There's been a tremendous amount of debate regarding Unilife (UNIS) on Seeking Alpha in recent weeks between the longs and the shorts. In a snapshot, the value proposition for each side is as follows:

- Long: Unilife has built an impressive portfolio of injectable drug delivery systems and are now starting to deliver on their potential having signed a series of major deals with leading pharmaceutical companies over recent months that include upfront and recurring revenue. This rapid growth trend is set to continue through 2014 and beyond as a steady progression of additional deals are signed, paving the way for a significant upward trend for the stock.

- Short: Unilife has less than one quarter of cash. There is no outlook as to when the company will become profitable. A significant secondary offering is required for the company to continue that will cause significant dilution to existing shareholders and create a strong downward trend for the stock.

On the surface, both sides of the discussion have some degree of accuracy and relevance. However when it comes to shorting UNIS, it is apparent that there are some serious investment risks that may not be apparent without conducting proper research into the business of Unilife, how its share register is structured, and non-dilutive financing options that are available to it. This article consists of a series of researched facts and educated conclusions that together serve to highlight the apparent risks of shorting UNIS at this time. In short, a decision to short Unilife at this time could be a very bad idea for the following reasons.

- Rather than running out of cash, Unilife is prudently managing its cash position to minimize dilution

- Unilife has flexibility to strengthen its cash position without causing significant dilution

- Only half of Unilife's register is held in the U.S., making it harder to readily access shares to cover

- The Unilife short position as a percentage of total U.S. registered stock is nearing dangerous levels

- A short squeeze event could be triggered at any time for multiple reasons

Unilife is prudently managing its cash position to minimize shareholder dilution.

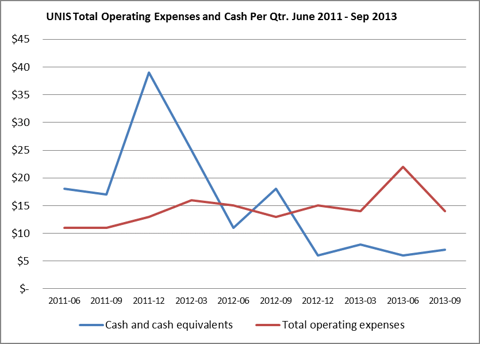

UNIS has a proven track record of raising capital at terms management has considered appropriate. Since listing on NASDAQ in 2010, UNIS has completed a handful of secondary offerings with investment banks including Jefferies and Leerink Swann. It's also utilized an At-The-Market (ATM) facility with Cantor Fitzgerald periodically during the last 12 months to raise approximately $25 million. In its last reported quarter for September 2013, Unilife had $9.4 million in cash and cash equivalents. This cash position per quarter has been fairly consistent for the last year (which also coincides with the period in which the short position doubled). This compares to previous years where the cash position per quarter was consistently much higher. A key red flag for investors seeking to short Unilife is that during the last 12 months, total operating expenses have been averaging around $15 million per quarter - more than double the cash position per quarter. In the Q1 2014 earnings call held on Nov. 11, 2013, Unilife CEO responded to a question regarding why the company had allowed its cash position to run so low:

The only reason we would do it and not have gone out….and (done) a secondary offering either on the back of a Sanofi deal or on the back of a MedImmune deal would be simply because of the confidence of the deals that are in process, that we know are going to happen, and that are going to deliver upfront funding. I'm making it categorical, we have no intention of doing a secondary offering…..we may tip the ATM a little bit here and there as we're getting the deals in place. However I don't even have an expectation of even doing that. But it is a nice back up to have so that we're not imprudent. We are sitting literally with aces in our hand and we're going to be generating money upfront.

Since that time, Unilife has announced three additional deals with pharmaceutical companies including Novartis and Hikma that have upfront, recurring payments. Despite these announcements driving the share price from $2.87 on Nov. 11 to a two year high of $5.10, the company held to its word and undertook no secondary offering or used its ATM facility. We know this because in Australia, where the about half of the company's shares trade on the ASX, they would be required to disclose any draw downs on the ATM facility within days.

Given the caliber of the institutional investors on the Unilife register and the increased price targets issued by most analysts, it is easy to speculate that there would have been strong demand for any secondary offering during November and December 2013. The company elected not to do so. However, I believe that the decision by Unilife not to utilize the ATM in particular represents a bullish signal from the company regarding near-term catalysts that can create positive shareholder value. With Unilife management continuing to reiterate its commitment to minimizing shareholder dilution as its heads into 2014, it becomes evident that the central tenant of the short argument appears seriously flawed.

Unilife has flexibility to strengthen its cash position without causing significant dilution.

Unilife has stated on several recent earnings calls that it has multiple options to strengthen its cash position without causing significant dilution to existing holders. The first and most obvious way is to generate cash from customers. Since its last earnings call, Unilife has stated that it has received (but not recognized) the first $5 million payment from its commercial supply contract with Sanofi. Unilife should also by now have received a $5 million payment from Hikma relating to another commercial supply contract. In addition, undisclosed payments are expected to now be coming in from other pharmaceutical companies including Novartis and MedImmune. With additional cash payments expected from these and other deals that are expected to be signed in early 2014, it is apparent that the company should have sufficient cash to support its operating activities.

A statement made by Mr. Shortall at its Annual General Meeting in December 2013 supports this position:

Given what we have today, we could cut back our investment in R&D and say: "You know what? We've got enough products. We don't need any more. Let's cut back on our R&D" and we'd have a very profitable business on what we have now.

Regardless of these accelerating revenue streams from new customers, it makes strategic sense for the company to further strengthen its cash position. It should make Unilife even more attractive as a viable business partner to pharmaceutical companies. It should also remove arguably the last question mark hanging over the Company today (the low cash position), opening the floodgates to institutional accumulation and reducing the short interest position.

In its Q4 2013 Earnings Call held in September 2013, Mr. Shortall stated:

We are in the process of finalizing the terms we received for a large non-equity based debt financing. I expect this debt financing can be completed shortly if we consider it to be in the best interests of our shareholders. Together with upfront payments from our new customers and ongoing payments from current and upcoming contracts, I expect such a debt financing would allow us to sustain the company through to cash flow positive. So, it goes without saying that we expect this can eliminate or at the very least minimize the need for any significant equity offering before reaching cash flow breakeven.

While nothing further has been stated to my knowledge by Unilife management since September 2013, it is intriguing to note a comment in the latest Jefferies update that was issued on Dec. 17, 2013 off the back of a non-deal roadshow:

Balance sheet secure near-term. Initial cash receipts from known deals include estimated $25mm in upfront payments from Hikma Pharmaceuticals (HIK LN, 1,184p, Buy) and $15mm from Sanofi (SAN FP, €72.38, Buy) over the next several Qs. Beyond this, Hikma will make additional milestone payments under its $40mn commitment. Other initial upfront and milestone payments are coming from pharmaceutical deals that have recently closed (Novartis and AstraZeneca-MedImmune) along with others that are expected in 2014. Among these, milestone payments on wearable injector deals will be sizable considering terms and size of the overall opportunity. Development payments could be in the range of $5mm per year for each molecule through what is expected to be a 2-3 year customization cycle per drug. Should these milestone payments be delayed, the company can supplement its cash needs through its debt facilities, which provide up to $40mm in financing in two tranches.

Should this be the case and Unilife secures a debt funding arrangement in 2014, then it is entirely possible that the combination of this and revenue from current and future customers will mean the Company will never need to go back to the market to raise capital ever again. I believe that debt funding alone, regardless of future contracts signed with other pharmaceutical companies, could be sufficient to trigger a short squeeze situation. Now, with that in mind...

Only half of Unilife's register is held in the U.S., making it harder to readily access shares to cover.

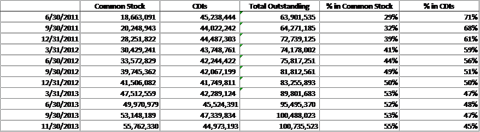

It would be very easy for an investor not to notice the fact that much of Unilife's shares don't trade in the U.S. Unilife originated in Australia, and only relocated itself to the U.S. and made NASDAQ its primary exchange in 2010. Shares however continue to trade on the Australian Stock Exchange under what is known as CDIs (the equivalent of ADRs) with six CDIs representing one share of common stock. As of the latest reporting in November 2013, only 55 million (55%) of Unilife's 100 million shares on issue are registered in the U.S. The other 45 million is held in Australia. While there is a process to convert shares between CDIs and common stock, the process of conversion can take several days. For an investor seeking to cover a short position at some future time when the price is on the run, several days might as well be an eternity. Therefore, it is best to review the Unilife short interest position using U.S. registered shares only.

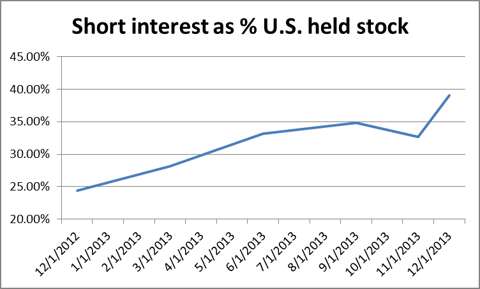

The Unilife short position as a percentage of total U.S. registered stock is nearing dangerous levels.

Against all 100 million registered shares of Unilife stock, a 22 million short position would be considered above average but still not potentially dangerous. However when comparing the current short position against only U.S. registered stock, the potential exposure to risk increases significantly. When looking at U.S. registered stock only, the current short interest position now represents four in every 10 shares. If insiders and long-term institutional holders that do not lend their shares out for shorting purposes were also removed from the equation, the actual short interest position is likely to represent the majority of all U.S. held shares. With so many potential near term events that can serve as a positive price catalyst, this short position as a percentage of U.S. held stock a dangerously high level of exposure. When the current price to borrow shares for shorting purposes is currently at around 16% (a very high number), it is safe to suggest that there are many safer targets for investors seeking to short a stock than Unilife is at present.

A short squeeze event could be triggered at any time for multiple reasons.

In speaking with many peers and reading other Seeking Alpha articles it appears that the majority of shorts, if not all, are currently underwater. Many suspect that there is currently a coordinated effort by the short community to short the stock. One could speculate that the recent increase in the short position to 22 million shares is the shorts doubling down in desperation. Looking back to 2012, the stock met resistance at $5. It again met resistance a few weeks ago at $5. It can therefore be argued that any price movement that brings the Unilife share price beyond $5 will see the shorts start to cover. I believe there are several factors that could result in the share price exceeding $5 in the near future:

- Deals: Unilife management has indicated there is a "tsunami" of deals coming. That may not be necessary. Even one to two significant new contracts with well-known pharmaceutical companies including upfront revenues have the potential to see demand for Unilife pass $5.00 per share.

- Debt funding: Should Unilife complete a debt funding facility that solidifies the cash position of the Company for the foreseeable future and eliminates the potential threat of dilution, the final question mark hanging over Unilife is removed and institutional interest in the company may accelerate rapidly enough to bring the price near or above $5.00 per share.

- The New Year Itself: The start of a new trading year in itself may represent a trigger for positive price movement with Unilife. Institutional interest in healthcare and biotech stocks is likely to begin afresh after a tremendous 2013. With Unilife sitting between a typical medical device company and a biotech, there are many healthcare-focused institutional investors currently absent from the Unilife register that may seek to initiate a formidable position. The positive analyst report arising from the recent non-deal roadshow by Jefferies may be a signal of upcoming institutional demand for Unilife.

Given the current situation of pending deals and non-dilutive financing options, it may already be too late for those who have already initiated a short position and are now underwater. Perhaps the best they can hope for is to hang on until the end of calendar year 2013. But for those investors who like to have a short or two in their portfolio, Unilife represents an extremely unattractive proposition at this time.

Disclosure: I am long UNIS. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

Aucun commentaire:

Enregistrer un commentaire