Wisconsin-based Associated Banc Corp (ASBC) is not as strong an investment as recent headline results might suggest. At first blush, ASBC looks like an interesting investment. After all, the bank saw 9.8% loan growth last year along with 5.9% net revenue growth. Further, amidst a tough environment for financials, the firm managed to meet estimates in the latest quarter (consensus expected $0.26) despite margin pressures.

In recent quarters, ASBC's performance has been largely driven by expense control and release of reserves. While the former is certainly admirable and positive from investors' standpoint, it is little substitute for legitimate organic loan growth. Further, with mortgage fee income weakening, the bank's performance is beginning to look ever weaker. The bank's nonperforming loans portfolio fell more than 80% in size over the last three years which provided a substantial earnings boost. This benefit will likely tail-off next year, and with mortgage fee income declining dramatically and loan growth called into question, just meeting EPS expectations for the next few quarters could be challenging. Given all of these issues, and the challenging valuation on a bank trading at almost 1.5X TBV, ASBC investors may want to buckle in for a volatile 2014.

Part of ASBC's challenges may step from its geographic footprint. Associated Banc Corp is headquartered in Green Bay, WI and has nearly 250 branches spread out across the upper Midwest, notably Wisconsin, Illinois, and Minnesota. The notable thing here from my point of view is that while all of these states are doing OK economically, none of them are doing great. Unlike the West Coast which is rebounding from a deep housing trough, or the mountain-west/Texas/mid-Atlantic which are benefiting from natural gas and shale oil growth, the upper Midwest has no exceptional economic drivers. Instead, the solid and sensible Midwest (with the exception of Detroit and Chicago) is just plugging along, and the prospects for exceptional growth in loan demand look limited.

Given this, and the fact that the bank is trading near its average high P/E for the last decade (average high is roughly 16X), it's hard to get excited about the firm. While the bank does sport a 2.1% yield after a recent 1 cent increase, it's hard to get excited about that alone.

Due to limited population and housing demand growth, a big chunk of earnings for ASBC has been driven by mortgage fee income. When the Fed started talking about tapering in mid-2013 and mortgage rates started rising, refinancing cratered across the entire banking industry. This hit many firms hard, among them, ASBC. This fall in fee income, combined with margin pressures lead to weakness in the most recent earnings quarter that was only offset by superb cost control.

In fact, net interest margins declined 3 bps to 3.13% with asset yields falling to 3.42% (down 5 bps) vs. funding costs of 0.38% (down 3 bps). This is partially a function of commercial real estate loan run-off. Unfortunately, this pressure on margins will probably be an issue for a while longer yet with competitive pressures holding loan pricing down (avg. yield of 3.72% down 5 bps). This issue is particularly acute in C&I where yields are running around 3.53% (down 14 bps).

To be clear none of this is to suggest that ASBC is a good short target. It's not (at least in my view). It's just that the competitive pressures facing the firm are holding back earnings growth and leading to the bank's struggles with loan and revenue growth (revenues are down YOY in 2 of the last 3 quarters).

Despite this, ASBC does have some positives going for it including a TCE ratio of 8.21%, tier 1 common ratio above 11.5%, and at least $250 million in excess capital by my estimates (based on a minimum TCE of at least 7%). Given the bank has a market cap of around $3B, this is a non-trivial pile of cash that could be used to buy back shares or payout dividends.

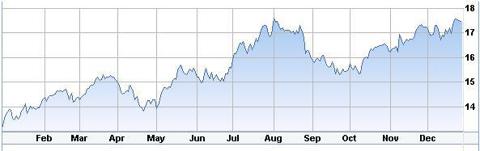

While I think that this capital flexibility along with low levels of NPAs gives ASBC some interesting options for boosting its share price, the stock is probably somewhere near its fair value. Close peers to ASBC in terms of revenue and EPS growth trade around 15.5X forward EPS or 14.8X ttm EPS. At around 15.9X trailing and forward EPS (my estimate for 2014 is $1.08), Associated Banc is not an obvious buy at current levels. Further, outside of general sector and macro catalysts like the taper's effect on the yield curve, there doesn't appear to be much in the way of upcoming catalysts for the stock. Long term investors in the stock may wish to hold or buy more, but for short and medium term folks, there are better banking opportunities out there.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire