One of the reasons our members love us is that we tell the story through the numbers. Every income statement says something, every balance sheet has a history and every cash flow statement reveals a firm's true intrinsic value. The numbers talk--and we think every investor should listen to them. Let's see what they say about Monsanto (MON).

We think a comprehensive analysis of a firm's discounted cash-flow valuation and relative valuation versus industry peers is the best way to identify the most attractive stocks at the best time to buy. This process culminates in what we call our Valuentum Buying Index, which ranks stocks on a scale from 1 to 10, with 10 being the best. Essentially, we're looking for firms that overlap investment methodologies, thereby revealing the greatest interest by investors (we like firms that fall in the center of the diagram below):

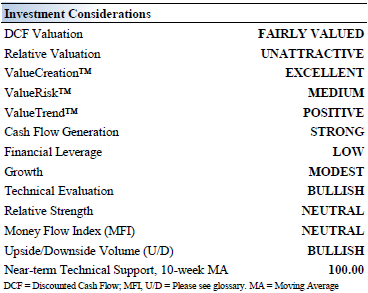

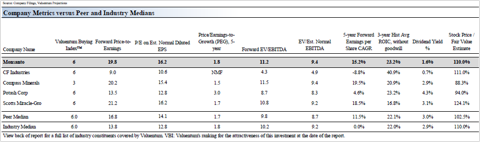

If a company is undervalued both on a DCF and on a relative valuation basis it scores high on our scale. Monsanto posts a VBI score of 6 on our scale, reflecting our "fairly valued" DCF assessment of the firm, its unattractive relative valuation versus peers, and bullish technicals. We compare Monsanto to peers CF Industries (CF), Compass Minerals (CMP) and Potash (POT).

Investment Considerations

Investment Highlights

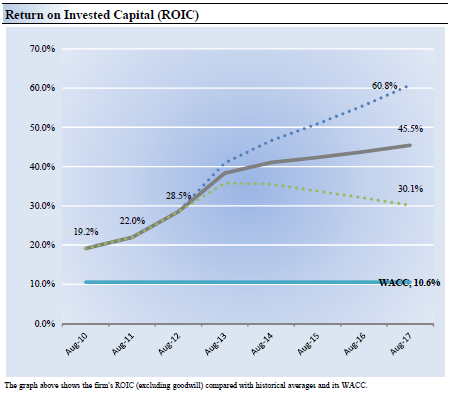

• Monsanto earns a ValueCreation™ rating of EXCELLENT, the highest possible mark on our scale. The firm has been generating economic value for shareholders for the past few years, a track record we view very positively. We expect the firm's return on invested capital (excluding goodwill) to expand to 41.1% from 28.5% during the next two years.

• Monsanto's seeds, biotechnology trait products and herbicides provide farmers with solutions that greatly improve productivity, but competition is fierce and continuous innovation remains vital to maintain superior returns.

• Monsanto has an excellent combination of strong free cash flow generation and low financial leverage. We expect the firm's free cash flow margin to average about 20.8% in coming years. Total debt-to-EBITDA was 0.6 last year, while debt-to-book capitalization stood at 14.9%.

• The firm's share price performance has been roughly in line with that of the market during the past quarter. We'd expect the firm's stock price to converge to our fair value estimate within the next three years if our forecasts prove accurate.

• We think success over the next decade will require more than improvements in individual component technologies. Monsanto is well-positioned to bring integrated technologies in the seed, plant, and feed "yield as a system."

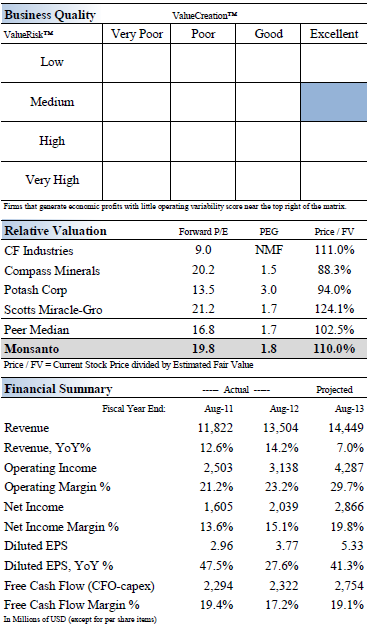

Business Quality

Economic Profit Analysis

The best measure of a firm's ability to create value for shareholders is expressed by comparing its return on invested capital - ROIC - with its weighted average cost of capital - WACC. The gap or difference between ROIC and WACC is called the firm's economic profit spread. Monsanto's 3-year historical return on invested capital (without goodwill) is 23.2%, which is above the estimate of its cost of capital of 10.6%. As such, we assign the firm a ValueCreation™ rating of EXCELLENT. In the chart below, we show the probable path of ROIC in the years ahead based on the estimated volatility of key drivers behind the measure. The solid gray line reflects the most likely outcome, in our opinion, and represents the scenario that results in our fair value estimate.

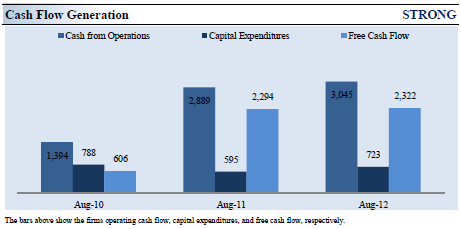

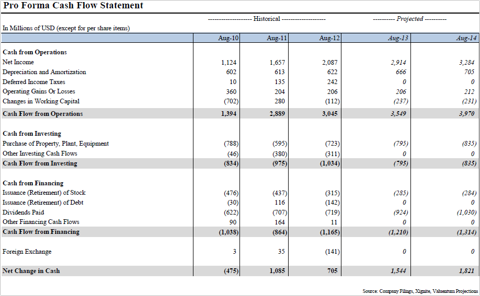

Cash Flow Analysis

Firms that generate a free cash flow margin (free cash flow divided by total revenue) above 5% are usually considered cash cows. Monsanto's free cash flow margin has averaged about 14.1% during the past 3 years. As such, we think the firm's cash flow generation is relatively STRONG. The free cash flow measure shown above is derived by taking cash flow from operations less capital expenditures and differs from enterprise free cash flow (FCFF), which we use in deriving our fair value estimate for the company. At Monsanto, cash flow from operations increased about 118% from levels registered two years ago, while capital expenditures fell about 8% over the same time period.

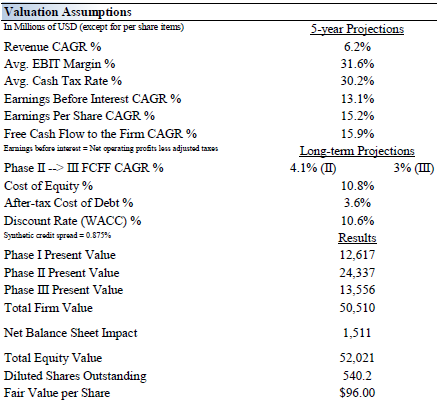

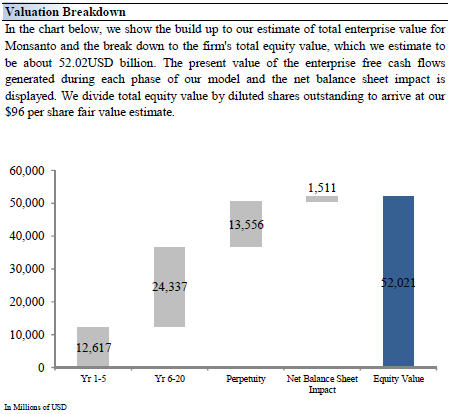

Valuation Analysis

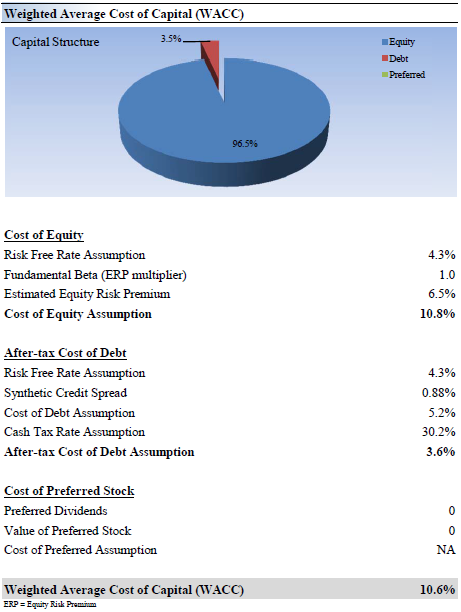

The estimated fair value of $96 per share represents a price-to-earnings (P/E) ratio of about 25.4 times last year's earnings and an implied EV/EBITDA multiple of about 13.4 times last year's EBITDA. Our model reflects a compound annual revenue growth rate of 6.2% during the next five years, a pace that is higher than the firm's 3-year historical compound annual growth rate of 4.8%. Our model reflects a 5-year projected average operating margin of 31.6%, which is above Monsanto's trailing 3-year average. Beyond year 5, we assume free cash flow will grow at an annual rate of 4.1% for the next 15 years and 3% in perpetuity. For Monsanto, we use a 10.6% weighted average cost of capital to discount future free cash flows.

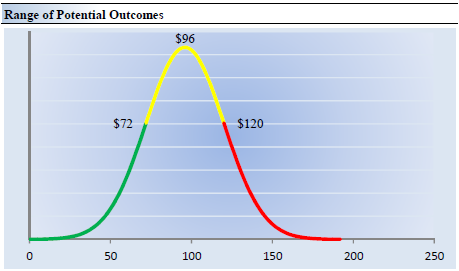

Margin of Safety Analysis

Our discounted cash flow process values each firm on the basis of the present value of all future free cash flows. Although we estimate the firm's fair value at about $96 per share, every company has a range of probable fair values that's created by the uncertainty of key valuation drivers (like future revenue or earnings, for example). After all, if the future was known with certainty, we wouldn't see much volatility in the markets as stocks would trade precisely at their known fair values. Our ValueRisk™ rating sets the margin of safety or the fair value range we assign to each stock. In the graph below, we show this probable range of fair values for Monsanto. We think the firm is attractive below $72 per share (the green line), but quite expensive above $120 per share (the red line). The prices that fall along the yellow line, which includes our fair value estimate, represent a reasonable valuation for the firm, in our opinion.

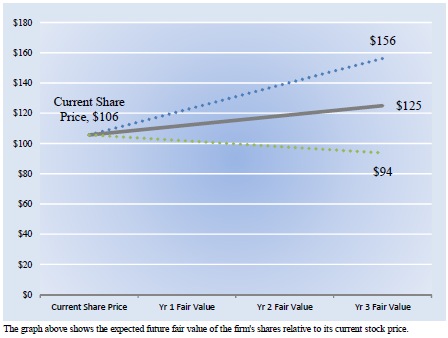

Future Path of Fair Value

We estimate Monsanto's fair value at this point in time to be about $96 per share. As time passes, however, companies generate cash flow and pay out cash to shareholders in the form of dividends. The chart below compares the firm's current share price with the path of Monsanto's expected equity value per share over the next three years, assuming our long-term projections prove accurate. The range between the resulting downside fair value and upside fair value in Year 3 represents our best estimate of the value of the firm's shares three years hence. This range of potential outcomes is also subject to change over time, should our views on the firm's future cash flow potential change. The expected fair value of $125 per share in Year 3 represents our existing fair value per share of $96 increased at an annual rate of the firm's cost of equity less its dividend yield. The upside and downside ranges are derived in the same way, but from the upper and lower bounds of our fair value estimate range.

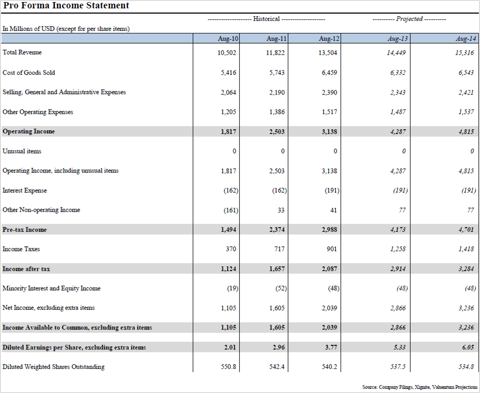

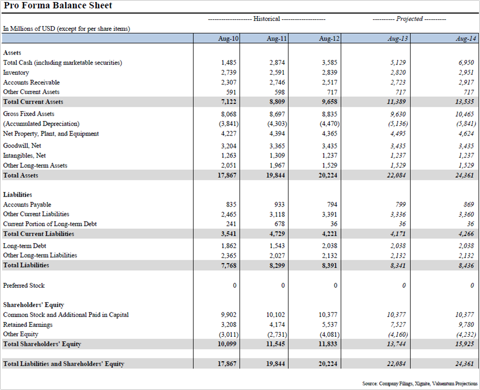

Pro Forma Financial Statements

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869041-looking-at-the-numbers-behind-monsanto?source=feed

Aucun commentaire:

Enregistrer un commentaire