I bought some Cisco (CSCO) shares at $21.20 last May. The stock is currently trading at $22 and I'm tempted to sell all of it now. I can't wait for the January quarterly cash dividend payment. For 3 months, I let all the bearish arguments go out of my left ear and kept the faith. However, after reading this post and this report, a HOLD position is no longer viable for 2014.

I'm selling the CSCO shares to buy more Nokia (NOK) shares. NOK had a much better 2013 market performance. I firmly believe NOK will again outperform CSCO this 2014. I love Cisco's solid fundamentals but its future operation is hampered by serious China and emerging market headwinds.

In great contrast, Nokia is enjoying a strong tailwind from successive contracts with Chinese companies. Nokia's YTD is +104.5% while Cisco only managed a +12% YTD performance. CSCO never again went past its August 7 $26.49 high.

President Obama, in his last press conference for 2013, acknowledged that Edward Snowden's revelations caused "unnecessary damage." Cisco is one of the biggest casualties of the NSA spying scandal. The company was very vulnerable because China blames Cisco Systems as the main reason behind the U.S. government's ban on Huawei and ZTE.

The Huawei Allegation

Huawei alleged that Cisco orchestrated an intense lobbying campaign against it which resulted to it being banned from supplying its products to U.S. government agencies. This accusation was a big flare-up last year. Huawei is Cisco's main competition in IP networking. The Washington Post said it obtained a copy of a 2011 Cisco memo, "Huawei's & National Security," which was used to dissuade U.S. firms from buying Huawei equipment.

This anti-Huawei black propaganda was allegedly done to protect Cisco's U.S. business interests. Huawei's rapid growth threatened Cisco's dominant position in IP networking. Huawei entered the U.S. market in 2001. It immediately found success thanks to its much cheaper networking equipments. In 2011, U.S. customers bought $1.3 billion of products from Huawei, which is equal to 4% of the Chinese company's total sales.

The cheaper Huawei products lured customers away from Cisco. The U.S. company, unable to slow down Huawei's rapid ascent, lobbied to portray its Chinese rival as a national security risk. Huawei and ZTE's rumored ties with the powerful Chinese People's Liberation Army gave Cisco an easy platform to launch their successful anti-Huawei propaganda.

China and Other Emerging Markets Are Very Important

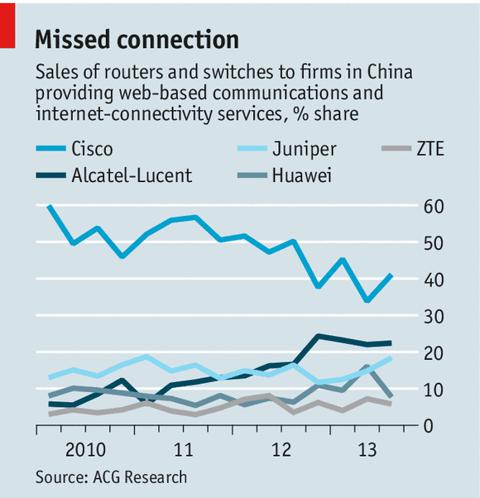

The Snowden Scandal is one big nail to Cisco's emerging coffin in China. CEO John Chambers might be regretting his 2012 Wall Street Journal interview where he said "Huawei doesn't always play by the rules." His company enjoyed more than a decade of profitable operations in China. However, Cisco's routers and switches market share in China has been in decline since 2011.

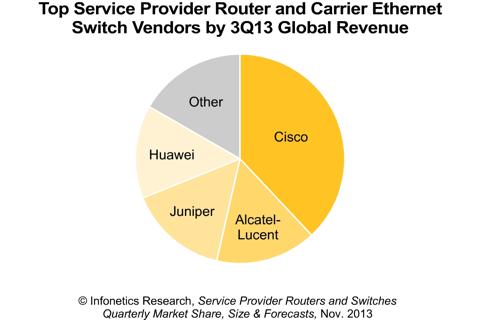

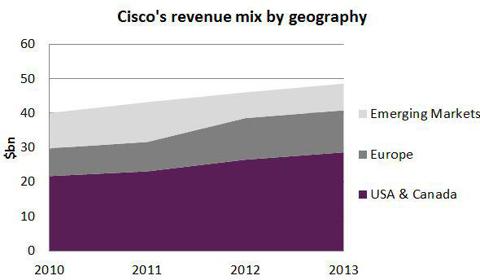

Cisco's gradual decline in emerging markets, particularly in China, is a long-term headwind . China, together with other Emerging Markets like Brazil, India, and Russia, accounts for 20% of Cisco's revenue. I find it very difficult to believe that Cisco can hold on to its No.1 ranking without substantial sales from China and EMEA.

A China-less Cisco will probably lower it down to the same market share level of Alcatel-Lucent and Juniper Networks (JNPR) within three years.

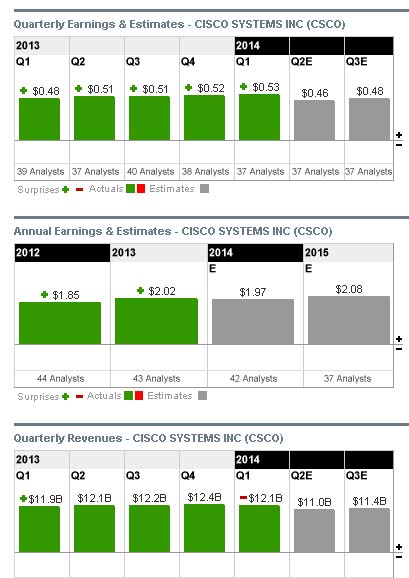

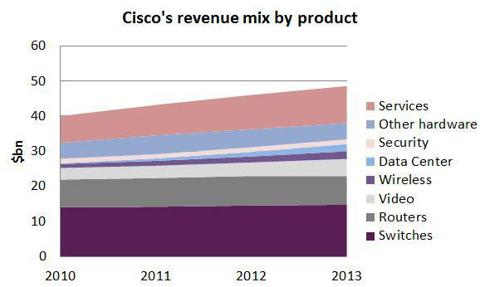

For Fiscal Year 2013, Cisco reported gross revenue of $48.6 billion, a 6% Year-over-Year growth. Cisco earned a GAAP net income of $10 billion or $1.86 per share. Businessweek's FY 2014 CSCO earnings and revenue estimates are stated in the following charts. These figures convince me that CSCO might never break the $25 barrier for the whole of 2014. It might even go down to $18 so I'm bailing out now and putting my money on NOK.

Summary

There are other more attractive tickers than CSCO right now. It's time for holders to consider unloading some of their shares. They can instead invest their money on other companies which are not burdened by political headwinds. Unless Obama threatens a full scale trade war versus China, Cisco has little hope of again enjoying a favorable business climate in China. The EMEA accounts for 20% of Cisco's revenue and the current anti-American sentiment there is a heavy handicap.

I also feel that Cisco's recent acquisitions this 2013 won't be enough to offset the declines in EMEA sales in 2014. Cisco's shift to the cloud computing and non-hardware business is admirable. Cisco now owns Insieme, Sourcefire, Whiptail, and Ubiquisys but their accretive effect may not be felt immediately in 2014.

The new acquisitions, in my opinion, are not enough to help CSCO hit a 2014 YTD increase of 30% or more. The company is still very dependent on its main hardware business.

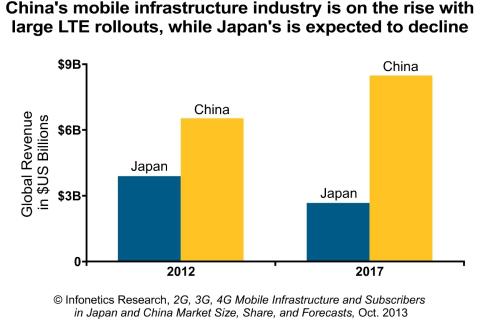

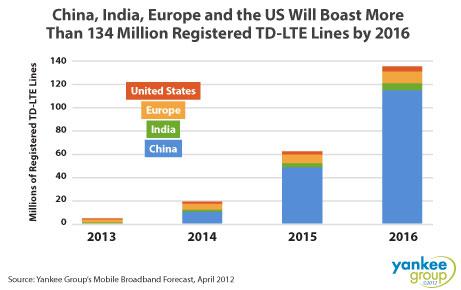

I'm liquidating my CSCO position so I can use the funds to invest on something else. I opted for NOK. Alcatel-Lucent, Juniper, and Ericsson are non-Chinese beneficiaries of Cisco's troubles. They are good alternatives to CSCO. Cisco is not yet (and may never be) on board the China 4G LTE roll-out money train.

Disclosure: I am long NOK. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire