Astoria Financial (AF) is a small (~$1.4B market cap) thrift operating in the New York City area. The firm is one of the most interesting small financials I follow because it has a lot going for it (geographic location, extreme benefit from rising rates, attractive proposition as a takeover target), and a lot working against it (heavy loan origination competition and an undiversified base of operations). On the whole the firm is definitely interesting as an investment… at the right price. And having seen the price rise more than 10% in the last month, investors might want to wait a little and see if the stock price comes back down a bit before establishing a position.

Firm Overview and Recent Results:

Astoria is a fairly unique financial company, so a bit of background is probably useful here. AF operates about 85 bank branches in Brooklyn, Queens, Nassau, Westchester, and Suffolk counties. It uses the deposits brought in by these branches to invest in 1-to-4 family mortgage loans, mortgage backed securities, commercial real estate loans, and multi-family mortgage loans. Traditionally, most of the firm's emphasis has been on making or purchasing adjustable rate mortgage loans for one-to-four family properties that are occupied by the property's owner. Recently it has diversified into the other loans mentioned above, particularly interest only loans, but one-to-four family mortgages still make up 66% of the firm's loan base. Multi-family mortgages make up another 25% (and growing rapidly as I will discuss later), while other loan and security types make up the remaining 9% of the firm's outstanding portfolio.

Now as I mentioned earlier, Astoria has a lot going for it. Its home NYC area is a pretty stable economy that has done fairly well even during the recession. The population base is robust and the housing market has been very solid. Further as the financial center of the US (and arguably the world), NYC naturally has very limited real estate which makes opening new bank branches difficult. Thus Astoria's network of established branches has a lot of value to potential acquirers, and the robust economy has kept the deposits flowing in and the loans flowing out.

The Benefit from Rising Rates:

Further, given Astoria's focus on ARMs, it is one of the few companies that will most certainly profit from rising interest rates, especially on the long-end of the curve (rising rates on the short end of the curve make its deposits more costly but also improve the profitability of short-term loans for the firm). In fact, the firm's net interest margin is already starting to improve, and management called out rising rates as a major driver for near term future profitability in the company's most recent conference call. In the most recent quarter, the net interest margin for the firm rose to 2.28% from 2.22%, and while analysts expect a ~1.8% fall in net interest income ($342mm) during 2013 vs. 2012, it also looks like the company is setting up for an 8-10% increase in 2014 (~$370mm).

These rising rates will not only make the firm's ARM products more profitable, but they should also improve their appeal to the public versus the competition. As interest rates rise, it should be less advantageous for consumers to lock in low rates via fixed rate mortgages, and ARMs should begin to gain greater appeal. The issue of fixed rate mortgage competition has dogged Astoria for some time, and any alleviation of this competition would have serious benefits.

Revenue (Million $) | 1Q | 2Q | 3Q | 4Q | Year |

2013 | 152.3 | 148.4 | 142.9 | -- | -- |

2012 | 177.4 | 168.3 | 164.9 | 163.2 | 673.8 |

2011 | 204.6 | 195.6 | 185.3 | 178.8 | 764.2 |

2010 | 247.3 | 243.8 | 228.2 | 217.2 | 936.5 |

2009 | 283 | 273.7 | 262.2 | 258.5 | 1,077 |

2008 | 294.5 | 291.5 | 218.6 | 296.2 | 1,101 |

Earnings Per Share | 1Q | 2Q | 3Q | 4Q | Year |

2013 | 0.14 | 0.13 | 0.15 | E0.18 | E0.60 |

2012 | 0.11 | 0.13 | 0.14 | 0.17 | 0.55 |

2011 | 0.29 | 0.18 | 0.12 | 0.12 | 0.7 |

2010 | 0.14 | 0.17 | 0.23 | 0.25 | 0.78 |

2009 | 0.1 | 0.03 | 0.09 | 0.09 | 0.3 |

2008 | 0.32 | 0.37 | -0.18 | 0.33 | 0.83 |

Loan Portfolio (Lack of) Growth:

Despite all of the advantages that Astoria has, the firm has also faced significant competition on loans in recent years and this has led to sustained declines in revenues and the size of AF's loan portfolio. This isn't really Astoria's fault though. Banking in general has gotten very competitive of late and nowhere is this truer than in loan origination in the thrift and mortgage finance business.

Traditionally, ARM loans offer interest rates that are lower at any given point in time than a newly originated fixed rate loan (since the interest rate risk is being transferred from the lender to the borrower). Yet as a result of the financial crisis and all of the bad press ARMs have gotten, most consumers have tended to shun variable rate loans. This has become more feasible in the low fixed rate environment where consumers do not need the interest rate break offered by ARMs in order to afford the house they want to buy. Further, with rates so close to zero, it is literally impossible for mortgage rates to go a lot lower, and this has taken away a significant incentive for consumers to use ARMs. These competitive headwinds for the ARM loan market should start to subside as the memory of the financial crisis grows more distant and the Fed becomes more willing to raise rates going forward.

No company that I'm aware of is better positioned to benefit from a rebound in ARM volumes than Astoria Financial. While Astoria does make fixed rate loans, ARMs have historically been a big part of their business. And a rebound in ARMs cannot come soon enough. With the company's loan book having shrunk 1.0% sequentially primarily due to a 3.8% decline in outstanding one-to-four family mortgages, Astoria shareholders really want to see loan portfolio growth. This desire has gone unrewarded in recent periods as the firm's book has shrunk in all but two quarters of the last four years. The firm's loan book and deposit base both peaked in 2008 at $16.6B and $13.5B respectively and are closer to $13B and $10.4B today. Given this, it should be no surprise that Astoria has struggled to grow net interest income and its bottom line despite a stable and even slowly increasing tangible book value per share (~$11.60 today).

Fortunately, this shrinking book has not created a market for lemons problem for Astoria, and the firm has been able to maintain credit quality. Charge-offs and non-performing loans are in-line with peers, and have been coming down since the financial crisis.

Takeover speculation:

While the competitive concerns and low rates have definitely been major headwinds for AF in recent quarters, one major positive for the stock is its attractiveness as a takeover candidate. In August of 2012, Hudson City Bancorp got a takeover offer at a sizeable premium. As a close competitor to Astoria, this immediately raised the likelihood of Astoria also being taken over, and this speculation has helped to buoy the shares ever since. With the Hudson City takeover now more than year in the rear-view though, it is surely obvious that a buyout of Astoria is not a foregone conclusion. Nonetheless, at the right price, Astoria is surely attractive to a variety of bidders and this attractiveness will only increase as rates rise. None of this is a guarantee of a takeover, especially imminently, but it should play into the calculus of any intelligent investor.

Valuation:

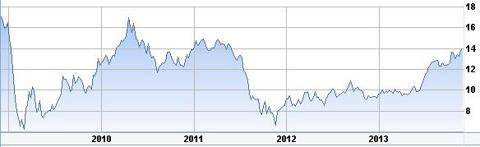

This takeover speculation along with the prospect of greatly improved profitability thanks to rising rates are probably the two most important factors supporting Astoria's admittedly rich valuation, especially lately with the stock up 10% in the last month.

Given the rich valuation, recent rise in the stock's price, highly speculative embedded takeover expectation, and tough competition Astoria faces, one might wonder why investors should have interest in the stock at all. The answer is entirely based on the stock's potential to return to its former glory days of 6-8 years ago. Back then, Astoria made 4 times the profits that it does today and its stock was 3-4 times higher even after the recent run-up. Now with TBV for AF sitting just below $12, and a widespread degree of investor caution regarding financials in play right now, Astoria surely does not merit a $30 price today; but it might in two years. Astoria's loan book has shrunk by 25% over the last 5 years, but the stock price has cratered much further. If interest rates start to rise at even a moderate pace, than historical trends suggest that Astoria's profits could easily double and its book value could grow more than 30% a year. Analysts aren't looking for anything quite this optimistic (consensus 2014 EPS of $0.65), but investors appear to be betting on pessimism among analysts here. Thus while the stock is trading at 1.2x TBV and ~23x this year's EPS, investors think it has more room to run. I'm not so sure most of the gains aren't priced in at this point, but I also wouldn't want to be short the stock here either.

Conclusion:

As I see it, Astoria Financial is too richly valued and faces too much competition right now to justify a long position. Yet if the Fed really does start raising interest rates and the long-end of the yield curve rises, the stock will become much more attractive. Given that, potential investors in AF should pay attention to the Fed and think carefully about their investment time horizon. Rates will almost certainly rise eventually and this will benefit AF shareholders, but the timing of these rate increases and the thrift's business improvement are far more uncertain. Caution is warranted given the exuberant run-up in prices lately.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868941-astoria-financial-rising-rates-are-major-positive-but-may-be-baked-into-price?source=feed

Aucun commentaire:

Enregistrer un commentaire