With a $51 billion market capitalization, Costco (COST) is the 4th largest retailer in the US and in the world as well. Through 92.6M square feet area, averaging 143,000 per warehouse, the company has employed 185,000 employees worldwide.

The aim of this article is to estimate the prospective price movements in the company's stock which would help investors in their assessments of the stock.

Industry Outlook

The discount and variety store industry is very competitive and there are a lot of factors affecting business. The main factors are price, member service, goods' quality and warehouse location. Costco has a widespread range of regional, national and global wholesalers and retailers which include super markets, internet-based retailers, supercenter stores, gasoline stations and department and specialty stores. Wal-Mart (WMT), Kohl's (KSS), Amazon.com (AMZN) and Target (TGT) are the major merchandise retail competitors of Costco. The company also faces competition from many single-category operators or narrow range merchandise operators such as Whole Foods (WFM), PetSmart (PETM), Home Depot (HD), Trader Joe's, OfficeDepot (ODP), Walgreen (WAG), Lowe's (LOW), Best Buy (BBY), CVS and Kroger (KR). Although the US economy is recovering the consumer expenditure will likely be constricted because of deleveraging. Consumer's price-consciousness indicates the fact that there are better prospects at discount stores. But as discount and variety stores strive to win customers, their competition could shake their margins in the future.

Performance

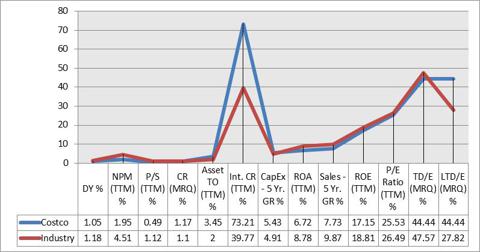

Considering the performance of the last twelve months', the company has not been able to successfully outperform the industry. Its net profit margin of 1.95% for trailing twelve months is well below the industry figure of 4.51%. Additionally, the return on asset of 6.72%, five years growth rate of 7.73% and return on equity of 17.15% are inferior to the industry figures of 8.78%, 9.87% and 18.81%, respectively.

Figure 1 shows Costco's performance against the industry as of December 20, 2013;

Nevertheless, the company has produced some positive results which indicate the optimistic future of the Costco. The company has a price to sale ratio of 0.49 for trailing twelve months which is much better than the industry ratio of 1.12. The current ratio of 1.17% for the most recent quarter is slightly above the industry ratio of 1.1%. Moving ahead, Costco's asset turnover of 3.45% against the industry average of 2% shows that the company is better at fetching sales despite the existence of massive competition.

The interest coverage ratio (TTM) of 73.21% is evidence of Costco's ability to easily pay interest on outstanding debt compared to the industry average of 39.77%. The company does not have short term debt which denotes the fact that there will be no major cash outflows in the near future. Another positive aspect of most recent quarter's performance is that Costco's total debt to equity ratio of 44.44% is beneath the industry average of 47.57%.

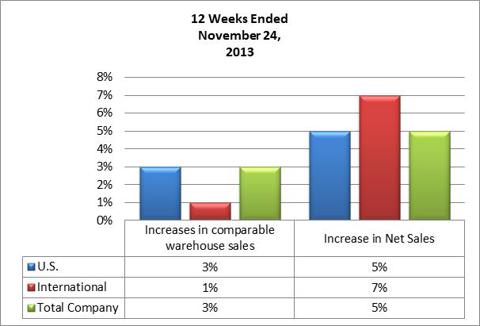

Fig 2 Source: Costco Financials

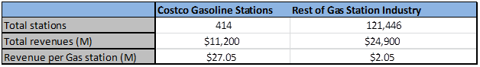

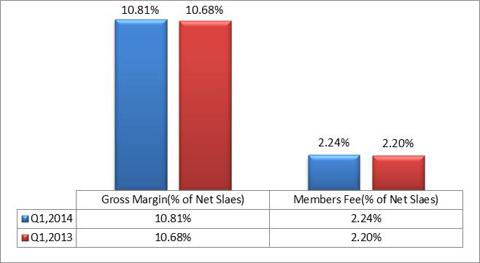

During the first quarter of 2014 net sales were 5% higher than the first quarter of 2013. This increase was driven by comparable warehouse sales that increased by 3% during the first quarter of 2014. Net sales also include the contribution from 29 new warehouses that were opened since the start of the second quarter of fiscal year 2013. Costco has a very loyal customer base which is depicted by the almost 90% renewal rate in the US and Canada. The total number of membership cardholders is 72.5M compared to 68M in the first quarter of 2013. Membership fees were 2.24% of net sales in the first quarter of 2014 compared to 2.20% last year. Gasoline is a magnet for membership for Costco. Richard Galanti, CFO, in his last conference call specified that in spite of fluctuations during the year gasoline is always lucrative for Costco. An average gas station is not able to beat the annual revenue of Costco's gas station.

The company was able to generate a 10.81% gross margin, as a percentage of sales, while the same ratio was 10.68% during the first quarter of fiscal year 2013.

Figure 3 shows the comparative trend of gross margin and membership fees as a percentage of total sales.

Fig 3 Source: Costco Financials

Net income in the first quarter of fiscal year 2014 was $425M compared to $416M last year which resulted in earning per share of $0.96 compared to $0.95 last year. This increase was the result of a growth in membership fees and enhanced sales of discretionary stuffs. The company declared a dividend of $0.31 per share compared to $0.275 last year.

Future Prospects

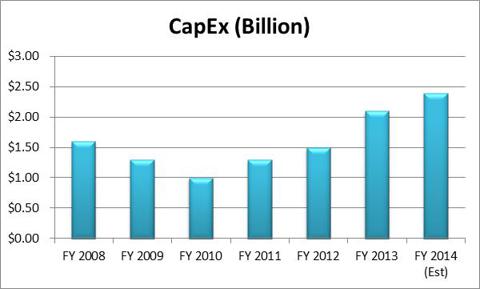

Since retail is a very competitive industry it is necessary for discount and variety stores to be located in as many places as possible because customers are attracted to their convenience and the variety of products available under one roof. Costco is well prepared to tackle this task quite efficiently. The company has a history of continuing capital expenditures to cater to the needs of new facilities and warehouses. This will be done to fulfill current customers' needs and to expand the customer base as well.

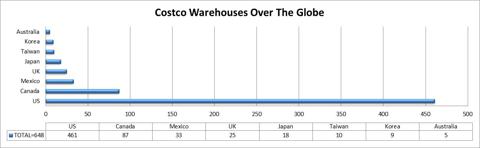

Currently Costco is operating 648 warehouses worldwide. A major portion of the company's business comes from the US market where the company operates 461 warehouses. Additionally, the company has 87 warehouses in Canada. The membership renewal rate in the US and Canada is around 90% which means that the company has its most loyal customer base among these two regions.

Figure 5 shows the geographical presence of Costco warehouses.

Fig 5 Source: Costco Financials

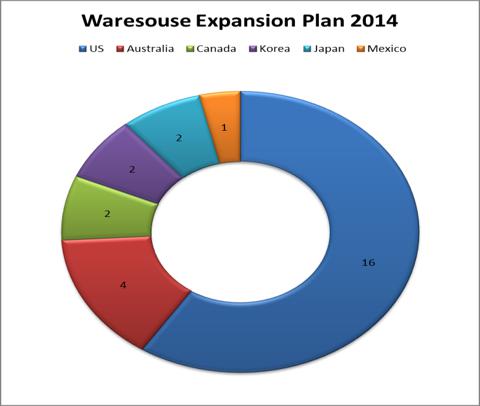

As per available statistics, Costco still has a long way to go in order to capture a broader clientele through covering more area by introducing new warehouses and expanding its service spectrum. Management is well prepared for this situation and is pursuing the company's history of capital expenditures. Figure 6 demonstrates Costco's expansion policy for fiscal year 2014.

Fig 6 Source: Q1,14 Financials

Valuation

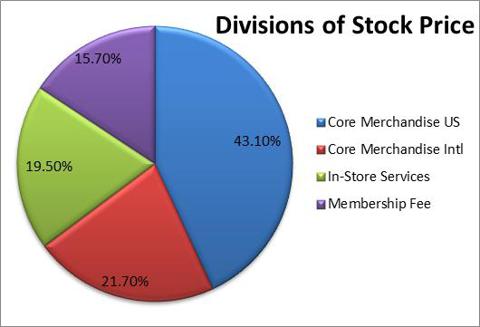

According to Trefis, Costco's stock price is composed of four divisions. A major portion of the stock price is driven by US core merchandise. Figure 7 shows the proportion of each division.

As discussed earlier, the company is focusing on expanding its facilities including warehouses and gas stations. Costco has a stable record of selling products by substantially discounting the price customers pay and this results in a considerably lower price to sales ratio. Fitch Ratings has declared an Issuer Default rating of Costco at A+ with a stable outlook.

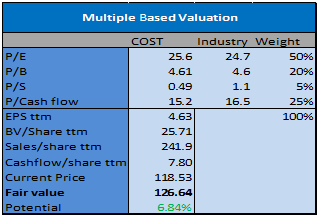

In view of all the given information and by interpreting the facts and figures, I have used the multiple based valuation method to evaluate Costco's intrinsic value. Market consensus estimates are used to give weightage to the different multiples of the price to earnings, price to book value, price to sales and price to operating cash flows.

As per my analysis, Costco is undervalued and has upside potential of at least 6%. Seeing the future growth opportunities, the company is well prepared and determined to succeed. My recommendation is BUY.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. (More...)

Business relationship disclosure: The article has been written by a Blackstone Equity Research research analyst. Blackstone Equity Research is not receiving compensation for it (other than from Seeking Alpha). Blackstone Equity Research has no business relationship with any company whose stock is mentioned in this article.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire