Finding undervalued companies in defensive sectors can be difficult in today's capital market. The bull run in 2013 has pushed indexes to all-time highs despite the macroeconomic uncertainty. There are no profitable places to store money expect from stocks, and why pay high prices for good companies like most investors do today? I would rather own cash than securities in overvalued companies. Buffett once said that waiting for the perfect company can be the hardest thing of all and most people can probably nod of this statement. I have, however, noticed a certain German food giant on sale due to market uncertainty within the European Union.

About Süedzucker AG

Süedzucker AG (GM:SUEZF) is a global German food group. The company was established in 1837 and back then, Süedzucker's activities was only focused around the production of sugar. The company has merged several times since then, adding new divisions and product segments to the group. Today Süedzucker has approximately 100 production facilities, 17.900 employees worldwide and a market capitalization of $5.2 billion. The revenues from 2012/13 equaled to $10.7 billion and the net income amounted to $1 billion. An interesting fact is that the company has quadrupled its net earnings since 2008 with the same number of employees.

The main segment is still sugar and Süedzucker is the biggest producer of sugar beets in Europe. The other segments are bioethanol, fruit preparations and concentrates and lastly a special products segment constituting of e.g. starch, frozen pizzas and portion packs. The company's segments shows a picture of a company with a strong and demanded product portfolio resistant to macroeconomic turmoil. The segments are explained further below.

- The sugar segment constitutes 52% of the groups total revenues. Süedzucker is the market leader in Europe and produced 4.9 million tonnes of sugar in 2012/13. The company has 29 factories and 3 refineries. Some of the sugar is distributed through various brand names to supermarkets around Europe to consumers. Moreover, the sugar is also used in candy, beverages, jam, preserved fruit, milk products, ice cream, biscuits and for pharmaceutical and chemical purposes. Süedzucker has established strong and long-term partnerships with key sugar producers in the LDCs (Least Developed Countries) and ACP countries (African, Caribbean and Pacific states). Only 18% of a sugar beet is used as raw sugar. The rest is used in Süedzucker's other divisions to produce e.g. animal feed and fruit concentrates.

- The special products segment constitutes 24% of the groups revenues. BENEO is part of the Süedzucker group and produces nutrients that ensures healthy and sustainable ingredients in human and animal food. The Freiberger brand produces chilled and frozen pizzas, frozen pasta as well as snacks. Freiberger is the biggest distributor of frozen pizzas in Europe and 2 million frozen pizzas are produced daily. Süedzucker is also the biggest manufacturer of portion packs on this continent. Finally, the starch division produces starch for food and non-food sectors as well as bioethanol.

- CropEnergies is Süedzucker's division for the manufacturing of sustainably produced bioethanol. The main customer group is the fuel sector. This segment constitutes 8% of the total revenues. Süedzucker is the largest producer of bioethanol in Germany and one of the largest in Europe. CropEnergies contributes to the production of food and animal feed as well.

- The fruit segment is an exciting new play. Süedzucker is the global market leader on this area and the main purpose is to produce fruit preparations for international food companies. The fruit preparations are used in e.g. dairy, ice cream and baked goods. The company has 26 production locations around the world. Moreover, Süedzucker produces fruit concentrates. The main juice concentrates are for apple and berry juice. Süedzucker is the market leader in Europe with 15 production locations. The fruit segment forms 16% of the revenues.

All segments except the fruit segment are experiencing significant increases in commodity costs, thus resulting in a sharp decrease in this years profit expectations. Therefore the management expect an operating profit in 2013/14 of only $884 million compared to $1325 million in 2012/13. Furthermore, the management downgraded the expectations from an operating profit in 2013/14 of $1122 million earlier this year. The revenue expectations got downgraded too from $10.9 billion to $10.3 billion. However, the fruit segments experiences substantial growth in revenues and profit. Revenues are up 10% to $854 million in the first half of 2013/14 and the operating profit of $58.5 constitutes a 72% increase. Regardless of previous years development, the current year does not look good compared to the historic financials, hence the current low valuation which I will elaborate below.

As the reader might notice, these segments are quite resistant towards macroeconomic uncertainty and what is even more exciting is the fact that Süedzucker benefits from the global mega-trends. The demand for food, energy and healthy ingredients will probably increase at a stable rate together with the expanding global population and rising incomes, and Süedzucker is definitely capable of exploiting this growing demand.

Fantastic balance sheet but challenged earnings

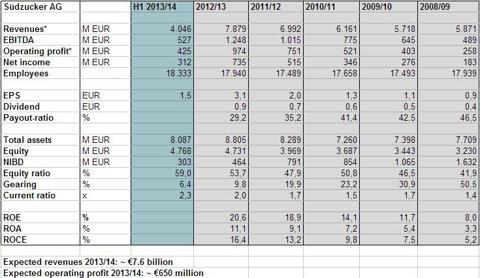

Even though Süedzucker faces higher commodity costs in the current financial year thus leading to a significantly lower profitability, the balance sheet still looks extremely sound and solid as shown below. The currency used in the figure is the euro.

The numbers for 2013/14 are for the first half of the financial year. As you will notice if you study this table, Süedzucker has a very solid capital structure with an equity ratio of 59%, low net financial debt constituting a gearing of just 6.4%. Moreover, the liquidity is also improving with a current ratio of 2.3x. The profitability has also been magnificent in the period shown above. The EBITDA-margin has improved from 8.3% to 15.8% and the operating margin has improved from 4.4% to 12.4%. The cash flow is also sound with a CFO in H1 2013/14 of $825 million and a net cash flow of $171 million after investing and financing activities. The adequate operating profit together with the low debt resulted in an interest coverage ratio of 11.7x in 2012/13.

The net result has quadrupled since 2008/09 thanks to cost cutting and rising revenues. This has also led to a 5-year dividend growth of 125%. The dividend for the financial year 2012/13 was of €0.9 per share ($1.2). The current dividend yield is therefore 4.8%. I expect yet another adequate dividend for 2013/14 even though the current earnings are challenged compared to previous years. The cash flow is still healthy in the first half of 2013/14 and the operating cash flow from last year of $1059 million covered the cash outflows of $282 from dividends nicely. This will probably be the case as well in this financial year. Moreover, the payout-ratio is far from dangerous heights as shown above. I expect an EPS for 2013/14 of approximately 2.35 EUR which equals to a payout-ratio of 38% if the dividend is kept at the same level. Therefore I do not see any reason as to why the dividend should get reduced. Süedzucker has no debt, a strong balance sheet and a nice cash flow. It is probably more likely that they will increase the dividend. However, the management recently downgraded this years expectations as mentioned above. The company expects revenues of $10.3 billion and an operating profit of $884 million, thus resulting in a sharp stock price decline of nearly 50% since March.

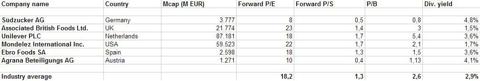

Below I have compared Süedzucker with a peer group consisting of Associated British Foods Ltd. (OTCPK:ASBFY), Unilever PLC (UL), Mondelez International Inc. (MDLZ), Ebro Foods SA (OTCPK:EBRPY) and Agrana Beteiligungs AG (GM:AABGF)

The expected EPS for 2013/14 of 2.35 EUR equaling to a forward P/E of 7.8x. The current market capitalization of $5.3 billion forms a 21% discount on the company's equity of $6.5 billion. Even if I subtract the hybrid capital of $816 million, the equity is still cheap compared to its peers. Moreover, the company provides the investor with the highest dividend yield in the chosen peer group. It seems that much of the downside is already reflected in the stock price providing the investor with a substantial margin of safety together with a high dividend yield.

The EU sugar market

Politics and lobbyism are important factors for Süedzucker. Even though the company has a strong and defensive portfolio, policies from the EU can have both good and bad consequences. The European Union is the biggest producer of beet sugar in the world and the dominant importer of raw cane sugar for refining. The sugar market in EU is regulated through production quotas, trade mechanisms and a minimum beet price. If the quotas are exceeded the amount can be used for e.g. biofuel or other non-food use. Recently the EU chose to postpone the expiration of the current sugar beet quotas and minimum price regulations from 2014/15 to 2016/17. This will result in greater price and volume volatility. Süedzucker continues the negotiations with the EU Parliament and the Council of Agricultural Ministers regarding the postponement of the expiration to 2019/20. Time will tell if their efforts pay off. Süedzucker calls for effective, budget-neutral safety nets to be installed when the current regulations end in order to be able to combat market crises. Similar crisis management mechanisms are available to other agricultural sectors and experience there has shown the necessity to install defined crisis management tools before crises actually occur. Despite these future problems, Süedzucker sees it self fit to face the challenges when the minimum beet price and quota regulations expire on September 30, 2017. This is especially due to the company's strong and long-term partnerships with its sugar farmers.

Conclusion

As mentioned before, Süedzucker faces significantly higher commodity costs in three out of four segments in 2013/14. This has resulted in a considerable decrease in profits. The current financial year will therefore look quite weak compared to the previous years, but the balance sheet looks stronger than ever. Moreover, Süedzucker continues to invest in its newer segments such as fruits, and the revenue risk will therefore spread more evenly over the company's four segments with time. As the famous Danish physicist, Niels Bohr, once said: "Prediction is very difficult, particularly when it concerns the future". I do not dare to guess when the earnings will improve, nor will I try to estimate the earnings after 2013/14. Nevertheless, the stock price has been cut in half since March 2013 because of these downgrades, thus resulting in a high dividend yield of 4.8%.

The market seems very pessimistic about Süedzucker, and this could very well be a good entry point for the fearless investor. The company is valued considerably lower than its peers and provides the investor with a high yield, a fantastic balance sheet and a sound cash flow. The earnings are challenged, but the company is well positioned to take advantage of mega-trends, and a potential favorable solution of the regulation issue can help as well. Moreover, Süedzucker has a strong market position to endure these obstacles. I believe that Süedzucker will succeed in maintaining a sufficient profitability during these challenging times. Until things look better the investor can enjoy a high yield and the comforting fact that this company is sound and solid in a strong industry that is destined to grow steadily - forming a high margin of safety. We will always need Süedzucker's products, so why not own this cheap and healthy company?

Disclosure: I am long GM:SUEZF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

Additional disclosure: I may increase my position in Süedzucker AG within the next 72 hours.

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868251-suedzucker-a-cheap-food-giant-with-a-high-yield?source=feed

Aucun commentaire:

Enregistrer un commentaire