General Dynamics (GD) is one of many companies sharing its success with investors through paying dividends and share repurchase programs. The stock has a dividend yield of 2.4% which is much higher than the industry average of 1.7%. The company's average dividend payout ratio (Dividends-to-Net Profit) over the last 10 years was 25.28%. Moreover, the company has repurchased common shares outstanding of $4,986 million over the last five years. Now, here the question arises as to whether or not General Dynamics will be able to continue sharing its success with investors through paying high dividends and share repurchase programs. I shall strive to answer that the question by analyzing the company's ability to generate earnings and cash flows in the future since dividends depend upon the company's ability to generate earnings and strong cash flows.

Both strong cash flows and high earnings depend upon the growth in the company's top line. Therefore, I will analyze the company's ability to generate revenues in the future so that I can derive an answer to the question posed above. The company operates four segments: Aerospace, Combat Systems, Marine Systems and Information Systems & Technology. I shall briefly analyze the performance of each segment. Moreover, I shall also deeply analyze the company's ability to generate revenues from each segment in order to come to an informed conclusion about the company.

Aerospace

Aerospace generated approximately 26 percent of total revenues during the first nine months of the current fiscal year. Year to date revenue grew by 18.5% compared to the results of the same period of fiscal year 2012. The segment's operating margin during the second to fourth quarters of2013 was 17.9%.

High operating margins in this segment were mainly due to high growth in revenues. Due to the expected strong deliveries of Gulfstream aircraft, in the short run, the segment's revenue is expected to experience a decent growth which will help the company to report high operating margins. High operating margins will lead to high earnings growth as well as high cash flows in the future.

Combat Systems

The company witnessed a decline of 25.7 percent in the revenues during the first nine months of the current fiscal year. This segment contributed approximately 19 percent to total revenues whereas the operating margin was 14.7% during the second to fourth quarters of 2013. Cuts in US Army spending and delays in international orders not only reduced the revenues of this segment in the first three quarters of the current fiscal year but its impact can also be seen on revenues in the near future. However, despite the razor sharp decline in revenues the company recorded decent operating margins which indicates that the company is successfully controlling its cost of revenue and operating expenses and this helped the company to report decent operating margins.

According to the company's recent quarterly filing, this segment's revenues are expected to decline to 20 percent by the end of fiscal year 2013. The long-term outlook of revenues of this segment looks negative because of cuts in the US Army budget. Therefore, I believe that the revenue of this segment will be in trouble. However, I believe that the company will be able to contain its cost of revenues as well as operating expenses and that this will eventually help the this segment to report high operating margins. Cost efficiency will not only help the company to post high earnings but will also help the company to generate high cash flows even in during challenging economic conditions.

Marine Systems

Marine Systems generated 22 percent of total revenues and the revenues of this segment improved by 1.6% during the first three quarters of fiscal year 2013. This segment's operating margin was 10 percent during the second to fourth quarters of 2013which is lower than the year to date operating margin of this segment in fiscal year 2012.I believe that the company's ability to generate high cash flows from this segment will deteriorate.

Information Systems & Technology

Information Systems & Technology generated 32.8% of total revenues during the second to fourth quarters of 2013. This segment's revenues increased by 1.8%, to $7,577 million, over the first three quarters of the current fiscal year. Its operating margin during the first three quarters was 7.9%which is lower than the year to date operating margin of the last fiscal year. The company stated in its recent quarterly filings that the revenues of this segment will decline slightly in full fiscal 2013therefore I believe that the company's ability to generate high cash flows will deteriorate.

Industry Outlook

The U.S Defense spending has declined over the last several years in order to reduce the federal deficit. The Budget Control Act of 2011 stated that the US would have to cut its previously planned defense funding to $487 billion or by about 8 percent over the next several years. A cap on discretionary spending will help the US Government to save more than $900 billion until 2021. This is important because the companies that are providing services to the US Department of Defense might be in trouble in the long-run. The decrease in discretionary spending would harm the revenues of companies like General Dynamics. However, General Dynamics is efficiently managing its cost of revenues and this is not only helping the company to report high earnings but also high cash flows even during the turmoil in the industry.

Sustainability Measures for Dividends

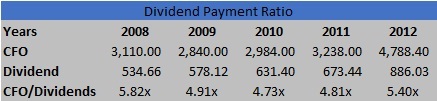

There are certain measures that can help us to identify the sustainability of dividends. I believe the dividend payment ratio and dividend payout ratio are two important ratios that can help us identify the company's ability to create or sustain dividends. If dividend payout is less than 30% then it implies that thecompany's dividends will increase in the near term.

As shown in the following table, the dividend payment ratio of the last five years remained in the range of 4.73 times to 5.82 times. I have used the adjusted operating cash flow of fiscal year 2012 to compute the dividend payment ratio.

In order to calculate the dividend payout ratio and examine the sustainability of dividends I have used the free cash flow to equity ratio instead of earnings as the denominator. I did this because cash flows are difficult to manipulate compared to earnings. Average dividends-to-FCFE ratio over the last five years was 27.38% which is less than 30%. Therefore, I can conclude that the company's dividends will increase in the future because it is unlikely that the company will use capital spending in order to expand its capacity when the industry has a negative outlook.

Final Call

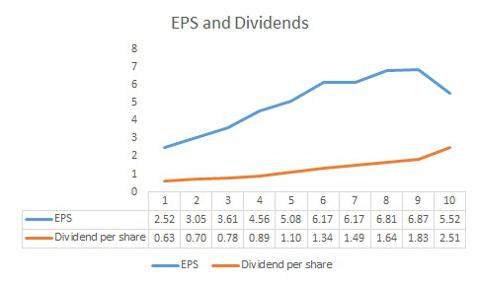

(click to enlarge) As shown in the following chart, most of the time, the company's dividends have increased along with the earnings over the last ten years.

As shown in the following chart, most of the time, the company's dividends have increased along with the earnings over the last ten years.

Moreover, the company is consistently paying higher dividends than the industry and the company's average modified payout ratio was approximately 69% over the last five years. The stock has a dividend payout ratio of 27.38% which is lower than the 30%, and the dividend payment ratio was between 4.73 times to 5.82 times over the last five years. Both measures indicate a strong sustainability of the dividends. In addition, Both the Aerospace and Combat Systems segments are expected to have decent operating margins which will help the company to produce strong cash flows. Moreover, the company does not have any plans to expand its business in such an environment. Therefore I believe that the company's dividends will grow in the future and create value for its shareholders. I believe that the company will not only continue to pay high dividends but also its dividends will remain sustainable in the future. For those investors who are interested in dividend-paying stocks I would recommend buying this stock.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868361-what-makes-general-dynamics-a-worthy-investment?source=feed

Aucun commentaire:

Enregistrer un commentaire