The June low for the gold mining sector was believed to the bottom for gold miners and, as such, presented a buying opportunity for the precious metals community. At the time we greeted this event with some trepidation and described the capitulation as a capitulation of sorts, but not a final one. In any bull market we have to climb the wall of worry, and gold and silver did exactly that in the first phase of this bull market as many objectors denounced its progress. This wall of worry will always be with us as gold clings on in the hope that there is a U-turn coming and the bull returns with a vengeance.

The Gold Bugs Index (HUI)

The June bottom in the mining stocks produced a rally that took this index from 210 to 280 for a gain of 33%. Since then the froth has dissipated and the HUI has dropped back to close at 204. It could be that the miners have returned to retest these lows and the bulls may lend a hand here by making more acquisitions, thus providing some support. On the other hand if the miners lose support and the HUI continues to plunge, then the June bottom will join the ranks of the many false dawns that we have experienced since the heady days of a couple of years ago, when the HUI traded at around 625. Since then the HUI has lost almost 70% of its value, a gut wrenching disappointment for gold bugs if ever there was one.

The fortunes of the gold and silver producers are largely predicated on the price of both gold and silver, and so it goes that we must focus intently on their progress or lack of it, as the case may be. But it has to be said that there are other factors that could adversely affect mining companies, such as a major stock market correction, which would in turn weigh heavily on mining companies as they could be grouped with stocks in general and sold down accordingly.

Gold

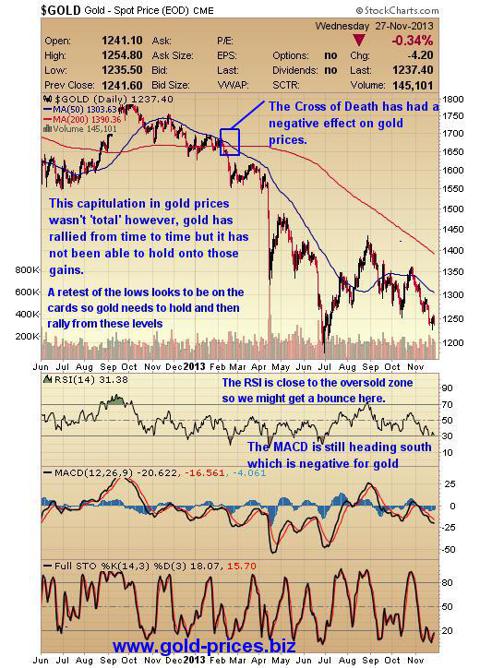

Click to enlarge image.

Since the record highs when gold hit $1,900/oz., gold's story has been a dismal one. As of today gold is trading at $1,241/oz. for a loss of 34%. At the end of June the rout looked to be over as gold prices traded briefly below $1,200/oz. and then rallied to $1,420/oz. in August. However, this summer rally soon faded and gold drifted forming lower lows along the way, wiping out a lot of the summer gains. Gold is now within $40/oz. or so of the summer lows and could easily test those lows in the coming weeks. Again, that support level needs to hold for all who are invested in this tiny sector of the market.

On the positive side of this equation we have the robust demand for the physical metal especially from the Eastern part of the world. We are aware of the amount of gold that passes through Hong Kong on its way to China, and those numbers are growing at a tremendous rate. China also imports gold through ports other than Hong Kong for which the numbers are vague, but could be considerable. The mints regularly report that they are temporarily out of product such as the domestic demand for coins and bars, so we anticipate higher prices.

Silver

Silver followed gold to higher levels during the summer rally when it moved from around $18/oz. to around $24/oz.; it has since drifted lower and now trades at $19.63/oz. So we can see that silver is also in retest mode and could test the summer lows in the near term. The demand for silver differs from gold in that it has many industrial uses, such as in the manufacture of solar panels, and it could therefore hold its value a tad better than gold. However, when gold moves in either direction, silver tends to follow it regardless of the additional demands for its usage.

Conclusion

There are a number of positive factors that go into this mix of considerations when formulating our investment strategy: physical demand, debasement of currencies, dwindling supply, insurance against disaster, backwardation in the paper market, etc. These are all good solid arguments and are supportive of gold and silver prices in most cases. However, the fact that the precious metals are struggling to gain any sort of momentum in what is traditionally their season for making gains does not bode well for a sustained rally.

The debasement argument has held up for some time and been supportive of the precious metals sector. However, the possibility of tapering still lurks in the background. A number of readers have rebuked us for suggesting such a thing, and they may well be correct. The new Fed head, Janet Yellen, is said to be even more dovish than the outgoing Fed head, Ben Bernanke. This may be so, but all along the Fed have said that they will remain data-driven. Now, as readers frequently point out, the employment numbers are riddled with low-paying part-time jobs and therefore this recovery is not strong enough to warrant any tapering of the current Quantitative Easing program. We disagree on this point and are of the opinion that tapering will be introduced should the employment numbers continue to improve. But, as they say, time will tell.

We also need to keep an eye on the European Union and the possibility of an introduction of negative interest rates, as well as Japan, where the new government has adopted an approach of printing more money in an attempt to boost its own economy. These actions will debase the yen and the euro. That, in turn, puts upward pressure on the USD, which has an inverse relationship with gold and so gold prices decline.

A more recent argument has been the increased activity in the options market whereby the 2015 call options have been purchased at a strike price of $3,000/oz. We agree that someone is sufficiently confident of making a profit to purchase these contracts. But on the other side of this trade, there is someone equally as confident that they will be ones to make a profit should gold not achieve these price levels. This is more of a neutral action than one which supports gold.

Many of the miners have costs in the vicinity of $1,200/oz., so if gold prices fall lower than their production costs, they will have real problems attracting investors and could face bankruptcy. There is also some new money vying for our attention in the form of virtual money, bitcoin. The stock market in general is still booming and is considered by many to be the place to be, thus taking funds away from the precious metals sector.

So it is down to us all to try and get the direction of the precious metals correct, in terms of the big picture, and then the rest will fall into place. If we get it wrong, then we could be faced with huge losses, so go gently whether you are a bull or a bear. In all, we are still of the opinion that both gold and silver will retest the June lows and penetrate them as this bear phase continues.

Got a comment to share? Please do so below, especially if you disagree -- the more opinions we have and the more we share, the more enlightened we become and hopefully the more profitable our trades will be.

Disclaimer: www.gold-prices.biz or www.skoptionstrading.com makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents our views and replicates trades that we are making but nothing more than that. Always consult your registered adviser to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this letter. Options contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. Past performance is not a guide nor guarantee of future success.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868651-the-hui-has-penetrated-its-june-lows-gold-and-silver-to-follow?source=feed

Aucun commentaire:

Enregistrer un commentaire