Champion REIT (OTC:CMPNF) is a commercial properties real estate investment trust based on the island of Hong Kong. The trust owns approximately 2.2 million sq. ft. of Grade A office space and approximately 650,000 sq. ft. of prime retail space on the island. All of this space is located in two locations, one in the Central District of Hong Kong Island and the other in the district of Mongkok on the Kowloon Peninsula. At the time of writing, the trust had a market cap of approximately $2.4 billion.

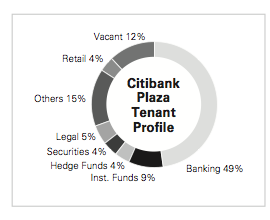

As I just mentioned, Champion REIT has the entirety of its assets tied up in just two developments. These two developments are Citibank Plaza, one of the largest Grade A office complexes in the Central District with over 1.22 million sq. ft., and Langham Place, which houses a Grade A office tower, a shopping mall, and a five star hotel. The trust owns a total floor area of approximately 1.3 million sq. ft. of office and retail space at the complex. The fact that the REIT only owns these two facilities is a definite risk for the trust. If something were to happen to either of these facilities then the trust would likely see its net property income be significantly impacted in a negative way. The trust almost assuredly has insurance to protect against the worst scenarios that might occur (such as the destruction of a building), but it is still something to be aware of. Fortunately, the downside risk here is something that can be quite readily quantified. To do this, we can take a look at the revenue and net property income generated by each of the trust's two properties:

Source: Champion REIT

As the figures clearly show, Citibank Plaza is responsible for 58% of the trust's net property income. The office tower and shopping mall at Langham Place are responsible for the other 42%. Therefore, should some sort of calamity befall Citibank Plaza that results in the destruction of the facility then the trust could see its revenues and net property income (and presumably unit price) cut in half or even by upwards of 58%. The impact on the unit price would likely take into account other factors such as the respective valuations of the trust's buildings.

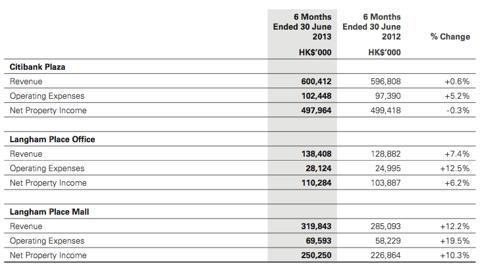

Source: Champion REIT

As these figures show, Citibank Plaza alone makes up 61.74% of the total value of the REIT's portfolio. Thus, should anything happen to this facility then the unit price may be more adversely affected than it would be were just the loss in net property income considered.

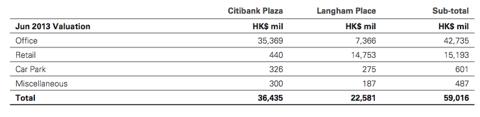

Another risk becomes evident when we look at the tenant profile of Citibank Plaza:

Source: Champion REIT

As the chart shows, fully 66% of the tenants in Citibank Plaza are involved in the financial services or investment industry in some way. This exposes the REIT in a big way to this industry and a downturn in the economy in general (since such downturns typically have a significant effect on the financial and investment industries) or in the financial services industry in particular is likely to have adverse effects on the REIT. Fortunately, the trust has some protection here as its tenants are typically locked into their leases for a period of several years so a short-term downturn is unlikely to have much of an effect. However, a more prolonged downturn may result in tenant departures as the tenants' respective leases expire and they move out in order to save money to better weather the downturn.

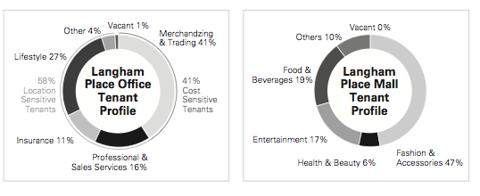

The REIT does have somewhat better tenant diversification in its Langham Place property.

Source: Champion REIT

Even here however, one single industry makes up a disproportionate share of the trust's tenants. In the Langham Place Mall, various types of retailers make up all of the trust's tenants and rental revenue. However, this is to be expected for a shopping mall and so is largely forgivable. Meanwhile, in the office tower, fully 41% of the trust's tenants are involved in merchandising and/or trading. The differences between this and retail are largely academic. Therefore, the trust's revenues and net property income also appear to be quite susceptible to a decline in the case of an economic downturn. After all, retailers have less customers during such an event so are naturally more desperate to cut costs. One way to do that is to scale back their operations which may include allowing rental leases to expire. Therefore, between this retail exposure and the trust's exposure to the financial services industry at its Citibank Plaza property, Champion REIT appears quite heavily exposed to a prolonged economic downturn.

The trust did face some difficulties at Citibank Plaza during 2013. In its interim financial report which was published on August 28, the trust stated,

"The operating environment will remain challenging for Citibank Plaza for the remainder of 2013. Uncertainties in financial markets have caused financial institutions to err on the side of caution when evaluating their space requirements. Concerns over the transition of China to a more balanced economy with lower GDP growth also linger."

Despite all the concern over China's slowing GDP growth, the giant nation's economy is still growing at a rate that any developed country in the world should envy. In the third quarter of 2013, Chinese GDP grew by 2.20%, exceeding the second quarter's growth rate of 1.70%. However, business is often based on perception and emotion and these perceptions have caused foreign financial firms to scale down their Chinese operations or slow down their expansion which has a very real effect on the demand for office space, which is what the trust is telling us here. Fortunately, the trust was able to find new tenants for nearly all of the space that was vacated due to tenants' leases expiring and their declining to renew. This allowed it to keep its revenue from Citibank Plaza relatively steady. Unfortunately, the trust has not yet stated how many of its leases are up for renewal in 2014. If it is a substantial amount then this is likely to be a challenge for the trust as the same market conditions are likely to persist in 2014. The trust may be able to successfully find replacement tenants but there is no guarantee of this so investors are advised to be aware of the potential risks here.

In contrast to the challenges facing the REIT at its Citibank Plaza property, the mall at Langham Place is doing quite well. This is because the mall has become a popular shopping location for younger people and for medium budget tourists. Unfortunately, the Hong Kong tourist industry has been slowing down and so the mall is no longer seeing the traffic from these people that it once did. The trust has been attempting to counter the slowdown in tourist traffic by increasing its promotional and marketing activities. There are no signs that the retail tenants in the mall have become disillusioned by the declining tourist traffic. In the second half of 2013, leases representing 28% of the total floor space in the mall were expiring but as of the end of August, all but 3% of this had either been renewed or replaced by another tenant. The new leases for this space were at higher rental prices than the original leases so should increase the trust's revenue and net property income going forward as the new leases take effect with the effects being fully realized in the first half of 2014.

Champion REIT trades at a significant discount to its book value. So much so that there is a huge margin of safety for a potential investor here, even given the already discussed risks. According to Bloomberg, the REIT currently trades a price/book value of 0.4361. Furthermore, the REIT also trades at a significant discount to its net asset value. As of June 20, 2013, the most recent date for which figures are available, the trust had a net asset value of HK$7.96. This means that if the trust were to sell off all of its properties, pay off all of its debt, and distribute all of the remaining cash to its investors then each investor would receive HK$7.96 per trust unit in cash in exchange for their trust units. However, the trust's current unit price on the Hong Kong exchange is HK$3.47. This is a 56.4% discount over the trust's net asset value at the current price.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire