I'm the eldest of five sons and one of the first things every big brother learns is that tormenting his younger brothers can be tons of fun. Some habits are hard to break and I've done my share of tormenting less experienced investors who believe in an EV Santa Claus. Every once in a while, however, every good big brother sits down and tells his siblings the plain truth about the joys, opportunities and challenges of life without deliberately pushing their hot buttons. Since I'm in a festive mood after a wonderful Thanksgiving dinner I'll take the rhetoric down a notch and see if a calm voice of reason can soothe bruised egos and explain the giga-scale battery challenges Tesla Motors (TSLA) must overcome if it wants to be more than a niche manufacturer of toys for rich boys.

Battery Supply Challenges

Over the last few months there's been a growing awareness that Panasonic doesn't have enough battery manufacturing capacity to satisfy Tesla's growth targets. While the two companies have inked an agreement that will give Tesla the ability to buy up to 2 billion cells over the next four years, Tesla can't make more than 300,000 cars with those cells. Tesla should have adequate cell supplies for likely sales of the Model S and potential sales of the Model X, but it can't seriously consider launching a third generation EV for the mass market without locking down a robust and dependable supply chain for the batteries those cars can't do without.

Finding adequate battery supplies for its planned third generation EV is, by definition, a giga-scale battery challenge that will be difficult and expensive for Tesla to overcome.

Everyone knows lithium-ion battery manufacturers overbuilt production capacity in anticipation of an EV market that evolved more slowly than the pundits predicted. That capacity glut drove cell prices down to ridiculously low levels as battery manufacturers faced the difficult choice of losing money on battery sales or losing more money decommissioning factories. Historically, Panasonic was willing lose a little money on battery sales to Tesla, or at least forego its normal 25% gross margin on battery sales in the hope that a robust new market for its obsolete 18650 cells would keep its factories working and defer decommissioning costs.

While nobody is discussing the details, I don't believe Panasonic's cell pricing under the new contract is as attractive as it was under the old contract. Tesla designed its cars for the specific performance characteristics of Panasonic's 18650 cells and it cannot easily substitute cells from Samsung or LG Chem because both of those companies use proprietary chemistries that perform differently than cells from Panasonic. If Tesla wanted to substitute cells from Samsung or LG Chem for cells from Panasonic it would need different pack designs and battery management strategies. A substitution wouldn't necessarily require Tesla to redesign its packs and control electronics, but the effort and expense would be substantial and ultimately futile since neither alternative supplier has enough capacity to meet Tesla's anticipated needs.

Ultimately Tesla faces the same challenges that all automakers faced when they were getting started. It's difficult for a manufacturer to spend 25% of its retail price on components from another company that expects to earn a normal profit margin. Problems arise because layering a second margin on top of a major component supplier's margin pushes prices to unreasonable levels. The only way to avoid the problem is aggressive vertical integration of major component systems. If Tesla wants to be more than a niche player in the car business, it must vertically integrate into the battery business and that will be costly and time-consuming.

As near as I can tell Tesla has been paying Panasonic about $24,000 for the cells in an 85 kWh battery pack, which makes the cells the most costly component in the car. If Panasonic was more aggressive in its pricing demands under the new contract and insisted on earning a normal gross margin of 25%, then Tesla's future costs will be about $32,000 per car. If Tesla wants to earn a 25% gross margin, it will need to add a $2,700 markup to Panasonic's $8,000 markup and bump the retail price of a Model S-85 by about $10,700. It won't necessarily be a deal killer for customers who can truly afford to splash out $100,000 for a car, but it will make the economics more difficult for the "stretch buyers" who need lease financing.

Journal of Power Sources 231 (2013) (pp. 293-300) recently published an article that drills down into the costs of building a new factory for 18650 cells. The quick overview is that the capital costs are about $4 per unit of annual production capacity, materials costs run about $1.30 per cell, and materials costs typically represent 78% to 80% of direct manufacturing costs. When you turn the crank on these numbers, the capital cost of building a battery factory is roughly twice the annual cost of making batteries from that factory. While the ratios will move around a little depending on form factor and cell chemistry, a rough 2:1 ratio of capital cost to annual production value is typical in lithium-ion battery manufacturing.

The bottom line is that if Tesla wants to build a $4 billion revenue stream over the next few years, it will have to invest at least $1 billion in a battery factory to support its production. If Tesla wants to build a $10 billion revenue stream, it will have to invest about $2.5 billion in a battery factory. Once Tesla builds a battery factory, it will be wedded to a specific form factor and cell chemistry for the foreseeable future and its ability to respond to changes in battery technology will be limited.

Battery Chemistry Challenges

All batteries are chemistry in a can, and chemistry is a cruel science with very rigid laws. The primary purpose of every cell is to create an environment that facilitates reversible chemical reactions. Inside every cell, unstable ions turn into stable compounds when the cell discharges and return to an unstable state when the cell recharges. Unlike electrons on a circuit board that have no appreciable mass or volume, the ions in a cell have substantial mass and bulk. As a result, the energy storage potential of every cell is limited by the number of ions you can cram into the space that isn't occupied by current collectors, spacers, electrolyte and other inactive materials. It's very complicated, and unlike the world of electronics where technology generally follows a 2, 4, 8 … progression, batteries follow a 50%, 75%, 87.5% … progression.

We've all been spoiled and profoundly confused by our experience with electronics where each generation of new devices is smaller, cheaper and more powerful than the last. That experience cannot and will not be duplicated by battery technology because the laws of electrochemistry are different. In the world of electronics less is more. In the battery world less is less. Batteries can and do improve slowly over time as electrochemists tweak materials and construction, but step changes are impossible without a different chemistry or a different can. Brilliant electrochemists have been working on improving battery technology for the last 150 years, but their best efforts have only resulted in a six-fold improvement in energy density because gains in one performance metric invariably require sacrifices in another. The idea that there's a Moore's Law equivalent in the battery industry is one of the great lies of the last decade. Improvements of 3% to 4% a year are likely, but anything more is an unrealistic expectation.

Battery Safety Challenges

Readers regularly tell me that battery technology is improving by leaps and bounds and battery costs will continue to plummet as energy densities improve. The mythology is robust, but the reality is:

Tesla initially chose NCA, a relatively unstable chemistry, for its battery packs because it was the only chemistry that was readily available in large enough volumes. To compensate for the inherent hazards of NCA chemistry, Tesla over-built its battery packs and used aggressive fail-safe measures to protect passengers from the all-too-predictable field-failure events that destroy one in 10 to 40 million 18650 cells and frequently lead to battery-pack fratricide when a thermal runaway event in one cell starts a failure cascade that spreads to adjacent cells and ultimately destroys a complete module or battery pack. We're about to learn whether fail-safe measures at the pack level are enough to overcome the inherent hazards of NCA chemistry.

The NHTSA has recently launched a formal investigation into the safety of Tesla's battery packs. I have never represented a client in an NHTSA proceeding and wouldn't dream of predicting an outcome in Tesla's case. I have, however, represented clients in several regulatory enforcement proceedings over the last three decades and my goal has always been to minimize the impact of an adverse outcome because the certainty of an adverse outcome was a foregone conclusion by the time an informal inquiry matured into a formal investigation. Based on my experience with other regulators, I think the odds of a get out of jail free card are extremely remote. That makes it essential for investors to carefully assess the likely cost of remedial measures.

Over the last couple weeks Tesla has emphasized the point that its battery packs are protected from road debris by a quarter-inch of aluminum armor and downplayed the point that the armor seems to be a structural element of the battery pack itself. If the armor plate was not a structural element, Tesla couldn't have demonstrated a quick-change system that dropped the battery pack from the bottom of the car and popped in a new one. That leads to me to wonder whether there will be a simple way to upgrade the protective armor without removing and completely rebuilding the battery pack. Depending on the details of Tesla's battery pack design, replacing aluminum armor with something stronger may be relatively easy, but without detailed information I'd be reluctant to assume that remedial measures for 20,000 cars will be quick, cheap or easy.

Looming Death-Cross

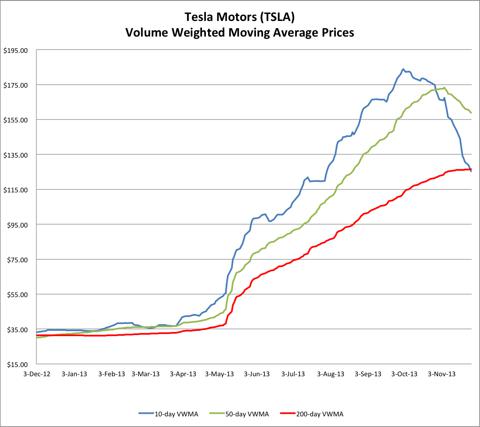

My technical analysis skills are very limited and I only use simple tools to forecast momentum changes. The most accurate tool I've found uses 10-, 50- and 200-day moving average prices as sentiment indicators. While most technical analysts use simple moving averages, I've found that SMA analysis is wildly inaccurate when a stock has significant volume volatility. In Tesla's case, the average daily trading volume has ramped from 1.5 million shares at the end of March to 11.6 million shares at the end of November. For stocks like Tesla that have extreme volume volatility during the measurement period, I prefer volume weighted moving average price data because I think volume weighted averages are more reliable. Here's my graph of the 10-, 50- and 200-day volume weighted moving average prices for Tesla's stock.

The pattern in this chart where the 10-day average pierces down through the 200-day average after the 50-day average turns down is called a death cross, the top indicator of a strong bearish reversal. While some might argue that the price hemorrhaging has just gotten started, I think the graph is less than conclusive at this point in time because there's a chance that the price may bounce to the upside instead of continuing the downward trend. On balance I classify the volume weighted moving average price graph as too close to call and too precarious to ignore.

Summary and Conclusions

I'm concerned about the NHTSA investigation because I think the probability of a clean bill of health is remote and I believe the work of upgrading the battery pack armor will be more costly and complex than most seem to assume. While I don't expect the NHTSA to require remedial actions that would threaten Tesla's corporate existence, it could still be very costly.

While the NHTSA will probably not present an insurmountable obstacle, I believe the battery supply challenges present a higher hurdle. At September 30th Tesla had $564 million in equity and $1.5 billion in debt. While a debt to equity ratio of three to one is not inordinately high, I have a hard time imagining how Tesla will find another $1 to $2.5 billion in financing for a dedicated battery factory. Tesla has no proprietary lithium-ion battery chemistry so there's no reason for a manufacturing partner to assume a disproportionate share of the risk in building a jointly owned factory. Besides, to the extent that a partner steps in to defray a substantial share of the capital costs, it will expect a reasonable return on its investment.

I also have a hard time imagining a situation where reasonable lenders would provide debt financing that's three to five greater than Tesla's current equity. While I've been around long enough to know that nothing is impossible, I think the only real option will be for Tesla to pursue a large offering of stock and debt prices that are closer to Tesla's book value of $5 per share than its market price of $130 per share.

Since Tesla can't build a giga-factory without $1 to $2.5 billion in additional financing and I don't see how a strategic partner could provide the required funds without defeating the basic goal of Tesla's planned vertical integration into the battery business, I think the market price may continue to deteriorate until the stock price represents a reasonable risk-reward balance that will allow Tesla to raise essential capital on terms that will be attractive to new investors.

Tesla has done a superb job of making exceptional toys for men of a certain age and income level who tend to think faster cars and younger women are important trappings of success. It's nothing to be ashamed of and I went through that phase a couple times. My first round was an Acura NSX in the early 90s. My second was a younger wife in the late 90s. The third was a ragtop Porsche Carerra4 in the early 00s. The only difference between what I did then and what Model S buyers are doing today is that I didn't rationalize my choices with lame excuses while expecting my neighbor to pay for my lifestyle choices.

Since the gulf between costly toys and mass-market products is wide and deep, particularly when improved energy densities create inordinate safety risks, I'm underwhelmed with Tesla's long term investment potential and plan to continue watching from the sidelines and commenting when the story is diametrically opposed to the facts.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article. (More...)

This entry passed through the Full-Text RSS service — if this is your content and you're reading it on someone else's site, please read the FAQ at fivefilters.org/content-only/faq.php#publishers.

from SeekingAlpha.com: Home Page http://seekingalpha.com/article/1869051-understanding-teslas-giga-scale-battery-challenges?source=feed

Aucun commentaire:

Enregistrer un commentaire