Advanced Micro Devices (AMD) develops graphics processors, chipsets, micro processors and related technology. It's main competitor is Intel (INTC) which has a significantly larger market capitalization than AMD ($128 billion vs. $3 billion). Nvidia (NVDA) is AMD's major competitor in the area of graphics processors. The company has a 45-year track record in developing innovative technology products and has been on the industry forefront in driving new inventions. I have previously established an opportunistic position in Micron (MU), a leading DRAM and NAND memory play, and I believe Advanced Micro Devices has equal turnaround potential.

Historical share performance

Advanced Micro Devices has gained substantially during 2013: Shares are up a massive 66% and among the best performing stocks of the year.

Other semiconductor firms in the sector have done much better than Advanced Micro Devices though. Texas Instruments (TXN), for instance, gained 49%, Freescale Semiconductors (FSL) 20% and Maxim Integrated Products (MXIM) at least 7%. Intel presented quite a disappointing return of 4% which is largely attributable to revenue challenges stemming from its PC hardware business. The return differential between AMD and other semiconductor firms depicted in the chart below is quite significant and highlights the turnaround potential for shares of Advanced Micro Devices. On November 12, 2012 AMD was trading at $1.86 per share and has more than doubled until now.

Shares of semiconductor firm Micron , on the other hand, skyrocketed 243% as memory prices rebounded sharply in 2013 and the company profited from positive momentum from a David Einhorn endorsement.

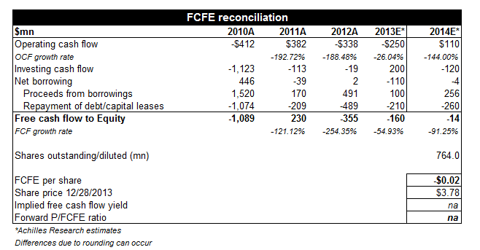

Intrinsic value estimate based on free cash flow

I had a look at Advanced Micro Devices' most recent 10-K and 10-Q filing in order to reconcile the free cash flow to equity for the company. As can be seen in the table below, AMD's operating cash flows have been quite volatile over the last three years and its erratic historical cash flow pattern increases the risk of forecast error. For the first nine month of 2013 Advanced Micro Devices has presented a net loss of $172 million and a negative operating cash flow of $169 (although net losses have come down substantially from $710 million in the first nine month of 2012).

In any case, I estimate that Advanced Micro Devices carries forward such momentum and might actually achieve a positive operating cash flow in fiscal year 2014. Nevertheless, I estimate that its free cash flow to equity will still be slightly negative at $0.02 per share in 2014.

However, a turnaround in operating cash flow and net income profitability should be substantial catalysts for AMD's shares. Impulses from a change of investor sentiment have led to outstanding returns for investors who purchased Micron or Infineon Technologies (OTCQX:IFNNY) at a time when they still posted negative results.

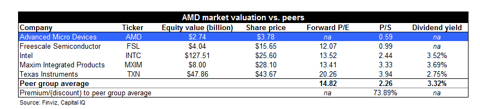

AMD's market valuation vs. peers

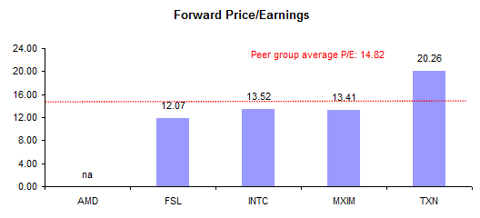

Many financial information service providers do not calculate a forward P/E ratio for Advanced Micro Devices which is due to negative earnings expectations for 2014.

However, broad line semiconductor companies fetch quite reasonable multiples: Freescale Semiconductors is trading at just 12x earnings which is quite low for a high-growth company. Intel trades at 13.52x forward earnings although I have previously held a short-position in the company due to contracting PC Group revenues.

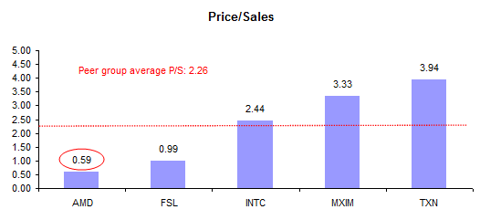

The next two tables depict the P/E and P/S ratios (if applicable) for the large-cap broad line semiconductor firms in the benchmark group.

The summary table below shows market capitalization data as well as market valuation data for our semiconductor firms:

Summary

Advanced Micro Devices, like many other broad line and specialized semiconductor firms, faces top-line challenges and heavy micro processor competition from Intel. However, semiconductor firms are highly cyclical companies and should do well as sales for PCs, laptops, tablets, game stations and servers grow when the economy expands at higher rates than now. As was the case with Micron and Infineon Technologies, sentiment and buyer interest can change quickly. Micron's Elpida acquisition, for instance, has led investors to adjust their price and earnings outlook as the company takes on a major role in industry consolidation.

At the moment, the market seems to be overly pessimistic with respect to AMD's competitive strength and earnings outlook. If Advanced Micro Devices manages to return to positive operating cash flows and earnings, there is no reason why AMD can not produce a Micron-like return and I can see AMD return to $8 price levels. Impulses could come from new mobile computing- and security processors that could find large-scale industry implementation. Anti-cyclical, long-term BUY.

Disclosure: I am long AMD, MU. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire