Introduction

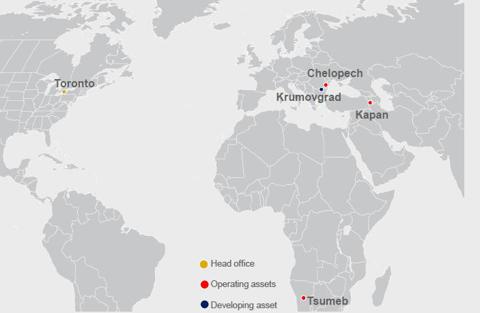

In this article I'll have a closer look at Dundee Precious Metals (OTCPK:DPMLF) which owns two gold mines in Eastern Europe and Armenia and a smelter facility in Namibia. I'll start with a brief overview of the producing mines and its smelter in Namibia, after which I will try to calculate the net present values of the two operating gold mines and its near-term development project in Bulgaria.

I will also discuss the potential risks inherent to investing in Dundee Precious Metals, and this will result in my investment thesis at the end of this article.

As trading in Dundee Precious Metals is quite limited on the US exchanges, I'd highly recommend to trade in Dundee stock through the facilities of the Toronto Stock Exchange where the company is listed on the main board with DPM as its ticker symbol.

Executive Summary

In this article I'll explain why I think Dundee Precious Metals is undervalued. I will prove that the fair value of all its cash flow generating assets and its development project have a total value of approximately $6.40/share, which is substantially higher than the last closing price of $2.63.

It seems like investors are overestimating the political risks in the countries where Dundee is operating and that the relatively high capex estimates for 2014 and 2015 are holding investors back. However, the majority of the capex will be financed through internally generated cash flow, and on top of that, Dundee can fall back on a $150M credit facility.

Long story short, if Dundee Precious Metals is able to deliver what it's promising, I think investors won't be disappointed down the road. I'm a buyer of DPM for its Chelopech asset and its investment in smaller junior companies.

Producing Asset 1: The Chelopech Gold Mine

Dundee's Chelopech Gold mine is located approximately 45 miles east of Sofia, Bulgaria's capital. The project has been in production since 1954 but was closed in the early nineties when the nearby smelter was no longer allowed to process the ore because of the high arsenic content in the concentrate. When the mine reopened in the late nineties, it had to ship the concentrate to other smelters all over the world, and now Dundee ships a large part of the concentrate to its 100% owned Tsumeb smelter in Namibia. Vertical integration is a wonderful thing.

The Chelopech mine has a long mine life as the project has 2.35 million ounces of gold in its reserve estimate, and a total of 4.5 million ounces of gold and approximately one billion pounds of copper in all categories. At the current production rate of 125-140,000 ounces of gold per year, this asset could be producing for another 27 years based on the current recovery rate of 55% for the gold.

However, Dundee has announced the results of a study which was aimed to increase the recovery of the gold to 90% by installing a circuit to recover the gold which is captured in the pyrite mineralization. This pyrite currently is being rejected in the flotation process in order to reach a saleable copper concentrate.

The pyrite concentrate could increase the gold production by 75-90,000 ounces per year which will obviously have an extremely beneficial effect to the cost structure of the Chelopech mine, as its cash flow profile will be higher than ever before if the production profile could be increased to 225-240,000 ounces of gold per year.

The total capex for this expansion was expected to be $202M (but will very likely increase a bit further because of cost inflation), of which $22M has already been spent. It gets even better, as the company will very likely use a two-step approach by installing two circuits of 200,000 tonnes of pyrite each, which would allow Dundee to lower the remaining capex to just $93M for the first circuit and $87M for the second circuit. In a later paragraph of this article I'll explain what this could mean for the NPV of the project.

Producing Asset 2: The Kapan Gold Mine

Dundee's second operating mine is the Kapan project in Southeast Armenia, near the border with Iran. The gold production is expected to be quite low at just 23-25,000 ounces of gold this year, but the company is currently conducting an internal review to expand the underground operations at Kapan after it revealed a substantial resource update earlier this year, which shows an indicated and inferred resource of in excess of one million ounces of pure gold, and two million gold-equivalent ounces at a cutoff grade of 2.24g/t gold equivalent.

I'm looking forward to see the results of this study, as it looks like the Kapan mine might be able to expand its production rate substantially as the increased grade will increase the output and decrease the cash cost per ounce of gold from the current rate of $860/oz which was the cash cost in the first 9 months of the year.

The Tsumeb Smelter - explaining the capex needs

Dundee's Tsumeb Smelter is located in Namibia, approximately 260 miles north of Windhoek, which is the capital of the country. The smelter has been operating for 50 years now, and is ideally located as it is directly linked to the deep water port of Walvisbaai by rail which allows Dundee to reduce its freight costs. The most important thing about the smelter is the fact that it's one of the very few smelters in the world which is able to treat 'complicated' concentrates, which offers the plant a huge competitive advantage over its competitors. As Dundee is planning to double the capacity of the smelter plant in just three years, I'm expecting to see nice things from Tsumeb in the future.

Its end product is so called 'copper blister bars' which have a purity of approximately 98.5% and are being shipped to refiners to further upgrade the product. Dundee is also able to recover and sell arsenic trioxide from its plant as a by-product credit, which further enhances the economics of the project.

On top of that, Dundee is also building a sulphuric acid plant at its Tsumeb operations. This comes with a hefty price tag of $240M and construction started approximately three months ago. This plant will produce between 230,000 and 280,000 tonnes (some even say 340,000 tonnes) of sulphuric acid and earlier this year, Tsumeb entered into an offtake agreement with Rössing Uranium (which is almost 69% owned by Rio Tinto (RIO) ) for the annual purchase of 225,000 tonnes of sulphuric acid to be produced by Tsumeb. This means that approximately 80-98% of the total annual production has already found a buyer. On top of that, it's very likely Areva Namibia will also approach Tsumeb for its sulphuric acid needs.

But let's not forget this move to produce sulphuric acid will also increase the support from the surrounding communities. The acid will be recovered through capturing and processing the dangerous sulphur dioxide gas which is actually causing breathing problems for the inhabitants of the surrounding communities.

The total amount of concentrate smelted at Tsumeb in Q3 2013 was 28% lower than the corresponding period in 2012 due primarily to the timing of the annual maintenance shutdown of the Ausmelt furnace. This caused the smelter to show a gross loss because of the lower throughput and higher operating costs per tonne of concentrate. Additionally, more third party concentrate was being processed, which has lower margins than processing its own ore coming from the Chelopech project.

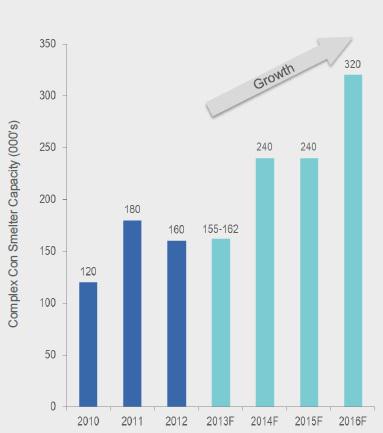

However, this situation will be reversed soon, as the company is still aiming to smelt between 155,000 and 172,000 tonnes of concentrate this year, which would mean that the Tsumeb smelter will smelt in excess of 40,000 tonnes in Q4 which is a 25% increase compared to Q3. For next year, the company says it's still on track to expand the capacity by another 50% to 240,000 tonnes per year in 2014 and another 33% to 320,000 tonnes per year in 2016. Such an expansion will obviously bring a lot of economies of scale, and I expect the cash cost per treated tonne of concentrate to drop below $400/t again. On top of that, the company said in its 2012 annual report it was able to secure much better terms in new concentrate treatment contracts.

Unfortunately the company does not give any indication about the expected cash flows at the Tsumeb smelter, and therefore it's extremely difficult to put a valuation on this part of the Dundee-assets. It purchased the smelter in 2010 for $33M, but the fair value today is obviously much higher.

What's the value of the two mining projects? A back-of-the-envelope calculation

Let's move on to the next stage and determine what the fair value of both mining operations would be at today's prices.

1. The Chelopech Mine

I'll start with the Chelopech Mine, and assume a gold production of 130,000 ounces of gold in 2014 and 2015, increasing to 175,000 ounces of gold in 2016 and 220,000 ounces of gold in 2018. I will also provide capex for the pyrite concentration in 2015 and 2017 to the tune of $100M each year. On top of that, I will assume a total sustaining capex, G&A and exploration expenses of $35M per year from 2014 on, on top of the assumed cash cost of $250/oz for 2014-2015, $400/oz for 2016-2017 and $500/oz from 2018 on. The assumed gold price is $1200/oz. The assumed mine life is 14 years (assuming not all of the mineralized ore is recoverable).

As Bulgaria is a part of the European Union, I feel comfortable using a discount rate of 8% as the project is in production and the local management has proven it knows how to run a mine. On top of that, Bulgaria also is a semi-tax heaven as its corporate tax rate is just 10%.

Cash Flow per year | Corporate tax at10% | after tax | Discount rate (8% per annum) | NPV8% |

88500000 | 10% | 79650000 | 1,00 | 79650000 |

-12500000 | 0% | -12500000 | 1,08 | -11574074 |

105000000 | 9% | 95550000 | 1,17 | 81918724 |

5000000 | 10% | 4500000 | 1,26 | 3572245 |

117500000 | 10% | 105750000 | 1,36 | 77729407 |

117500000 | 10% | 105750000 | 1,47 | 71971673 |

117500000 | 10% | 105750000 | 1,59 | 66640438 |

117500000 | 10% | 105750000 | 1,71 | 61704109 |

117500000 | 10% | 105750000 | 1,85 | 57133435 |

117500000 | 10% | 105750000 | 2,00 | 52901328 |

117500000 | 10% | 105750000 | 2,16 | 48982711 |

117500000 | 10% | 105750000 | 2,33 | 45354362 |

117500000 | 10% | 105750000 | 2,52 | 41994780 |

117500000 | 10% | 105750000 | 2,72 | 38884056 |

716,863,195 |

As you can see, thanks to Chelopech's low cash cost profile and the low corporate tax rate in Bulgaria, I estimate the fair value of the Chelopec operation to be approximately $717M. This assumes the production expansion later this decade to recover and process pyrite concentrate.

2. The Kapan Mine

The Kapan mine is more difficult to analyze. The cash cost per ounce of gold was $800 in the first nine months of the year (it was $860 per ounce sold, but the production was higher than the amount of sold ounces), but this does not take the sustaining and growth capex to the tune of $700/oz into consideration. However, the capex is expected to fall from next year on (and the output to increase) when the stockpiling problems at Kapan will have been solved. However, Kapan will still be a marginal producer at the current gold price as it won't generate a lot of free cash flow.

That being said, I'll focus on the underground expansion as the grades are much higher. I expect an additional up-front capex of $60M which should allow Dundee to increase the production to 40,000 ounces per year (based on an average head grade of 2.4g/t and a recovery rate of 88%). I expect the cash cost to decrease substantially to almost zero if the grades of the resource estimate turn out to be correct.

The total processing cost was $75/t in 9M 2013. If I would allow for an increase to $85/t, the total processing cost for a 600,000 tpy facility would be $51M. As Kapan will produce 700,000 ounces of silver as by-product as well as 23M lbs of zinc and 4M lbs of copper, these by-products will generate a cash flow of $43M based on a silver price of $18/oz and a zinc and copper price of $0.85/lbs and $2.75/lbs respectively. This means the net cash cost of the gold is approximately $8M, which results in a cash cost per ounce of approximately $200. If I allow $20M per year in exploration expenses and sustaining capex, the AISC would increase to $700/oz, which is the number I will use in my calculation. The other parameters are a mine life of 18 years and a tax rate of 20%.

Cash Flow per year | Corporate tax at 20% | after tax | Discount rate (10% per annum) | NPV10% |

-60000000 | 0% | -60000000 | 1,00 | -60000000 |

20000000 | 0% | 20000000 | 1,10 | 18181818 |

20000000 | 0% | 20000000 | 1,21 | 16528926 |

20000000 | 0% | 20000000 | 1,33 | 15026296 |

20000000 | 10% | 18000000 | 1,46 | 12294242 |

20000000 | 20% | 16000000 | 1,61 | 9934741 |

20000000 | 20% | 16000000 | 1,77 | 9031583 |

20000000 | 20% | 16000000 | 1,95 | 8210530 |

20000000 | 20% | 16000000 | 2,14 | 7464118 |

20000000 | 20% | 16000000 | 2,36 | 6785562 |

20000000 | 20% | 16000000 | 2,59 | 6168693 |

20000000 | 20% | 16000000 | 2,85 | 5607902 |

20000000 | 20% | 16000000 | 3,14 | 5098093 |

20000000 | 20% | 16000000 | 3,45 | 4634630 |

20000000 | 20% | 16000000 | 3,80 | 4213300 |

20000000 | 20% | 16000000 | 4,18 | 3830273 |

20000000 | 20% | 16000000 | 4,59 | 3482066 |

20000000 | 20% | 16000000 | 5,05 | 3165515 |

20000000 | 20% | 16000000 | 5,56 | 2877741 |

82,536,028 |

Based on these rough parameters, the after-tax NPV of the Kapan mine is approximately $82.5M. Obviously the NPV will be a lot higher if the capex for the underground expansion is lower than I expect. I'm looking forward to the results of the internal study and a decision to move ahead with the plans. As no decision has been made, I think a ratio of 0.6X the NPV would be a fair value for this project, which would result in $50M.

Work in progress: The Krumovgrad project

Dundee also owns a second project in Bulgaria which it aims to develop down the road. The Krumovgrad project contains approximately 800,000 ounces of gold in the reserve category. A feasibility study was completed in 2011, which outlined an annual production of 74,000 ounces of gold during an initial 9 year mine life. The estimated capex was $127.5M and the sustaining capex and closure costs are very low at just $26M. The cash cost was expected to be $410/oz (after re-converting the gold-equivalent ounces to pure gold ounces).

In my assumptions I will use an initial capex of $140M and an AISC of $600/oz (which is quite low thanks to the low sustaining capex and closure costs).

Cash Flow per year | Corporate tax at 10% | after tax | Discount rate (8% per annum) | NPV8% |

-140000000 | 0% | -140000000 | 1,00 | -140000000 |

44400000 | 0% | 44400000 | 1,08 | 41111111 |

44400000 | 0% | 44400000 | 1,17 | 38065844 |

44400000 | 0% | 44400000 | 1,26 | 35246152 |

44400000 | 5% | 42180000 | 1,36 | 31003559 |

44400000 | 10% | 39960000 | 1,47 | 27196105 |

44400000 | 10% | 39960000 | 1,59 | 25181578 |

44400000 | 10% | 39960000 | 1,71 | 23316276 |

44400000 | 10% | 39960000 | 1,85 | 21589145 |

44400000 | 10% | 39960000 | 2,00 | 19989949 |

122,699,718 |

Based on these assumptions, the after-tax NPV8% of the project is approximately $123M. As this project is just in the feasibility stage, I think a P/NAV of 0.4 is desirable, which would lead to a fair value of $50M for this project.

That being said, my estimated total value for all three projects totals $817M with Chelopech by far the most interesting and impressive part of Dundee Precious Metals.

The risks associated with an investment in Dundee Precious Metals

A first risk is obviously the commodity risk. I based all my calculations on a gold price of $1200/oz, and all three of Dundee's projects remain viable at the current gold price. As Chelopech has an extremely low cash cost basis, I'm not worried at all about that asset, but for the Kapan project it will be imperative to expand the production profile and lower the costs per ounce in order to survive at a triple digit gold price.

A second risk is the geopolitical risk. Bulgaria, Armenia and Namibia aren't exactly the Canada, USA and Australia of the mining sector, so there is some political risk. However, as I think Bulgaria is relatively reliable (being a part of the European Union reduces a lot of the political risk) I used an 8% discount rate for the Chelopech and Krumovgrad calculations. For the Armenian Kapan mine a discount rate of 10% was used.

Investment Thesis

Dundee Precious Metals has four interesting assets of which the Chelopech mine seems to be the company's absolute flagship. If Dundee will be able to install the pyrite concentrate expansion on time and within budget, I'm expecting an output of 220,000 ounces of gold by the end of this decade.

A fair value of all three mining projects combined would be $817M. If I would attribute a very preliminary value of $100M to the Tsumeb smelter and $23M to its investments in other junior exploration companies, Dundee's assets should be worth approximately $940M if the company can effectively push all the expansion programs through. If I deduct the net liabilities position of $50M, I end up with a fair value of $890M for Dundee Precious Metals, which translates into $6.40/share.

As Dundee Precious Metals is trading at less than half its fair value, I expect the company to be re-rated by the market after it completes its expansion and upgrade projects at Tsumeb and Chelopech. As Chelopech - which is the company's main asset- has a very low operating cost, I think Dundee is in an excellent position to continue its gold production.

I currently have no position in Dundee Precious Metals, but I might actually dip my toes in the water and initiate a position, mainly because I'm in awe of the Chelopech operation and because I gain exposure in two small junior companies with promising assets.

Disclosure: I have no positions in any stocks mentioned, but may initiate a long position in OTCPK:DPMLF over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire