In this article, I will feature one services sector stock that has seen intensive insider selling during the last 30 days. Intensive insider selling can be defined by the following three criteria:

- The stock was sold by three or more insiders within one month.

- The stock was not purchased by any insiders in the month of intensive selling.

- At least two sellers decreased their holdings by more than 10%.

Starbucks (SBUX) operates as a roaster, marketer, and retailer of specialty coffee worldwide.

Insider selling during the last 30 days

Here is a table of Starbucks' insider-trading activity during the last 30 days.

| Name | Title | Trade Date | Shares Sold | Rule 10b5-1 | Current Ownership | Decrease In Ownership |

| Troy Alstead | CFO | Nov 25 | 114,807 | No | 100,545 shares + 125,905 options | 33.6% |

| Clifford Burrows | Group President | Nov 25 | 35,000 | No | 102,006 shares | 25.5% |

| Howard Schultz | CEO | Nov 21 | 557,000 | No | 18,784,468 shares + 566,469 options | 2.8% |

There have been 706,807 shares sold by insiders during the last 30 days. More details about the Rule 10b5-1 trading plan can be found from this link.

Insider selling by calendar month

Here is a table of Starbucks' insider-trading activity by calendar month.

| Month | Insider selling / shares | Insider buying / shares |

| November 2013 | 706,807 | 0 |

| October 2013 | 0 | 0 |

| September 2013 | 121,103 | 0 |

| August 2013 | 471,608 | 141,573 |

| July 2013 | 0 | 0 |

| June 2013 | 63,385 | 0 |

| May 2013 | 626,630 | 3,300 |

| April 2013 | 20,000 | 0 |

| March 2013 | 1,083,210 | 0 |

| February 2013 | 58,000 | 0 |

| January 2013 | 104,449 | 0 |

There have been 3,255,192 shares sold and there have been 144,873 shares purchased by insiders this year.

Financials

Starbucks reported the fiscal 2013 full-year, which ended September 29, financial results on October 30 with the following highlights:

| Revenue | $14.9 billion |

| Net income | $1.7 billion |

| Cash | $3.2 billion |

| Debt | $1.3 billion |

Outlook

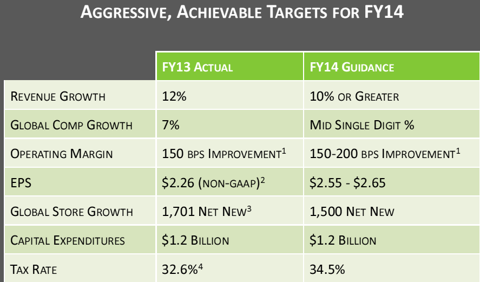

Starbucks' guidance is as follows:

| 2014 revenue growth | 10% or greater |

| 2014 EPS | $2.55-$2.65 |

| Q1/2014 EPS | $0.67-$0.69 |

| Q2/2014 EPS | $0.54-$0.55 |

(Source: November 19 presentation)

Competition

Starbucks' competitors include Green Mountain Coffee Roasters (GMCR), and Farmer Brothers (FARM). Here is a table comparing these companies.

| Company | SBUX | GMCR | FARM |

|---|---|---|---|

| Market Cap: | 61.51B | 10.06B | 320.78M |

| Employees: | N/A | 6,300 | 1,793 |

| Qtrly Rev Growth (yoy): | 0.13 | 0.11 | 0.08 |

| Revenue: | 14.89B | 4.36B | 519.37M |

| Gross Margin: | 0.57 | 0.37 | 0.38 |

| EBITDA: | 2.86B | 994.42M | 31.93M |

| Operating Margin: | 0.15 | 0.18 | 0.00 |

| Net Income: | 8.30M | 483.23M | -9.56M |

| EPS: | 0.01 | 3.16 | -0.61 |

| P/E: | 8,162.00 | 21.36 | N/A |

| PEG (5 yr expected): | 1.57 | 1.20 | 1.23 |

| P/S: | 4.12 | 2.19 | 0.62 |

Starbucks has the highest P/S ratio among these three companies.

Here is a table of these competitors' insider-trading activities this year.

| Company | Insider buying / shares | Insider selling / shares |

| FARM | 6,449 | 163,458 |

| GMCR | 39,000 | 1,090,450 |

Only Starbucks has seen intensive insider selling during the last 30 days.

Conclusion

There have been three different insiders selling Starbucks and there have not been any insiders buying Starbucks during the last 30 days. Two of these three insiders decreased their holdings by more than 10%. Starbucks has an insider ownership of 2.60%.

Starbucks is trading at a P/E ratio of 8,162.00 and a forward P/E ratio of 25.70. The company has a book value of $5.96 per share and the stock has a dividend yield of 1.27%.

Before entering short Starbucks, I would like to get a bearish confirmation from the Point and Figure chart. The two main reasons for the proposed short entry are relatively high P/S ratio, and the intensive insider-selling activity.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869381-starbucks-3-different-insiders-have-sold-shares-this-month?source=feed

Aucun commentaire:

Enregistrer un commentaire