It was a big day recently for footwear retailer Crocs (CROX). The company announced a financial partnership with Blackstone that will involve $200 million of preferred shares. According to the press release, this cash infusion will allow Crocs to buy back a significant amount of stock going forward, which normally looks good for any company. However, Crocs made a number of other announcements that may have been missed, which don't tell the whole story with this struggling retailer. Today, I'll detail why the latest deal for Crocs may seem good at first glance, but not when you drill it down. The devil is truly in the details.

Specifics of the deal:

An investment fund affiliated with Blackstone will purchase $200 million in newly issued series A preferred stock. Additional details below are taken right from the press release:

The Preferred Stock will have a 6.0% cash dividend rate and is convertible into shares of common stock at a conversion price of $14.50 per share. This conversion price represents a 9% premium to the closing price of $13.33 per share on December 27, 2013, and a 10% premium to the 30-day average closing price of $13.19 per share. On an as-converted basis, the Preferred Stock will represent 13.8 million common shares, or approximately 13% of the fully-diluted common shares outstanding after giving effect to the issuance.

At any time after three years from the issuance date, if the closing price of Crocs common stock equals or exceeds $29.00 (i.e., 200% of the conversion price) for a period of 20 consecutive trading days, then the shares of Preferred Stock will, upon notice from Crocs, convert into shares of common stock. At any time after eight years from the issuance date, Crocs will have the right to redeem, and the holders of the Preferred Stock will have the right to require Crocs to repurchase, all or any portion of the Preferred Stock at 100% of the stated value plus any accrued but unpaid dividends.

Investors cheered this deal tremendously, sending Crocs shares higher by $2.81 on Monday, or 21.08% to $16.14. This put Crocs shares at their highest point since July, and up about 35% from the 52-week low reached roughly two months ago. The number of shares traded on Monday was the most for any single day in more than two years.

Helping the share count?

Management came right out in the press release and said that it has revised its capital structure to accommodate a $350 million stock repurchase plan. This plan will include the net proceeds of approximately $180 million from the deal. Management believes that this repurchase plan will help to reduce the company's float by 30% (based on Friday's close I believe). Now, Crocs did have a repurchase plan in place. At the end of the third quarter, a little under 18 million shares were to be repurchased on the plan, as per page 15 of the 10-Q. Crocs has now switched to a dollar amount of shares instead of a share amount. Crocs also said in the press release that it has been unable to repurchase shares while negotiating this deal. The company expects to be able to repurchase shares in the first quarter of 2014.

This deal will certainly help the share count in the short term. However, since this is a deal for convertible shares, investors must realize that the conversion of those preferred shares could reverse some of the progress from the buyback. There are a few important points to remember here. First, most companies pay executives with stock options (part of their compensation or sometimes all of it). These options dilute shareholders, but they are offset by the buyback. So if a company is buying back X amount of shares over a few years, it may not get the share count down by X, due to the dilution from the options. Secondly, Crocs' buyback depends on share price. At Friday's close, $350 million in shares was equal to 26.16 million shares. That's where the company got the 30% number for the float, which Yahoo! Finance has at about 87 million shares. However, at Monday's close, thanks to the rally in the stock, $350 million would just get the company 21.69 million shares. Should shares get up to $20 a share, Crocs would be down to 17.5 million shares. Conversely, if Crocs shares were to fall to $10, the company could buy back 35 million shares. The power of this buyback will be determined by the average share price, which is anyone's guess right now. Monday's rally did not help in that respect, so new investors looking at Crocs now must keep that in mind.

The company stated that the conversion price for the preferred shares was $14.50, which means 13.8 million shares of common equity if converted. It will be a couple of years before those shares could be converted, but depending on the buyback and share price, a conversion of these shares could cancel out some or most of the buyback!

The biggest problem of all!

A couple of months ago, I last reported on Crocs when discussing the potential for the company to be bought out. While I stated the buyout potential gave enormous upside to shares, I argued at that time that a deal did not make sense. This cash infusion via preferred shares would seem to back up the notion that a buyout is not coming. One of the reasons I said that Crocs was not a great buyout candidate is that the company was struggling with revenue growth. A look at Crocs' recent earnings history shows a couple of revenue misses and some terrible quarterly revenue guidance. Crocs was expected to have a pretty strong 2013 earlier this year. There was a lot of hope, and I even discussed the potential in shares if Crocs did well. Back in June, analysts were looking for more than 11% revenue growth this year and earnings per share of $1.42.

Well, after the last couple of poor quarters, analysts do not see as bright a future for this company. Current estimates call for 2013 revenue growth of just 5.6%, basically half of what analysts were looking for about six months ago. The average earnings per share estimate is $0.82, compared to a $1.40 in the year ago period. These are non-GAAP earnings numbers, which take out certain one-time expenses, like the company's new ERP system.

So why do I make such a big deal about revenues and poor results? Well, the company provided this gem of a statement in the press release for the preferred shares:

"As we look forward, 2014 will be a significant transition period for the company. We will recruit a new CEO who will work with the reconstituted board to refine our short-term and long-term strategic plans, which will include a sharper focus on earnings growth with less emphasis on top-line growth."

So basically, the company is not going to focus on revenue growth, and it is a retailer! A company in a sales industry that's not going after sales does not make sense. The biggest problem for this company is revenue growth. Remember a few years ago when this company almost went out of business? The company had a fad product, open holed shoes. Crocs has diversified its product lines since then, but as I showed above, revenue growth is struggling. Sure, the buyback will reduce the share count and that will help earnings per share. However, the buyback will have no impact on revenues, no impact on net income, and that is something to realize. Additionally, the company will be paying $12 million a year in cash dividends on those preferred shares. I'll compare Crocs against some other names later in this article.

4th Quarter guidance:

This part may have been lost in the long press release for the deal, but Crocs did update its fourth quarter guidance:

Crocs also updated its fourth quarter 2013 outlook and currently expects revenue to be at the low end of the previously provided guidance range of $220 million and $225 million, and diluted loss per share to be at the low end (meaning the higher loss) of the previously provided guidance range of ($0.20) and ($0.23). Excluded from this outlook are all costs and expenses associated with the Blackstone transaction, the tax expense associated with the repatriation of excess foreign cash, charges associated with separation agreements, retail store impairments, other asset impairments and legal reserves. We expect these aggregate charges in the fourth quarter to be in a range of $47 million to $52 million, which is an additional loss per diluted share of $0.45 to $0.50. The cash portion of the aggregate charges in the fourth quarter is estimated to be in a range of $20 million to $25 million. While not currently estimable, we expect additional restructuring charges may be necessary in 2014 as we refine our strategic plan.

So revenues are going to disappoint again. Analysts were already expecting a 1.2% decline in Q4 revenues to $222.25 million. It looks like Crocs will come in around that or perhaps even a bit lower. Analysts were looking for a $0.20 loss, so Crocs will also come in at that or a bit lower. Crocs did not provide Q1 guidance at this report, so we'll have to wait until the official Q4 earnings report, unless Crocs announces guidance before then. However, with analysts expecting a higher revenue growth rate (6.2% in 2014 above 5.6% in 2013), I expect estimates will be coming down, and Crocs could easily warn again. Remember, this company is NOT going to primarily focus on revenue growth in 2014. Additionally, weak sales through the back half of 2013 will leave the company with excess inventory. That will probably force the company to sell some items at a discount, which will pressure margins and earnings into 2014.

But there is one more part of that guidance I want to focus on. Crocs will take a cash charge in the range of $20 million to $25 million, and the company will be repatriating cash. Normally, companies do not repatriate foreign funds because they carry a heavy tax bill. The following statement is one I included in my buyout potential article about Crocs' cash situation.

As of September 30, 2013, we held $323.6 million of our total $332.5 million in cash in international locations. This cash is primarily used for the ongoing operations of the business in the locations in which the cash is held. Of the $323.6 million, $72.3 million could potentially be restricted, as described above. If the remaining $251.3 million were to be immediately repatriated to the U.S., we would be required to pay approximately $53.4 million in taxes that were not previously provided for in our consolidated statement of operations.

Because Crocs has limited cash resources in the US, it has to bring funds back into the US, and thus pay a tax. The preferred shares deal will give Crocs a lot more financial flexibility, but that cash is going directly to buying back shares! I would have been much happier if the company had used the money to expand its product line, perhaps with an acquisition. Sure, the buyback will help the earnings per share number look good, but so what if the rest of the company looks terrible?

CEO Departure:

Perhaps another lost item in this whole deal was that Crocs announced that CEO John McCarvel was retiring as president, board member, and CEO, on or about April 30th, 2014. Mr. McCarvel has been with Crocs for the past decade and has led since 2010. The board has already begun an outside search for a new CEO.

So, wait a minute. Not only did Crocs warn for Q4, meaning revenues and earnings will disappoint again. Not only is the company going to lower its focus on top line revenue growth for 2014. Now, the company will be going through a transitional period to find a new leader. It's hard to recommend an investment when the company is not focusing on revenues, only cares about buying back stock, and will be in the midst of a large executive transition.

A comparison of names in this space:

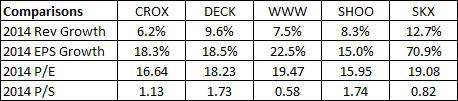

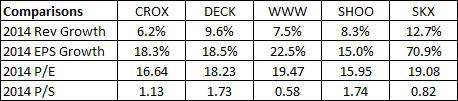

When I last compared Crocs to others in the space, I used the following names as comps: Deckers Outdoor (DECK), Wolverine World Wide (WWW), Steven Madden (SHOO), and Skechers (SKX). The following table shows a comparison of these names for 2014 in both of growth estimates (from analysts) and valuations. These numbers are as of Monday's close for valuations and estimates. So should analysts take down their revenue numbers for Crocs (and raise EPS numbers), it will not be reflected in the table.

As you can see, Crocs is projected for the least amount of revenue growth in 2014. This follows a poor 2013, where Crocs is also projected to show the least amount of revenue growth. Crocs, as I mentioned above, is also expected to show a huge earnings drop in 2013, but let's put the past behind us for now. In 2014, Crocs is expected to show the 4th most earnings per share growth at present. The buyback will probably get that number to 3rd or 2nd place, but that assumes that results come in as expected.

On paper, Crocs does appear to trade at a discount to the other four names. The average P/E and P/S values for the other four companies are 18.18 and 1.22, respectively. However, Crocs is giving you the least amount of revenue growth. Additionally, Crocs is giving average earnings growth for the space, and you must consider the huge plunge in 2013 earnings. Even if Crocs' buyback were to boost earnings to 10% above current analyst estimates, the company would still be looking at a large drop from 2012 levels. Another point to consider is that Crocs rallied by 21% on Monday. If you were looking to buy the name at a huge discount, last week was your chance. A large chunk of the discount is gone now.

Final thoughts:

Crocs' deal to sell preferred shares in an effort to buy back stock seems great on paper, but the devil is in the details. These preferred shares come with a $12 million annual cost, so one must wonder if Crocs could have done better with a debt deal. Additionally, these shares could become convertible in a few years, which could reverse a small or even a significant part of the buyback.

But perhaps the worst part of this deal is that it is all about capital returns and trying to maximize share value. It is not about maximizing company value. Crocs has disappointed on the revenue front in 2013, and just warned on Q4 results. The company specifically said that it is not going to primarily focus on revenue growth during a transitional 2014 period. This transitional period will also see the departure of the current CEO and the company will need to find a new leader. The departure of a leader really hurt shares of Canadian apparel maker lululemon (LULU) recently. After showing the least amount of revenue growth in 2013 against others in the industry, Crocs is expected to show the least amount of revenue growth again in 2014. Again, the money from this deal is not going to improve the business, it is all about propping up the stock.

In the end, the deal seems like a short-term positive. The buyback will certainly help boost earnings per share and will reduce the share count and float. However, do keep in mind that the longer term implications of this deal shift to the negative side, as the company's biggest issue in my opinion is sputtering revenue growth. Crocs will have to pay 6% a year on these shares, and the only way it can stop those payments is to have the shares converted, which will reverse part or most of the buyback. In the end, Crocs is looking to appease shareholders in the short run, but I think that hurts the company in the long run. For that reason, I'm tagging this article as a "Short Idea". I'm not necessarily recommending you run out and short Crocs today, but there will be times when you can do so. I don't see how this deal helps Crocs the company in the long run, and that will make Crocs stock a decent short at some point as results are likely to disappoint.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.