By Kevin Cook

One of the most notable brand face-lifts of 2013 was when Coinstar changed its name (and stock symbol) to Outerwall (OUTR). At the time, you may have wondered why they didn't just call themselves Redbox, after their premier brand of DVD kiosks. But if you have read anything I've written about the company in the past few years, you know I saw something like this coming.

From my October 2011 article Coinstar Sees Red on Price Boost, here is the rationale I gave...

Innovation is About Knowing What Business You Are In

And speaking of machines that give you things when you put money in them, they've got ideas too, as this mysteriously close-to-the-vest quote implies: "Our New Ventures segment is moving forward with our innovative automated retail concepts."

Right on! They know they are in the consumer engagement business. I'm asking, "What can't you sell out of a kiosk?" People love simplicity, convenience... and pressing cool buttons that give them candy, DVDs, and other fun things.

The Business of Convenience

Following my prescient views, in 2012 Coinstar rolled out the Rubi Kiosk to serve Seattle's Best Coffee. More on this in a moment, as my enthusiasm about what the company could do with kiosk concepts of any color hasn't exactly turned into green.

Along with the name change in 2013 came their newest innovation, the ecoATM, which is tackling the problem of e-waste by recycling consumers' old phones, mp3s, tablets and more-and paying cash for most devices.

And I don't expect they are stopping the innovation there. As the company website proclaims:

"We transform empty spaces into exciting retail solutions that make life easier and less complicated for consumers - and more profitable for retailers. Powered by proven technologies and practices - and a great instinct about people - we're revolutionizing the way people shop and do business with a growing portfolio of products and services."

The Earnings Outlook

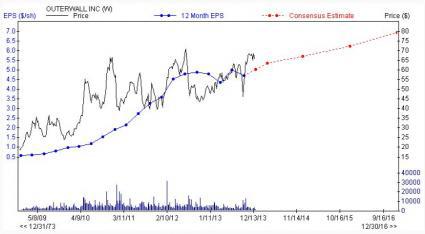

As you can see in the 12-month EPS projection with price below, shares have ridden the upward trajectory of actual earnings and analyst estimates. But the path has often been bumpy and volatile.

Outerwall became a Zacks #1 Rank again last week after a wave of upward EPS estimate revisions hit in mid-December, bumping the 2014 consensus 6.5% to $5.72 from $5.37 and back to double-digit earnings growth of 13.5%. The catalyst was a corporate restructuring which actually had to do an about-face on a few innovations.

Here were the highlights from the December 10 press release announcing the company's intentions:

- Plans to Exit Three New Venture Concepts

- Announces Leadership Transition at Redbox

- Implements Additional Actions Expected to Achieve $22 Million of Annual Cost Savings

- Increases Senior Secured Credit Facility by $350 Million to Achieve Target Net Leverage Ratio in Q1 2014

Analysts Encouraged

Among the discontinued "new venture concepts" were Rubi, Crisp Market (vegetables in a kiosk?), and Star Studio. It looks like innovation just hit a big speed bump.

But, following the 14th Annual California Dreamin' Conference, which was the same day as the company revelations, Wedbush analysts had this to say...

"We are encouraged that management continues to demonstrate alignment with shareholders, and believe that the restructuring has positioned Outerwall to substantially grow EPS in 2014. The company will discontinue three of its New Ventures businesses, but continue to invest in its ecoATM business, which we expect to be accretive to EPS in 2014.

We think Outerwall is a cash flow story and believe that its cash flows will be relatively stable over time. We think that with a shrinking share count and stable cash flow, Outerwall shares will continue to appreciate over the long term."

The firm has an $82 price target on OUTR, which reflects just over 12x their 2014 EPS estimate of $6.75, the highest on the Street.

Other analysts were less enthusiastic, with JPMorgan maintaining its $60 price target, noting that while Redbox is clearly the dominant player in DVD rentals, that market may be getting close to saturation. But they also noted the potential for the company to manage its cash flow generation in positive ways.

I would tend to agree about the DVD saturation argument. It's not like there is a growing segment of the population that will soon be adopting DVD rental. In fact, arguments could be made that "late-adopters" of the Netflix (NFLX) model could give up the Redbox way.

Bottom line: As Outerwall makes an adjustment to its 2013 face-lift, they get to streamline their existing cash cow and buy themselves some time back at the innovation drawing board. So far, Wall Street likes the adjustment, with shares making a new 52-week high at $72 after the plans were announced and now only 7% off those highs.

If they can come up with innovations to build off of Redbox success -- and that don't require a lot of cash burn -- they might create the next catalyst to break that $6 EPS ceiling and keep the shares attractive above $60.

OUTERWALL INC (OUTR): Free Stock Analysis Report (email registration required)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire