V.F. Corporation (VFC) (hereafter referred to as "VF") owns popular clothing brands: Lee, The North Face, Vans, Timberland, Reef, among others. The company competes against a slew of other apparel makers, including Columbia Sportswear (COLM), Under Armour (UA), Phillips Van Heusen (PVH), and Lululemon Athletica (LULU).

VF, founded in 1899, has a pretty straight-forward recipe for growing EPS. It uses its broad portfolio of popular brands to provide stable revenue growth, which are maximized through management's smart use of cash on investments. That recipe is solid, but revenues should grow even faster as the company continues to expand and gain exposure to Asia and its burgeoning middle class.

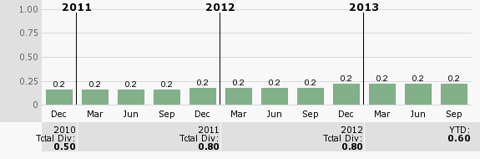

This stock offers so many things. As if having that juicy profit recipe wasn't enough, the company also performs buybacks and pays a healthy dividend to shareholders -- 1.7% at the time of this writing. This company does 3 of the best things a corporation can do for shareholder value -- it provides organic EPS growth, stock buybacks, and stable dividends. Below is a graph of the past 3 years of quarterly dividend payments.

The company holds old and new iconic brands in American style. The old, but still popular, brand of Vans has been a symbol of surf and skate culture for decades. The newer North Face brand is a brand of outerwear that teenagers and twenty-somethings wear to school and in just about any other casual setting.

To paraphrase Blackrock portfolio manager David Cassesse last month on CNBC, there is a tailwind in athletics and outdoor apparel that he will use to his advantage. That makes VF attractive, and combined with the potential for international growth, revenue should continue to grow above its industry average.

The Metrics

VF is undervalued despite its stock running up 63% in 2013. VF has a P/E of 23.6, right at its sector average, but that is reasonable for a company projected to have a 5 year annual growth rate of 15%. That compares to an industry average 5 year growth rate of 6.25%.

VF's price to cash flow ratio is 19, lower than its sector average of 20.8. VF also keeps it debt under control. It currently sports a long term debt to equity ratio of .25. This compares favorably to other well-run apparel stocks, and much better than major competitor Phillips Van Heusen .

Also, VF offers a return on equity of 21%, meaning that management does a solid job of returning net income compared to equity in the company.

The Management

Back in June, VF announced that it would grow through: innovation, expanding its direct-to-customer business, connecting with consumers, and by expanding geographically.

The company sells apparel, so its innovations come from its new clothing designs. These are mostly found in the technical clothing it sells from Jansport, North Face, and Timberland. Those advances are part of the reason people still strongly demand those brands for their outdoor clothing needs. The company's direct-to-customer business is increased any time they open a new store (or increase sales from the web) and they are adding new stores at a strategic, calculated pace. The company "connects with consumers" via advertising campaigns. Finally, it is growing its business in Asia to grow revenues.

VF specifically stated that it would be spending an additional $50 million each on The North Face, Vans, and China operations, because these were the 3 biggest growth areas for the company. This touches on 3 of the 4 growth methods it outlined in its growth plan -- geographic expansion, connecting with consumers, and expanding direct-to-consumer )since Vans and North Face have stores of their own).

The Chart

The VF chart dating back to 2009 has performed outstanding, and the 2013 year was exemplary of that. The stock has almost entered an extreme climb since the end of October. This can cause me some hesitance to pull the trigger and buy.

The Play

Despite the large price increase this past year, which make a stronger pullback a possibility, I think that VF's reasonable valuation and strong business model make it a solid buy. For those concerned of the possibility of a pullback, scaling into the position over a few months is a wise strategy.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire