A documentary film called Blackfish (dir. Gabriela Cowperthwaite) was released early in 2013. The film takes direct aim at Seaworld's (SEAS) practice of keeping killer whales and having them perform shows at its parks. It includes footage of the poaching of orcas from the wild in the late 60s; Seaworld trainers being thrashed by whales; and a heart-rending scene of a baby orca being separated from its mother.

The film screened in early 2013 at Sundance, opened in theaters in July and ran through October, grossing just over $2 million. Having been short-listed for the Oscars and now available on Netflix and Amazon video for streaming, the movie seems to be getting a second wind. As of December 30 it has been viewed over 490,000 times on Netflix. The film has also appeared on several annual lists of top movies and documentaries.

Seaworld gets dunked

The film seems to have been a catalyst for several recent blows against Seaworld:

- The majority of bands in an upcoming festival at Seaworld-Orlando have withdrawn, citing concerns raised in the film. Cancellations include Trisha Yearwood, Heart, Willie Nelson, REO Speedwagon and Barenaked Ladies. Willie Nelson said, "What they do at Seaworld is not OK."

- A 6-year-old boy named Cash was upset after viewing Blackfish. His parents helped him shoot a simple video requesting that people not go to Seaworld on his birthday, December 22. The video has over 44,000 views as of December 30, and protests were reportedly held at all three Seaworld locations on Cash's birthday.

- A school in Malibu, CA has cancelled its annual trip to Seaworld-San Diego, citing concerns about Seaworld's use and captivity of orcas.

- Based on my close observation of the web and Twitter over the last week, criticism of Seaworld online has intensified. Tweets supporting the film and protesting Seaworld have gone out from Kellan Lutz and Kevin Smith (more than 1 million and 2 million followers respectively). Aaron Paul, with nearly 1.5 million followers, writes: "Watched the most heartbreaking doc on the enslavement of Orca whales at #SeaWorld on #Netflix. Everyone should see this. So sad..." As I write this, the tweets are streaming in every minute. Here's a typical tweet from @abbyreuland: "I hope everyone watches Blackfish & never goes to Sea World again". @coltonpence goes straight to the point: "Watch blackfish. You'll hate seaworld".

On December 20 Seaworld published an open letter in several major newspapers contesting claims and facts in the film. It also posted a letter on its website. During the shooting of the documentary, Director Gabriela Cowperthwaite invited Seaworld to participate but the company declined. Seaworld's more recent responses seem to reject the film outright. CEO Jim Atchison has been quoted describing the film as the work of animal activists who do not represent the views of the American public.

The Oceanic Preservation Society posted a sharp rebuttal to Seaworld's letter.

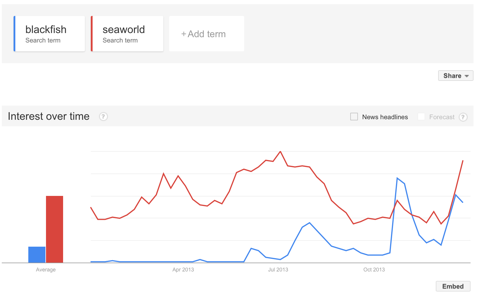

This graph from Google Trends shows that a recent spike in searches for Blackfish coincides with a dramatic spike in searches for Seaworld:

The increase in searches last summer may have been driven by planning for summer vacations. This spike in the middle of winter, the low season for Seaworld, seems more likely than not driven by wider awareness of the film.

Because the killer whale shows are iconic elements of the Seaworld experience, the growing public response to the film represents a genuine threat to Seaworld's business.

Depths of debt and waves of seasonality

Let's put aside the PR firestorm for a moment and assess Seaworld's financial profile and outlook. We need to review a somewhat complicated recent history involving a private equity firm purchasing the company from AB InBev and then taking it public in 2013.

In 2009 Blackstone Group (BX) bought Seaworld from AB InBev for $2.3 billion in cash. In Q1 2012 (pre-IPO), Seaworld took out a $500 million loan to finance a dividend payment of the same amount to Blackstone and co-investors. As of the beginning of 2013 the company was carrying $2.07 billion in total debt with a debt-to-equity ratio of 4.6.

In April 2013, Seaworld went public with a market capitalization of $2.5 billion. Impressively, the company has been steadily chipping away at this massive debt load, bringing the debt/equity ratio from 4.6 down to 2.6 in the last four quarters. Its cash balance has been increasing during this same period:

Seaworld debt and equity (in millions)

| Q4-2012 | Q1-2013 | Q2-2013 | Q3-2013 | |

| Total liabilities | 2,071 | 2,162 | 2,007 | 1,929 |

| Total stockholders' equity | 450 | 410 | 626 | 729 |

| Debt/equity ratio | 4.6 | 5.2 | 3.2 | 2.6 |

| Cash balance | 46 | 59 | 94 | 211 |

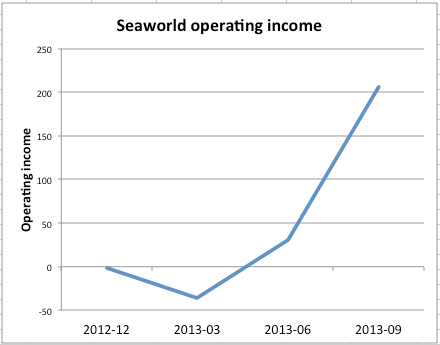

Seaworld's business is highly seasonal, with the bulk of revenue coming in Q3, covering the summer season:

Even without an unfolding PR firestorm, Seaworld would be expected to report negative or very low operating income for Q4 2013. Last year's Q4 operating income before taxes was -$28 million. Because the company is under heightened scrutiny and less diligent investors may not be aware of the strong seasonality of the business, a negative or very low number in the next earnings release may trigger panic in investors.

Financial outlook

In the crucial third quarter of this year, revenue improved by 3% over the prior year. The company has improved revenue per capita, partially offset by a decrease in attendance over the prior year.

The company has mentioned another strategy in its recent quarterly filings:

In addition to the theme parks, we are also involved in entertainment, media, and consumer product businesses that leverage our intellectual property. While these businesses currently do not represent a material percentage of our revenue, they are important strategic drivers in terms of consumer awareness and brand building. We aim to expand these businesses into a greater source of revenue in the future.

One can imagine film and merchandise tie-ins using the Shamu character or drawing on the performances in its parks. I count at least 20 trademarks or trademark registrations on its Orlando Attractions page. Under normal circumstances, this would seem to be a promising new source of growth in the style of Disney.

Unfortunately for the company, if public opinion continues to turn against Seaworld, the animal characters and shows in which they star could move into the liabilities column. If Seaworld becomes "uncool", other companies may not wish to license its characters and performances.

The PR firestorm builds

The surge in anti-Seaworld sentiment from young people seems to represent the biggest threat to Seaworld's business. If this trend continues I can imagine that reporting back to your friends on your 2014 trip to Seaworld will not be well looked-upon. Seaworld may be more oriented to younger children, but these teens may relay the message to their younger siblings.

Seaworld has been slow in responding (they would have known about the film since 2012 if not earlier), dismissive of the film and, at the moment, silent. The contrast between the Twitter stream for "blackfish" and Seaworld's stream is striking. Here are a few more tweets from people who have seen the film (you'll easily find hundreds like these):

After watching #Blackfish I will not be visiting Sea World anymore. It is completely horrible what they do." - @emmmcastillo

"Everyone needs to watch Blackfish #saynotoseaworld" - @bigkryndall

"I am not an animal rights activists but after watching #Blackfish I definitely have a new perspective." - @zorbazuloc

"why the hell is @SeaWorld still open?! shame on you. #Blackfish" - @alyssamarriee

(There are tweets that question the film but they appear vastly outnumbered by sympathetic ones such as these.)

Compare with the Seaworld twitter stream:

You "otter" have a Merry Christmas! pic.twitter.com/C3GoO4gFfg

Or:

Wishing you a cozy Christmas Eve spent with your loved ones! pic.twitter.com/xgVfiK3Q7M

Judging by Seaworld's Twitter feed, one would not know the company is in the eye of a public relations hurricane. Instead we find Christmas wishes accompanied by photos of parrots and otters.

Because of the relatively high operating and financial leverage of the company, a drop in attendance could be devastating. If EBITDA drops, this will increase leverage ratios which are key triggers for Seaworld's debt covenants (search for "leverage ratio" in the 10-Qs).

Even though the company has weathered a private equity transaction, an IPO and partial paydown of massive debt, the current PR storm may be the biggest challenge to the company's business in the last several years.

As Seaworld points out in its SEC filings, the park business is competitive; visitors can easily opt for Universal, Disney or Six Flags instead of a Seaworld park. It appears that Seaworld has no competitive moat (note that three of its 11 parks are centered on water attractions, but Busch Gardens is a significant exception). Let me put this simply: If attendance at Seaworld's three flagship parks declines meaningfully in 2014, Seaworld will find itself in deep water.

While Seaworld has received pressure from animal activists in the past, it has now been thrust into a much broader crisis that could jeopardize its entire business (it seems high time to call in PR experts). After initially dismissing the film's claims and its makers as fringe activists, and now getting a drubbing from its core constituency (young people), Seaworld has gone silent.

The film will continue to be on the radar as we are heading into Oscar season and Blackfish is on the shortlist for documentaries. I could not imagine a higher-stakes crisis for Seaworld. I honestly do not know how I would respond if I were Seaworld, because its critics are questioning the very notion of using captive animals -- especially orcas -- for entertainment. I cannot envision a compromise between the two camps that would allow Seaworld to keep its three parks in Orlando, San Antonio and San Diego open. If you can, please suggest it in the comments.

Disclosure: I am short SEAS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire