Energy Transfer Partners (ETP) is a master limited partnership with around 43,000 miles of natural gas/natural gas liquids, refined products, and crude oil pipelines in the United States. The company further owns 100% of ETP Holdco Corporation and holds a 70% interest in Lone Star NGL LLC, a joint venture that owns and operates natural gas liquids storage, fractionation and transportation assets. ETP operates in the same arena as high-yield MLP's Kinder Morgan Energy Partners (KMP) or Plains All American Pipeline (PAA) and might be suitable for investors who desire a more concentrated, large-cap MLP.

Background

Hydraulic fracturing and the accessibility of shale reservoirs has led to a surge in domestic oil- and gas production over the last few years. In fact, crude oil and natural gas production have reached such high levels that the US is well on its way to energy independence; a long-time political and economic goal of the United States. Extraordinary levels of production growth in the shale regions of the US have led to increased demand for transportation, storage and fractionation capacity. In fact, high domestic exploration levels now offer the US significant export opportunities going forward which will require an expansion and upgrade of export facilities. Investors in Energy Transfer Partners as well as other MLPs bet on an ongoing fracturing boom and a simultaneous expansion of the US pipeline network in order to accommodate larger commodity flows.

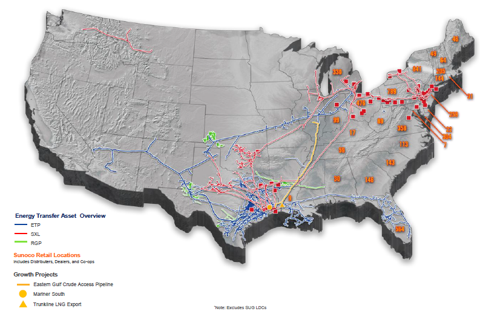

Footprint concentrated in Eagle Ford formation

The map below depicts Energy Transfer Partners' asset footprint in the United States. ETP's assets are concentrated in the South of the US, especially in Texas. Energy Transfer Partners has a particular strong position in the Eagle Ford area and is massively adding to its processing capacity. In 2010 ETP had an Eagle Ford processing capacity of 120 Mbpd and expects to grow its capacity to 1,340 Mbpd in 2014. Eagle Ford is one of the highest-impact drilling areas in the US and the expansion of processing capacity will serve the company and its unitholders well in the future.

ETP's unit price approaching five-year High

Energy Transfer Partners has returned 23% over the last two years and currently quotes at $53.86. Shares are now just sitting below its five-year High at $54.79 which was marked on February 28, 2011.

(click to enlarge)

Superior LTM relative price performance

Energy Transfer Partners has outperformed other large-cap, pipeline companies over the last twelve month. ETP has returned 24% over the last year, while Atlas Pipeline Partners (APL) gained 3%, Enbridge Energy Partners (EEP) 4%, PAA 10% and KMP was flat.

Distributions

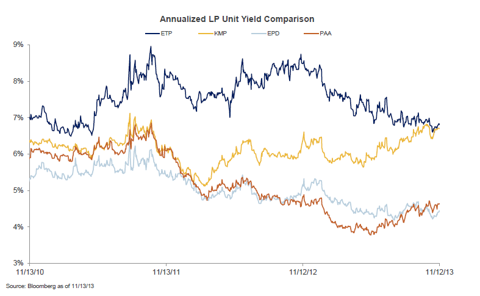

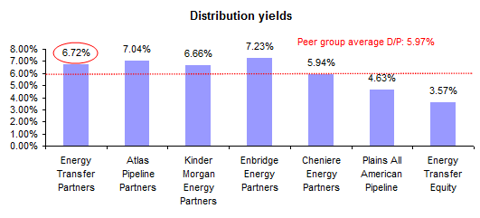

Energy Transfer Partners presently pays a forward dividend yield of 6.72%. The company just recently increased its quarterly distribution to $0.90500 (up 1.3% q-o-q) and now pays a total annualized distribution of $3.62. While the yield certainly holds up to yield comparisons with other top-performing MLPs (see graphs below), it is also noteworthy that Energy Transfer Partners has a distribution record since 2001 which is definitely worth checking out. In 2005 the company completed a 2:1 unit split.

Energy Transfer Partners' unit yield certainly holds up to other pipeline companies with equally strong asset footprints in key production areas:

(Source: Enery Transfer's investor presentation)

Conclusion

Kinder Morgan Energy Partners and Plains All American Pipelines are much more covered and well-known among investors although MLPs such as Energy Transfer Partners or Atlas Pipeline Partners are equally attractive pipeline investments with great distribution yields and operations.

Pipeline companies do not only profit from increased oil-, LNG- and natural gas production. Investing in infrastructure assets like pipelines and storage facilities are highly capital intensive. Once a pipeline is in place marginal costs of throughput volume are minimal providing investors with decent upside potential should outsized production growth in Eagle Ford continue (which I believe it will).

Energy Transfer Partners is particularly interesting for MLP investors who want an energy player with significant concentration in highly promising production areas like the Eagle Ford formation in Texas. Correspondingly, the risk of investing in Energy Transfer Partners is higher than in more diversified plays such as Kinder Morgan.

In addition, Energy Transfer Partners has less of a distribution growth record than a steady distribution record. Since 2008 ETP has paid $0.89375 quarterly per unit and only just recently increased its distribution to $0.90500. However, the distribution yield was and is still very decent at around 7%. Long-term BUY for investors who desire a concentrated energy pipeline play with a great distribution history and with prospects of increasing yields going forward.

Disclosure: I am long KMP, APL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868311-energy-transfer-partners-a-concentrated-7-mlp-to-consider-for-your-income-portfolio?source=feed

Aucun commentaire:

Enregistrer un commentaire