I reiterate my bullish stance on U.S. coal stocks, as I believe the worst is priced in and coal stocks have bottomed out. The U.S. coal industry has been going through difficult times since the last two years when natural gas prices fell and coal demand decreased. However, I believe better coal supply management and rising natural gas prices will portent well for the industry. As I have been reiterating my bullish stance on the U.S. coal industry, and believe that stocks have bottomed out, the stock price performance (increase) of leading U.S coal stocks supports my thesis. The following table shows the stock price performance of four leading coal stocks and coal ETF.

Peabody Energy (BTU) | Arch Coal (ACI) | Alpha Natural Resources (ANR) | Walter Energy (WLT) | Coal ETF (KOL) | |

Stock Price Increase Since 2H2013 | 24% | 6.8% | 26% | 36% | 12% |

Source: googlefinance.com

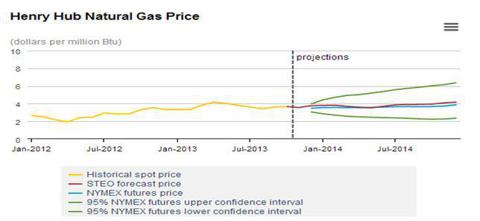

A drop in natural gas prices to below $2 mmBtu in April 2012 promoted the use of natural gas-fired electricity generation; added to lower coal demand this resulted in an oversupplied coal market. However, natural gas prices have bottomed out and have been trending upwards recently; currently natural gas prices are at $3.86 mmBtu. The Energy Information Administration [EIA] has projected natural gas prices to rise above $4 mmBtu in 2014. As natural gas prices continue to increase, it will portent well for the coal industry, resulting in higher coal-fired electricity generation and an increase in coal demand.

(click to enlarge)

Source: eia.gov

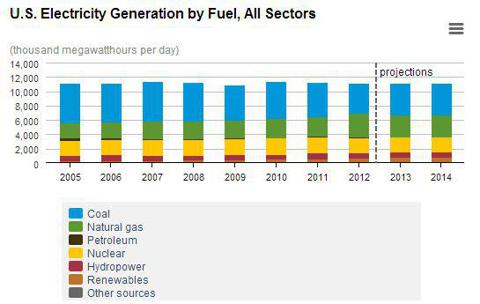

Coal fired electricity generation will become more cost competitive as natural gas prices continue to rise in the future; hence, coal fired electricity generation will increase. According to EIA estimates, updated earlier this month, coal fired electricity generation is expected to increase to 39.4% and 40.2% in 2013 and 2014, respectively, up from 37% in 2012. Also, it is anticipated that during this winter, due to higher natural gas prices, coal fired electricity generation will increase by 3.1%. The following chart shows U.S. electricity generation by fuel.

(click to enlarge)

Source: eia.gov

Better coal supply management in response to soft coal prices also remains an important factor for a recovery in the coal market. In response to soft coal market conditions, leading coal companies, including ACI and ANR, are lowering their production, which will help a coal price recovery. Total coal production for 2013 in expected to be 1,011 mmst, down from 1,095mmst and 1,016 mmst in 2011 and 2012, respectively. Coal companies' revenues and earnings will strengthen as excess supply will be removed from the market.

Overview of four U.S Coal Stocks

During the tough business conditions, coal companies have been aggressively working to lower their production costs to support their earnings and improve financial flexibility. In the first nine months of 2013, leading coal companies reduced their production costs by approximately 9% as compared to the first nine months of 2012. BTU and WLT were the leading coal companies, who lowered their production costs per ton by 7.5% and 11%, respectively, in the first nine months of 2013. Cost reduction still remains among the top priorities of the companies, which I believe will strengthen bottom line results as we move forward.

As I believe coal stocks have bottomed out and remain good investment opportunities for investors, analysts' forecasts for future earnings support my thesis. Analysts are forecasting earnings of coal companies to increase in upcoming years, as shown in the table below.

2013 | 2014 | 2015 | 2016 | |

BTU | $0.36 | $0.59 | $1.44 | $2.5 |

ACI | ($1.1) | ($0.49) | $0.2 | |

ANR | ($1.86) | ($1.08) | ($0.8) | |

WLT | ($1.58) | $0.3 | - |

Source: Nasdaq.com

Conclusion

BTU in my opinion remains the best stock to play a coal market rebound, as coal markets will improve in the future due to rising natural gas prices, increased coal fired electricity generation and better coal supply management. BTU has a cheap forward P/E of 7x (based on 2016 EPS estimate), in comparison to ACI's forward P/E of 20x. BTU also has a lower debt-to-equity of 130%, in comparison to its peers' average of 190%, which indicates better financial flexibility for BTU. Moreover, BTU has a better gross margin of 21%, in contrast to its peers' average of 15.5%, as shown in the table below.

Forward P/E based on 2016 EPS Est. | Debt to Equity | Gross Margin | |

BTU | 7x | 130% | 21% |

ACI | 20x | 200% | 15% |

ANR | - | 80% | 14% |

WLT | - | 340% | 13% |

Average | 13x | 190% | 15.5% |

Source: Yahoo finance and Calculations

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868071-the-return-of-king-coal-and-the-coal-stocks-to-play-a-rebound?source=feed

Aucun commentaire:

Enregistrer un commentaire