Bullish long-term investors and bearish short sellers have been waging an ongoing battle in the stock of Sears Holdings Corporation (SHLD). Opportunistic speculators have occasionally joined both sides as the limited float and high short interest have repeatedly caused short squeezes and minor crashes. Other participants, on both the short and long side, have thrown in the towel due to fatigue. All the while analysts have carefully parsed every word and action taken by Chairman Edward Lampert in a modern form of Kremlinology.

I recently visited one of Sears' most valuable domestic properties, a fully owned anchor "big box" at the high-end Plaza at King of Prussia, and got some insight into what direction the ongoing transition at Sears Holdings will take next. A single site visit to a company with ~2,000 locations is an extremely limited data point, but I believe it could shed some light on Lampert's broader strategy.

THE ONLY QUESTION THAT REALLY MATTERS

Analysts have spent countless hours researching the actuarial lifespan of pension plan participants (overstated by GAAP), the effects of higher discount rates on the pension liability (lower at YE 2013), the amount of debt that a spun-off Land's End can be burdened with, constraints of the revolving credit facility, the potential sale of the home services and/or warranty segment and many other salient aspects of this largely opaque corporation. For both longs and shorts, however, the biggest question is what Lampert will do with the real estate and when.

Sears Holdings owns a lot of real estate. Each share of Sears Holdings represents a claim on roughly one sq. ft. of owned Sears Domestic retail space plus one sq. ft. of leased K-Mart space, as well as a collection of other businesses and liabilities. While the value of this real estate continues to be debated, reasonable estimates suggest it is worth more, and possibly a lot more, than the current share price. The question in many investors' minds is whether the real estate value can be realized without substantially eroding the value of the other owned businesses or even bankrupting the two domestic retail subsidiaries.

WHAT CAN ONE LOCATION TELL US ABOUT THE FUTURE OF THIS COMPANY?

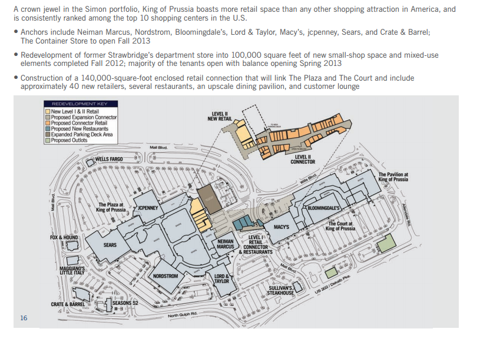

The Sears location at King of Prussia, PA, is one of the vaunted "trophy properties" owned by Sears Holdings. 2011 sales at this mall were $750 per sq. ft. and the entire mall was valued at $522 per sq. ft. at the time when Simon Property Group (SPG) purchased an additional 50% of the mall from one of its partners. While not a perfect apples to apples comparison, this metric puts a value on Sears' 212,252 sq. ft. box of $110 million.

While undeniably valuable, this store has also been poorly maintained and - in my belief - marginally profitable at best over the last few years. While this is a great location, real estate-wise, few shoppers wander over from the Gucci or Hermes store in search of discount apparel and a washing machine. Despite the fact that Sears and its attached auto center might no longer fit in a mall that has increasingly gone upscale, this is an important location geographically and, I would suspect, for the retailer's image in the community.

Short sellers have brought up a number of legitimate issues over the last few years. While long investors take comfort in the real estate valuation, shorts point out the difficulty of firing hundreds of thousands of employees and liquidating billions of dollars in merchandise to get to that value. For investors who put great value in the brands, service, and warranty businesses owned by Sears Holdings, shorts point out that the value of these assets will erode quickly with a shrinking store count.

More intangibly, it doesn't take a retail expert to surmise that closing flagship locations and slashing advertising budgets is likely to have a significant negative impact on the value of the brands and profitability of remaining locations.

This brings us back to the King of Prussia location; a valuable piece of real estate, poorly maintained, underperforming, and yet one of the many vital hubs for an intertwined web of brands, service businesses, and a growing online and membership experience. It would seem that this location would stand as evidence for the short thesis, because either keeping the store open or closing it to sell the real estate will damage the overall value of Sears Holdings Corp.

CAN LAMPERT HAVE HIS CAKE AND EAT IT TOO?

I was not surprised to find this Sears location (or any Sears location for that matter) in a state of cosmetic disrepair.

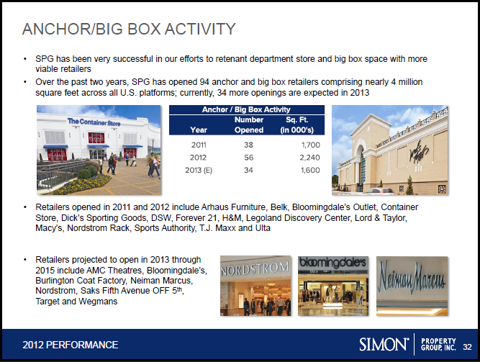

What did surprise me was my conversation with one of the - very capable and pleasant - associates, who said that the store is consolidating early next year into just the bottom of the two floors. I was told that the top floor was being rented to Dick's Sporting Goods and the auto center was being rented to a restaurant. Dick's is one of the retailers Simon Properties has mentioned in presentations as actively growing their big box footprint.

(click to enlarge)

While investors have read in the past of similar redevelopments, with one-off subleases to Whole Foods or health clubs, there is no mention anywhere online of the King of Prussia location being redeveloped, nor is it mentioned anywhere on the Seritage website. The only reference I could find online was a YouTube video from a vintage elevator enthusiast who went to the store for one last ride on the 1983 Otis hydraulic elevator.

In a previous article, I suggested that 2014 was likely to see an acceleration of store closures and real estate sales, as performance at the retailer continues to deteriorate while real estate values have soared. Given continued operating losses and a seller's market in real estate, my assumption was that a number of stores would operate as usual through the holidays and then shut down rather than re-stock inventory for the spring season. However, the actions being taken at the King of Prussia location suggest a middle path that could be the best-of-all-worlds for Sears Holdings shareholders.

One associate I spoke with said that the store would no longer sell women or children's apparel when it consolidated into a single floor. The new smaller Sears will focus on the retailer's core strengths of appliances and tools as well as seasonal items like patio furniture in the summer and exercise equipment in the winter, which the associates I spoke with suggested were "big moneymakers". The store also has a large and well maintained Land's End area.

I had assumed that Lampert would close stores like King of Prussia in 2014, opting to trade a mediocre retail location for something in the neighborhood of $100 million in cash. Instead, by leasing most of the space and operating a smaller retail location, it seems Lampert can have his cake and eat it too. What was an eyesore within a great mall will now have a brand new facade as a Dick's Sporting Goods (the bottom floor where Sears will be is less visible from the street and parking lots).

The Sears store itself will be more profitable and have lower costs with fewer employees. The Sears auto center, which was completely out of place in this mall, will now be one of many new restaurants in the area. Importantly, Sears maintains a presence as an anchor at a top mall, while upgrading the real estate it resides in and making it easily saleable (with a smaller Sears as one of the tenants for the buyer). If Sears Holdings does not sell this location, combining the cash flow from a more profitable Sears store with the rent from two good tenants in a great location (which could later be spun into a REIT structure), it will still substantially improve profitability while cutting costs and adding flexibility.

WHAT'S NEXT?

The fate of one location means little for an investment in Sears Holdings Corp, but if as few as 100 good locations are undergoing a similar transformation in 2014, it will both have a meaningful impact on the bottom line and provide the flexibility that makes the real estate thesis much more clear and tangible. Redevelopment and leasing on a store-by-store basis is both costly and time consuming, but it is only rational to assume Lampert has been working on these plans for years and he now has at least $2 billion in liquidity which can deploy as he sees fit.

The transformation of the King of Prussia location could very well be just one more profitable one-off deal within a lumbering behemoth of a corporation that still has many real problems. However, if this is the start of a serious push by the company in this direction, investors could see the real estate value begin to be unlocked (and meaningful cash flow from rent if not large inflows from real estate sales), while simultaneously seeing improved performance (smaller losses) from the retailer - all while preserving the value of the ancillary businesses and brands. For investors who believe the current share price offers a margin of safety, this possible end-game offers substantial upside in a reasonable timeframe.

Have other investors seen similar unannounced redevelopments going on at Sears locations?

Disclosure: I am long SHLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: The author, his family, employees of Union Square Research Group, and their clients are long Sears Holdings Equity as well as derivative securities that will rise in value if the stock rises.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire