By Kenny Fisher

EUR/USD continues to look strong as we begin the new trading week. The pair has moved higher on Monday and is trading in the mid-1.37 range. In economic news, there are only three releases on Monday. Eurozone Retail PMI came in at 47.7 points, pointing to continuing contraction in the retail sector. There was little change on the yield from Italian 10-year bonds, which came in 4.11%. Over in the US, today's sole event is Pending Home Sales. The markets are expecting a strong gain after a string of declines.

A quiet holiday week hasn't stopped the euro from continuing to post gains against the US dollar. Low liquidity over a holiday period can lead to strong currency movements, and we got a taste of that on Friday. The euro shot up about 200 points as it hit a high of 1.3896. However, it then retracted and closed in the mid-1.37 range. As well, the recent Fed taper decision has fueled a "risk on" atmosphere which has led to increased selling of the safe-haven US dollar and boosted the euro. With thin trade likely this week as well due to the holidays, we could see further volatility from EUR/USD.

Late last week, Unemployment Claims bounced back nicely following two disappointing releases. The key employment indicator fell to 338,000, compared to 379,000 in the previous release. The estimate stood at 346,000. With the Federal Reserve poised to begin its long-awaited QE taper next month, employment releases have taken on added significance. If the US labor market continues to improve, the Fed could decide on another taper early in 2014, which would give a boost to the US dollar against its major rivals.

There was some holiday cheer from US releases last week as manufacturing and housing numbers pointed upwards. Core Durable Goods Orders posted a strong gain of 1.2%, its best showing since April. The key manufacturing indicator had posted four consecutive declines, so the sharp gain was welcome news. Durable Goods Orders bounced back from a sharp decline in October with a gain of 3.5%, well above the estimate of 1.7%. New Homes Sales also impressed with a five-month high, climbing to 464,000. The estimate stood at 449,000.

With all the bad news about Eurozone bailouts for struggling members, there was a happier episode as Ireland recently exited the bailout program it had received from the EU and the IMF. Ireland had been party to the bailout for three years, and will now be able to borrow money on the international markets. Key sectors such as tourism and agriculture are improving, and unemployment is down to about 12.5%. However, economic growth is expected to be limited as the country was forced to undergo drastic budget cuts and tax increases as part of the bailout. Finance Minister Michael Noonan has said the exit from the bailout is a step in the right direction, but admits that the road to recovery will be a long one.

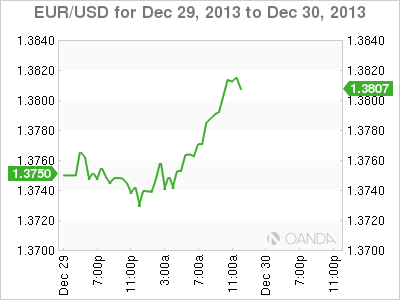

EUR/USD for Monday, December 30, 2013

EUR/USD December 30 at 11:20 GMT

EUR/USD 1.3770 H: 1.3776 L: 1.3729

EUR/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 1.3500 | 1.3585 | 1.3649 | 1.3786 | 1.3893 | 1.4000 |

- EUR/USD has posted modest gains in Monday trading as the euro continues to move higher. The pair touched a low of 1.3729 late in the Asian session but has since moved higher.

- On the downside, 1.3639 is the next support line. This line has some breathing room as EUR/USD trades at higher levels. This is followed by a support level at 1.3585.

- On the upside, 1.3786 is under strong pressure. This line could break if the euro continues to gain ground. This is followed by resistance at 1.3893.

- Current range: 1.3649 to 1.3786

Further levels in both directions:

- Below: 1.3649, 1.3585, 1.3500 and 1.3410

- Above: 1.3786, 1.3893, 1.4000, 1.4140 and 1.4268

OANDA's Open Positions Ratio

EUR/USD ratio is pointing to gains in long positions in Monday trading. This is consistent with what we are seeing from the pair as the euro continues to gain ground. The ratio is still made up largely of short positions, indicative of a trader bias toward the dollar reversing directions and moving to higher ground.

The euro rally continues as the currency has gained about one cent against the dollar since Christmas. We could see some further movement during the North American session as the US releases key housing data later on.

EUR/USD Fundamentals

- 9:10 Eurozone Retail PMI. Actual 47.7 points.

- 10:12 Italian 10-year Bond Auction. Actual 4.11%.

- 15:00 US Pending Home Sales. Exp. 1.1%.

*Key releases are highlighted in bold

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire