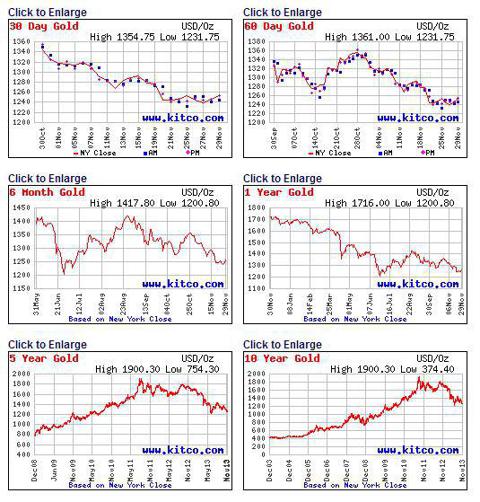

So, by now, I had expected that new lows would have been seen in both silver and gold. Don't get me wrong, I am still of the opinion that lower lows will most likely be seen. However, the action over the last week has made me question whether another rally will be seen before the final "flush" down is seen in the metals.

At this time, I have to be honest in that I am struggling to present you with a fundamental argument for buying or selling silver and gold. Many others have pointed to Chinese demand, or the HUI chart, or many other reasons as to why the metals will either tumble further or will rally strongly.

But, this is nothing new to those of you who have been terribly whipsawed over the last two years. All of you know one thing: the metals are not an easy trade, and fundamental "reasons" have not aided in providing insight into the next move in the metals.

Furthermore, there are many that attempt to day trade the metals, and I have always discouraged this practice. The metals are among the most volatile of all investment vehicles, so trying to trade the smallest moves in them is extraordinarily difficult and something I try to discourage for most people. However, the swing trade set ups in the metals are some of the best trades to be had, as long as you have an appropriate pattern with which to work.

For example, back towards the end of the summer of 2011, I was looking for a top in silver in the 43/44 region, with the potential to decline to the 26/27 region. I personally loaded up on out of the money puts for that trade, and using approximately 2% of my aggressive trading account, I was able to double that entire account within a month's time. However, those type of trades do not present themselves exceptionally often, so one must take advantage of them when they do. But, at the time I was suggesting such a move, most of the readership here at Seeking Alpha was viewing me as a complete crackpot, especially since I had only started writing for Seeking Alpha a few months before that.

Yet, right now, I will be completely honest and tell you that this market can go either way. At the time of this writing, I have no serious clarity as to what the next 10+% move in the metals will be. In fact, it is something I will have to monitor very closely over the upcoming week to be able to make that determination.

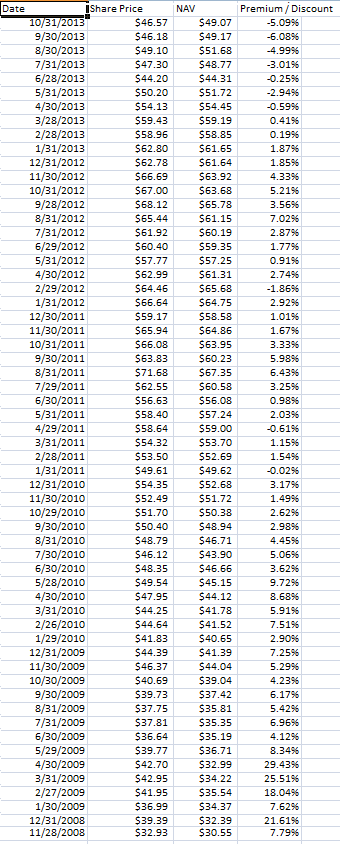

But, since I did suggest to readers that I will provide an update this weekend, I am simply following through on my promise, and will tell you what I will be making my determination over the next week. And, any decision I make will likely be on the fly, and will not be able to provide you with forewarning here at Seeking Alpha, so I will have to suggest extreme caution to those who are trying to catch the 5-10% moves in the metals, rather than the much larger moves in the metals. Those that are trying to catch the much larger moves in the metals know well enough that any further declines seen over the next week or two is likely another opportunity to add to long term positions, and I am completely on board with that perspective. Furthermore, I see no reason to cash in my longer term puts unless I see a strong move over the GLD 123 region (for a 15 point profit from our shorting point of 138GLD).

At present, even though 117GLD has held as support so far, we can now see a break down below the 117 region, which may no longer suggest a waterfall decline. Unfortunately, it will now take a strong break down below 115 to get me to target the 98 region. And, any move through the 123 region will have me targeting the 131.50 region at a minimum, with the potential to still head back to the 140 region.

It was for this reason that I strongly suggested in our Trading Room this past week to all those that were still in put options with expirations of earlier than February of 2014 to consider taking their profits from our initial short trade from 138. And, if you want to maintain a short position, my suggestion would be to use options that go further out into 2014 in order to play it safe.

As for silver, it still can drop back into the 18.30-18.95 region without confirming that a long lasting bottom is in place, and it then may see a rally back to the 26 region before being its final phase to lower lows, if it is unable to break down below 18.30.

But, please do not believe that I am of the position that we will be clearly making a final low in the metals if we see a bit lower in the metals. While it is certainly possible, I still maintain that we will see the 100 region in GLD and 16.50-17.75 region in silver before we can consider that a bottom has been made in the metals. However, for those that are playing for the longer term trend, I am hoping that you are seriously considering buying VERY long term positions on the long side in the metals on any further drops, as we will likely be closing in on major lows in the metals within the next 3-6 months.

Disclosure: I am long SLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I also have intermediate term GLD put positions.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869561-silver-and-gold-another-rally-before-lower-lows?source=feed