MV Oil Trust (MVO), as its name suggests, is an oil-heavy, oil and gas trust that "was created to acquire and hold a term net profits interest [in]... approximately 994 producing oil and gas wells... in the states of Kansas and Colorado." (Source:MVO 10-Q 11/10/08, p4.) MVO has recently developed a cult following and its share price has taken a wild ride, spiking as high as $32.60 in July before dropping off 30% in the second half of this year.

While MVO's robust distribution and price momentum attract my attention as a possible value play, a deeper review reveals a big warning sign: the term of MVO's net profits interest is likely to end in 2026. With this termination in mind, I applied an engineering-style model to forecast MVO's future distributions based on individualized forecasts of production, prices, and expenses and the results suggest that investors should show extreme caution if considering MVO at current prices. This article discusses the assumptions and results of the model.

A General Model Used to Value Trusts

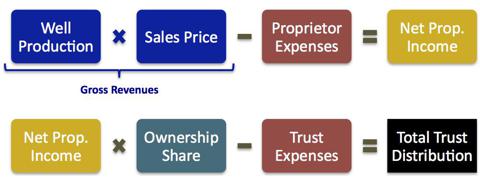

An oil and gas trust is a type of commodity investment in which investors receive periodic royalty payments from the sale of oil and gas from a set of underlying properties. For investors, the value of a trust is the net present value, or NPV, of its future royalty payments. Although each trust has a unique process for determining its distribution, most resemble the generalized model shown below; the total distribution for a period is the gross revenues from the sale of oil and gas, less production-related expenses incurred by the proprietor, times the share of income owned by the trust, less the trust's own administrative expenses.

Of course, the devil is in its details. Future distributions are subject to uncertainties in well production, sales prices, and expenses, as well as unforeseen events. In addition, well proprietors and trust administrators may use various accounting and contractual techniques to manipulate net income and, indirectly, their distributions (see "Tricks that Inflate the Value of Oil and Gas Trusts"). While these techniques are legal and often spelled out in a trust's SEC filings, they can mislead investors. I recommend that all trust investors become very familiar with these techniques.

The rest of this article discusses my assumptions regarding forecast revenues, expenses, and other underlying circumstances for MVO.

MVO: Key Model Assumptions and Considerations

Total well production will exhibit a gradual, sustained decline

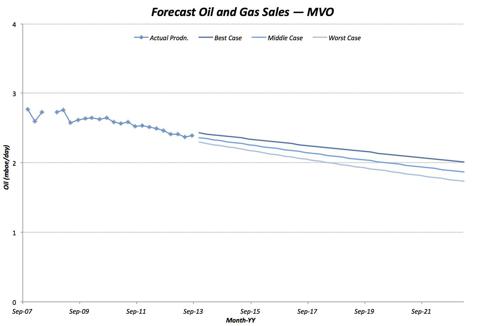

As of Dec. 31, 2012, MVO's net profits interest applied to just over 900 net, producing wells that are operated by MV Partners, LLC, a joint venture between Vess Oil Corporation and Murfin Drilling Company, Inc. Since the inception of the trust in 2007, the number of producing wells has remained nearly unchanged and total well production has exhibited a consistent annual decline of around 2.5%/year, which is better than most trusts that I have reviewed.

Moving forward, production may increase or decrease based on natural production declines and MV Partner's decisions to shut-in/reopen old wells or add new ones. Regardless of these decisions, MVO is likely to dissolve on June 30, 2026, at which point the net profits interest will revert to MV Partners (additional notes on dissolution provided below).

The model considers three possible forecasts of future production, each of which assumes a different decline rate but with little or no change to the number of producing wells. The middle forecast assumes that total production will decline at the current rate of 2.5%, while the best and worst cases assume 2% and 3%, respectively. Historical and future forecast production is shown in the following chart.

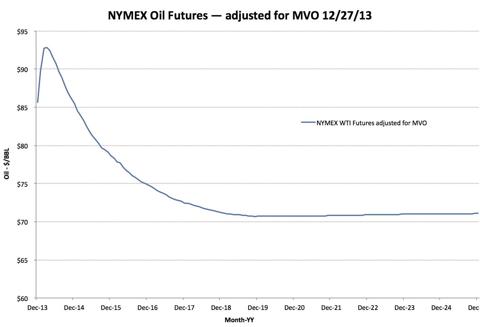

Production will continue to be sold at a discount to WTI futures

Over the past year, MVO's production has been sold at prices that have averaged $7.42/boe less than the WTI closing end-of-month spot price. The model assumes that future production will be sold at the values given by NYMEX WTI/Light Sweet Crude futures, adjusted for this spread. These prices are shown in the following chart.

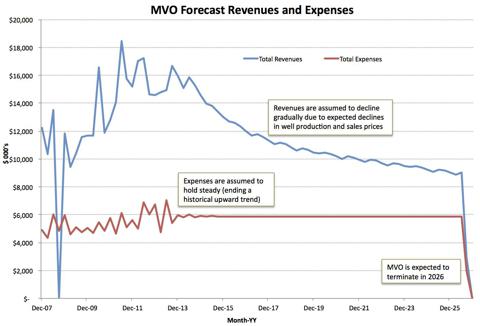

Proprietor and trust expenses will hold steady over time

MV Partners deducts a single quarterly charge from trust revenues that includes development and production costs, taxes, and various service fees paid to Vess and Murfin. Although MV does not provide a consistent detailed breakout of these costs, some, such as production and taxes, may decrease over time, while others, such as the service fees, are likely to increase. The model assumes that the future aggregate cost will be the rolling average of the preceding 4 quarters.

MVO trust management also deducts a single charge related to trust management expenses. This charge varies from a high of $500k (Q4 2008) to a low of $0 (Q3 2008), averages $216k, and exhibits no discernible trend to increase or decrease over time. The model assumes that this charge will continue as the historical average until the trust terminates. The chart below shows total historical and forecast revenues and expenses attributable to the trust.

MVO will terminate on June 30, 2026 with $0 residual value

At first glance, some readers may find this assumption to be the most controversial in this analysis. However, the language is pretty clear on the issue, so I'd suggest that those who wish to object first consider what is written in MVO's trust documents. (I don't like it either, but that doesn't make it untrue.)

Per MVO's 2012 annual report:

The net profits interest entitles the trust to receive 80% of the net proceeds attributable to MV Partners' interest from the sale of production from the underlying properties. The net profits interest will terminate [emphasis added] on the later to occur of (1) June 30, 2026, or (2) the time when 14.4 MMBoe have been produced from the underlying properties and sold, and the trust will soon thereafter wind up its affairs and terminate.

Source: MVO's 2012 Q4 10-K (dated 3/15/13), page 16

While I am not a lawyer and do not have any training in contract law or interpretation, the language above seems to pretty clearly spell out the conditions under which the trust will terminate.

Noting these conditions and given total well production to date, current production rates, and forecast production declines, the model anticipates that total production will exceed 14.4 mboe some time during 2023, which would result in the trust terminating on June 30, 2026. The 2026 termination of MVO is further supported by the 2012 annual report. The paragraph cited immediately above continues….

"Based on the reserve report [produced in February 2013 by Cawley, Gillespie & Associates, Inc. (CG&A), an engineering firm hired by MVO], CG&A estimated that the trust would terminate June 30, 2026 based on the calculation that 14.4 MMBoe would have been produced from the underlying properties and sold… prior to this date."

As MVO's net profits interest also terminates, its residual value will be limited to just the petty cash that the trust has in its account, effectively $0. The only way for the trust's net profits interest and value to extend after June 30, 2026 would be if well production were to experience significant production declines, which would lower, not raise the value of a share of MVO today.

MVO: Overvalued by 60%

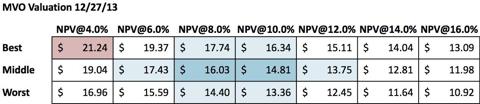

Shown below are the NPV of future distributions for the best, middle, and worst cases and for various rates of return, as calculated by the model on 12/27/13.

Model results support a $15-16 valuation

As the table suggests, MVO's fair valuation, which assumes the middle case and an 8-10% ROI, is between $14.81 and $16.03 per share. The current market price ($23.83, as I write this) overvalues MVO by 60%. Even considering reasonable upside potential, the model yields a value of no greater than $17.74, or 25.6% less than today's market price.

The difference between MVO's current market-based value and that suggested by the analysis is greater than that of any other trust that I have reviewed. This fact alone suggests that the analysis of MVO should be viewed with an especially critical eye. However, when considered in context, the results are reasonable.

MVO's reserve estimates support a $16 valuation

MVO's last reserve report, dated December 2012, estimates the NPV-10 of future production attributable to the trust as $218M, or $18.96/share. Since that report, MVO has released $2.54/share in distributions, resulting in a remaining valuation between $16 and $17/share. (For various reasons, I believe that the reserve report overstates expected value; regardless, the market's value is still significantly higher.)

The reserve report is available as an appendix to the 2012 Q4 10-K. For full disclosure, it is worth noting that CG&A estimates that the Dec. 2012 NPV-10 might be as high as $21.95/share, if MV Partners fully develop the underlying properties (which they have not done). That's still $2.54 in distributions ago and 10% under today's market price.

Current market prices would be appropriate for a perpetual trust

To test the sensitivity of the model to alternate assumptions, I removed the assumption that MVO will terminate in 2026 and reran the model. (In this way, the trust is assumed to be perpetual.) The resulting valuation for MVO is roughly $23/share, which is consistent with the current market price. This suggests that the current market valuation may not have considered the termination of MVO in its valuation.

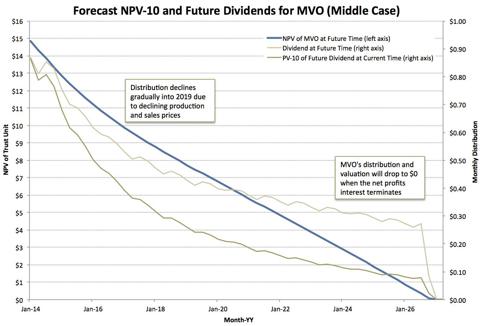

MVO distributions will gradually reduce until termination

Over time, the fair value of MVO will decrease as distributions are made. The following chart illustrates the forecast of future distributions and the future fair share valuation.

As shown, MVO's distribution is forecast to decrease over time. However, the decline is slow; the distribution will still be $0.50/qtr in 2018. This distribution stream would make MVO a good candidate if the trust were perpetual.

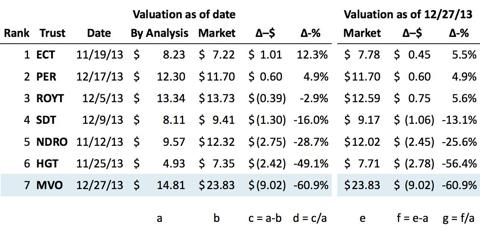

MVO's value is very unfavorable as compared to other trusts

MVO is the seventh trust that has been evaluated by the model. Others include:

- Enduro Royalty Trust (NDRO) (Forecast as of 11/12/13)

- ECA Marcellus Trust I (ECT) (Forecast as of 11/19/13)

- Hugoton Royalty Trust (HGT) (Forecast as of 11/25/13)

- Pacific Coast Oil Trust (ROYT) (Forecast as of 12/5/13)

- SandRidge Mississippian Trust I (SDT) (Forecast as of 12/9/13)

- SandRidge Permian Trust (PER) (Forecast as of 12/17/13)

The table below shows a ranking of trusts based on the difference between the model NPV and the market price at the time of evaluation. For MVO, the difference is -60.9%; which ranks it seventh.

Given the results of the model, MVO's own reserve reports, and the comparison to other trust analyses, I would suggest that investors exercise extreme caution with MVO.

Disclosure: I am long PER, ECT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire