On Nov. 7th, shares of Twitter (TWTR) debuted on the NYSE at $45.10 per share and closed at a price of $44.90. Since then it has increased nearly 66% to a record high of $74.73 per share before falling to about $63.75 at the time of writing. This is equivalent to a gain of about 41% in less than two months, which I believe is mainly driven by market optimism instead of company growth.

While Twitter is a great company with a lot of growth opportunities in the U.S. and international market, I believe that the company's stock price is way ahead of its current intrinsic value which should be somewhere between $26 to $33 per share (or $14.4 to $18.3 billion in market cap). This will be explained below, but first we must understand how Twitter earns its revenues.

Twitter earns its revenues from two main sources: advertising revenues through promoted products and data licensing.

In the nine months ended Sept. 30, 2013, advertising revenues contributed 89% of Twitter's total revenue, while data licensing contributed the remaining 11%. The company expects that it will continue to make the majority of its revenue from advertising.

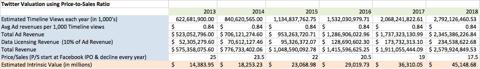

Since Twitter has not made any profits to date, I used the Price-to-Sales Ratio to estimate Twitter's current intrinsic value instead of a Discounted Cash Flow model (see image below):

The intrinsic value calculation is based on these assumptions:

- Twitter's timeline views will grow at about 35% each year in the next five years.

- Average ad revenues per 1,000 timeline views will be $0.84. This number should increase over time as Twitter improves its ad platform, but I decided to use a conservative number based on the average ad revenues per 1,000 Timeline Views from the last four quarters (Source: Twitter S-1 form).

- Data licensing revenue is about 10% of ad revenues each year.

- The Price/Sales ratio starts at 25, which was the P/S when Facebook launched its IPO. This number is assumed to decline over time.

Based on my calculations and estimates, Twitter's intrinsic value should be around $14.4 billion in 2013 and should increase to about $45.1 billion in 2018 as the company continues to attract more Monthly Active Users (MAU), timeline views and Ad revenues through promoted products (e.g. promoted accounts, tweets and trends). If this intrinsic valuation is correct, it would mean that Twitter's current market cap of about $35 billion--at the time of writing--is overvalued; in other words, its current market cap is about four years ahead of its current intrinsic value.

I believe that Twitter is a great company that will do well in the long term because it has a great business model that attracts an increasing number of users around the world and many platform partners such as news media. In addition, live content via tweets can spread much faster on Twitter than on Facebook (FB) and Google (GOOG). Twitter's ad platform is also as competitive as Facebook's, despite having less users. As of Sept. 30, 2013, Twitter had around 230 million monthly active users while Facebook had around 1.19 billion.

However, investors should take caution if they decide to invest in Twitter because the stock is currently traded at a premium price. And it will likely take the company several years before its intrinsic business value can catch up to $35 billion in market cap.

As Benjamin Graham once stated: "The price is what you pay. Value is what you get."

Warren Buffett also said: "Be fearful when others are greedy and greedy when others are fearful."

These two quotes should apply to any stocks, especially those that are traded at a premium price.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire