Since the last time that I wrote about Splunk (SPLK), the share price has increased substantially; I was looking at Splunk as a short candidate, back in August. I think my biggest mistake was viewing Splunk as a value play rather than as a momentum play. From a value perspective the company is overvalued, but from a momentum perspective Splunk can continue to meet and beat growth expectations. I was wrong, and I'm going to have to eat a slice of "humble pie."

But that is a mistake that I am able to put into an analytic context and I won't make that mistake again. Now moving on to what has happened with Splunk since the last time wrote about the company.

The fundamentals of this company are bullish; according to management, Splunk is on pace to take the largest share of IT wallet. Also, the company remains undervalued. As a consequence of the aforementioned, and because I'm not a nimble trader, I'm going to have to wait for a bearish catalyst to sell short shares of Splunk.

Fundamental Analysis

Splunk reported revenue that was up 51 percent compared to last year in the third quarter. Management is looking for Q4 revenues between $88 million and $90 million and full-year revenues in the range of $291 million $293 million.

The company recently released new products including Splunk Enterprise 6, a new app for VMware (VMW), and a partnership with Amazon Web Services; these products should be able to help Splunk maintain the pace of revenue growth in 2014.

The enterprise's customer base has increased to over 6,000 users. This leads me to think future revenues growth has to come from selling more products to existing customers rather than coming from increased customer count. In other words, I am looking at revenue per customer as a key indicator. But with slightly less than half of the Fortune 500 using Splunk, there is room for customer count growth. Additionally, I will be looking for the international expansion to drive revenues growth.

A couple key points, Splunk is on pace to take one of the largest shares of IT expenditure. Next, customers are using Splunk more than originally estimated; people are buying a fixed amount of data for say 18 months and they are coming back in 7 months and saying that they need more space.

In summary, Splunk is driving revenue growth through cross-selling to existing customers, international expansion, and the increased use of the traditional package by existing customers. This seems to be a solid multi-pronged approach to continuing to drive revenues growth.

There are a few threats to revenues growth. Splunk faces the threat of having its customers develop their own solutions. Also, traditional enterprise applications vendors have relationships with Splunk's customer base and may be able to offer a better solution than Splunk is able to offer. Simply said, there are competitive forces that should limit Splunk's profitability.

One of the tools that I will use to analyze Splunk is the momentum indicator, the rate of change. I will apply it to the revenue growth rate to get a better indication how the growth rate is changing over time. In this way, I may be able to more accurately forecast when Splunk will report revenue growth that comes in lower than expected.

We are seeing a decline in the pace of revenue growth, but I need more data points to increase the accuracy of the forecast.

The fundamentals of Splunk are bullish. As much as I would like them to be bearish, that is not the case; Splunk seems to be able generate mid-double digits revenue growth for at least the next fiscal year. Part of the revenue growth will be driven by the increased indexing of data. Even though Splunk is overvalued, the fundamentals suggest that the market for shares will continue to be bullish.

Valuations

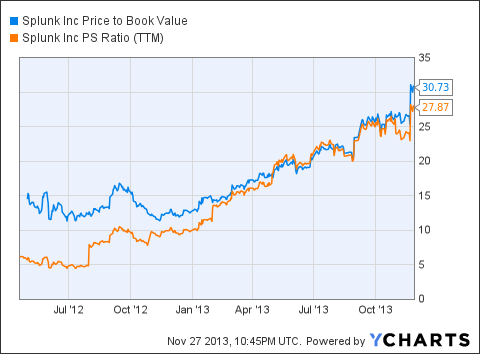

At a price to book of 30, I believe that the market has priced in a significant amount of growth. Using the classical models, the growth rate would be above the required rate of return, which would mean that Splunk has an infinitely high valuation. Clearly, that is not economic reality. Further, book value would have to increase significantly to justify paying the current price.

Lastly, relative to the industry, and the S&P 500, Splunk is overvalued.

I can not justify an investment in Splunk at these valuations. I think the best play here is to wait for an economic reason, a catalyst, to get short shares of the overvalued enterprise applications vender.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1868301-splunk-im-watching-for-slowing-revenue-growth?source=feed

Aucun commentaire:

Enregistrer un commentaire