive, considering the management and yield of the fund(s).

- Calamos Convertible Opportunities & Income "CHI" Fund - Currently distributing 8.63%, maintaining an expense ratio of 1.57%. At first glance CHI seems like a sound investment, however, in the last couple of years CHI has returned capital to investors with fund income to maintain its 8% yield level, which may mean an increase in return of capital dividends in the future (which is value destructive from a convertibles focused closed end fund perspective). When reviewing the alternatives, CHI is not exactly that attractive when considering the fund's leverage ratio (which is at 24.95%). Overall, the fund is managing more capital than NCZ ($230mil+ more), but charges a higher expense ratio while distributing almost 3% less (which is made up of a capital returns and fund income) per year. Additionally, Calamos also manages Calamos Convertible & High Common "CHY" Fund, which yields 7.85% with even greater leverage and with more assets under management (and an even higher expense ratio). There is one attractive characteristic that CHY has that CHI does not, which is the discount to NAV. CHI currently trades right below its NAV (-0.48% discount), while CHY on the other hand vaunts a -7.21% discount to NAV, which may be an indicator of higher price appreciation to some investors at current trading levels.

- Advent Claymore Convertibles Securities & Income Fund (AGC) and Advent Claymore Convertibles & Income Fund (AVK) are arguably the strongest NCZ alternatives, not because of their yield offerings but because of the discounts to NAV. AGC currently trades at a -12.5% discount to NAV and AVK trades at a -8% discount to NAV, making the two funds very attractive from a price appreciation perspective (if price appreciation is imminent). However, at the current trading levels, both funds maintain 35%-plus leverage levels, which is a bit alarming from a market risk and volatility perspective. Not only is the leverage a bit of a red flag, but both funds have paid out a mix of fund income, short term capital gains, and capital returns to investors in the last couple of years, making the fund performance fairly inconsistent. From a distribution perspective, both funds pay out around 6% to 7% per year (of which, only 3% to 5% was from fund income), while NCZ managed to pay out 100% of its 11.40% in fund income in the same time span.

- Putnam High Income Securities Fund (PCF) - Currently distributing 5.65% to investors. PCF is one of the few funds in the convertibles closed end fund universe that does not utilize leverage to increase returns (an attractive characteristic in this analysis, given unpredictable market developments and potential market volatility in 2014). PCF also trades at a -9.62% discount and maintains a three year average discount of -4.05%, which signals to me that the price may appreciate by up to 5% (if performance slightly improves in 2014 and leverage is held at 0.00%). Surprisingly, PCF maintains a 0.90% expense ratio and manages $137.3mil in assets, making it one of the most efficiently managed funds in the convertibles closed end funds universe. Overall, very interesting fund to consider buying, but yields a relatively low distribution compared to its highly leveraged peers.

- Ellsworth Common Fund (ECF)

- - Like PCF, ECF is not a leveraged fund, and trading at a whopping -16.22% discount to NAV, however, in this case, a price appreciation does not seem imminent given the fund's three year average discount of -14.25%. ECF only distributes 2.93% to investors, which is drastically less than NCZ and other peers listed earlier. Positively, ECF has only paid out fund income in the last few years and has appreciated 12.62% in the last three years, and 78.45% in the last five years, making it an attractive price appreciation trade/position, but not a high yielding investment vehicle when compared to NCZ.Bancroft Common Fund (BCV) - BCV distributes 4.34% to investors and trades at a -17.43% discount to NAV, making it one of the cheapest funds in the closed end fund universe (from a discount to NAV perspective). Like ECF and PCF, BCV is not a leveraged fund and is almost solely invested in convertibles instead of a blend of bonds and convertibles like some of the other funds in the convertibles fund world. Overall, not a very attractive fund to jump into, but could be appealing to risk averse investors seeking low volatility investment ideas.

Betalyst View: Considering all the funds in the convertibles closed end fund universe, I plan on adding more NCZ to my portfolio and plan on holding the positions for a substantially long time (5 to 10 years) given the fund's distribution rate and portfolio strategy does not change. As long as that fund continues to perform at current levels, it is a buy and hold in my book.

Disclosure: I am long PHK, NCZ, NCV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire