The department store sector offers investment opportunities for everyone. There are companies that grow consistently and pay dividends and others that exhibit characteristics of a distressed investment. Consumer spending also is not great yet as unemployment in the US remains high and wage growth is poor. An ongoing housing recovery and an improving jobs picture will likely increase consumer confidence and open customer wallets. That being said, department store companies are cyclical investments that will do well when the economy grows heartily and consumers have high confidence with respect to their future earnings.

Background

Macy's (M) belongs in the first category of companies that grow consistently. The company just posted its 15th quarter of consecutive EPS growth which, in all fairness, comes in a challenging consumer spending environment.

Macy's reported a third quarter EPS of $0.47 in Q3 2013 vs. $0.36 in Q3 2012 (a plus of 31%). Comparable store sales, an important retail key performance indicator, also grew 3.5%. The holiday season could also bring new EPS surprises and accelerated EPS growth for the full year.

J.C. Penney (JCP), on the other hand, is a retailer that isn't enjoying the honey but instead has fallen on hard times. Revenues, profitability and market share have been declining over multiple quarters and the company just stopped the bleeding via an equity offering to bolster up its balance sheet and provide the company with financial flexibility. However, investors still remain largely bearish on the retailer. Negative news and circumstances somehow resonate more strongly with the human mind.

Share performance

Shares of Macy's have risen an impressive 522% over the last five years and have just marked a new five-year High at $53.54. J.C. Penney shares have lost 51% over the same period. Correspondingly, the return differential exhibited by J.C. Penney and Macy's is massive.

The one-year performance charts below shows that Macy's has been the top performer with a plus of 39% and J.C. Penney has been the worst performer with a minus 44%. Adding to J.C. Penney's recent share price decline was its secondary offering which dragged down the share price below the offering price of $9.65 per share. Shares eventually fell as low as $6.42 on October 21, 2013 reflecting deep levels of pessimism about J.C. Penney's future prospects.

Other companies in the department store sector have at least achieved a positive one-year performance: Target (TGT) and Dillard's (DDS) gained 3% each, Nordstrom (JWN) 15% and Kohl's (KSS) 24%. The choice between either Macy's and J.C. Penney reflects buying the best- or worst performing department store in the sector.

Market valuation

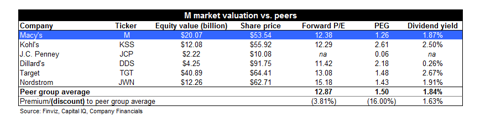

J.C. Penney's earnings estimates for 2014 are still negative which is why its P/E ratio is rendered meaningless.

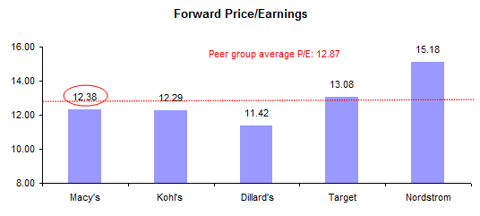

Despite strong EPS- and comparable store sales growth, Macy's is still not overpriced. Its P/E ratio stands at 12.38 and even fetches a discount to the peer group average P/E ratio of 12.87.

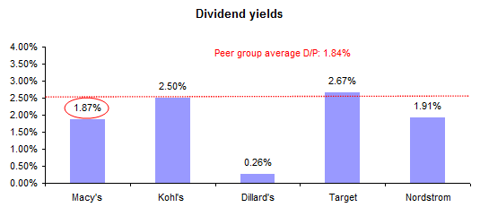

In terms of dividends, Macy's scores midfield with a yield of 1.87% while Kohl's pays 2.50% and Target 2.67%. Retailers are not making good income investments and shouldn't be bought for their dividends. Income investors will find much better value in the REIT space or energy related sectors.

The summary table below provides an overview of the forward P/E, PEG and D/P ratios for department store companies.

Conclusion

Macy's is a top performing department store with consistent EPS and store sales growth. J.C. Penney is just the opposite: Falling sales have led to significant cash burn rates. The secondary offering is intended to offer the company financial stability as well as flexibility and the equity offering could very well mark an inflection point in J.C. Penney's restructuring. David Tepper, founder of Appaloosa Management, disclosed that he purchased a J.C. Penney trade position at an average price of $14 in the third quarter. People who follow Tepper know that this hedge fund manager is highly successful with annualized returns of ~30%. He is a contrarian, trade-driven type of guy who had great success with super contrarian investments in Citigroup (C) and Bank of America (BAC) at the height of financial crisis back in 2009. He also said that J.C. Penney 'has gone down too far too fast' which mirrors my assessment in my previous article about J.C. Penney (here).

Consequently, J.C. Penney is a department store which might be suitable for contrarian investors who like to have a renowned,contrarian hedge fund manager on their side. The equity offering could indeed stabilize the company. Macy's, on the other hand, might be an interesting investment for investors who desire retail exposure to a company with steady sales- and EPS growth and an accepted business model. Its low valuation also adds to Macy's appeal. Despite a significant run over the last five years, Macy's isn't too expensive at 12 times forward earnings. Improvements in consumer spending in the next couple of years are also likely to provide tailwinds for both Macy's and J.C. Penney.

Disclosure: I am long JCP. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868081-buy-j-c-penney-for-turnaround-macys-for-steady-growth?source=feed

Aucun commentaire:

Enregistrer un commentaire