Advanced Micro Devices (AMD) has two major operating segments: GVS (graphics and visual solutions) and CS (computing solutions).

In this first article I would like to look at the developments within AMD's GVS segment that will shape AMD's 2014 in graphics. The main sources of revenue for AMD's GVS segment are consoles and GPUs. This article will focus entirely on these prospects, while the next article will focus on CS.

Out Going Consoles: One Last Ride Before Sunset

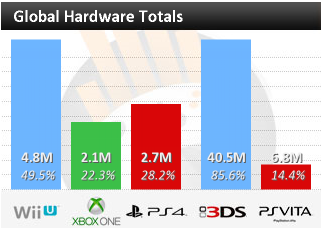

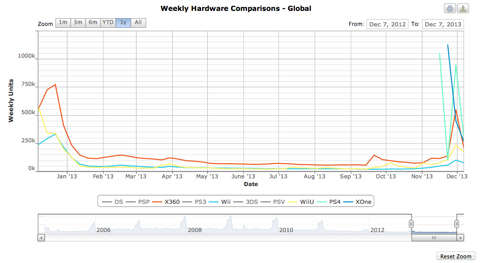

VGChartz uses a collection of data to model hardware sales over a given period of time. So although these numbers could be slightly off, they generally line up with trends in order to get somewhat of a guess as to what console sales are doing.

Looking at the sales data shows that the new consoles are indeed selling well, and that the old consoles have actually seen a little uptick throughout Q4.

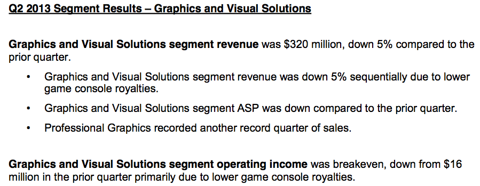

Q2 CFO commentary and the 10-Q reveal data about how much these small upticks and downticks could potentially affect incomes and revenue. Unlike the new consoles, old consoles (along with the Wii U) are royalty based, so although the revenues are low, the GM and associated operating margin are quite high.

From Q1 to Q2, AMD's GVS revenues fell $17M, with income falling $16M. However, Q1 of 2013 was stated to have had increased GVS revenues as the result of higher console royalties, which points to a 1 quarter delay from sales to realization of revenues and income.

If you visit VGChartz.com and view hardware sales over a longer period, you can see sales for all consoles declining from previous levels, and that the Wii U has not achieved the same success as its predecessor.

So based on this information, I expect to see a small bump in revenues and income realized specifically related to the Xbox 360 and Nintendo systems during Q1 of next year, with these contributions tapering off to something less relevant moving forward.

The next generation consoles will be holding the brunt of the bag moving forward.

Next Generation Consoles Contribute Meaningful Revenue and Income

Looking at official statements from Microsoft (MSFT) and Sony (SNE), along with more data from VGChartz, we can see that the next generation console sales have already outpaced forecasts. Note that the news articles linked to on TheVerge are from earlier in December, and the sales figures from VGChartz have not been updated since December 14th.

Demand for the consoles seems to be very strong, as it should be since this is the first major refresh (excluding the Wii U) in several years. The trick will be to ensure continued demand, with the evidence being if Microsoft and Sony can grow sales over the next couple years, given AMD's comments of console sales peaking during the third year.

Based on this data, console sales are likely to come in at 5.5M units or so during this quarter, representing a 25% increase over IHS estimates of ~4.4M, and consoles were on sale for only ~half a quarter.

Using console sales of ~5.5M units per quarter total, operating margins of 15%, and an ASP of $90 per APU, this would equate to ~$75M in income per quarter from consoles. This combined with tighter OPEX spending should aid AMD in stemming losses. Both consoles (PS4, XB1) have a strong list of titles in 2014 which should help maintain demand.

Given roughly 160M PS3s and Xbox 360s have shipped during the respective lifetimes, 5.5M is roughly in line with historic trends. The 5.5M historic trend is a product of growth during the first three years of introduction followed by a tapering to current levels, so it is feasible to see demand increasing during these first years after launch. AMD has also stated it should be possible to see a slight increase in margin as yields for consoles improve.

Competition For The Living Room

The biggest competition for the living room will be from Valve's SteamOS and Steam Machines arriving in 2014. I have pointed out previously that the Steam user base is larger than that of those subscribing to the Xbox Live service.

Looking at the benefits the Valve looks to bring over current generation consoles will give an idea to the appeal of the Steam Machine:

- Upgradeable hardware

- CHEAPER GAMES

- Bridge gap between mouse/keyboard controls and console controller

Steam Machines will be open hardware, meaning the designs are not locked and once the OS gets past beta stages, you can build a Steam Machine, buy one, or even create a separate partition on your PC to boot directly into Steam OS. And when your hardware gets outdated, you don't have to buy an entirely new console; simply upgrade whatever hardware will get you the performance you want.

Steam periodically has some pretty ridiculous sales online. Or when consumers buy discrete GPUs with coupons for free games they either do not want or already own, the consumer can simply sale the coupons via something like eBay.

Upgradeable hardware, cheaper games, and a larger availability of free-to-play titles on Steam (provided) will lower the cost of ownership for consumers, presenting a value over the current generation.

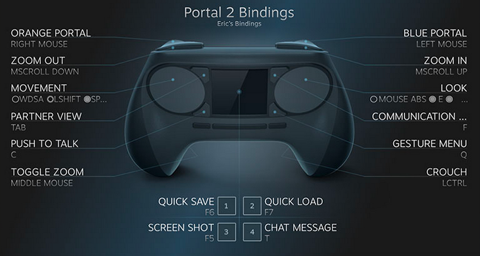

As you can see from photos and video demonstrations of Valve's new controller, the company has taken a radically new approach and went away from thumb sticks to what appear to function similar to two touch pads.

If Valve is able to pull together a viable free OS for gaming, a controller that offers a similar level of control to the combination of a mouse/keyboard, and gain developer support to create titles that will run natively on Linux, the Steam Machine could be a disruptive force in the gaming market.

I see two downsides for the Steam Machine.

First, it is essentially a PC being marketed as a console. The concept isn't that novel. The Steam gaming platform already runs in "big picture mode", which is a TV friendly way of looking at Steam. Consumers don't have to wait to buy a Steam Machine until 2014; they can build one now, with the only real extra cost being the requirement of a Windows license if they do not want to deal with the headaches of trying to get SteamOS up and running in a beta stage.

Second is that the open hardware design will make it more difficult to implement the same scale of low level optimizations we see in console games today. With one target platform, console games can be finely tweaked to ensure a smooth gameplay experience and a near perfect level of hardware utilization. One of the benefits to consoles are that programmers know the capability of the hardware through and through, and therefore can design games that utilize 100% of the hardware efficiently. Since the capabilities of Steam Machines will vary, it will be much harder to optimize to the same level.

Is The Steam Machine Bad for AMD?

Not necessarily. For those wanting to build a budget Steam Machine capable of playing light games at full HD, or running a good number of AAA titles at 720p, AMD's Kaveri will likely offer the best performance/dollar solution.

I am limiting the amount of detail regarding Kaveri in this article as it will be discussed in much more detail in a later article, but a quick discussion of integrated graphics performance is warranted.

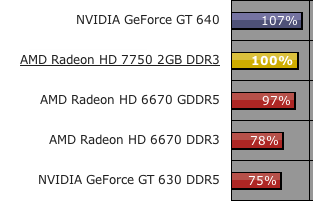

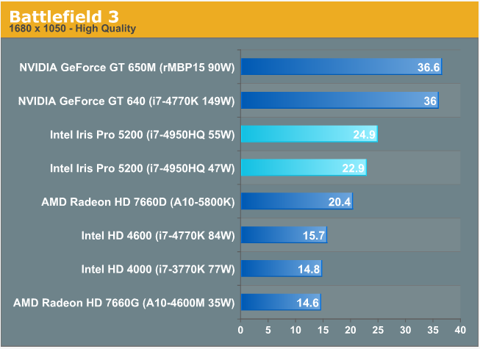

I believe the most apt representation of what is likely to be representative performance of Kaveri's iGPU is the HD 7750 DDR3 version. The HD 7750 DDR3 card features the same number of shaders (512), with a GPU clock 800 MHz.

Source: HT4U.net, TES Skyrim @ 1680x1050, 4xAA/16xAF

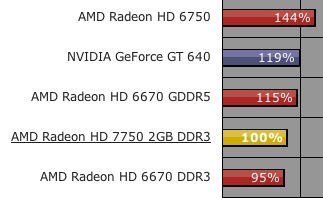

Source: HT4U.net, BF3 @ 1680x1050, 0xAA/16xAF

These benchmarks are at >720p resolutions, high levels of detail, and some post rendering effects, and the HD 7750 DDR3 card offers ~12% or so lower performance than the GT 640 from Nvidia. This video (starting at around the 2:30 mark) shows a Kaveri APU and Battlefield 4 demo in the opening hallway scene of the game running at 720p, high settings and 30 FPS.

Source: AnandTech

Looking through benchmarks on AnandTech, you can see that Anand consistently shows the GT 640 beating the Iris Pro iGPU. Note that BF3 is one of the largest performance deltas between Iris Pro and the GT 640, with other benchmarks showing a more narrow gap. But I have included this specifically as it provides a more direct comparison by using BF3 as a focal point for the data.

You can see based on the information above that Kaveri looks to provide most, if not all, of the performance of Intel's (INTC) most powerful integrated graphics solutions at likely a much lower price point. Rumors (via CPU-World) point to Intel including the large L4 graphics cache for all socketed "K" series Broadwell chips due out during 2H 2014, but this upgrade will likely serve only to keep Intel up to parity on iGPU performance with AMD on absolute performance, but still not price.

None of these benchmarks factor in the "Mantle" wildcard, which should give Kaveri a nice little performance boost by reducing CPU overhead, which would shift bottlenecks to AMD's GPU, as well as likely free up resources (bandwidth) for the GPU.

EA (EA)/Dice were supposed to release a Mantle Battlefield 4 patch this month, but given the problems Dice is currently working through with BF4, the patch may end up delayed until 2014. I bring this up because BF4 performance will likely be the first indication of performance advantages Mantle will offer AMD's GPUs. If the gain is substantial, then a Kaveri + Mantle solution becomes that much more potent.

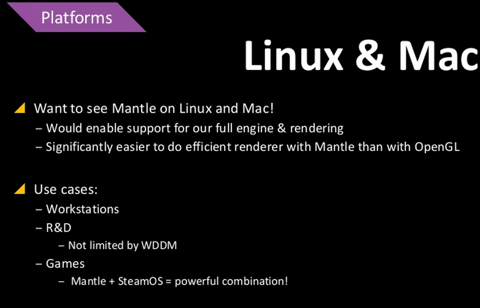

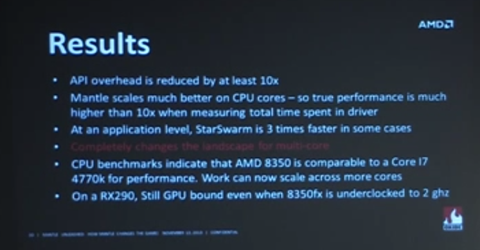

Source: SlideShare

Notice the bullet point about Mantle + SteamOS? Note, I think the context refers to more of a desire than a done deal, but if Valve gets on board with Mantle, this benefits developers, Valve, and of course AMD. Mantle would make it easier to port titles to SteamOS, helping to expand the game library. Developers would benefit by making more of their optimizations reusable.

And AMD would benefit from the increased performance on AMD's GPUs, which could lead to increased APU/GPU sales for the company.

One of the first advertised Steam Machines actually features both an AMD CPU and GPU. If Steam Machines catch, it isn't necessarily true that a Steam Machine sold eats into AMD's chip sales; it is dependent on the ratio to which Intel or Intel/Nvidia machines compare against AMD solutions.

So the Steam Machine isn't necessarily a detractive force on AMD's revenues. Kaveri should offer a very compelling solution for OEMs interested in providing a cost friendly "mini" Steam Machine capable of light gaming. Early leaks (I, II) suggest prices of around $175 or so for Kaveri, but I believe the price could end up coming in slightly lower. Note that the R9 290X leak prices were considerably higher than the price point of the cards when they physically launched.

Drumming Up Negative Sentiment Surrounding AMD GPUs

I think AMD's splash in the consumer GPU space is best seen by Nvidia's (NVDA) actions.

Prior to AMD launching the new Hawaii GPU, several tech sites featured articles regarding frame variance issues with multiple AMD GPUs being used at >1080p resolutions. Myself, and the site Legit Reviews, both noticed that Nvidia was pointing members to the press toward issues with AMD's GPUs. The thing that struck me was that the issues affect only a small percentage (a fraction of 1%) of AMD consumers.

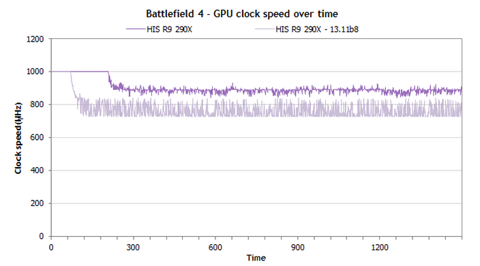

After the Hawaii GPU launched, Joel Hruska describes Nvidia's attack of the issues as "heavy handed"; once again Nvidia took to drumming up negative press regarding AMD's GPUs. Once other sites were starting to figure out that these issues were mainly a result of inadequate cooling, Nvidia refused to let the issue die by actually buying more retail samples for TechReport and having them do further testing.

I think the following quote from TechReport sums up the situation in a succinct fashion:

Thing is, small differences in performance can cost you a lot of money at the very top end of the graphics card market, with bragging rights on the line. The price difference between the Radeon R9 290 and 290X is $150, and the two were 3% apart in our overall performance assessment.

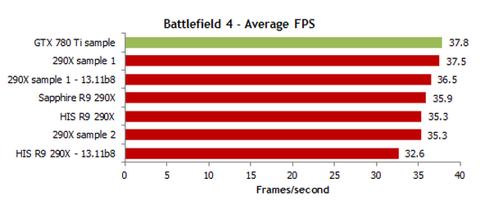

But since a picture is worth 1,000 words, rather than typing out a 2k word explanation, let me post a couple of benchmarks:

What you are looking at here is before and after results between the worst case scenario of the HIS 290X retail card. Once the BIOS was updated and new drivers used, you can see the performance delta narrowed substantially. By taking the steps recommended from AMD, the FPS delta is narrowed to ~2 FPS or less in this example.

I believe the numbers above can be parsed in a few different ways, depending on how whoever is typing wants to spin it:

- The most extreme performance variation between retail and press samples (after taking recommended steps by AMD) is 6%, or ~2 FPS at very high resolutions

- Reviews could focus on the most extreme case, prior to BIOS updates and updated drivers from AMD, and focus on the larger performance delta

- The R9 290 offers ~90% of the performance of a GTX 780 Ti at about 75% of the price.

For scenario 1, I will point out that in the reviews on TechReport, the variance between different AMD cards after updating the BIOS and drivers actually falls between the two sample cards.

Both the HIS and Sapphire retail cards actually perform better than one of the samples after the recommended steps are taken.

Scenario 2 is noise and FUD. This is what was first experienced when the negative reviews first started coming out.

Scenario 3 is why I feel we are seeing Nvidia push the negative issues regarding AMD's GPUs so hard. Prior to the boom in virtual currency mining (which has driven demand, along with price, of AMD GPUs higher), the R9 290 could be had for ~$400 -- $350 less than the GTX 780 Ti. This exerts some serious competition for Nvidia, and is stated as being the reason Nvidia was forced into price cuts.

The truth about AMD's retail cards is that the demand for the R9 290 and 290X was quite high before the litecoin mining boom. Since the 290X has launched, the card has had trouble staying in stock for any length of time, and this includes the time period before the value of LTC exploded. Although Zoolert does not track the 290, the R9 290 (based on personal observation) was also selling quite well.

The one common theme of negative sentiment surrounding AMD's new cards was the reference blower. Cards with aftermarket cooling solutions are now available for retail, and early reviews are glowing (source: AnandTech):

For $450 the card will consistently outperform the GTX 780 or outright tie the 290X in quiet mode, offering equal-to-better performance than those $500+ cards without the noise drawback that came with the reference 290, making it an even more practical replacement for those cards. Given that, Sapphire is essentially charging $50 for a better cooler, but as we've seen from our results they can easily justify it due to the fact that there isn't anything else on the market right now that can match both their performance and their acoustics at the same time.

A common theme by looking at various forums and reviews was that many were waiting for custom cooling solutions prior to making the jump to Hawaii. Reviews suggest that those that have waited won't be disappointed, and custom cooling solutions will help move these cards going into Q1, which could potentially offset seasonality in sales.

Nvidia Attempts To Create A Moat Around GPU Market Share With Proprietary Technologies

Other than the negative press, Nvidia is also releasing proprietary GPU technologies that will only benefit Nvidia cards; namely G Synch and GameWorks.

For more information on G Synch, read this article. I will say that this is one of the Nvidia initiatives I am paying attention to. It looks promising and could provide a moat for Nvidia if it catches.

GameWorks is more of a direct assault. GameWorks essentially provides "black box" libraries that will help developers, but also make it extremely difficult for AMD or Intel to optimize drivers to improve performance. For more information, read Joel's article. But let me draw attention to his conclusion:

In the long run, no one benefits from this kind of bifurcated market - especially not end users.

Titles that use GameWorks libraries will put AMD and Intel at a distinct disadvantage by preventing driver level optimizations after a game is launched.

Consumer GPU Conclusion

I bring this up because comments from AMD point to the fact that Hawaii was designed from the beginning with the idea of performance/dollar in mind. This was done in order to take marketshare from Nvidia. During the Raymond James Technology Conference, VP Mr. John Byrne stated that AMD believes the company will be "over half the market in the coming quarters."

In order to protect market share, I believe Nvidia is taking a two pronged approach as outlined above, in which the company is helping members of the press focus on negative aspects of AMD's cards, as well as releasing proprietary technologies such as G Synch and GameWorks that are designed to give a sole advantage to Nvidia's cards.

Mr. Byrne also stated during the tech conference that AMD's professional GPU market share is ~20%, and the TAM is ~$1B a year. Console royalties have also been quoted before as being around $30M/qtr.

Using this information to subtract out professional GPUs and console royalties, in the consumer space AMD likely generates around $250M or so per quarter from consumer class GPUs on 38% market share (using Q2 data from Jon Peddie Research). Assuming a linear relationship in revenue and market share (just to get a rough estimate), each 5% increase in consumer GPU market share could result in around ~$30M in added revenues.

AMD has the right products in place in order to gain market share, and initiatives like Mantle will further bolster the company's attempts.

AMD will also try to recapture some notebook market share by releasing new notebook GPUs. According to Videocardz.com, AMD will be releasing the "crystal series" notebook GPUs. These leaks align well with comments made during the Raymond James conference that AMD is preparing a notebook GPU line that will be ready for Broadwell and Kaveri notebooks next year. AMD has a much smaller market share in notebooks than Nvidia, so any traction here will be accretive to revenues and earnings. AMD ("enduro") and Nvidia ("optimus") both have similar technologies that are designed to extend battery life by switching between discreet or integrated graphics depending on graphics load, but Nvidia's technology typically receives better reviews. I am waiting to see if AMD is able to further polish this technology, which would be a plus in notebooks.

Note that Kaveri is slated to launch later during 1H 2014, and Broadwell appears to be pushed to late Q2/sometime Q3 retail availability(based on CEO comments of a 1 quarter delay). This is to say that "Crystal" notebook GPUs are probably more a story for Q2 or Q3.

Professional GPUs

There are several good nuggets of information in the Raymond James conference, one being that AMD will continue to focus on professional GPU market share.

Recent articles have suggested that AMD could have around 30% of the professional GPU market in 2014 (Source: DigiTimes).

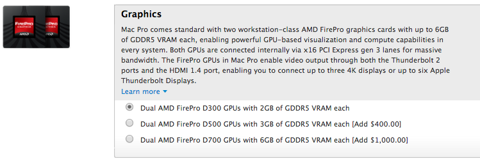

Put away the pitch forks and torches and let me explain. This 10% bump is roughly inline with my earlier estimates for Mac Pro sales if I adjust my estimated revenue per Mac Pro up slightly. I assumed a revenue of only $350 per Mac Pro in order to be conservative. This is less than one W5000's (should be roughly equivalent to the D300) retails price.

Source: Apple

Upgrading from the D300 to D500 GPUs will cost an extra $400, while the D700s will set you back an extra $1000. I personally feel that $500 per Mac Pro is completely in the realm of possibility, and may end up being too conservative. But using my earlier estimates for 40k units per quarter and $500 per Mac Pro, we arrive at $20M/qtr.

Based on the above estimate I laid out of AMD professional GPU revenues of approximately $50M/qtr, an extra $20M in incremental revenues represents a 40% increase in pro GPU revenue, which aligns well with an increase in market share from 20% to 30%. Note that all Mac Pro PCs sold out in haste, and new units will not be shipping until February, so it will be Q2 of next year (after the units have been on sale for a full quarter with good availability) before we can get a more accurate idea of demand and earnings potential.

The Intangible Benefits Of The Mac Pro

Many wondered why Apple (AAPL) chose AMD for the Mac Pro given Apple's ties to Nvidia in the rest of the product stack, and I believe the decision rests with AMD's OpenCL performance.

Many associate OpenCL with the Khronos Group, but Khronos Group actually licenses OpenCL from Apple.

"The OpenCL trademark and logo are trademarks owned solely and exclusively by Apple and have been licensed to the Khronos Group in connection with the development and implementation of the OpenCL standard."

While OpenCL itself is a royalty free, open programming initiative, the original specification was authored by Apple with input from various others including AMD, Intel, Nvidia, and Nokia (NOK), and use of the logo requires it to be licensed from Apple.

"Does your application use OpenCL to accelerate performance or have you created your own OpenCL implementation? Tell the world by using the OpenCL logo."

Make sure to give Apple some money while you're telling the world.

So why am I thumping on about OpenCL, AMD, and Apple? It's because AMD GPUs excel in OpenCL performance. When you think about the Mac Pro, think about professional users who use their computer to generate income, and whose time is money.

This blog post details the collaboration between Adobe and AMD in order to optimize Adobe software for OpenCL. And benchmarks of Quadro cards vs. AMD FirePro cards in photo and video applications using OpenCL acceleration show a very strong performance for AMD.

THG concludes their review of Quadro and GCN based FirePro cards with the following:

When we look at the market as a whole, AMD is much more competitive now than ever before, while Nvidia continues to optimize and polish its existing products. The race hasn't been this exciting in a long time. It remains to be seen if AMD can get its drivers certified for more applications. After all, the tremendous architecture that works so well for the company in the gaming space has a ton of potential in the workstation segment, too. Makes us wonder if an excellent software bundle might do wonders for its workstation line-up?

Essentially, Tom's points out that AMD's hardware has a ton of potential, but it is up to AMD to punch up driver support in the space. Going back to the technology conference quoted earlier, Mr. Byrne also states that AMD has been investing heavily in driver certifications.

EETimes has an interesting article based on an interview with Dr. Jon Peddie from JPR regarding the professional GPU market. Taking one quote from the article reveals an interesting upcoming tidbit of info:

"The range of software available for exploiting GPU compute using GPUs is increasing every week," he said. "AMD is going to make an announcement in January. Kronos has announced Open CL 2.0 which is very robust. Now it is possible to get parallel processing of Open CL in Open VX. The acceleration of this space is extraordinary. There are new announcements every week. It's happening by orders of magnitude."

Given that the theme of the EETimes article is the professional GPU market, my guess is that if an announcement is made in January, it will be something that further bolsters AMD's spot in the pro GPU space.

Taking these data points in aggregate, the Mac Pro win represents both an incremental revenue stream for AMD, as well as generating a halo effect by having software optimized for OpenCL (and thereby AMD) hardware. AMD is focusing on the professional GPU space as a growth market, and is making strategic moves toward being successful here. With the design win in the Mac Pro, AMD has managed to net a significant portion (~10%, give or take a few points) of the overall professional GPU market.

Conclusion

There are a lot of pieces to this puzzle. GVS revenues come from consoles, consumer GPUs, and professional GPUs.

Regarding consoles, the old consoles will go away soon, leaving AMD as the sole supplier of chips for the new generation. The new generation is selling well (already outpaced forecasts), and is currently on track for 5M+ units this quarter. This is with only being on sale for half the quarter. However, I am taking a shorter view on consoles and monitoring from quarter to quarter.

In the consumer space, AMD has had no trouble selling cards at the high end of the product stack, even before the increased demand from litecoins. The demand has somewhat disrupted the supply chain, and some retailers (or possibly AIB partners) have used this as an opportunity to price gouge consumers. Once demand has settled from cryptocurrency mining it will be easier to get an idea as to AMD's traction in the consumer space. My guess is we'll see AMD gain market share in the add-in-board market, but this is with the added benefit of LTC increasing demand.

Initiatives like Mantle will not only help GPU sales, but could filter down to CPU/APU sales as well, as Mantle shifts the bottleneck from the CPU to the GPU.

Source: YouTube

During the Oxide demo, the developers were able to underclock an FX 8350 to 2 GHz, and still have the GPU be the bottleneck. The FX 8350 was considered comparable to an i7-4770k with Mantle.

This is a result of reducing API overhead. I am personally not hanging too much on Mantle until I see real world demonstrations, the first of which should be from Dice after various problems with BF4 are ironed out.

In short, AMD's new cards have been selling well, and now cards with after market coolers seem to have put to rest earlier concerns. Mantle is a wildcard, and I'm using a "wait and see" approach. Mantle's success will depend on:

- How much traction it gains

- How useful it is in real world applications

In the professional space, the Mac Pro is a very nice design win that will not only drive revenue increase, but could also have the halo effects mentioned above. And as more software effectively utilizes OpenCL acceleration, this will serve to deemphasize the importance of the CPU and accentuate the GPU. AMD has very good OpenCL performance, and is spending the capital to better driver support in this space.

The net effect of all these positives in GVS will be to increase GVS revenues, offsetting potential decreases in CS. And with the consoles contributing nearly $400M in revenues this quarter, if this pace can be maintained going forward, GVS revenues are likely to approach those of CS revenues.

With console chip sales hitting the books during Q3, AMD generated $671M revenues and $79M in operating income. Using a range of 30-40% GM in the GVS segment, this implies a total OPEX for GVS of ~$130M to $195M, or about 1/3 of the total OPEX.

Similar calculations for CS point to an OPEX of ~$215M to $300M, or about 2/3 of the OPEX budget.

But what is easily verifiable is that AMD's GVS segment, thanks to consoles, generated a substantially higher income than CS, and this was on ~17% lower revenues for GVS.

This continued strength for GVS will further lessen AMD's dependence on CPUs and APUs.

Disclosure: I am long AMD, INTC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I actively trade my AMD position, and own both shares and options. I may add/liquidate shares/options at anytime, or initiate a small hedge via puts in AMD at anytime.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire