Despite becoming the #4 most shorted stock in NASDAQ 100 Component in March this year, Garmin's (NASDAQ:GRMN) stock price has rallied nearly 30% since July, closing at $46.67 as of December 27th. Although earning surprises and optimistic outlooks on upcoming products attributed to much of the appreciation, it is important for investors to re-evaluate the fair value of the company amid intense competition and determine if Garmin is worth its current share price.

Business Overview

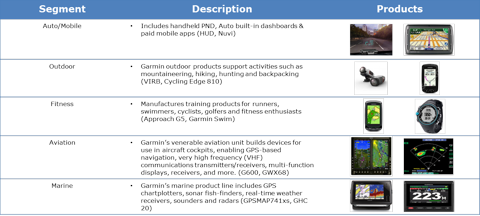

In summary, Garmin makes a variety of global positioning system (GPS) devices. The following segments make up Garmin's revenue: auto/mobile, outdoor, fitness, aviation, and marine. Garmin has various products developed across these segments to target its niche markets.

For the past 5 years, Garmin's stock price has depreciated significantly due to a dying portable GPS industry, otherwise known as the portable navigation devices (PNDs). The main reason is due to the rise of smartphones. Smartphones can have access to free applications that give great navigation such as the Google Maps and many consumers no longer want to pay for Garmin's PNDs and upgrade fees when they can use their smartphones instead. Investors lost confidence in Garmin as PND was their core business and Garmin has been in the decline since then. As shown in the price chart below, Garmin has dropped nearly 60% from its peak of approximately $120/share in 2007.

With declining sales and a dying core business model, it was no surprise when Garmin became one of the most shorted stocks.

Investors Became Optimistic

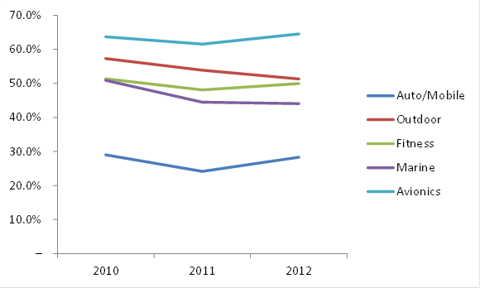

During this year's summer, Garmin's stock price began to rally after beating earning's estimates in addition to a series of new product announcements. More and more investors became aware of the growth in other segments of Garmin and its high margins. In the graph below, you can see a clear distinction between the EBIT margins of the auto/mobile segment compared to the rest. As a result, many investors became hopeful that the growth in the other segments of Garmin would be able to offset the PND sales decline.

With segments that have high margins and vast opportunities for growth, no debt, decent free cash flow, and new products such as the VIRB, Garmin has appealed to many investors as the company making its comeback after years of struggle.

Challenges Ahead

Although Garmin has done quite well for itself for the past 6 months, investors should continue to perform due diligence on the company to see how sustainable Garmin's advantages are and how reasonable they can maintain investors' high expectations for the future.

-Intensified competition in the 4 high-margin segments

Going into 2014 and the near future, the wearable technology industry is expected to be "the next big thing". Wearable technology is essentially clothing and accessories that incorporate electronic technology. According to an equity research report on the wearable industry by Credit Suisse, we are at a possible inflection point in market adoption for wearable technology and there is potential for a ten-fold increase over the next 3-5 years from $3-5bn to $30-50bn. These growth are driven by a growing installed base of smartphones, performance improvements, established software ecosystem and new apps/business models. Garmin will definitely benefit from this news as its fitness and outdoor segment can both be classified under this industry. Many investors have been pricing this possibility into Garmin's share price and that is one of the reason why it has rallied 30% the past 6 months.

As Econ 101 tells us, increased profit will attract more suppliers over the long run; this is the case here for Garmin. Technology behemoths such as Apple (NASDAQ:AAPL), Google(NASDAQ:GOOG), Samsung (listed in Korea), and LG(listed in Korea) have all made their move towards the wearable technology industry this year. Although Apple hasn't been very public about any new developments of iWatch, a series of patents filed by Apple suggest Apple is active in considering wearable products - although it does not guarantee anything at this point. If Apple does decide to release iWatch, it is likely to include many features that would be competitive in today's smartwatch market such as heartbeat monitor and GPS. These features would cannibalize Garmin's current market share. In addition to Apple, Samsung has already released its smartwatch called Galaxy Gear, which compliments the Note 3 (phone). The watch has the ability to check text messages, take pictures, and call. With the existing products of smartwatches and rumors of Google and LG developing their own line of products, Garmin's attractiveness to many consumers would be hindered by bigger names such as Apple or Samsung. As a result, Garmin's products may only appeal to a small subset of consumers, thereby limiting their profit to very niche markets.

Not only technology companies are racing to gain dominance in the wearable industry, consumer and retail companies such as Nike and Adidas have all released products within this sector. As a matter of fact, Nike and Adidas compete directly with the niche market that Garmin is trying to target within its fitness segment - competitive and recreational athletes. Nike has its Nike+ integrated into Nike eCommerce platform while Adidas miCoach has a family of products that would make direct competitors to Garmin.

Going forward, Garmin faces intense competition within its fitness and outdoor segment. Although the expansion of the wearable industry in the future will no doubt benefit Garmin's topline, it is unlikely to satisfy the expectations of investors which are priced into the current stock price as increased competition decreases margins. As a result, the current premium investors are paying for Garmin's shares (DCF analysis below) is not justified.

-It is unknown how much the PND sales will decline by

Garmin has made a great progress towards diversifying its revenue streams compared to a couple years ago, when the majority of their revenue came from the sale of PNDs. At current level, PND is declining at the pace of around 15% annually. In the latest Q3 earnings, non-auto/mobile segment revenue has increased 12% on a year-to-year basis. Nonetheless, total revenue for the quarter has declined 4% due to the decrease in PND sales. This reaches my next point: although Garmin has been able to balance its revenue decline from growth in other segments, it is difficult to estimate when the PND sales will bottom out. In addition, as I have indicated from above, the growth in other segments will not be easy for the near future as Garmin faces stiff competition from well-known companies that have arguably "better" brand equity. It should be acknowledged that although the PND sales are declining, Original Equipment Manufacturer (OEM) partnerships such as the ones with Mercedes-Benz are certainly encouraging news to Garmin. Nonetheless, these sales are included in the auto/mobile segment, and it has not made the decline in sales any slower. Since there is no indications of when PND sales will bottom out, if the decline in the auto/mobile segment far surpasses the growth generated from other segments, Garmin's investors will suffer a great loss from stock depreciation.

-Cash reserve in the company does not equal to a good investment

Yes, having cash in the balance sheet is certainly a good thing for shareholders as the company can pay out dividends, issue stock buybacks, or re-invest it into the business. However, this does not mean a company with cash will be safe to invest in. BlackBerry (NASDAQ:BBRY) had a great cash reserve for the past couple years, but look at its stock price right now. If the company cannot utilize the cash and spend it appropriately, the cash becomes just numbers on paper and shareholders cannot benefit from it.

-Too much expectation of VIRB

The VIRB is an action camera that is set to compete against GoPro. It was released 2 months ago and we have yet to see how it adds to Garmin's revenue. However, it is concerning how much investors and equity research analysts are expecting from this new product - the general consensus is that the VIRB may be able to capture the action camera market and become the #2 player going head-to-head with GoPro. Although it is possible for the VIRB to be popular within the action camera market, investors should be aware of high expectations of a product that has yet to prove any results. The higher the expectation, the more investors set themselves up for disappointment.

-Insider sale

When the management has a large stake in the company, investors should feel more confident as the management and shareholders' interests are aligned. Throughout August and into September, insiders have been selling their stake in Garmin - most notably Garmin's Co-Founder Min Kao and Director Donald Eller. These stock sales range between $40-$42 and investors should be alerted whenever management sell their stake in the company. If the management was confident about Garmin's future, why would they sell their stake? (note: the high end of the DCF analysis also was in the range of $42/share)

Valuation

Although I have commented in my last article that a DCF analysis is fundamentally flawed, its implied upside can be seen as a reference to a company's intrinsic value.

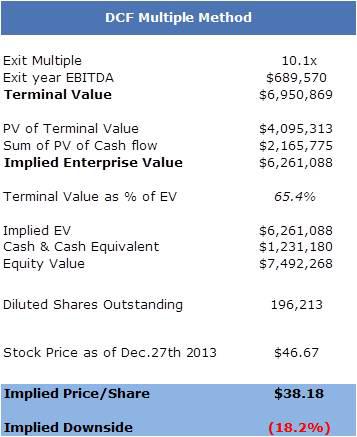

For the assumptions, I continued to decline the auto/mobile segment sales 15% consistently across the 5 years of projection period while growing the other segments at a range of 5-10%. I have also created a depreciation schedule and working capital schedule. Due to Garmin's clean balance sheet, a debt paydown schedule and Cost of Debt in the calculation of WACC were not included. It was very difficult to find information of the comparables for Garmin and I could not obtain any filing for MiTac as they are a major competitor with Garmin. As a result, I took the average of TomTom and Garmin's forward 1 year EV/EBITDA from Thomson One as my exit multiple. Although this method is unconventional, the figure itself it higher than Garmin's comparable average as listed in Thomson One. This would value Garmin higher than it should be and make my thesis more conservative.

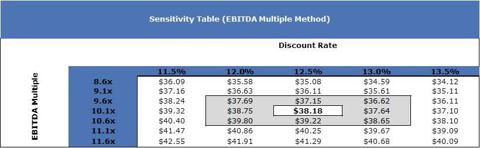

At the WACC of around 12.5% and exit multiple of 10.1X (premium to peers), Garmin is at an implied loss of 18.2%. If lower exit multiples had been used, Garmin's implied share price would have been even lower. With many challenges ahead of Garmin, I would suggest investors to be wary of Garmin's sustainable advantage in the high growth segments.

As the sensitivity table suggests, Garmin's implied share price ranges from $34.12 to $42.55. Even the highest valuation does not reach where the current stock price is trading at. This may imply that many investors and equity research analysts are overly optimistic about Garmin as they expect the best case scenario for the future.

Conclusion

Although Garmin has given investors a decent return for the past 6 months, I believe it is time to sell off your Garmin stocks as the company faces intense competition in its fastest growing segments in the future. The brand equity of Garmin simply does not rival the likes of Apple, Google, or Samsung and it will only limit Garmin to a very niche market of consumers (such as professional cyclists). The stock's current price is setting itself up for a bubble in the future: once Garmin stops beating wall street estimate due to stiff competition in the near future and investors wake up to their overly optimistic expectations, it may be too late to sell.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire