The coal industry has been hit extremely hard the last few years. The strategy in which Rhino Resource Partners (RNO) decides to counter this new market will determine their resilience and ultimately their position within the sector in the next couple years. With new management, will Rhino continue to diversify into other non-mining assets such as Natural Resource Partners (NRP), or will they concentrate on their core business of coal and take the chance of higher market prices in the near term?

Overview

Rhino Resource Partners is a master limited partnership that is focused on coal, oil and gas, and related infrastructure within multiple basins in the United States. They produce steam coal that is used to produce electricity and metallurgical coal used in the steel-making process. At the time of writing this article, the share price stood at $10.16.

Management

As of October of this year there was a change of leadership within Rhino . David Zatezalo was the CEO since May 2004 and is now chairman of the board of directors, as per his retirement. He has been replaced by the long standing Senior Vice President and COO Christopher Walton. Walton has over 20 years of experience within the mining industry with roots in Sands Hill Mining Group and holds a degree in mining engineering and an MBA. The remaining leadership and bios can be seen here.

The leadership of Rhino is very interesting in that not only do they have specific and extensive experience within various positions within the coal industry, they have very little experience in other sectors. In actuality, the only member of the management that does have other experience is the corporate secretary Ms. Kegley who practiced law prior to joining Rhino in 2012. I find this interesting in that the coal industry could benefit from new ideas outside the sector given the beating it has taken the last couple of years. Granted, this has been primarily due to market prices, though I would have actually liked to of seen "fresh blood" within this sector.

This is especially important within the coal industry that has such emphasis on leadership having a mining background. Coal mining needs a new strategy in order to take advantage of the bottoming out of prices, if it is now or when it occurs. Promoting from within does has its advantages though when it comes to the CEO position, I do not believe that this always applies. Without a new aggressive plan to take advantage of a rising coal market I am concerned that Rhino will not be able to take full advantage. In essence, will old tricks work in a new coal market?

Number Comparison

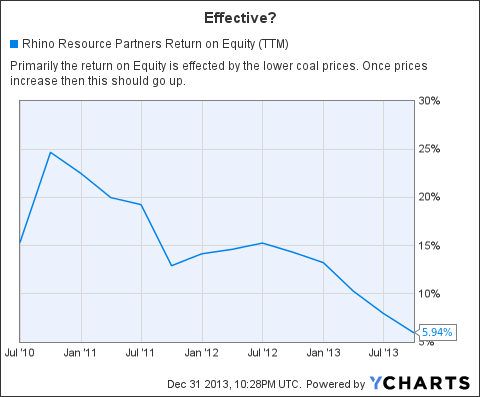

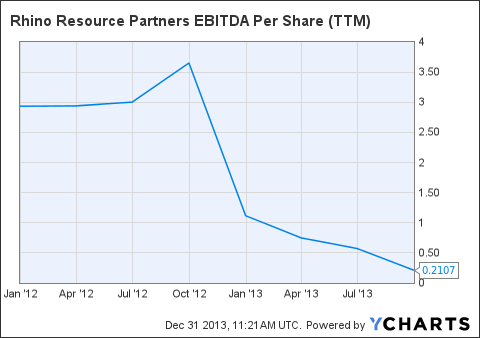

Rhino continues to hurt due to low coal prices on par with the others within the sector.

| September 2013 | December 2012 | |

|---|---|---|

| Total Assets (Last 3 Months) | $ 552,147,000 | $ 559,458,000 |

| Income (Last 3 Months) | $ 2,841,000 | $ 8,803,000 |

| Net Cash (Last 9 Months) | $ 1,077,000 | $ 540,000 |

| Net Cash Reinvested (Last 9 Months) | $ 22,797,000 | $ 50,777,000 |

| Net Cash Increase (Last 9 Months) | $ 616,000 | $ 91,000 |

(More on hand cash due to less reinvested.)

Diversity

Rhino has geographically diverse asset base with coal reserves located in Central Appalachia, Northern Appalachia, the Illinois Basin and the Western Bituminous region.

Non-Mining Assets

Oil and Gas: Rhino has invested into oil and gas mineral rights that have/continue to generate revenues via infrastructures support services primarily in the Utica Shale region as the "Projects" section below describes.

Cana Woodford

During 2011, they completed the acquisition of oil and gas mineral rights in the Cana Woodford region of western Oklahoma for a total purchase price of approximately $8.1 million, which consists of approximately 1,900 net mineral acres. Royalties from mineral rights started early 2012.

Razorback

In the second quarter of 2012, service company "Razorback" created to provide drill pad construction services in the Utica Shale for drilling operators. Razorback completed the construction of three drill pads during 2012.

Muskie Proppants

In December 2012, initial investments of approximately $2.0 million in a new joint venture, Muskie Proppants LLC Wexford Capital affiliates. Muskie was formed to provide sand for fracking operations to drillers in the Utica Shale region and other oil and gas basins in the U.S.

Timber Wolf Terminals

In March 2012, initial investment of approximately $0.1 million in a new joint venture, Timber Wolf Terminals LLC with Wexford Capital affiliates. Timber Wolf was formed to construct and operate a condensate river terminal provides barge trans-loading services for parties conducting activities in the Utica Shale region. The initial investment was Rhino's proportionate minority ownership share to purchase land for the construction site of the condensate river terminal.

Limestone

The Sands Hill mining complex's purpose is to sell to various construction companies and road builders that are located in close proximity to the mining complex when market conditions are favorable.

Advantages

In addition to coal mining, Rhino has a linear production model with subsidiaries in support of their mining operations via transportation (Rhino Trucking), mine related construction, site and roadway maintenance, and post-mining reclamation (Rhino Services), and in house drilling and blasting activities. A somewhat stable customer base of electric companies provides some stability as long as production costs are kept low. Coal purchases come primarily from U.S. utilities to generate electricity and the production of steel. A stable customer base of electric companies is a plus though the hardship of steel companies like American steel companies AK Steel Holding Corp. (AKS) and United States Steel Corporation (X) provides even more difficulty for Rhino though it provides cheaper materials for American steel companies. For the year-ended Dec. 31, 2012, data from the U.S. Energy Information Administration (EIA) showed that the United States relied on coal for approximately 37% of its power generation, compared to approximately 30% for natural gas.

Negatives

Unlike Natural Resource Partners, Rhino has not made a concerted effort to branch out into other natural resources to supplement the coal production. Revenue from non-mining activities continue to grow though will it be enough? They seem to have concentrated on their in-house linear production model vice diversity. I believe this is the greatest mistake that they have made given the uncertainty of coal pricing. However, the advantage to this is any prolonged coal bottoming will give Rhino an advantage, as they should be able to provide coal to the market for the cheapest prices. If they do not achieve low industry production costs they will have an increased chance of falling behind rivals like Natural Resource Partners. Slumping steel prices also play havoc on the bottom line as this is another primary source of income for Rhino.

Safety and Environmental

Non-fatal days lost time incidence rate for all operations for the year ended Dec. 31, 2012, was 1.27 as compared to the national average of 2.40, as reported by MSHA, or 47.1% below national average. 2012 average MSHA violations per inspection day was 0.51 as compared to the national average of 0.87 violations as reported by MSHA, or 41.4% below national average. In 2012 Rhino received seven "Sentinels of Safety" awards from the Department of Labor.

Conclusion

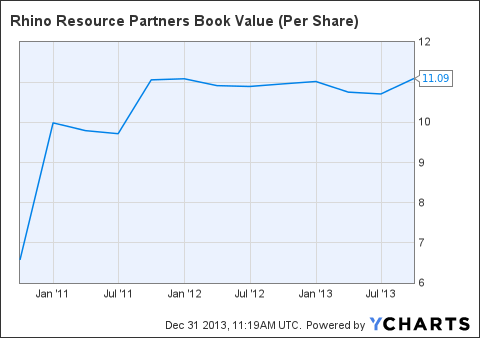

I believe that coal prices will increase though I believe they will not hit historic levels. Natural gas will continue to take market share as time passes and coal will eventually be primarily an export for Rhino. Companies such as Kinder Morgan (KMI, KMP, KMR) will have the advantage of long-term stability. I think Rhino needs to increase their international footprint in order to be a long term holding. Rhino Resource Partners is a potential short position (bought below $11.09) once coal prices begin to recover, though I do not believe this is a potential long-term holding until they continue to diversify outside of the coal sector or they increase their international exposure.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire