The stock market has performed tremendously well thus far in 2013. Overall, the S&P 500 Index (SPY) has risen by +29%. But when examining the composition of this rally, some notable facts quickly rise to the surface. First, such robust stock gains have not been supported by fundamentals at all this year with revenue and earnings both growing only in the low single digits. Perhaps more notably, the performance of the lowest quality companies in the S&P 500 Index has exceeded that of the highest quality companies by a wide margin. In other words, the incredible stock rally witnessed in 2013 has been primary driven not by quality, but instead by the most speculative companies in the market.

Quality stocks actually began the year on a strong note. Through the first four months of 2013, the more stable companies in the stock market as measured by the S&P 500 Low Volatility (SPLV) were up by +15% while their more volatile counterparts in the S&P 500 High Beta (SPHB) were only up around +2%.

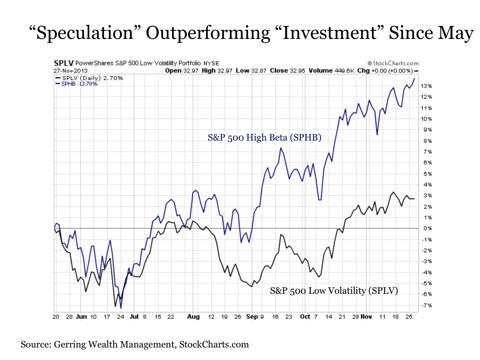

But since the time in April when the Fed began leaking its intent to begin scaling back on asset purchases as part of its QE3 stimulus program, the more stable stocks in the market effectively ground to a halt while the more speculative offerings suddenly exploded to the upside.

This has led to the following wide performance disparity year-to-date. The more speculative S&P 500 High Beta is now up nearly +35% for the year. The more stable S&P 500 Low Volatility , on the other hand, is up +22% in 2013 but only less than +3% since the middle of May.

Of course, beta is not necessarily a measure of quality, so it is worthwhile to explore this returns disparity a bit further. For this we look at the Goldman Sachs Weak Balance Sheet Basket, which includes the group of companies that rank the worst in the S&P 500 Index in terms of probability of corporate default. This basket is up over +42% for the year, while its Strong Balance Sheet Basket counterpart that includes those companies that are least likely to default is up nearly half that amount at +22%.

In short, the stock rally since May has come thanks almost exclusively to speculation among the lowest quality names. Put more bluntly, it is a rally filled with crap.

Fortunately, the characteristics of the market rally since May do provide potential opportunity for those investors that may otherwise be highly skeptical of the rally but are seeking to hedge their portfolios against a continued market melt up through the remainder of the year. Given that higher quality stocks have struggled during the latest rally, particularly since early August, investors may be well served to allocate to this more stable area of the market, as it provides lower risk exposure to stocks while at the same time offering the potential for additional upside if these higher quality names reconverge in performance with the more speculative names in the index over the coming months. Moreover, investors may discover even better opportunities in taking the time to focus on specific names within this lower volatility, higher quality segment.

This post is for information purposes only. There are risks involved with investing including loss of principal. Gerring Wealth Management (GWM) makes no explicit or implicit guarantee with respect to performance or the outcome of any investment or projections made by GWM. There is no guarantee that the goals of the strategies discussed by GWM will be met.

Disclosure: I am long SPLV. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868291-todays-stock-rally-is-full-of-it?source=feed

Aucun commentaire:

Enregistrer un commentaire