An Improving Picture:

The middle of November was a rosy time for Penford's (PENX) investors. The company reported a blowout quarter after an extremely rocky past two years. The company's most recent fourth quarter earnings release and fiscal year end financial results included some compelling results.

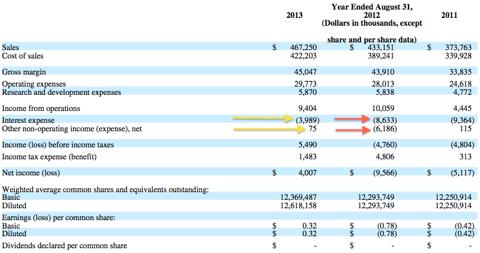

The company's recent results are compelling, almost too good to be true. With full year sales up 8% and operating cash flow up $22.1 million over last year, the results are a stunning turn around for a previously faltering company. Annual diluted EPS of $0.32 was compared to a loss in the prior year of ($0.78). On a top line basis, Penford's revenue expanded 6.5% in the fourth quarter to $117 million from the year ago period and sales increase in both divisions in the quarter compared to last year's fourth quarter.

The results released on November 14 were interesting, especially for a company that has had seven negative EPS releases over the past ten quarters. Adding insult to injury, eight of the past ten quarters were misses. Penford's better than expected results for the fourth quarter and the fiscal year 2013 begs the question - is this the beginning of a turnaround in Penford's shares or a trap that investors should stay far away from?

The Fiscal Year:

Industrial Ingredients:

Penford's blowout year was not as amazing as it seems. The company's loss from operations in industrial ingredients grew from a loss of $0.9 million in 2012 to a loss of $3.2 million in 2013 due to decreases in gross margin and operating expenses related to an acquisition. I would not blame the acquisition for hurting operations though the acquired company, Carolina Starches, added $12.2 million in sales. Industrial Ingredient sales overall were up 7.7% YoY to $356 million in 2013, although the loss from operations grew due to a decrease in gross margin.

The company's key item affecting its operating income is Penford's inability to pass on higher costs to its customers -such as the $6.7 million in higher corn costs that the company was unable to pass on to customers. This is a very undesirable trait in a company, as sales grew 7.7% YoY backed by an acquisition. Although this growth was checked by a decrease in gross margin that halted sales growth from reaching the bottom line. Until Penford is able to efficiently pass on increased costs to its customers, its bottom line will be affected. This division's growth in sales is strained by a decreased gross margin - a troubling factor for the company.

Food Ingredients:

The company's second division, food ingredients, had a better picture for the year. Sales grew 8.5% to $111.2 million on the back of a 7% volume increase and a pricing increase of 2%. The company's gross margin for this division improved $2.2 million YoY. This resulted in an income from operations of $23.265 million for 2013 for the food ingredients division. This was a positive for Penford, seeing growth in the company's main division.

Liquidity:

For the first time out of the past three fiscal years, Penford saw an increase in cash. Penford's cash flow generated from operations of $24.6 million in 2013 was a $22.1 million increase over 2012. This was a blowout gain for the company. The company's cash increased a meager $67,000 for the year, although was a turn around from the decrease of $127 thousand in 2012 and decrease of $34,000 in 2012. This is only an extremely slight increase for a company that is worth $158 million.

Penford's Balance Sheet:

On a year over year basis, Penford's balance sheet does have its quirks standing in 2013. The company had a great year, ending with a positive EPS figure of $0.32 compared to losses in 2012 and 2011 of ($0.78) and ($0.42) respectively. Although one item I choose to target is that much of this gain is not the result of organic growth.

(click to enlarge) (Source)

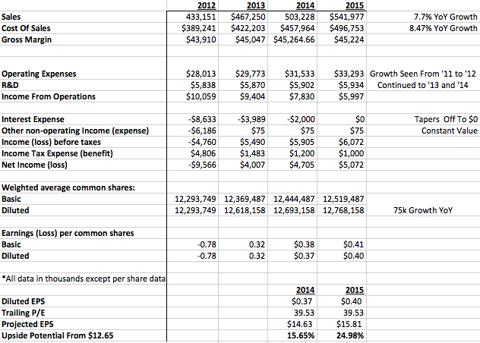

As can be seen from the above figure, sales grew 7.87%, although the cost of sales grew 8.47%. Cost of sales is below the amount of actual sales so this resulted in a growth in the company's gross margin of 2.59%, all on a YoY basis in 2013. Although two factors that are not necessarily pure organic growth that affected the years EPS was a decrease in interest expenses and non-operating income expenses. On a YoY basis, interest expense dropped from a negative $8.633 million to a negative $3.989 million and non-operating expenses of negative $6.186 million became a positive $75 thousand in 2013.

These two gains from previously higher negative numbers resulted in a net gain on a YoY basis of $10.905 million ($4.644 million decrease in interest expenses, and a $6.261 million decrease in other operating expenses as 2012's negative value was eradicated plus that $75 thousand gain in 2013). If these non-organic gains were not attributed to the company's 2013 results, then income loss before income taxes would be roughly a loss of $5.415 million ($10.905 million minus $5.490 million in income before income taxes in 2013). This loss of $5.415 million would be actually above 2012's loss of $4.760 million before income taxes. This would results in a negative EPS value worse than in 2012. The key item here is whether or not these two items will become negative again in the future, or if they will not affect the company in the future.

These Two Factors Discussed:

A closer look at Penford's balance sheet revealed one clean fact, 2013's positive EPS figure was not negatively worse than 2012 due to a narrowing of interest expenses and a newly turned positive value in other non-operating income or expenses. As to the first item, interest expense, decreased to $4 million in 2013 from $8.6 million in 2012 due to the redemption of the company's 15% Series A Preferred Stock in fiscal 2012. This resulted in roughly $4.6 million that did not negatively affect operating income in 2013 over 2012. ( Source For All Pictures)

As to the second item, other non-operating income (expense), the $6.6 million loss in 2012 that was turned into a gain of $75 thousand in 2013 is attributable to the loss on redemption of the company's Series A Preferred Stock.

As we can see, the redemption of the company's Series A Preferred Stock is a positive event. It removed two roadblocks affecting the company's operating income and thus bottom. These two roadblocks were the negative hampers of interest expense and other non-operating expenses that is will not negatively affect the company moving forward - with regard to the Series A Preferred Stock. This is a one-time event and we can generally expect that the negative shortfall that did affect these two balance sheet items in the past will not affect the company moving forward. This is due to the fact that the item causing these two values to be negative and affect the bottom line has thus been redeemed - the company's Series A Preferred Shares.

Projections:

My EPS projection for Penford results in potential gains through 2014 and 2015 of 15.65% and 24.98% respectively. These projections utilize conservative growth estimates seen in fiscal year 2012 to 2013 of 7.7% growth in sales and 8.47% growth in cost of sales YoY. Moreover operating expenses and R&D continue to grow using rates from 2012 to 2013. Interest expense continues to taper off and other non-operating income remains constant at $75. This assumes no material changes to either moving forward. Basic and diluted share count grows at 75k per year each, as seen roughly from 2012 to 2013.

Although these projections are conservative, I would not invest in Penford as the potential gains are light and are subject to many risks moving forward.

Risks :

Penford's bottom line is subject to various risks that when coupled with the moderate growth projected for 2014 and 2015 deters me from investing in the company. Starting with 60% of the company's manufacturing costs stemming from agricultural materials that are volatile on an annual basis due to weather conditions, plantings, government programs, policies and mandates of energy costs and global supply all affect regularly.

Volatility in energy and chemical costs that amount to 6% and 8% of the company's manufacturing costs also has the potential to impact the bottom line.

Penford also only has one customer for the sale of its ethanol products. Penford's ethanol sales to Eco-Energy, its sole ethanol customer, resulting in roughly 21% and 24% of the company's net sales for 2013 and 2012. If the company were to lose one or more of its major customers, this could be catastrophic for the top and bottom line. Moreover, the company does not multi-year agreements with its customers and many customers just place orders on an as-needed basis (Source for all statistics).

These very real and materially significant risks moving forward have swayed me from investing in Penford. The meager projected gains are not worth the very real risks moving forward.

When these risks are coupled with the company's already 0.96x debt/equity ratio, 41.07x P/E ratio and 17.93x Price/Cash flow ratios (Source E*TRADE) - the deal is sealed and I would not invest in Penford at all. The company's P/E ratio is higher than 94% of the company's peers in the chemical manufacturing industry. Having a high P/E ratio, a high amount of debt to equity and an extremely high price to cash flow ratio is reminiscent of a high growth company that is set to expand in the future. With only roughly 15% gains projected in store for 2014, my investment is deterred with coupled with the risks and already high valuation of the company

The Bottom Line

Penford reported blowout 4Q and fiscal 2013 results on November 14, 2013. Cash flow was up $22.1 million and sales up 8% both on a YoY basis. Sales increased in both divisions and annual diluted EPS of $0.32 was reported in comparison to the 2012 loss of ($0.78). These results beg an interesting question for investors, is this the start of a turnaround or a one-time blowout report? After seven negative EPS releases over the past ten and eight of the ten being misses, Penford's recent results beg the question as to whether or not this is a true turnaround.

Penford's two divisions are seeing an opposite picture. Industrial ingredients saw a loss from operations of $3.2 million worse than in 2012. All the while Penford's second division Food Ingredients improved $2.2 million YoY to $23.265 million in 2013. Operating cash flow was up $22.1 million to $23.649 million in 2013, although after factoring in net cash used in investing activities and financing activities cash only increased $67,000 in 2013.

Penford's balance sheet in 2013 sported the positive yearly EPS figure of $0.32. A closer look revealed two previously hampering items that improved on a YoY basis. These items, interest expense and other non-operating income, had a powerful effect on earnings. If they had not improved on a YoY basis, earnings per shares would be worse than the ($0.78) reported in 2012. A closer look reveals these two items' improvement stems from the redemption of the company's Series A Preferred Shares - a one-time event that will no longer hamper the company moving forward. Although not organic growth, the removal of this roadblock will help the company's bottom line moving forward.

I have pointed out just how much these two items helped the bottom line, to the tune of $10.905 million on a YoY basis. If they had not improved through the redemption of the Series A Preferred shares, then the company would have reported an EPS figure worse than 2012.

Penford is a company that may be on the cusp of a turnaround. The company's sales are up along with operating cash flow increasing $22.1 million. The redemption of the company's Series A Preferred Shares removed a series roadblock that was previously hampering the company. The removal of this roadblock will undoubtedly help the company's bottom line moving forward, as it did in 2013.

My EPS projection for Penford results in potential gains through 2014 and 2015 of 15.65% and 24.98% respectively. On the other hand these projected gains are not worth the investment when coupled with the very real potential risks the company faces and the already high valuation of the company. Penford as company made a great financial decision to redeem the company's Series A Proffered Shares to remove a balance sheet roadblock. Although this is not enough, as future projected gains are simply not worth the high valuation and risks involved with Penford.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: Always do your own research and contact a financial professional before executing any trades. This article is informational and in my own personal opinion.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire