If you didn't get everything you wanted for Christmas this year, don't worry - Citron Research has given you the opportunity to purchase Textura (TXTR) shares now. The recent report by Citron is completely absurd - we believe the real "pump and dump" is being orchestrated by Citron. All of us know that 2013 has been a difficult year to make money shorting stocks. As a result, Citron is making a desperate and pathetic last ditch effort to attack Textura with baseless claims like a pack of wolves.

The report misleads the public through myopic false interpretations of obscure financials and outdated data. Instead of only looking at filings, we've completed actual research, spoken with general contractors, met with management, and provided in-depth analysis that doesn't involve movie titles. We hold steady that Textura is a highly durable business model that will become the industry standard in construction management.

Furthermore, Citron's report was also written during a blackout period for Textura's insiders, so they are currently restricted from purchasing any stock at this moment. The report also aligns nicely up with Christmas break, when no one was in their office and volume was light, triggering a panic.

Full disclosure: Goudy Park Capital owns over 77,000 Textura shares and views the pullback created by Citron to be an extraordinary opportunity to buy shares in a highly scalable business with a huge long-term moat for many years to come. We bought more shares on Thursday and Friday and will be buying more shares on Monday. Prior to taking a position in Textura, we first met with the company in 2011, while it was still private. Over the course of the last 3 years, we have met no less than 8 times with Pat Allin and no less than 3 times with Franco Turrinelli, EVP of Corporate Development, and Jillian Sheehan, CFO. In addition, we have met multiple times with the senior member of the engineering team who wrote the original code for the CPM software. We are impressed by how customizable the software is (250,000 ways to configure, incredibly complex code). The software allows construction companies to work more efficiently, lower risk, start projects faster, generate and share unique documents amongst hundreds of disparate teams, and save on expenses as well. A typical customer saves 4-5x the cost of the software. The software is covered by 41 global patents with 50 more pending (see SEC publicly available disclosures).

One of our primary reasons for investing in the company was the strong leadership of the management team and especially that of Chairman/CEO, Patrick Allin. We were impressed with his combination of leadership skills and success as COO and CFO of PricewaterhouseCoopers' Global Consulting Practice along with his entrepreneurial spirit. We were also impressed with his integrity and what people had to say about him in the community. Currently, Pat serves on the Board of Directors of Lurie's Children Hospital in Chicago. He is also the former Chairman and Director of the United Way of Lake County Campaign, former Director of the Toronto Symphony, and former director of the National Ballet School of Canada. (all publicly available information).

We met with management two weeks ago in their office and spoke to them again over the weekend to discuss Citron's report and gain better understanding.

Here's our point by point rebuttal:

"Lying to the SEC" - Citron claims that Textura lied to the SEC because their original S-1 included the terms "high client retention" and "growing demand from our increasingly multinational clients," which was removed after an SEC inquiry. We want to note that it's common practice for S-1 documents to go through 5+ revisions, in which items get taken out or revised. We're not even sure how this is considered "lying," but if Citron took time to actually talk to management, they'd learn that management does substantiate these claims. Although Textura may not disclose the exact retention rate or growing demand figure that Citron is expecting, the company has consistently stated that once a general contractor ("GC") implements their software (which takes about 12-18 months), almost ALL future projects (except for some one-offs) are done through Textura. Basically, retention rates are near 100%. So why doesn't Textura come out and state this figure? This is because the business model isn't a standard subscription based approach - it is recurring revenues, but Textura charges using a multi-tiered system in which both a monthly rate and a percentage rate exist. (see public filings)

As for their international clients, Textura has stated that they are leveraging their large GC base to expand into new markets. They've recently announced their first foray into Europe through Gilbane (an existing North American GC) and also mentioned more Western Europe opportunities by way of their Australian GCs. Additionally, their Latista acquisition this month provides a physical presence inside Russia. (see SEC public filings)

CEO's Past - Citron states that the CEO, Mr. Allin, sold 230,000 shares in the follow-on offering. What the article fails to mention is that since the offering, insiders still own 32% or 8.3m shares. None of these shares, including Mr. Allin's 1.2m, were sold during the lockup expiration earlier this month. (see SEC public filings).

The article then jumps back to 2002 and brings up Mr. Allin's former company that ended up as a "pump and dump." Citron never actually states that Mr. Allin had any wrongdoing, and instead states it clearly that it was others that were convicted of fraud. None of the links that Citron provide include Mr. Allin's name - did Citron assume that readers wouldn't do their own diligence to check? FINRA's investigation clearly states that it was investigating activities that occurred PRIOR to Mr. Allin's acquisition of CPFS. Mr. Allin left the company after less than one-and-a-half years. This information has no basis on his stewardship at Textura.

Internal Controls and Misstatement - Part of Citron's thesis is that there will be major misstatements and revisions due to the prior lack of internal controls. However, Textura is a recently public company. We've seen many growth companies have some initial weakness in internal controls - after all, these companies weren't under audit scrutiny in the past. More importantly, none of these weaknesses were due to revenue or expense line items. Rather, they revolved around accounting for warrants. Textura has already stated that they have taken care of the issue and do not expect it to arise again. (see SEC public filings).

EVP of Corporate Development from William Blair - Citron's report implies that Textura hired their EVP from William Blair's sell-side right before the IPO in order to receive an "outperform." In fact, the hire was completed over THREE years before this year's IPO. Citron then mentions that this individual was the boss of the current analyst. If you left a firm, you would assume that your subordinate would eventually take your position. How this is relevant to Textura confuses us. Furthermore, any simple search will show that sell-side analysts have been able to move to the corporate side with success. This is an example of more fluff from Citron without any substance. Charles Phillips was a sell-side analyst and has since become the president of Oracle (ORCL). Sarah Friar was a sell-side analyst who is now the CFO at Square. John Torrey was a sell-side analyst who is now the Corporate Strategy Executive VP at Concur (CNQR). There have been many others who have successfully made the transition without any prior industry experience. (see SEC filings)

"Deceiving" Investors with Market Sizing - Another classic case of being buried in the filings without learning the whole picture. Citron believes that the "construction value" reported figure is completely useless because revenue is much different. However, Citron doesn't understand that Textura derives revenue AS A PERCENTAGE of construction value. In fact, about 80% of revenues are based off construction value. If Textura charges 10 basis points per implementation, how else would they model revenues? This isn't a hidden fact - it's been mentioned multiple times by management and is stated in SEC filings.

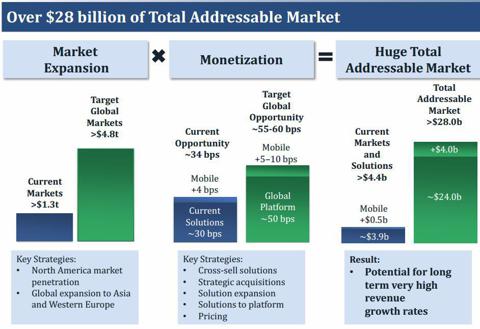

Furthermore, Citron believes that Textura is pulling outrageous numbers out of a hat. If you look at current pricing and current construction activity worldwide, you see that Textura has about a $4 BILLION opportunity. The construction market isn't new, but implementing a SaaS solution for CPM is new. Most large GCs have in-house software, and Textura is the first to market with a standardized product. Including pricing increases (which will go into effect Feb 2014), platform cross sell (already happening), and increased worldwide expansion, the opportunity balloons into $28 BILLION. We're not saying Textura will achieve 100% of this market - but even if Textura only gains 1% of this opportunity, the company jumps from 35m in revenues to 280m very quickly. This isn't an unrealistic number - the total construction market is ~5-7 trillion, and Textura is expected to generate up to 60 bps off this value.

(source: company presentation)

Textura's "Real" Business - We think that it's hypocritical of Citron to bring up a lack of experience for Textura's EVP, yet claim to understand the Textura's core business without their own experience or background. For example, Citron claims that the CPM business is a simple process of collecting Lien Waiver forms. Why didn't they mention the billing, invoicing, tracking, authorization, and compliance solutions? Or why did they decide to omit the fact that over 300 GCs and 80,000 subcontractors currently use Textura's CPM? We believe the product speaks for itself - if it's good enough for the GCs (GCs use it on nearly all their projects, including 3 of the top 20), it's good enough for us.

Here's an easy way to think about Textura's CPM business. Just off the current client base, Textura is about 50% penetrated. It's only at 50% because it takes 12 to 18 months to fully implement the system; to date, every GC that has started using Textura has fully implemented. So without any new clients and zero pricing considerations (even though increased pricing starts Feb 2014), Textura will double revenues in 12-18 months.

Bhavan Suri - William Blair

Okay. So within your existing GCs the opportunity to double still remains and then that fully accounted will be 10% of the North American market. Is that the right way to think about it?

Pat Allin - CEO

Yes, no, if they fully implement it, we'd be more in the 18% to 20% range

(source: last Textura earnings call).

Negative Operating Leverage - Citron mentions that there was negative operating leverage in the last year, but fails to state the fact that Textura has announced publicly that 2014 will generate positive leverage, in which operating expenses will increase at only 60% of revenue growth. (see Company presentations and reports issued by Credit Suisse, William Blair, Barrington, JMP and Oppenheimer)

Subcontractor Churn - Textura doesn't disclose subcontractor churn because it's irrelevant and nearly impossible to track. A large GC might have 200 projects running concurrently, each with different subcontractors. What if a GC decides to start a new project that doesn't require plumbing - the plumbing subcontractor might "churn" off, but Textura doesn't lose revenue. Textura gets paid based off the entire value of the project, whether it's from electrical, plumbing, flooring, etc. Again, Citron doesn't understand the business model - subcontractor churn number isn't relevant as long as the GCs keep using Textura for their projects. The key takeaway from this is that Textura doesn't need to spend sales & marketing dollars on the subcontractors - as long as the GCs agree, everyone is required to use Textura's products. Subcontractors understand the model as well - when a GC looks at a new project, about 70-75% of the subcontractors have already used Textura before. Since the subcontractor is obliged to use the products, Textura also has significant pricing power as well. If a subcontractor is unhappy, the GC will just go to the next subcontractor down the line.

In summary, the cost to acquire a subcontractor client is essentially zero, and although you can't track lifetime value from subcontractor to subcontractor, you can from the subcontractor group as a combined whole. (See SEC public document of company prospectus summary for further clarity on business model)

Aon Concentration - Citron brings back an old agreement that isn't relevant anymore. Aon Risk Services divested of 100% of their ownership in Textura. If we are worried about "major" concentration risk, it's just easier to look at customer concentration. Textura's largest customer accounted for 9% of revs, down from 11% in the 2012. Top 10 customer concentration decreased from 42% in 2012 to 29% in 2013. This is clearly disclosed in the filings - we wonder why Citron missed this part. (see SEC public documents)

Insolvency - Textura has about 85m in cash, post Latista acquisition. The company generated negative FCF of 13m in 2013. This is already a large enough cash cushion, and considering that the company expects to achieve significant operating leverage in 2014, we believe that Textura will be breakeven on FCF by 2H 2014. No real going concerns here. (see SEC public documents for balance sheet and cash balance)

Valuation - Citron basically grabbed the worst comp they could find to value Textura. Sage (OTC:SGGEF) is a low single digit growth company, compared to Textura, which is expected to grow over 55% for the next two years. It's appalling to see the comparison being made as they are in opposite ends of the lifecycle. Sure, the companies operate in the same industries, but they do not have competing products. In fact, Textura is listed as one of Sage's partners on the Sage website.

Furthermore, even at 3-4% growth, Sage commands a healthy 3.2x sales multiple, even though they aren't fully SaaS, nor are they in one vertical - two main advantages that Textura possesses. At 60%+ growth in 2014, we don't see why Textura can't trade in the range of 12-15x sales.

For a better comparison, we like to look at the Bessemer Venture Partners' Cloud Computing Index, which lists most SaaS companies.

If we look at the 12/18 list, we see that Textura has the second highest growth rate, yet isn't even in the top 10 in valuation anymore at 10.8x 2014 EV/sales. This is a SaaS company that has significant runway, no competition, and has a significant greenfield market opportunity. If you use a conservative base case valuation of 10x on 2015 sales, including cash, the stock is worth $41, or 36% upside from today's price. 15x sales gets you to $60, or 100% upside. We think the $60 share is further justified as the company reaches the breakeven point by 2015 and starts generating FCF in the 2H of 2014. At worse, we don't see Textura trading below the 6-8x range, which is what comps in the 25% growth range trade at. This places the downside case for Textura at about 10%. To sum it up, Textura has a 3.5 to 1 upside ratio, with optionality to go as high as a 10 to 1 ratio in the next year. We challenge readers to find investments with these asymmetrical returns, especially one with continued room to grow in the long term with similar barriers to entry and pricing power.

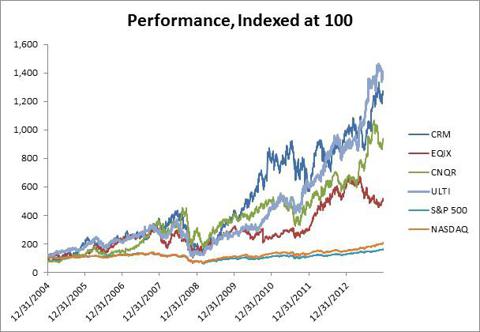

We can also look at other high growth SaaS or recurring revenue companies in the past. These companies are similar to Textura - high growth companies that were scrutinized for their multiples and lack of profitability. Let's see where they are now:

The investment with these companies and with Textura is based on the sustainability of growth. As long as growth doesn't decelerate drastically, the multiple won't compress. Obviously, all companies slow over time, but if you short a high growth company solely based on valuation too early in its lifecycle, you'll get carried out on a stretcher (this is seen in other industries as well, in names such as Chipotle (CMG), Cerner (CERN), Lululemon (LULU), and Green Mountain Coffee (GMCR), among many others.). We don't disagree that an investor will have to pay a premium multiple for a predictable recurring revenue business model with pricing power, no competition, and significant networks effects. However, if you take a step back from a given quarter, it's very likely that Textura can grow from 36m in sales in 2013 to 200m in sales over the next four to five years and generate $2.50-$3 a share in FCF.

Respected enterprise companies such as Oracle, SAP, and IBM have all been acquiring SaaS companies over the last several years for 5-10x sales. These companies that have been acquired typically have half the growth rate of Textura, so this further justifies our valuation.

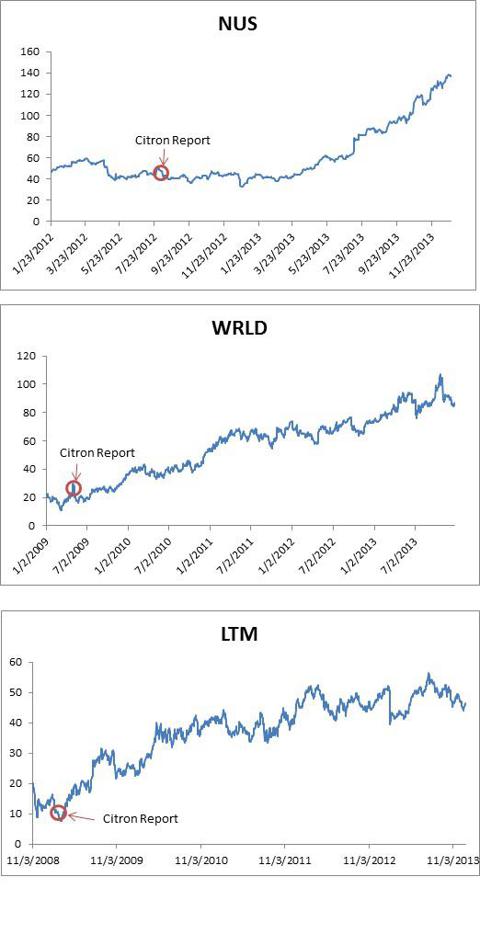

While Citron has done good work in the past with Chinese companies, we've seen them fail multiple times with legitimate, growing companies. Names such as NuSkin (NUS), Life Time Fitness (LTM), and World Acceptance Corp. (WRLD) come to mind. NuSkin has tripled since Citron's report on that stock in 2012, while Lifetime Fitness is up 5x since 2008 and World Acceptance has quadrupled since 2009.

We also see that highly respected funds such as Fidelity, Federated, and Blackrock all own and have increased ownership in Textura.

Fidelity Investments (under FMR LLC), which has operated for 67 years and has 1.7 trillion in AUM, added over a million shares in Q3.

Federated Investors, with a 56 year history and 367 billion in AUM, also added over one million shares in Q3.

Blackrock Advisors, with 25 years of operations and 4 trillion in AUM, the largest investment manager in the world, added over 200,000 shar es in Q3.

A full list of current holders is here.

Citron has essentially gift wrapped Textura for investors - the company is ~25% off last week's price point, and even cheaper when we consider the upside. The company expects to fully implement another top 20 GC soon, and half of the top 20 by the end of 2015. Through our point by point rebuttal, we believe that Citron's piece is completely worthless, and encourage investors to do their own research to understand the attractive investment in Textura for themselves.

Disclosure: I am long TXTR. (More...)

Business relationship disclosure: Business relationship disclosure: The article has been written by Goudy Park Capital. The author is Roy Liao, one of the analysts at Goudy Park Capital. Goudy Park Capital is not receiving compensation for it (other than from Seeking Alpha). Goudy Park Capital has no business relationship with any company whose stock is mentioned in this article.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire