A unique special situations play that can offer investors huge rewards going forward is a company called Allied Motion Technologies (AMOT). The company just recently acquired an enterprise that was around the same size. The attractiveness of the acquisition is the fact that it will be accretive to earnings right away and will more than double the size of Allied Motion's revenues.

Basically Allied Motion Technologies Inc. is engaged in the business of designing, manufacturing and selling motion control products to a broad spectrum of customers throughout the world. The company's electro-magnetic, mechanical and electronic motion technology is used in a wide range of motion applications and products; from electric powered surgical hand pieces, to military equipment. It operates in the United States, Europe and Asia.

Acquisition Globe Motors

On October 18 this year Allied Motion completed the acquisition of Globe Motors, Inc. from Safran USA, Inc., for approximately $90 million in cash. Investors not familiar with Safran, Safran S.A. (GM:SAFRF) is a French multinational that manufacturers aircraft & rocket engines, aerospace components and security products.

Established in 1940, Globe Motors employs more than 500 employees worldwide and has its headquarter in Dayton, Ohio with additional operations in Dothan, Alabama; Reynosa, Mexico; and Oporto, Portugal.

The company has a well-established and strong industry reputation as a high quality provider of customized and innovative motion solutions. Combined with Allied Motion you can talk about a small powerhouse with enough critical mass to compete with the majors.

Financing Globe Motors

As you can read in the 8-K filing the funding of the acquisition of Globe Motors is almost not dilutive for shareholders.

The company awarded 225,232 shares of restricted stock to Richard S. Warzala, Chief Executive Officer, and 23,073 shares of restricted stock to Robert P. Maida, Chief Financial Officer. The restricted shares will vest annually (1/5 each year) over the five-year period following closing of the acquisition.

The arranged Credit Agreement provides for a $15 million five-year revolving credit facility and a $50 million five-year term loan. In connection with the funding Allied Motion entered also into a Note Agreement, to which Allied sold $30 million of 14.50% Senior Subordinated Notes due October 18, 2019 to Prudential Capital Partners IV, L.P. in a private placement.

Financials

The company recorded revenues of approximately $106 million for the year ended December 31, 2012 and around $114 million for the trailing twelve month period ended September 30, 2013.

The tables below summarize the unaudited pro forma calculation of Revenue, Net Income, Earnings per share, EBITDA and Adjusted EBITDA combined with Globe, numbers are in thousands. These pro forma results give a better view of the new financial situation. The pro forma balance sheet will be presented the coming months.

Unaudited Historical | Unaudited | ||||||||||||||||

Financial Results | Pro Forma | ||||||||||||||||

Nine Months | Nine Months | ||||||||||||||||

Ended | Ended | ||||||||||||||||

September 30, | September 30, | Increase (decrease) | |||||||||||||||

2013 | 2013 | $ | % | ||||||||||||||

Revenues | $ | 75,371 | $ | 164,400 | $ | 89,029 | 118 | % | |||||||||

Net income | $ | 2,612 | $ | 6,626 | $ | 4,014 | 154 | % | |||||||||

Net income per share | $ | 0.30 | $ | 0.73 | $ | 0.43 | 143 | % | |||||||||

EBITDA | $ | 5,083 | $ | 21,439 | $ | 16,356 | 322 | % | |||||||||

Adjusted EBITDA | $ | 7,226 | $ | 22,654 | $ | 15,428 | 214 | % | |||||||||

Historical | Unaudited | ||||||||||||||||

Financial Results | Pro Forma | ||||||||||||||||

Year Ended | Year Ended | ||||||||||||||||

December 31, | December 31, | Increase (decrease) | |||||||||||||||

2012 | 2012 | $ | % | ||||||||||||||

Revenues | $ | 101,968 | $ | 208,168 | $ | 106,200 | 104 | % | |||||||||

Net income | $ | 5,397 | $ | 8,641 | $ | 3,244 | 60 | % | |||||||||

Net income per share | $ | 0.63 | $ | 0.97 | $ | 0.34 | 54 | % | |||||||||

EBITDA | $ | 9,309 | $ | 25,537 | $ | 16,228 | 174 | % | |||||||||

Adjusted EBITDA | $ | 9,918 | $ | 26,555 | $ | 16,637 | 168 | % | |||||||||

source: Press release

The results for the first nine months include $1,1235,000 or $840,000 net of tax of new business development expenses in conjunction with acquisition of Globe and $234,000 or $159,000 net of tax of a relocation expense. There was also a pretax charge to a certain electronic component and a concession payment from a landlord for early termination of a building lease.

Excluding these non-recurring items, adjusted net income for the first nine months would have been $3,611,000 or $0.41 per diluted share. So pro forma EPS would have been $0.84.

We think pro forma EPS could be around $1.00 for this fiscal year, calculating 9,028,000 diluted shares.

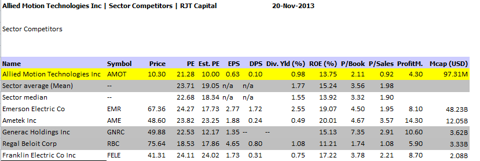

Comparing The Peers

If we look to some metrics of peers such as Emerson Electric (EMR) or a direct competitor such as Regal Beloit Corp. (RBC). and compare them with the same metrics as Allied Motion we come to the conclusion that the company is still deeply undervalued.

Of course is looking to metrics such as Estimated PE and P/Sales maybe a little bit too shortsighted, but we think also that the some other metrics could improve going forward. If you look for example to Allied Motion's profit margin you see that there is clearly some room for improvements.

The company can profit from operational efficiencies in the nearby future. We think the stock price could gain 70% before the end of 2014.

As mentioned before Regal Beloit is the closest competitor and also a manufacturer of electric motors, mechanical and electrical motion controls and power generation products. It is headquartered in Beloit, Wisconsin, and has manufacturing, sales and service facilities throughout the United States, Canada, Mexico, Europe and Asia. The same regions that the combination Allied and Globe has presence.

In 1980 annual sales of Regal Beloit were approximately $40 million, in 2012 annual sales were over $3.1 billion. With a current market capitalization Regal Beloit of more than $3.3 billion the company is one of the market leaders.

A similar growth story applies for Allied Motion. In 2002 Allied started to acquire companies, back then the company had around $12 million in revenues. Six acquisitions (including Globe) further combined revenues will exceed the $200 million mark.

Final Note

The acquisition of Globe Motors is a "strategic fit" acquisition. The synergies provided by the combination will drive efficiency and profit growth the years to come. We think also the acquisition will be beneficial for the company's profit margin.

Both companies service the aerospace, defense, medical, industrial, and vehicle markets. If Allied Motion can leverage the combined market shares in these market segments revenues will increase accordingly.

From a comparison point of view and looking to the fundamentals, we think the stock price has around 70% upside potential.

Disclosure: I am long AMOT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868641-allied-motion-technologies-an-accretive-acquisition-opportunity?source=feed

Aucun commentaire:

Enregistrer un commentaire