Sometimes cash is king. Today is one of those times. The dreaded taper has arrived and the Fed has begun the dangerous process of unwinding its massive Quantitative Easing (QE) initiative. With a balance sheet now in excess of $4 trillion and still growing albeit at a slower rate, the normalization of the Fed's involvement in so-called "stimulus" may not go as smoothly as bullish investors hope.

The Fed has assured the market that interest rates will remain low. The market has its own view. Ten year treasuries have risen to a two and one half year high.

Higher short term rates might lure some funds into money market funds but they are not going to make anyone lengthen the duration of their bond portfolio for the time being. The bond market is likely to be shark infested waters.

At the same time, bullish sentiment in the stock market has reached what I believe is fever pitch. The market valuation of momentum darlings like Tesla (TSLA), Amazon.com (AMZN), Twitter (TWTR), and Salesforce.com (CRM) stretch the imagination of what has to take place for these companies to grow into their valuations. More than likely, they cannot and will not.

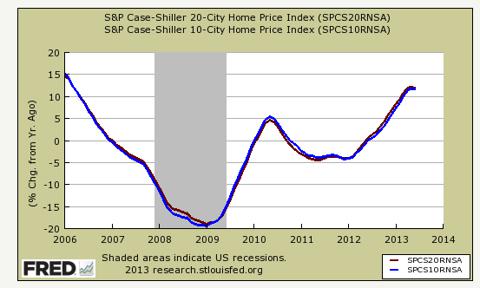

Housing prices having rebounded to their pre-crash highs in some markets.

The bullish run is now almost five years old and the stock market is hitting all-time highs. World economies are improving, Europe is recovering, China is still growing, Japan has seen a modest upturn in inflation (a welcome sign after years of deflation), and start-up companies like Twitter are doubling within weeks of their initial public offering.

Does it sound a bit too good to be true? It should. It is.

The fact is that the United States has done little to deal with its debt load and the time will come to pay the piper.

The expansion in China has been fueled by central government policies that rival those in the early days of post-Tsar Russia. Thousands of new homes sit empty. The Chinese banking system is chock full of toxic loans that may never be repaid with potential losses large enough to wipe out the banking system's capital. Poor environmental controls have resulted in pollution that has made major Chinese cities' air quality almost unlivable.

The Middle Kingdom has been the engine of growth for the world for a dozen years but that may hid a pothole or two over the coming months as China grapples with its issues.

Populous India has often been seen as the next major source of world growth creating demand for Western technology and goods. But India faces its own economic problems including high inflation, rising interest rates, slowing growth and a falling exchange rate.

The best hope for continued world growth is surprisingly the United States. Rapid advances in oil & gas drilling technologies have given the U.S. the possibility of becoming not only energy self-sufficient but also a net exporter of oil in the next decade or two. Environmental issues are real ones and deserve more than lip service, but they cannot nor should not be a barrier to progress. Instead, with its enormous technical capabilities the United States should be moving aggressively to overcome environmental roadblocks and capitalize on the chance to be free from dependence on OPEC once and for all.

I don't see much happening in 2014. Despite a lot of lobbying by proponents of natural gas based vehicles like Boone Pickens, policy has yet to emerge to give any impetus to this initiative. Oil & Gas explorers and developers will tailor their drilling to fast payback operations and defer long term developments until energy policy is clear and well-articulated.

Some sectors should do well in 2014. Gold and materials have been depressed and related stocks are trading at deep discounts to net asset values and low multiples of cash flows. Over time, both base metals and precious metals hold promise of significant returns.

For the same reasons, well financed and profitable oil & gas companies look attractive. Mid-tier dividend paying entities like Enerplus Resources (ERF), Canadian Oil Sands (OTCQX:COSWF) and Pengrowth Petroleum (PGH) look like relatively safe bets with good current yields and the potential for capital appreciation. More aggressive investors might look at Lightstream Resources (OTCPK:LSTMF) or Pennwest Petroleum (PWE), both beaten down badly but with excellent landholdings and new management in place.

In the materials sector, gold companies like Detour Gold (OTCPK:DRGDF)and IAMGOLD (IAG) trade at historically low valuations and are highly levered to any rise in gold prices with strong enough balance sheets to weather a modest decline without fatal consequences. Small cap players like Capstone Mining (OTCPK:CSFFF), Nevada Copper (OTC:NEVDF) and Augusta Resources (AZC) offer leverage to copper prices, and industry leading Cameco Corporation (CCJ) may reward those who see a recovery in uranium prices now that the conversion of weapons grade uranium to peacetime uses has run its course and new reactors under construction add to demand.

But cash may be the most rewarding investment of them all. Only those with dry power will be able to capitalize on any sharp downturn in markets. There are plenty of risks still facing this old bull market and it would not take much to bring it to an end or at least to correct sharply. While earnings multiples do not look overly extended, they are multiples of peak and not trough earnings and my view is that 15 to 18 times peak earnings is dangerous territory.

A sensible portfolio includes diversification, a weighting in depressed materials, a bit of gold and a healthy allocation to cash - at least 15% to 30% as I see it.

SA Author Chuck Carnevale has published two excellent articles suggesting that now is not the time to move to cash. Chuck is an excellent author and has spent his life studying investing and his inputs are of great value. On this point, however, and at this time in the market, I think he is short term right and long term wrong.

Market turns are impossible to time. But they can be violent when they occur. Suppose you wake up tomorrow and learn that North Korea has declared war on South Korea; or that Iran has detonated a nuclear weapon; or, that India has invaded Pakistan. These events are unlikely but could move the markets. But they are not probable and are not the events to plan for.

Instead, suppose you woke up to learn that the treasury auction of 30 year notes was undersubscribed and long rates had moved up 50 basis points; or that a major bank in China had failed; or, that Argentina had nationalized all mining assets in the country. Those are risks that could reasonably happen and turn the market from bull to bear overnight.

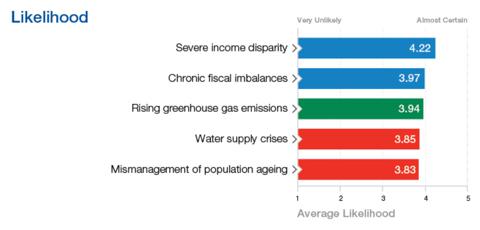

There are other risks to the world economy. The top five according to the World Economic Forum include dislocations from income disparity, fiscal imbalances, greenhouse gas emissions, water supply crises and mismanagement of population ageing. All have a high degree of likelihood although none are easy to forecast or prepare for.

Income disparity has worsened in the past five years. Fiscal imbalances remain a key issue. Greenhouse gas emissions continue to avoid real solutions. Water supply is a serious problem in the developing world. And none of the major economies has made any real progress in preparing for their ageing population's demands on pension income or health care.

We live in an uncertain world. The major forces that can hurt the market are as present today as they were 5 years ago but the market has more than doubled. It is simply prudent to hold some cash.

Good luck with your investments and every wish for a successful 2014.

Disclosure: I am long PWE, PGH, OTCQX:COSWF, ERF, IAG, OTCPK:OTCPK:DRGDF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I am short CRM

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire