A few months ago, I suggested that Vanguard Natural Resources (VNR) was very close to making a meaningfully large acquisition. In its conference calls and press releases the company seemed very eager to tout its excess liquidity due to several capital raises over the summer. It took a few months but it seems as if this prediction has finally come to fruition. On December 30, Vanguard Natural Resources announced that it had entered into an agreement to acquire natural gas and oil properties in Southwestern Wyoming for a purchase price of $581M. This would be a massive acquisition for the company, essentially increasing its enterprise size by 20%.

A closer look at Vanguard Natural Resources' acquisition

- Purchase price: $581M

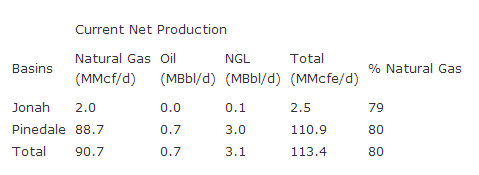

- Current production: 113.4 MCFE/D

- Production mix: 80% natural gas, 16% NGLs, 4% oil

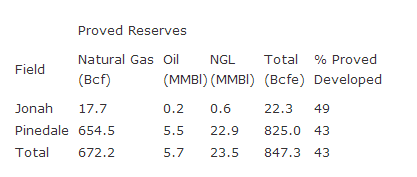

- Proved Reserves: 847 BCFE with an estimated reserve life of 20 years

The acquisition is for natural gas and oil properties in the Pinedale and Jonah fields of Southwestern Wyoming. These assets are spread out over 87,000 gross acres (14,000 net acres) and currently producing 113.4 MCFE/D, or roughly 18,900 BOE/D. This would boost the company's current production by nearly 55%. In terms of production type, the acquired assets are almost entirely natural gas and NGLs at 80% and 16% respectively, with only 4% of the production being oil.

In terms of reserves, the acquired assets add roughly 847 BCFE and boost Vanguard Natural Resources overall reserves by nearly 80%.

Vanguard Natural Resources noted that it intends to significantly hedge the expected natural gas and oil production from these assets through 2017. This is the standard operating procedure for the company as it essentially locks in future cash flows at current margins while also helping secure the long term health of the distribution. In addition, as natural gas prices are near their YTD highs, it protects the company from swings in the price of the commodity. Do note that none of the acquired NGL production is expected to be hedged.

Vanguard Natural Resources plans to fund this transaction via its existing reserve-based credit facility. As of September 30, the company had about $900M in excess liquidity available. The company close this acquisition by the end of January, 2014.

Acquisition is accretive to DCF

For investors in upstream MLPs, the most important metric for determining if an acquisition is a good one is if it allows the company to further boost its cash distributions. For this transaction, the company noted that the acquisition will be immediately accretive to distributable cash flow at closing. In effect, this should translate directly into a DCF per unit boost for the company. Given that the coverage ratio was a strong 1.09X last quarter, this may give the company wiggle room needed to further boost its distribution. Do note that it is still to early to know if Vanguard Natural Resources will issue any debt or equity to help with the financing, so the amount of accretion per unit is still up in the air.

Vanguard Natural Resources plans to deploy capital for drilling

In a change of course, Vanguard Natural Resources noted that the acquired assets have an inventory of approximately 970 proved undeveloped drilling locations, allowing the company to allocate capital towards drilling. The current plan is for an 8 rig drilling program, with each rig anticipated to drill 2 wells per month in 2014. In other words, Vanguard Natural Resources will be spending capital on growth capex rather than maintenance capex on a portion of these assets. CFO Richard Robert noted that this will mark an important change for the company as it will be the first time it will allocating capital to drilling wells.

Typically, Vanguard Natural Resources has been more focused on maintaining its cash flows rather than on growing production. As the end result, the company usually saw its capital shift toward higher return projects while quarter to quarter production often fluctuated. By spending capital on growth, Vanguard Natural Resources may open up more opportunities for internal incremental growth. Another benefit will be that it gives the company more options in terms of acquisitions. The downside here will be that it exposes the company to more potential setbacks and hence increases the risk profile.

Final Thoughts and Conclusion

Overall, it seems as if Vanguard Natural Resources is getting a very fair deal. On a per BOE basis, both the reserves and production seem to be very cheap. However, do note that these assets are mostly natural gas, and hence are extremely undervalued compared to oil.

Vanguard Natural Resources will also likely benefit from the recent increase in natural gas prices. During the past few weeks, natural gas has soared over 30% to over $4.20 per MCF. As the company expects to hedge nearly all of the expected production, it will likely be able to lock in an attractive price for the natural gas.

Disclaimer: The opinions in this article are for informational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned. Please do your own due diligence before making any investment decision.

Disclosure: I am long VNR. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire