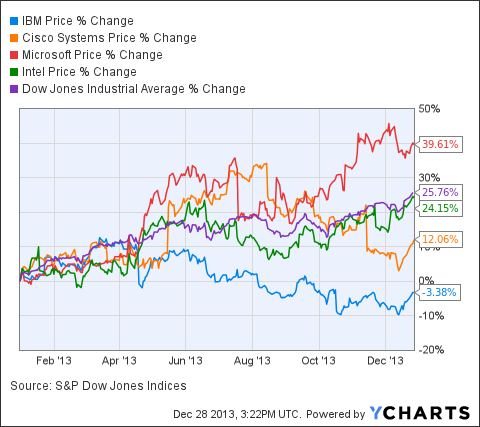

In 2013, one of the worst performing sectors of the Dow Jones Industrial Average (DIA) was the technology sector. This is not to say that technology as a whole did poorly, it didn't. However, the stocks that led the tech sector in 2013 were high growth, high valuation, non Dow, names such as LinkedIN (LNKD), Facebook (FB), Netflix (NFLX), and Amazon (AMZN). The only Dow tech stock that managed to outperform the index as a whole was Microsoft (MSFT). Intel (INTC) managed to perform inline with the index while IBM (IBM) and Cisco (CSCO) underperformed the Dow significantly in 2013. There are three reasons why I like MSFT, IBM, CSCO, and INTC going into 2014. While not a Dow component, I also believe Apple (AAPL) shares similar characteristics and should be viewed favorably heading into 2014.

1. Investor Skepticism

Generally speaking, investors tend to be quite skeptical about the prospects for old tech such as MSFT, IBM, CSCO, and INTC. These companies are unloved because they have only marginal growth prospects and face increasing competition in many key markets. Expectations for these stocks-- especially IBM & CSCO-- are quite low. Contrastingly, expectations for most of the other Dow stocks are quite high. Investors have bid up shares of American Express (AE), Boeing (BA), 3M (MMM), Visa (V), United Technologies (UTX), Johnson & Johnson (JNJ), and others to record levels on hopes of a strong 2014. It is not that I believe 2014 will not be a great year for these companies, I just believe a great 2014 is already priced into these stocks. Johnson & Johnson is up 33% in 2013, American Express is up 55% in 2013, and Boeing led the Dow with a 81% gain so far in 2013. for these companies to have explosive moves again in 2014 company results will need to be shockingly strong. Comparably, even slightly better than expected results could send IBM, MSFT, CSCO, and INTC surging as these stocks have not been bid to record levels, and investor expectations and low.

2. Valuation

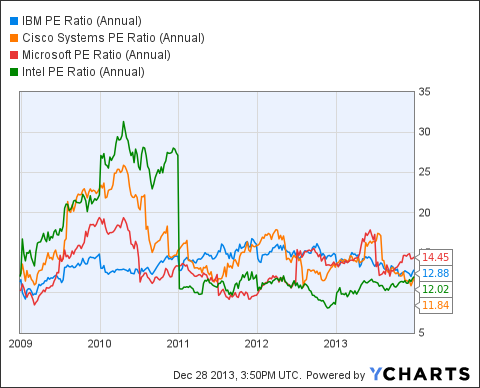

The four Dow tech stocks trade at cheap valuations relative to both other Dow stocks and their own historical valuation range. The current PE ratio on the Dow is close to 17. Comparably, the highest valued Dow tech stock, MSFT, trades at a PE multiple of less than 15. The cheapest Dow tech stock, CSCO, trades at less than 12 times earnings. In addition to trading at lower valuations than other Dow stocks, the 4 Dow tech stocks are also trading at lower valuations than was typical in the past. As recently as 2010, all of the Dow tech stocks were trading at PE ratios significantly higher than today. Simply put, I do not believe there is a lot of downside for the Dow tech stocks are current valuations while upside to current valuations is achievable if results improve.

IBM PE Ratio (Annual) data by YCharts

IBM PE Ratio (Annual) data by YCharts

3. Limited Downside

The popular prediction for 2014 seems to be that the stock market will continue rising to new highs. While I am not negative on the market for 2014, I think there are certainly risks that could cause 2014 to be a bad year for equities. In the event that the global economy and equity markets perform poorly in 2014, I believe the Dow tech stocks will be four of the best performing stocks in the index. One reason why I believe MSFT, CSCO, IBM, and INTC will hold up well in a difficult environment is the strength of these companies balance sheets. These companies are not heavily leveraged. Moreover, these companies tend to pay nice dividends and have large stock buyback purchases, two traits that could help offset macro based selling. Finally, given current valuations, I do not believe significant downside is likely even in a difficult environment. Almost certainly macro based selling would be more aggressive in frothy Dow stocks trading at high valuations. Typical defensive Dow names such as Johnson & Johnson and Prizer (PFE) are trading close to the upper end of their historical valuation trends and are thus vulnerable to selling even if their earnings are less impacted by a slowing economy.

Apple

While not a Dow component, I also believe Apple shares many of the same characteristics as MSFT, IBM, CSCO, and INTC. AAPL valuations are cheap and more upside would not be difficult to achieve from current levels. Perhaps more importantly, I believe the downside is limited for AAPL due to the same reasons as the Dow tech stocks. AAPL is trading at cheap valuations and has the world's strongest balance sheet.

Conclusion

In my view, MSFT, IBM, CSCO, INTC, and AAPL offer a unique characteristic of being likely outperformers in a strong market and a weak market. The primary reason for this is valuation. The Dow tech stocks (and AAPL) can move up a lot in price without becoming terribly expensive on valuation metrics. This can not be said for many Dow stocks. On the other hand, the Dow tech stocks are also well positioned to outperform in a weak market environment due to low valuations, high dividends, stock buybacks, and strong balance sheets.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in CSCO, MSFT, IBM, AAPL, INTC over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire