HealthSouth Corp (HLS)is a provider of inpatient rehabilitative health care services in the United States. I wasn't familiar with this specific company. A reader sent me a note asking for an opinion on this company. He really liked it mainly because of its attractive cash flows and margins.

The company turned out to be really interesting and I decided to turn the research into an article. One of the selling points of this thesis is the great cash flow that is obscured by temporary expenses, it's a healthcare company but instead of a one product company HealthSouth is in the diverse business of rehabiliation, in addition regulation and economies of scale add up to a narrow economic moat. As a cherry on top the company has paid down debt enough to start returning cash to shareholders.

It's unusual for me to research a company without using my screens to narrow down the field and then dismissing company after company because there is no long or short case to be made. I didn't expect to come out with a strong long or short. I was surprised when a DCF showed the company to be 10% undervalued. A comparison with competitors shows the company to be attractively valued on a relative basis as well.

Business Summary

According to Yahoo Finance; HealthSouth Corporation owns and operates inpatient rehabilitation hospitals that provide specialized rehabilitative treatment on an inpatient and outpatient basis in the United States. Its inpatient rehabilitation hospitals offer specialized rehabilitative care services to patients in various medical conditions, such as strokes, neurological disorders, hip fractures, head injuries, and spinal cord injuries.

As of December 31, 2012, it operated 100 inpatient rehabilitation hospitals, including 71 owned hospitals and 29 jointly owned hospitals in 27 states and Puerto Rico; operated 24 outpatient rehabilitation satellite clinics; and managed 3 inpatient rehabilitation units through management contracts, as well as provided home health services through 25 licensed and hospital-based home health agencies.

The company receives payment for patient care services from the federal government (primarily under the Medicare program), managed care plans and private insurers, and, to a considerably lesser degree, state governments (under their respective Medicaid or similar programs) and finally directly from patients. Revenues and receivables from Medicare are vital to its operations.

Digging through past news and articles on the company I quickly found out that Founder and former CEO Richard Scrushywas found liable for $2.876 billion in a civil trial in Birmingham, Alabama. This after Scrushy was found to have actively participated in fraud as described in this Bloomberg article.

Although this is not the kind of history you hope to encounter reading about a company, at least this affair is in the past. After having the FBI raid the company and the kind of media attention that come with open court trials it looks like the company has cleaned ship. All ties with Scrushy have been cut and he no longer has the right to a pension from the company.

Fellow Seeking Alpha contributor Brad Kenagy wrote about the stock on November 22 2013:

Going forward I believe the stable nature of its business along with its capital allocation programs, and strong demographic trends will lead to the shares moving higher from current level.

He is quite bullish on the company and although he makes a few compelling arguments there are also parts within his analysis that I think are overly optimistic or likely to be accounted for by the market.

For example he argues the stock is undervalued in part because of the aging demographic which he describes as follows:

The biggest catalyst for HealthSouth going forward is the continued aging of the United States population. According a recent CNN articlethe number of people who will be aged 65+ by 2030 is projected to double from current levels. This will be the driver for HealthSouth as a long-term catalyst for the company because as people age they are more likely to have medical issues

I'm afraid knowledge about the U.S aging demographic trend is widely spread. This trend is most likely fairly reflected in the price of the stock.

Another part of his, nonetheless interesting article, that I disagree with is his use of an eternal growth rate in his DCF of 1%. In my DCF I've used a terminal growth rate of 0%.

The reader who called my attention to this stock specifically mentioned positives like a solid free cash flow and the company's margins.

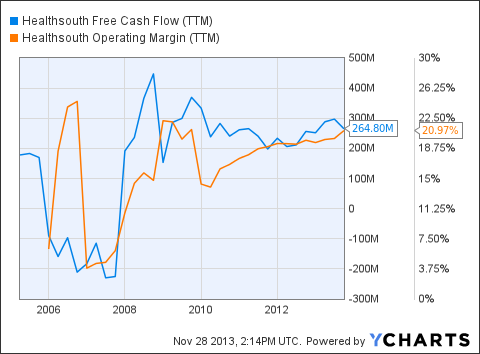

HLS Free Cash Flow (TTM) data by YCharts

From the graph its obvious margins are solid over the past few years and Free Cash Flow appears to be stuck but at least its close to $300 million.

Strengths

To develop an opinion on HealthSouth I researched both positive and negatives of the company and listed them in order to get a better picture of the fundamentals that I'm going to base valuation on.

Scale Advantage

As the nation's largest owner and operator of inpatient rehabilitation hospitals and with its business focused primarily on those services, the company believes it can offer a broader platform of services and provide clients with superior clinical outcomes. I'm not sure they can provide superior clinical outcomes but it is possible, as the largest operator of inpatient rehabilitation of hospitals it can leverage economy of scale advantages. And in this way provide the same care while attaining better margins or better care at the same margins.

The company's size helps to provide inpatient rehabilitative healthcare services on a cost-effective basis. Specifically because of its large number of inpatient hospitals. The company can take advantage of certain supply chain efficiencies. In addition, the company created and installed a proprietary management reporting system, which aggregates timely data from each of its key business systems into a comprehensive reporting package.

People

People are both a positive and a negative for the company. The company cites its people specifically as an important strength in its annual report:

We believe our 22,700 employees, in particular our highly skilled clinical staff, share a steadfast commitment to providing outstanding rehabilitative care to our patients. We also undertake significant efforts to ensure our clinical and support staff receives the education and training necessary to provide the highest quality rehabilitative care in the most cost-effective manner.

It's possible the company can educate and train its personnel in a more cost effective manner because of its scale. This would be a sustainable competitive advantage. However the company's reliance on the skill of its employees also has a downside. When a company relies heavily on the skills and training of employees it needs to keep them. That leads to higher wages, eroding the company's ability to achieve returns above cost of capital.

Technology

As a market leader in inpatient rehabilitation the company is also efficiently leveraging technology to improve patient care and operating efficiencies. Specific rehabilitative technology, such as its internally-developed therapeutic device called the "AutoAmbulator," utilized in its facilities allows the company to effectively treat patients with a wide variety of significant physical disabilities.

To date, HealthSouth has installed the CIS in 16 hospitals with another 20 installations scheduled for 2013. The company expects to complete installation in its existing hospitals by the end of 2017. CIS will improve patient care and safety and enhance operational efficiency. Given the increased emphasis on coordination across the patient care spectrum, CIS is also preparing the company for connectivity with referral sources and health information exchanges.

I'm citing this as a positive trait of the company because management believes it will impact patient choice. However I'm not entirely convinced it will and if it does, this advantage is most likely temporary in nature.

Demographic trend

Demographic trends, such as population aging, will affect long-term demand for healthcare services. While HealthSouth treats patients of all ages, most of its patients are persons 65 and older. The company believes the demand for inpatient rehabilitative healthcare services will increase as the U.S. population ages and life expectancies increase.

The number of Medicare-eligible patients is expected to grow approximately 3% per year for the foreseeable future, creating an attractive market for inpatient rehabilitative care. I do believe this is a strong positive factor for the company but I also believe the market is taking it into account.

Strategy

In its annual report the company lays out its strategic plan to provide high-quality, cost-effective care to patients in existing markets while seeking incremental efficiencies in its cost structure. It wants to achieve organic growth at existing hospitals and continuing to expand services to more patients who require inpatient rehabilitative services. Mainly by constructing and opportunistically acquiring new hospitals in new markets.

I'm pleased that management is seeking organic growth and will only acquire hospitals if there is a real opportunity. I also look favorable on the inclusion of strengthening the balance sheet in its annual report although this goal has been retired on the latest earnings call. Debt has been brought down but this is still a weakness of the company. The upside to the debt load is that it is a very reliable way to generate decent returns on invested capital for the company.

Competitive advantage

In some states and U.S. territories where the company operates, the construction or expansion of facilities, the acquisition of existing facilities, or the introduction of new beds or services similar to those offered by the company may be subject to review by and prior approval of state regulatory bodies under a "certificate of need" or "CON" law.

Barriers to entry because of government licenses are one of the few true competitive advantages as described by Bruce Greenwald in what I consider the bible on competitive advantage analysis: Competition Demystified.

The necessity for these approvals serves as a barrier to entry for competitors. and have the potential to limit competition, including in markets where the company has a CON and a competitor is seeking approval. As of December 31, 2012, approximately 49% of HealthSouth's licensed beds are located in states or U.S. territories that have CON laws.

Cash to shareholders

The company just announced a $200 million buyback plan and started issuing a dividend this year. I'm very fond of companies returning cash to shareholders and think this is a positive trait in any investment. I would be even more pleased if the company deleveraged a little bit more instead but this is great nonetheless.

Weaknesses

Like any investment HealthSouth also has a few weaknesses. For example its reliance on Medicare for revenue, debt load and the CON laws can also work to its disadvantage.

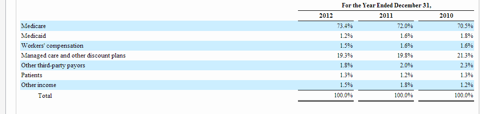

Reliance on Medicare

As the table above taken from the annual report shows, the company is very reliant on Medicare to generate revenue. On August 2, 2011, President Obama signed into law the Budget Control Act of 2011, which provided for an automatic 2% reduction of Medicare program payments for all healthcare providers in January 2013.

Additionally, concerns held by federal policymakers about the federal deficit and national debt levels could result in enactment of further federal spending reductions, further entitlement reform legislation affecting the Medicare program, or both. It's hard to predict what alternative or additional deficit reduction initiatives or Medicare payment reductions, if any, will ultimately be enacted into law.

Con Law

In some states and U.S. territories where the company operates, the construction or expansion of facilities, the acquisition of existing facilities, or the introduction of new beds or services is reviewed by state regulatory bodies under a "certificate of need" or "CON" law.

CON laws can make the company to abide by certain charity care commitments as a condition for approving a certificate of need. Any time a CON is required, the company must obtain it before acquiring, opening, reclassifying, or expanding a healthcare facility or starting a new healthcare program.

The company potentially faces opposition any time it initiates a certificate of need project or seek to acquire an existing facility or CON. This opposition may arise either from competing national or regional companies or from local hospitals or other providers which file competing applications or oppose the proposed CON project.

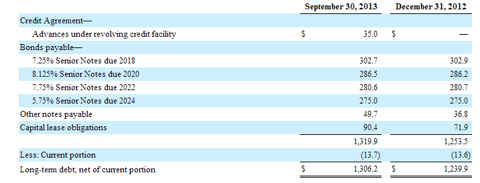

Debt

Because its debt load is a risk factor, I've included a table with an overview of the company's debt. This also gives an idea of the level of interest the company is paying and what it means in relation to the company's cash flows.

On October 29, 2013, the company gave notice of its intent to redeem $30.2 million and $27.9 million of the outstanding principal amount of the existing 7.25% Senior Notes due 2018 and the existing 7.75% Senior Notes due 2022, respectively. Which will result in a total cash outlay of approximately $60 million to retire the $58.1 million in principal. This redemption is expected to close in November 2013.

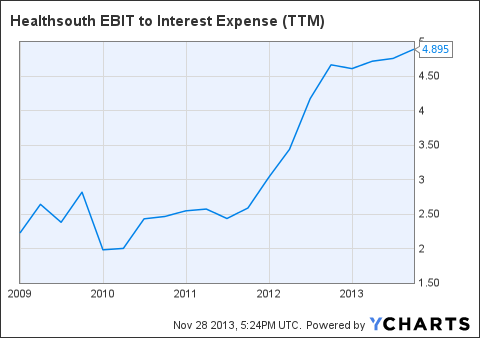

HLS EBIT to Interest Expense (TTM) data by YCharts

The EBIT to interest expense ratio is improving but the company is not as financially sound as I would like to see it. The company listed improving its balance sheet as a strategic priority in last year's annual report - among selected others - and I think it should be.

Yet management is of the opinion that it is safe to start returning cash to shareholders as stated in the latest earnings call:

in January, we announced we would be looking for ways to return capital to our shareholders because we had successfully deleveraged the company, and were generating free cash flow in excess of what was required to fund our organic growth.

In the first quarter, we launched and completed a tender offer for our common shares, resulting in the repurchase of approximately 9.5% of our then-outstanding shares at a price of the $25.50. In the second quarter, we announced the initiation of a quarterly cash dividend of $0.18 per share, which we paid on October 15. And yesterday, we announced a share repurchase authorization for up to $200 million of our common stock. We believe these actions clearly demonstrate we are proactively executing this new element of our business plan and remain committed to returning excess free cash flow to our shareholders.

On the other hand the patient base is quite diverse and among medical equipment/services company's HealthSouth is relatively safe from the discovery of miracle cures. Returning cash to shareholders is the second best use of capital I can think of.

Competition

Morningstar listed the following companies as competitors to HealthSouth. In addition they also listed two others but as they were almost exclusively providing dialysis care, I left them out. I didn't review them on valuation.

Fresenius SE & Co KGaA ADR (OTCPK:FSNUY) is a health care provider with products and services for dialysis, hospitals, and outpatient medical care. The company also offers engineering and services to other hospitals and health care facilities.

HCA Inc. (HCA) is a health care services companies with no less than 157 general, acute care hospitals; five psychiatric hospitals; and only one rehabilitation hospital.

Universal Health Services, Inc, (UHS) owns and operates, acute care hospitals, behavioral health centers, surgical hospitals, ambulatory surgery centers and radiation oncology centers.

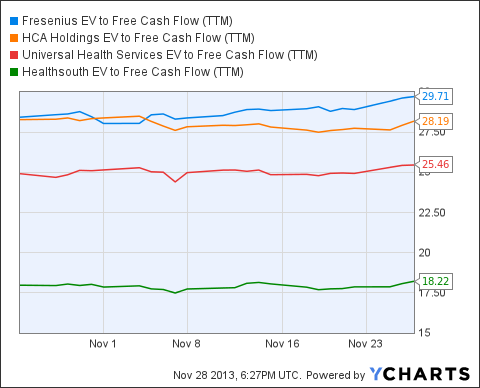

My go-to metric to compare competitors is EV to Free Cash Flow. As you can clearly see in the graph below, HealthSouth is trading at a quite elevated absolute level, 18x is not exactly cheap, but at a very attractive relative valuation. This certainly helps the frequency with which takeovers or mergers will materialize.

FSNUY EV to Free Cash Flow (TTM) data by YCharts

Valuation

I was very happy to see that the company broke out maintenance CapEx in its recent financial statements as this makes a DCF a lot more reliable.

Maintenance CapEx for the first 9 months of 2013 was $54.3 million. The year-over-year decline in maintenance CapEx for the first 3 quarters of 2013 is predominantly a pacing issue, and our estimate for the full year remains at $80 million to $90 million.

I will base my DCF on operating cash flow but subtract maintenance CapEx from this number. That puts Free Cash Flow at $389 million.

The company has a narrow economic moat because of the barriers of entry in the shape of the CON law combined with a minor advantages gained because of economies of scale in its specific industry. Because of this narrow economic moat I'm extending my DCF calculation to 7 years into the future. The narrow economic moat also leads me to believe the company will be able to grow at least at the same rate as its market is expanding. You can make a case that it will most likely grow slightly above the speed at which the market is expanding. After that I'm going to assume 0 terminal growth.

Finally I will discount against the historic average of the S&P 500, or about 11%.

This leads me to the conclusion that the present net value of a share of HealthSouth is $39.34 dollar. That means that the share are 10% undervalued at a share price of $35.69.

Conclusion

HealthSouth is 10% undervalued by DCF and even more when compared on a relative basis. The business of rehabilitation is fairly robust. It's unlikely a magic potion will wipe out the need for these services. Because the company is focused on rehabilitation it enjoys economy of scale advantages over many competitors. In addition, regulation provides hurdles to competitors in 49% of the company's markets. Together this adds up to a narrow economic moat.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868541-healthsouth-narrow-economic-moat-and-strong-free-cash-flow-at-a-10-discount?source=feed

Aucun commentaire:

Enregistrer un commentaire