I feel like Warren Buffett or Jeremey Grantham in 1999. As you may recall, both of these legendary investors substantially underperformed the markets in 1998 and 1999, which in turn caused them to lose a significant amount of their clients/shareholders. Grantham's firm famously saw 60% of their client assets walk out the door, as investors looked for greener pastures. Actually, I feel even worse now than they did then for two reasons. First, as I am writing this, I am dealing with a severe case of the flu/bronchitis, which comes on top of a recent staph infection that I obtained at the hospital when our third child was born. It is not fun to review a rotten year (relative or absolute), let alone when you are under the weather! Second, Buffett and Grantham were already long tenured money managers by the 1998/1999 timeframe. Conversely, I started my firm in the spring of 2009, so this is the first significant out-of-favor period that I have endured in owning a money management firm, and it has been a doozy, as it seems almost everything has appreciated meaningfully in 2013, except the undervalued, out of favor investments that we have targeted. My recent struggles come after generating exceptional returns during the 2009-2012 timeframe. Additionally, I personally made money in 2008, so I am comfortable having an opinion and/or position outside the box. Nonetheless, 2013 has been my toughest year since I began actively investing in 1996. With this article, I want to explain my investment philosophy, reflect on 2013 (hopefully this is therapeutic), reflect on 2011-2013, examine the current environment, and look ahead to what I feel will be several extremely attractive investing opportunities in 2014.

Investment Philosophy

At heart, I am a contrarian, value orientated investor, looking for investments across all asset classes and capital structures that are cheap on a price-to-cash flow and/or a price-to-book value basis. As a contrarian, I believe the behavioral sentiment surrounding an investment is of extreme importance, as I prefer to buy things out of favor when they are cheap, and sell them when they return to favor and are fully priced. I am both a top down macro investor, who places a heavy importance on inter-market relationships (i.e. stocks, bonds, commodities), and a bottom-up fundamental stock picker. Over the past five years, I have delved ever further into the deep value arena; notching some of my biggest wins, while also paying a steep tuition price for investments in several companies that I felt were severely undervalued, but ended up being overleveraged, even in our current world of almost infinite liquidity. I expect that these learning lessons will ultimately prove beneficial over the course of my career. In fact, it is surprising the frequency in which the same decision making process comes back around, so some of the lessons learned may be applied sooner than later. During the past five years, I have developed a further appreciation for the merits of value investing, with a particular focus on the behavior of management when a company is at the bottom of its cycle. For example, my best public equity investment so far in my career was buying Macquarie Infrastructure (MIC) when it traded in the $2 per share range in the spring of 2009. Today, MIC trades north of $50. When reviewing the decision making process behind this investment, I could not possible know all the things that would go right for Macquarie over the ensuing years, including an incredible thirst for yield by the investing public, but what is clear to me in my review, is that the management of MIC was clearly aligned with shareholders, and they consistently expressed this view in all the decisions that they made during the downturn and through the subsequent recovery. Most importantly, they did not dilute equity owners by issuing shares at the bottom of the cycle to take pressure off their balance sheet. An aligned, shareholder friendly management is crucial in a good value investment, particularly a deep value investment. That is one of the biggest learning lessons for me over this period, and this will help our firm's clients in 2014 and beyond.

2013 - A Year In Review

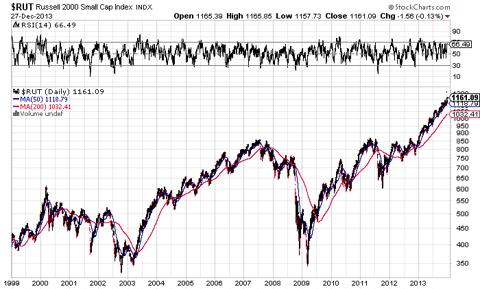

Since domestic equity markets made their lows in March of 2009, the campaign higher has been volatile, until 2013. Over the past year, the advance in U.S. markets has been steady and relentless, driven not by earnings growth, but rather price-to-earnings (P/E) multiple expansion. After climbing the proverbial wall of worry higher all year, both the S&P 500 and the Russell 2000 indexes look overextended from their longer-term moving averages as shown below:

While U.S. markets were the safe-haven for global capital flows in 2013, emerging markets struggled on a relative basis, unable to surpass their 2011 highs, and actually finishing down on the year as shown in the chart below:

The BRICs (Brazil, Russia, India, and China) really struggled, with China's Shanghai market now much closer to its 2009 lows than its 2011 highs:

While the broader U.S. markets have been a safety trade for much of the last three years, there has been a subtle shift towards a reflationary backdrop. Since July of 2013, proving my first article on SA prescient, the S&P 500 material stocks have outperformed the broader S&P 500 as shown in the chart below:

While material stocks have just begun to outperform, the Baltic Dry Index (BDI) has had a banner year, which foreshadows more gains in economic sensitive stocks. For 2013, the BDI is up 225%, to a new three year high:

2011-2013 - Perspective

Before analyzing the current environment, I want to take a look back for perspective. First, a portion of my underperformance in 2013 came from my mistaken macro belief that reflation orientated equities (i.e. material stocks) had bottomed in July of 2012 as shown in the chart below:

What appeared to be a change of character in a market relationship was really a false breakout (January of 2013). Thus, while my fundamental driven, value orientated research had pointed me in the direction of economically sensitive commodity stocks ever since the beginning of 2012 due to their historically low valuations, capital was still being allocated to the stock market from a defensive perspective, as both retail and professional investors chased blue chip, dividend paying equities, no matter their valuation, and that is still the case today as momentum begets momentum in the stock market.

The recent melt-up in the domestic equity markets has blurred the fact that commodities have been the asset class in a long-term secular bull market, though they have been in a severe cyclical bear market since April of 2011. The following long-term performance chart gives perspective on the secular bull market in commodities versus stocks, as it measures the performance of a commodity basket versus the performance of the S&P 500 since 1999:

Despite the underperformance of commodities versus equities since April of 2011, from a macro perspective, I believe the secular bull market in commodities is intact. The fundamental drivers of the secular bull market in commodities, including emerging market economic and population growth, negative real interest rates, and historic liquidity still remain in place. My conviction in my macro thesis is reinforced by my bottom-up stock research and screening, which shows many commodity orientated stocks at historically cheap valuations.

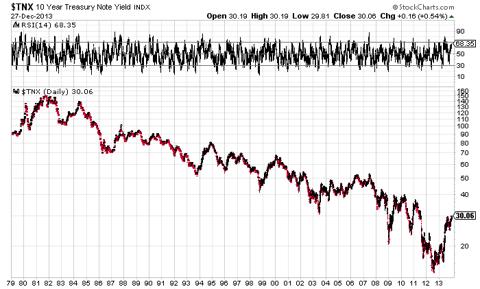

In trying to find perspective, I want to present one final chart, which I think will be incredibly important over the next several years in the investment markets. The following graph shows ten-year Treasury yields (TLT) over the past 35 years. The bond bull market that has been ongoing since 1981 appears to have ended in 2012:

If 2012 marked the end of the secular bull market in bonds, what will be the impact of rising interest rates on equity valuations? My guess is that the rush for yield over the last several years will be reversed, as investors re-align their focus to an inflationary backdrop.

The Current Environment - Third Bubble Phase In Equities

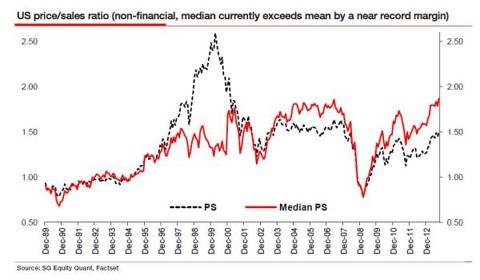

The term bubble has gotten thrown around with increased frequency to describe the global financial markets. So much so, that many investors are now reflexively dismissive, rationalizing that we could not possibly be in a bubble if so many people routinely have brought it up over the past year. In my humble opinion, I believe we are in the third bubble phase in equity markets in the last 15 years. David Stockman gives a succinct explanation that echoes my view as does Dr. John Hussman in his latest weekly missive. A highlight of the Hussman piece was his reference to the career altering experiences of Stanley Drunkemiller and Julian Robertson during the crest of the bubble in 1999 and the initial unwind in 2000. Incidentally, Drunkenmiller and Robertson are two of my hero's in the money management business. Ultimately, I think the following chart answers the bubble question in a definitive manner:

In the chart above, it is clear to see why the current bubble is hidden in plain sight, just like it was in 1999. Currently, low interest rates and record profit margins make P/E ratios look more reasonable than they are, while the price-to-sales (P/S) ratio reveals just how much investors have bid up domestic equities. In reviewing the 1998/1999 bubble, Jeremy Grantham has mused that the bubble was easy to spot as the P/E ratio of the S&P 500 was 35 at its peak in 1999, greater than the P/E ratios of 1929 (21) and 1965 (21). In Grantham's words, "investors just chose to ignore it". Retail investors could be absolved more easily, while professional investors looked the other way because of career risk, not wanting to leave the party early and have clients leave their firms. Ultimately, like Drunkenmiller, many investors were caught dancing while the music had already stopped. Right now, the same investors that have partaken in, and been taken advantage of by two equity bubble markets over the past 15 years, are willing to look past record high profit margins, record low interest rates, and the record P/S ratios and lose themselves in another bubble for the third time!

2014 - A Potential Banner Year For A Contrarian

I am happy to turn the page on 2013 in what was a rough year for this contrarian, value orientated investor. This review and recap was meant to be cathartic for me personally, but I also wanted to develop and build some themes that I think will help investors in 2014. In contrast to 2013, when the U.S. stock market roared and the global economy sputtered, I believe that there will be a significant rotation into economically sensitive assets, including commodity stocks and emerging markets equities in the first half of 2014. Diverging from the broader equity market since April of 2011, these stocks generally trade at the low end of their 20-year ranges on a host of valuation metrics including P/S ratios. Specific recommendations that I would endorse and own include:

- Arcelor Mittal (MT)

- Arch Coal (ACI)

- Alpha Natural Resources (ANR)

- Cliffs Natural Resources (CLF)

- iShares China Large-Cap (FXI)

- iShares MSCI Emerging Markets (EEM)

- Molycorp (MCP)

- Newmont Mining (NEM)

- Walter Energy (WLT).

Incidentally, Newmont, Cliffs, and Peabody were the three worst performers in the S&P 500 for 2013. For reference, 2012's three worst performers in the S&P 500 were Hewlett-Packard (HPQ), Best Buy (BBY), and Pitney Bowes (PBI), and each of these stocks has appreciated handsomely in 2013. This rotation of capital into economic sensitive stocks will coincide with a continued move higher in longer-term interest rates, proving the unrelenting liquidity provided by the world's central bankers can still positively impact real economic growth. Astute investors will note and remember, however, that the dose of monetary medicine needed to impact real economic growth continues to climb in scope and scale. Commodities will end their cyclical bear market, resuming their secular bull market and outperforming equities for the first time since 2011. In the U.S., the Federal Reserve will be reluctant to remove the punch bowl, as the precarious recovery is just now gaining momentum, so they will balance a withdrawal of asset purchases with promises of extended low short-term interest rates. The rise in longer-term interest rates and commodity prices will negatively impact equities sometime in 2014, as profit margins are pressured and yield orientated investors are reminded, for the first time in several years, that they have other alternatives to overpriced, dividend orientated equities. The broader U.S. equity markets are extremely extended as both the S&P 500 and the Russell 2000 have gone all of 2013 without any meaningful pullback. Additionally, and more importantly from a timing standpoint, is the fact that we are firmly entrenched in another equity bubble in the U.S. markets, as P/S ratios exceed all-time highs. How far this bubble goes is anyone's guess, but the specter of it popping will cast a long/dark shadow sometime in 2014. As the equity bubble matures, inflation and excess liquidity will overflow out of the stock market, finding its way into undervalued assets. Thus to maximize return and minimize risk, buy out of favor assets, including commodity stocks and emerging markets, and sell the fully priced, in favor ones, including domestic equities, particularly the overextended small caps. As Citigroup's former CEO Charles O. Prince infamously articulated in July of 2007, "As long as the music is still playing, you have to get up and dance". The music is playing. Investors are dancing. Inflows into equity funds are surging for the first time since the markets bottomed in 2009. Private equity firms are selling everything not nailed to the floor as Apollo's Leon Black said in April of 2013! When will the party end, I don't know, but five years into this parabolic bull market run in U.S. equities, I can confidently say that we are much closer to the end than the beginning. In conclusion, it is amazing to me that the world's central bankers have been able to put humpty dumpty back together again; reviving financial markets and encouraging them beyond the excesses that caused the 2008/2009 unwind. Somehow they have managed to convince investors that five plus years of unprecedented monetary policy is normal and they have goaded investors of all stripes into participating in a third bubble phase in financial markets that is more comprehensive is scope than the first two phases. This mirage will fall apart. Everyone who has been bearish the last several years has been wiped out, just as the ultimately correct bearish market prognosticators were wiped out in the 1996-1999 and 2004-2007 time frames. With all buyers and no shorts, we have an extremely unbalanced market ready for an explosion in volatility. This could manifest itself in a surge higher in financial markets in 2014 coupled with a violent correction later in the year. As the promise of heady returns work their magic and coax the mountains of money waiting on the sidelines back into risk assets, the velocity of money will explode higher in 2014, forcing interest rates sharply higher. In my humble opinion, rising rates and the confirmation that the secular bull market in bonds is over, will be the spoke in the wheel that stops the music and ends the party. In an ironic twist, increased economic growth, an increased velocity of money, and rising rates will ring the bell on the latest chapter of central bank bubble blowing. Thus, now more than ever, it is time, once again, to be contrarian.

Disclosure: I am long ACI, ANR, CLF, FXI, EEM, MCP, MT, NEM, WLT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire