In the first round of the Dividend Portfolio playoffs we have #9 seeded JPMorgan Chase & Co. (JPM) taking on #8 seeded Dunkin Brands Group Inc. (DNKN). JP Morgan is a financial holding company and is engaged in investment banking, financial services for consumers and small business, commercial banking, financial transaction processing, asset management and private equity. Dunkin' Brands Group is a franchiser of quick service restaurants serving hot and cold coffee and baked goods, as well as hard serve ice cream in the form of Dunkin' Donuts and Baskin-Robbins, respectively.

The following table depicts the recent earnings reports for each company:

Ticker | Earnings Date | Actual EPS ($/share) | Estimated EPS ($/share) | Actual Revenue ($ in billions) | Estimated Revenue ($ in billions) |

JPM | 11Oct13 | 1.42 | 1.29 | 23.90 | 24.14 |

DNKN | 24Oct13 | 0.41 | 0.43 | 0.186 | 0.182 |

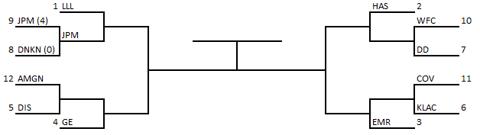

JPMorgan is up 34.02% excluding dividends in the past year (up 36.76% including dividends) while Dunkin' is up 48.93% excluding dividends (up 50.34% including dividends), and are beating the S&P 500, which has gained 31.28% in the same time frame. This matchup will be played out in a best of seven game series based on the metrics below. For a complete list of all the metrics utilized in the seven game series click here (http://seekingalpha.com/article/1920771-dividend-portfolio-super-bowl). Not all the metrics will be looked at if a team can win and win early. This wild-card matchup will determine the winner which will go on to play against L-3 Communications Holdings, Inc. (LLL) in the next round of the playoffs for the Dividend Growth Portfolio Super Bowl.

Forward P/E

Forward P/E is the metric of how many times future earnings you are paying up for a particular stock. The earnings portion of the ratio I utilize is the earnings value for the next twelve months or for the next full fiscal year. I like utilizing the forward P/E ratio as opposed to the trailing twelve month P/E ratio because it is an indication of where the stock is going to go in the future. I like to get a glimpse of the future, but will take note of where it was coming from in the past. JPMorgan carries a 1-year forward-looking P/E ratio of 9.65 which is inexpensively priced for the future in terms of the right here, right now while Dunkin's 1-year forward-looking P/E ratio of 26.81 is currently fairly priced. Game 1 goes to JPMorgan.

1-yr PEG

This metric is the trailing twelve month P/E ratio divided by the anticipated growth rate for a specific amount of time. This ratio is used to determine how much an individual is paying with respect to the growth prospects of the company. Traditionally the PEG ratio used by analysts is the five year estimated growth rate, however I like to use the one year growth rate. This is because as a capital projects manager that performs strategy planning for the research and development division of a large-cap biotech company I noticed that 100% of people cannot forecast their needs beyond one year. Even within that one year things can change dramatically. I put much more faith in a one year forecast as opposed to a five year forecast. The PEG ratio some say provides a better picture of the value of a company when compared to the P/E ratio alone. The 1-year PEG ratio for JPMorgan is currently at 0.36 based on a 1-yr earnings growth of 35.96% while Dunkin's 1-yr PEG ratio stands at 1.98 with a 1-yr growth rate of 18.85%. JPMorgan takes a 2-0 lead on Dunkin'.

EPS Growth Next Year

This metric is really simple, it is essentially taking the difference of next year's projected earnings and comparing it against the current year's earnings. The higher the value the better prospects the company has. I generally like to see earnings growth rates of greater than 11%. Again, in this situation I like to take a look at the one year earnings growth projection opposed to the five year projection based on what I discussed in the PEG section above. JPMorgan has great near-term future earnings growth potential with a projected EPS growth rate of 35.96% while Dunkin sports a growth rate of 18.85%. JPMorgan seems to be running away in this battle by taking a 3-0 lead in this best of seven series.

Dividend Yield

Dividend yield is a no brainer; it must be had in a dividend portfolio. The dividend yield is the amount of annual dividend paid out by a company in any given year divided by the current share price of the stock. In my dividend portfolio I don't discriminate against low yielding stocks as long as they provide excellent fundamental metrics in the form of the forward P/E, the 1-yr PEG and the 1-yr EPS growth rate. Dividends are a way to measure how much cash flow you're getting for each dollar invested in the stock. Obviously, the higher the yield, the better, as long as it is covered by the trailing twelve month earnings. JPMorgan pays a dividend of 2.62% with a payout ratio of 34% of trailing 12-month earnings while Dunkin pays a dividend of 1.58% with a payout ratio of 59% of trailing 12-month earnings. JPMorgan takes the series in a clear sweep of the seven game series.

Conclusion

Although JPMorgan upsets #8 seeded Dunkin', Dunkin is still a great company with excellent growth prospects. Because I am a value dividend investor the first three matches carried the most importance because they were fundamental metrics and JPMorgan appeared to be the better valuation stock. In my opinion the banks still have not participated in this rally and I believe 2014 will be a strong year especially for JPMorgan. After dismantling Dunkin', JPMorgan will advance to the next round of playoffs and go head to head against the #1 seeded L-3 Communications.

Disclaimer: This article is meant to serve as a journal for myself as to the rationale of why I bought/sold this stock when I look back on it in the future. These are only my personal opinions and you should do your own homework. Only you are responsible for what you trade and happy investing!

Disclosure: I am long JPM, DNKN, LLL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire