CROWN POINT ENERGY

Share price: C$0.40 (as of 11/27/2013)

Shares outstanding: 104.5 million

Debt (as of Q3 2013 financials): nil

Market cap: $42 million

Net working capital (as of Q3 2013 financials): $14 million

Enterprise value: $28 million

Production (Q3 2013): 1,730 boepd

Introduction

Crown Point Energy (OTCPK:CWVLF or CWV on the TSX Venture exchange) is a junior oil and gas exploration and production company with assets in three Argentine sedimentary basins. CWV's average production in Q2 2013 was approximately 1,730 boepd, consisting of 470 barrels of liquids (92% oil and 8% NGLs) and 7.6 mmcf/d of natural gas. The company is planning to start the most active drilling program in its corporate history in Q1 2014, which will consist of 12 wells (8 development and 4 exploration) that have the potential to not only increase cash flow, but to also substantially increase corporate reserves. Due to the potential materiality of the exploration targets and the low-risk nature of the development program, I believe the risk-reward profile is highly skewed in favor of investors looking for exposure to the inevitable resurgence of Argentina's energy sector.

Figure 1: Sedimentary Basins Where Crown Point is Active

(source: company reports)

Of note, two key developments have recently taken place in Argentina's political and economic landscape. First, on October 27th, Cristina Fernandez de Kirchner lost significant support in Argentina's mid-term election, with her party's majority dropping to 33% from the 54% the party captured in the 2011 election. Second, press reports are now circulating that Repsol (OTCQX:REPYY) and Argentina have finally reached a deal which defines compensation for Argentina's irrational seizure of Repsol's stake in YPF dating back to 2012 (link here for a press report with more detail).

Fernandez's losses in congress are perhaps the most direct reflection of her decreasing influence and popularity within the country, largely due to the unsustainable economic policies of her party. I will not debate the intricacies of Argentine politics here, but I will provide two articles from The Economist (linked here and here) for those interested in a deeper dive on the topic. There is also an excellent recent Seeking Alpha article on the Argentinean landscape linked here.

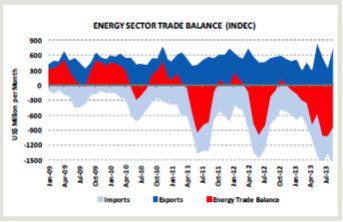

In my view, the primary "Achilles Heel" of the Argentine economy actually comes in two silos: 1) trade and foreign exchange policies, and 2) a persistent and growing energy deficit. While the former could be debated ad nauseam, the latter is more easily characterized. As Argentina came out of default in 2001-2002, the economy was boosted by a government policy targeted at maintaining artificially low energy prices. This was great for stimulating economic growth, but it severely impacted capital investment in the hydrocarbon exploration and production industry. Over time, Argentina went from being a net energy exporter to a large net energy importer (Figure 2). Natural gas is being imported at world LNG prices (currently in the $10-15/mcf range), the gas export lines to Chile have been almost entirely shutdown, and domestic production continues to falter. A good summary of the current situation is linked here. The situation is not sustainable.

Figure 2: Argentina's Energy Balance

(source: G&G Energy Consultants c/o company reports)

However, there are points of light on the horizon. Domestic oil and gas prices have gradually risen in recent years, and export restrictions and artificial price caps have been loosened and raised respectively (see commentary from The Economist linked here). Intuitively, energy producers in Argentina should be the beneficiaries of the improving domestic energy climate in the form of higher prices and fewer export restrictions as the country seeks to stem the outflow of foreign exchange reserves. On top of that, domestic gas supplies are dangerously low, ensuring a market for produced molecules.

Taking all of the above into consideration, I would say that the Argentinean energy investment landscape is improving, not worsening, which is the first time I've felt confident enough to say that in a long time. Clearly there is more debate to be had on this topic, but given the discounted valuations of some of the publicly listed Argentine energy firms I am comfortable enough to wade into the space.

I have chosen Crown Point Energy as the focus of this article for the following reasons:

1) The company has assets that I believe are capable of generating significant production and reserves growth;

2) There is almost $14 million of positive working capital and zero debt on the balance sheet, resulting in an enterprise value of only ~50% of the company's proven plus probable reserve value on a NPV10 basis (as per the Dec. 31, 2012 reserve report);

3) The company is about to embark upon the most active drilling campaign in corporate history, with plans to drill 12 wells starting in Q1 2014 (8 of which are development and 4 of which are high-impact exploration); and

4) The company is not yet well covered by the brokerage industry, which means that it is still under the radar of most investors.

The Assets

The majority (~1,500 boepd, or 85%) of Crown Point's production comes from a 25.78% interest in a large (505,000 acres) concession in Tierra del Fuego that hosts numerous oil and gas pools (other JV partners are: Roch S.A. (operator), Apco Oil and Gas (APAGF), and two other Argentine private entities). This asset was bought from Antrim Energy in H1 2012 for approximately $50 million in cash and stock in what was arguably a depressed market, given that 1) Argentina had just announced that they were taking back a controlling interest in YPF and 2) Antrim was facing financial challenges of its own in the North Sea.

At the time, the TdF production contract was set to expire in 2016 and domestic gas prices were in the $2/mcf range, so there was little incentive for additional drilling. Fast forward to today, and the contract term has recently been extended to 2026 and Crown Point is projecting go-forward gas pricing of $4.10/mcf, without accounting for the potential benefits of the recently announced "New Gas" program, which would see new production fetch as much as $7.50/mcf. For a complete summary of the corporate asset/production base and well economics, I have linked the Crown Point corporate presentation here.

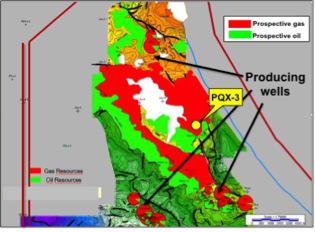

In short, the fiscal landscape has moved significantly in Crown Point's favor since the assets were acquired and the historical reasons for the underdevelopment of the TdF acreage have been addressed. Quite simply, no wells have been drilled in the TdF acreage since Q4 2011, despite a deep inventory of development, step-out, and exploration drilling targets on the block and a historical 90% drilling success ratio in areas with extensive modern 3D seismic coverage. Ten wells are planned by the JV in 2014 in the TdF acreage, eight of which are development wells offsetting known production with two more falling into the step-out/exploration category. Field extensions are mapped on essentially all currently producing fields and in many cases hydrocarbon-water contacts have yet to be found, suggesting additional upside potential.

The planned PQX-3 well (Figure 3) is of particular note in the upcoming program. The well is targeting a highly prospective ~50 square kilometer undrilled fault block prospect. The prospect is a classic example of what is referred to as "low hanging fruit" in the E&P industry. It is covered by 3D seismic, shows amplitude response suggestive of gas charge, and is adjacent to, and up dip of, proven oil and gas production. Investors should look for Crown Point to secure a drilling rig for the TdF concessions in the near future (the company has stated it is in advanced negotiations regarding contracting a drilling rig for an ongoing program).

Figure 3: PQX-3 Well Location with Surrounding Productive Areas

(source: company reports)

When all of the above is considered together, I believe the case for TdF alone is quite compelling. If the PQX-3 well is successful in proving up an additional 50 square kilometer area for oil and gas development, I believe it could double Crown Point's current reserve base and provide years of drilling inventory on top of the 35 development and exploitation locations that have already been identified on existing fields.

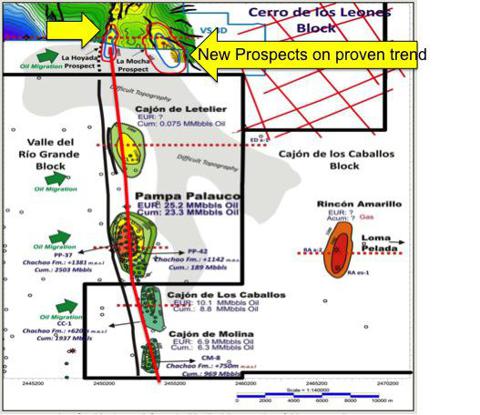

Additionally, Crown Point has completed a 3D seismic survey over a portion of the company's 100%-owned Cerro de los Leones block in the Neuquen Basin. The seismic survey has identified two prospective structures on trend with proven production to the south from multiple fields (Figure 4).

Figure 4: Cerro de los Leones Targets Relative to Regional Trend

(source: company reports w/ Argentina gov't data)

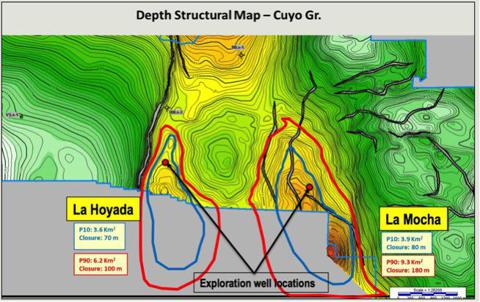

Government data suggest that analog pools to the south range in size from 7-25 mmbbls, which would constitute a highly material discovery for Crown Point. The fault-bounded structures (Figures 5 and 6) are defined on three sides by 3D seismic, with closure to the south implied by regional 2D and well data (due to topography, surface access is difficult to the south, but higher-cost 3D could be shot over the area in the event of a discovery).

Figure 5: Detailed Map of Cerro de los Leones Exploration Targets

(source: company reports)

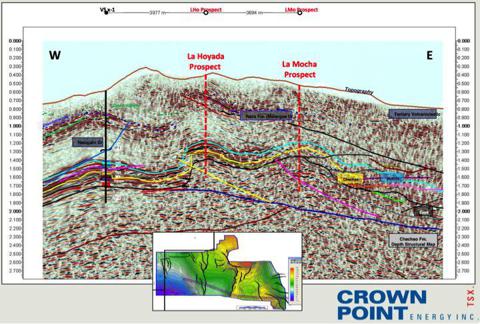

Figure 6: Seismic Cross-Section of Cerro de los Leones Prospects

(source: company reports)

There is strong evidence for oil generation and migration in the area and Crown Point plans to drill two wells targeting the newly defined prospects in the Cerro de los Leones concession. Well planning and logistical preparations are at an advanced stage and the company plans to begin drilling in Q1 2014, concurrent with the TdF program (using a separate rig for which negotiations are underway). Even using $5/barrel for a single new discovery in the size range of the analog fields would arguably yield ~$0.35 to $1.25 of upside. Not bad as a "free option" on a 40-cent stock.

Both wells will also provide a "free" evaluation of the Vaca Muerta shale, as the wells will drill through this formation on the way to their primary target horizons. The Vaca Muerta is known to be thermally mature in the concession area based on oil typing of the 2 billion barrel Llancanelo oil field which sits updip and to the east of the modeled maturity window (see the corporate presentation for more detail). Obviously, this "free" evaluation could prove to be material given the large area (350 sq. km) of modeled Vaca Muerta thermal maturity within the concession. Though I would not expect Crown Point to implement a dedicated Vaca Muerta program on its own, such a project may be worthy of a future joint venture.

Valuation

Crown Point appears cheap, trading at around $16,000 on an "EV/per flowing boe" basis and an "EV/2P boe" of reserves less than $4/boe (see their corporate presentation for details). Netbacks on Q3 2013 production were in the $13/boe range, which is low, but new drilling should increase that netback as pricing for new gas volumes are expected to average at least $4.10/mcf going forward (nearly a $1/mcf improvement over 2013 year-to-date).

Using a $13/boe netback and 1,700 boepd, Crown Point generates approximately $8 million in annual gross cash flow from operations, putting the equity value in the 3.5x EV/CF range using trailing prices and constant production, which I would suggest is exceedingly conservative given the discussion surrounding pricing developments and future drilling plans detailed above.

As of December 31, 2012, Crown Point's before-tax 2P NPV10 was $62 million and its after-tax NPV was $47.5 million. Given the current enterprise value of approximately $28 million, that implies that the company is currently trading at 0.45x to 0.59x on an EV/NAV basis. The company did record an impairment charge on its non-core El Valle concession in Q2 2013, which should show up in the next annual reserve report, but given the low declines in TdF production and the improvement in the forward pricing curve, I would expect a fairly neutral report on a year over year basis. However, as detailed above, I believe the planned drilling program has the potential to materially increase reserves in 2014.

The $14 million in net positive working capital, plus a $5 million credit line (which was drawn down subsequent to the Q3 2013 financial period), plus cash flow appear to be sufficient to fund Crown Point's share of the aforementioned 2014 development program; a rare feat in the world of junior E&P companies.

I would also draw attention to the corporate presentation one more time with respect to expected well economics in the TdF drilling program. Modeled "base case" well payback periods range from 0.4 to 1.1 years with IRRs ranging from 144% to >500% on a before tax basis. In any jurisdiction, those are impressive numbers. The company sells all their production based on U.S. dollar pricing, so the company is naturally hedged against the Argentinean peso.

Summary

In my view, Crown Point is best characterized as a skewed risk-reward trade. My investment thesis is based on my belief that the exploration targets provide exposure to outsized upside while the existing reserves and development wells should provide a solid value backstop close to core NAV.

The company has a clean balance sheet and is well funded to carry out its 2014 program, with an enterprise value of around half of what I view as a truly base-case NPV10. In terms of upside potential, I would suggest that the low-risk PQX-3 well could define something in the order of $50-60 million in incremental value (roughly equal to total current reserves), while the two Cerro de los Leones wells could each define $35-125 million in value on success. Recall that this is all on a company with a current enterprise value of $28 million.

Despite encouraging early data, I have assigned zero potential value for any prospective resources in the Vaca Muerta shale. Perhaps after one or both of the Cerro de los Leones exploration wells have drilled through this shale on the way to their target depths, I may have more commentary on the topic.

Risks

No discussion of a small-cap stock would be complete without a summary of the risks. First and foremost, the oil and gas industry has inherent risks with respect to drilling, completion, access to services, and any number of other operational components. These financial and operational risks are part of the industry and cannot be avoided, but can be magnified in small-cap stocks. Similarly, prospective structures and associated resources are based on existing "hard data", but until a discovery is made, those prospective resources are hypothetical in nature.

Next, it is important to remember that investing in assets in any foreign jurisdiction comes with inherent regulatory, economic and political risks. While I believe that sentiment in Argentina has turned the corner, I believe it is important to recognize the country as a higher risk jurisdiction. In this regard, smaller companies can be advantageous as they do not tend to attract the attention of politicians, but at the same time they hold little political sway. In essence, junior energy companies in foreign jurisdictions go with the tide, they do not influence it.

Commodity pricing is subject to change without notice as a result of global markets or government intervention. In Argentina, the government sets prices for domestic energy sales and has a habit of tinkering with local pricing structures, though recent developments have moved prices in the upwards direction. The macroeconomic justification for higher domestics energy prices is clear, but it is still important to keep an eye on the political landscape.

This list of risks is by no means exhaustive, but does reflect some of my key considerations with respect to my evaluation of the risk-reward balance for Crown Point Energy. It is a small-cap stock with all of the associated risks and rewards. Based on the information I've gathered, I like what I see. Time will tell.

Disclosure: I am long OTCPK:CWVLF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868591-a-diamond-in-the-rough-in-argentinas-energy-sector?source=feed

Aucun commentaire:

Enregistrer un commentaire