Alternative energy investing was very profitable in 2013. This article reviews how green mutual funds and ETFs performed in 2013, what stocks were most favored by these funds, and forecasts where funds should go in 2014 and beyond.

Alternative Energy Fund Returns

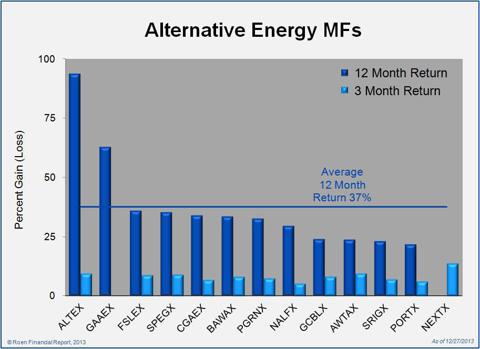

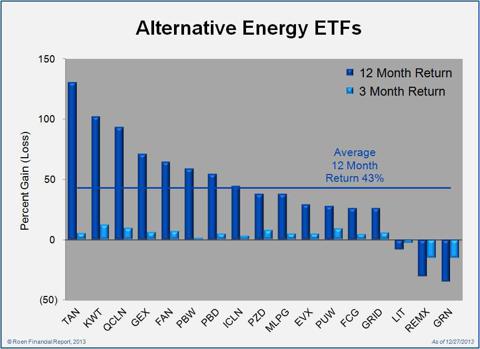

(click to enlarge) (click to enlarge)

(click to enlarge)

2013 has been the year of the comeback for alternative energy mutual funds and ETFs. As of close last week, green mutual funds were up 37% on average. Without exception, not one of the 13 mutual funds ended down for the year. ETFs did even better on average, up 43%, with 14 out of 17 funds posting gains for the year.

Contrast this with last year, when alternative energy mutual funds were up less than 10% for the year, with 2 out of 8 mutual funds closing down. Alternative energy ETFs fared even worse, down 3% in 2012. Half of the ETFs closed down in the red.

2013 returns were best for funds heavily invested in solar stocks, including Firsthand Alternative Energy (ALTEX), Guggenheim Solar (TAN), Market Vectors Solar Energy ETF (KWT) and First Trust NASDAQ® Clean Edge® Green Energy Index Fund (QCLN). Many of the solar stocks in these funds were at or near their lows at the end of 2012, so their annual returns look very good. Still, the majority of those solar stocks are far below levels they were trading at several years ago. For example, ALTEX is back up to where it was trading at in August 2011, but has far to go to reach its highs made 5 years ago.

Mutual Fund and ETF Stock Holdings

It is instructive to take a close look at the most popular securities that alternative mutual funds and ETFs are invested in. Of the green investments that the Roen Financial Report tracks, the most widely held by alternative energy mutual funds and ETFs is Johnson Controls (JCI). According to Morningstar®, JCI is owned by 13 green funds, making it a component of over 40% of all alternative energy mutual funds and ETFs. This blue-chip company is heavy into the building efficiency and power solution business, with the goal of having clients save on their energy bills while reducing their carbon footprint. For example, JCI helps clients achieve green building certification (such as LEED®) through demand-response systems and other efficiency measures. Though we feel JCI is above fair value in its current trading range in the low 50s, this is a solid company that professional fund investors consider a relatively safe and profitable green investment.

The other most widely held stocks are Itron (ITRI), SunPower (SPWR), Cree (CREE), SunEdison (SUNE), First Solar (FSLR) and SolarCity (SCTY). Of these, FSLR is the most heavily weighted stock by a wide margin. In other words, the quantity of FSLR stock that these funds hold makes up the highest percentage of any other single stock. In this case, FSLR makes up over 2% of all the combined portfolios of all 30alternative energy mutual funds and ETFs. The next highest weighted stock is SUNE at 1.7%. The rest of the stocks are around 1% or lower.

Annual sales for FSLR continue to climb, and earnings for this Arizona-based thin-cell solar company came in very strong for the most recent quarter. FSLR is a moneymaking pure-play company in the alternative energy investment world.

Looking Forward

We believe the recovery of alternative energy companies will continue into 2014. Alternative energy continues to enjoy a robustly growing share of the energy market, and there is little indication that his will change over the long-term. We project that these mutual funds and ETFs will maintain double-digit gains on average in 2014.

Another factor to consider is that when people continue to discover the price momentum green investments have seen in 2013, more and more investors will want to get into in these upward moving funds. On the down side, this type of momentum investing will likely cause much continued volatility in the alternative energy sector. The patient investor, however, is likely to be well rewarded by being in a high-quality alternative energy mutual fund or ETF.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire